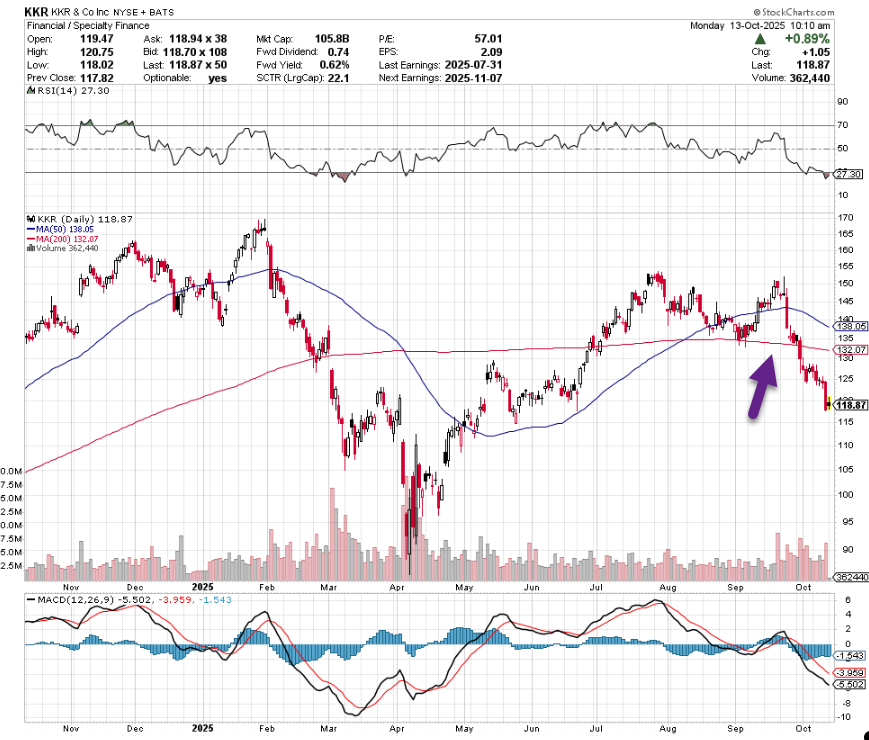

1. Start Today with Private Equity Manager’s Charts…..KKR -20% Year to Date-Failed to Make New Highs—Close Below 200day

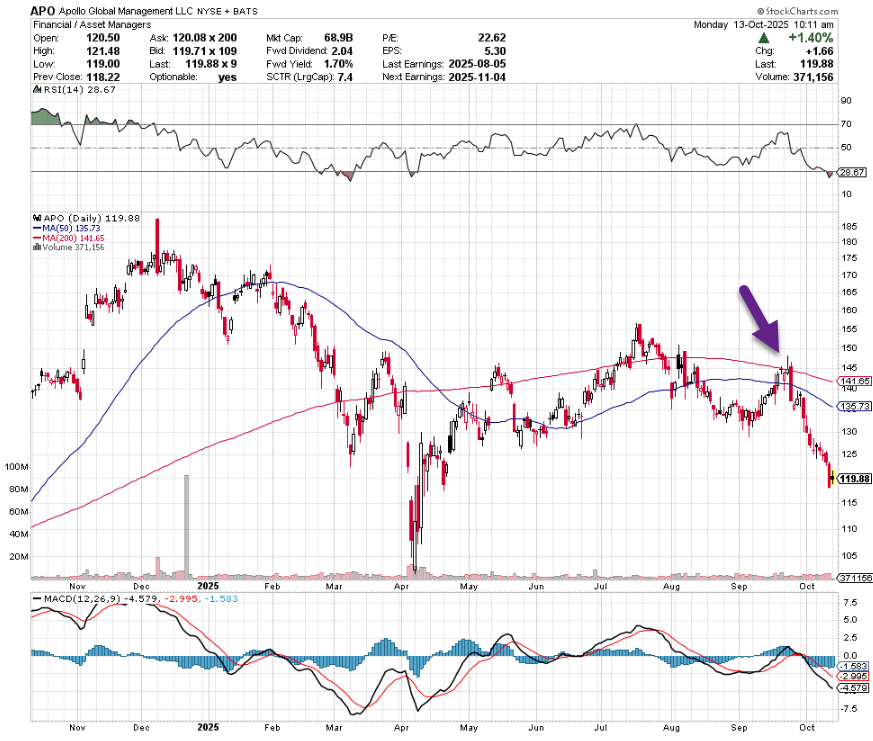

2. Apollo -28% Year to Date…Failed to Make New Highs….50day and 200day sloping down

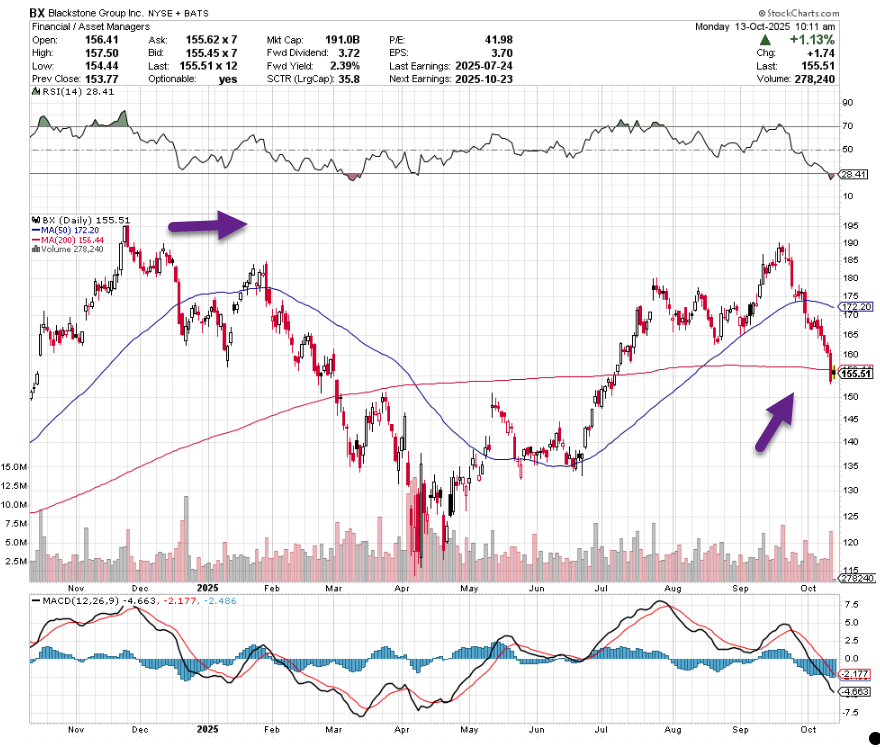

3. Blackstone -10% Year to Date…Failed to Make New Highs…Closed Below 200 Day

StockCharts

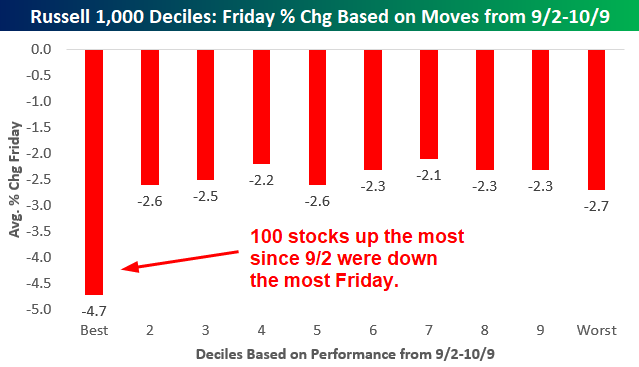

4. 100 Best Stock Performers 2025 were Down the Most During Friday Pullback

Bespoke-The 100 stocks that were up the most from 9/2 through the close last Thursday (10/9) were down an average of 4.7% on Friday. Every other decile of stocks saw average declines in the 2% range.

Bespoke

5. Gold Most Overbought Based on RSI in History

Barchart

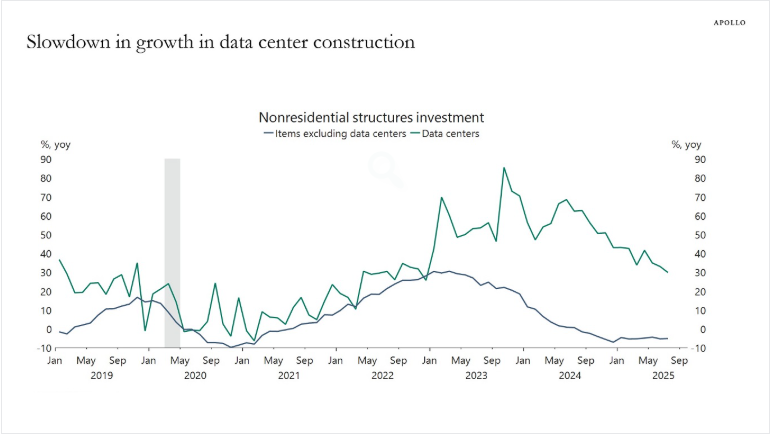

6. Slowdown in Growth of Data Centers

Torsten SløkApollo Chief EconomistThere is still strong growth in data center construction, but the current growth rate at 30% is lower than the 80% observed two years ago, see chart below.

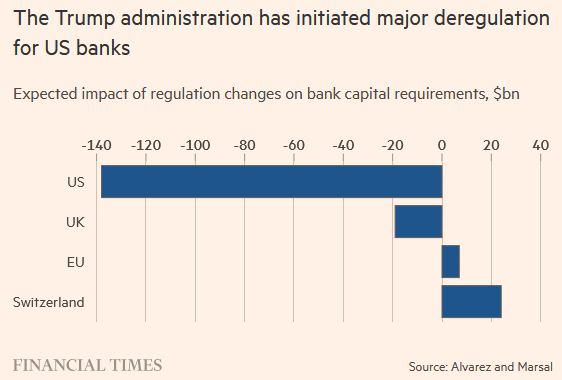

7. Major Bank Deregulation Underway by Trump Administration

Dave Lutz at Jones Trading “We think the Trump administration is kicking off a major wave of deregulation, unlocking a huge amount of capacity, which will give a massive economic boost and an earnings uplift,” said Fernando de la Mora, co-head of financial services at Alvarez & Marsal. The New York-based consultancy predicted US banks would benefit from a 14 per cent reduction in their requirements for common equity tier one, a capital buffer that gives them capacity to absorb losses.

THE FINANCIAL TIMES

It forecast this would result in a 35 per cent boost to their earnings per share and a 6 per cent increase in their return on average tangible common equity — a benchmark used by investors. The report, due to be published on Monday, provides detailed estimates of the impact of changes to banking regulation across the world.

8. Kalshi Prediction Markets Hits $5B Valuation

Kalshi, a prediction market that allows people to bet on future events, announced that it raised over $300 million at a $5 billion valuation. The company’s value has increased 2.5x since its last fundraise just three months ago, when it was valued at $2 billion.

The fresh capital came from Kalshi’s existing investor, Sequoia Capital, with new investor Andreessen Horowitz co-leading the round. Paradigm Ventures, CapitalG, and Coinbase Ventures also participated.

Kalshi also revealed that consumers in 140 countries can now make bets on its platform.

The prediction market is seeing a dramatic surge in activity: Kalshi is set to reach $50 billion in annualized trading volume, up significantly from the approximately $300 million volume posted last year, the New York Times reported.

Kalshi’s fundraise announcement follows one made just days earlier by archrival Polymarket, which revealed that it had secured an investment of up to $2 billion from Intercontinental Exchange (ICE), the owner of the New York Stock Exchange, at a pre-money valuation of $8 billion. The deal valued Polymarket at $8 billion pre-money, a monumental increase from its $1 billion valuation only two months earlier in August.

Both Kalshi and Polymarket rose to prominence last year, drawing significant attention for their prediction markets on the presidential election outcome.

Polymarket has been barred from serving U.S. residents since 2022, following a settlement with the Commodity Futures Trading Commission (CFTC). In July, the company acquired a derivatives exchange and a clearing house. The move helped Polymarket receive the right to reenter the U.S. market. Last month, the company’s CEO and founder, Shayne Coplan, said on X: “Polymarket has been given the green light to go live in the USA by the CFTC.” Kalshi secured the right for Americans to use its platform after successfully suing the CFTC last year

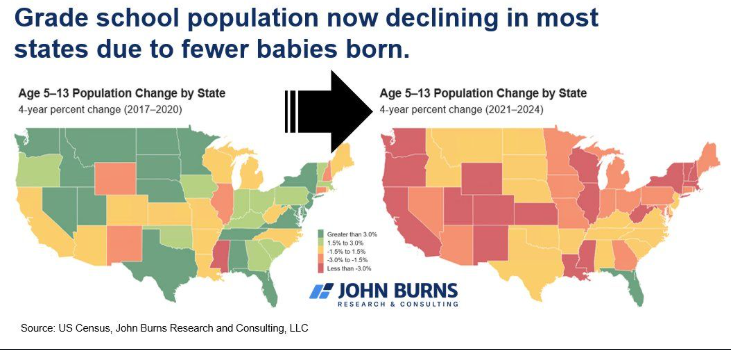

9. Shrinking Grade School Population by State-John Burns Real Estate

Eric Finnigan

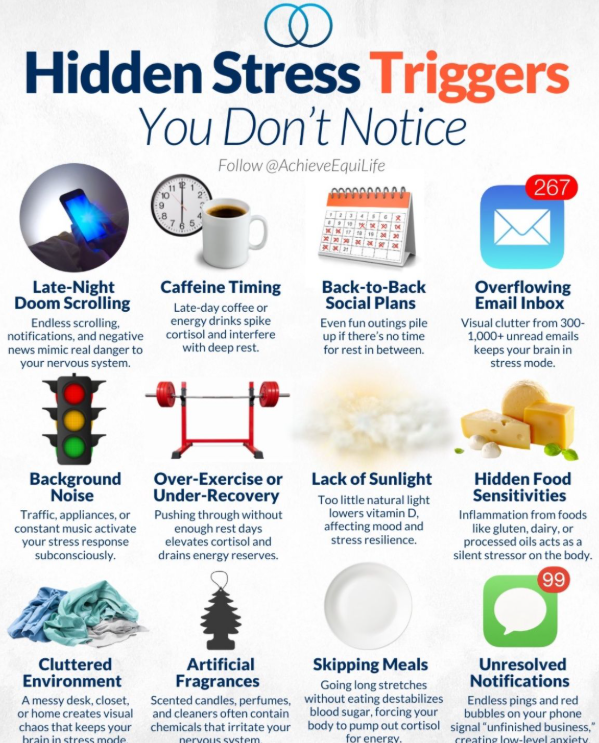

10. Ten Stress Triggers

Andrew Lendnal