1. U.S. Treasurys are seeing longer bear market than stocks did in the 2008 financial crisis or the 2000 dot-com crash

Marketwatch Frances Yue

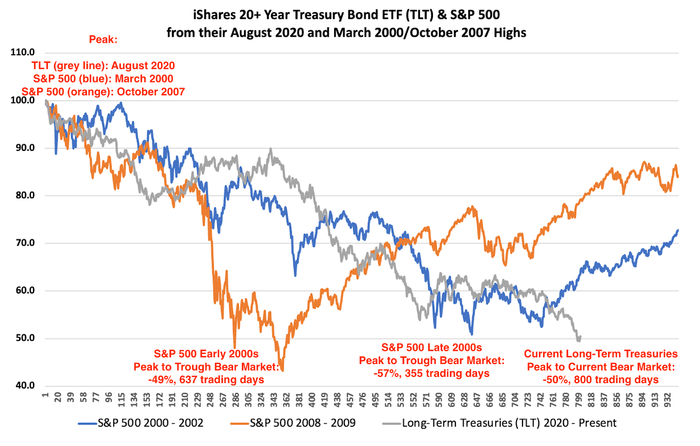

Longer-term U.S. Treasurys are experiencing a bear market longer than what stocks endured during the 2000-02 dot-com crash and the 2007-08 financial crisis, according to DataTrek Research.

It has been three years and two months, or 800 trading days, since the iShares 20+ Year Treasury Bond ETF TLT, which invests in long-term Treasurys, reached an all-time high on Aug. 4, 2020. The fund has since fallen 50%, noted Jessica Rabe, co-founder at DataTrek.

A bear market is traditionally defined by an index falling by 20% or more from a recent high.

In comparison, the S&P 500 SPX recorded a 49% loss over 637 trading days from its cycle peak on March 23, 2000, to its trough on Oct. 9, 2002, as the dot-com bubble burst. The large-cap U.S. equity gauge fell 57% over 355 trading days from its peak in 2007 in the aftermath of the global financial crisis.

DATATREK

Long-term Treasury yields have surged lately, with the 30-year BX:TMUBMUSD30Y and the 10-year Treasury rates last week hitting their highest levels since 2007, respectively, before pulling back. The yield on the 10-year Treasury retreated 15.6 basis points to 4.627% on Tuesday, and the 30-year Treasury fell 11.5 basis points to 4.826% on Tuesday.

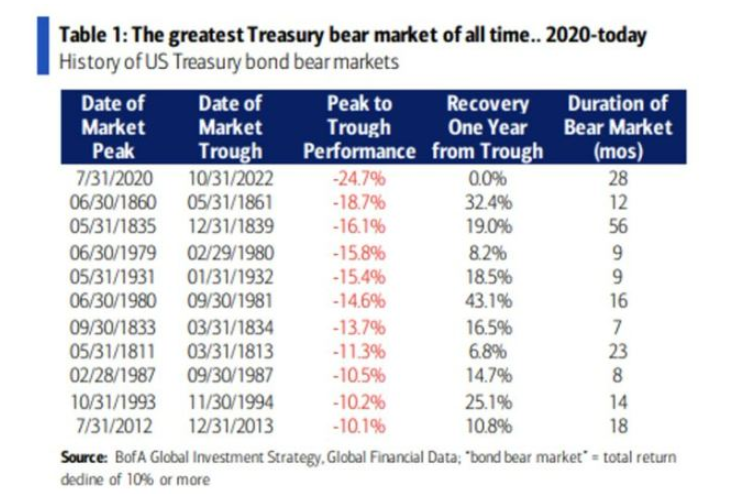

2. The Greatest Treasury Bear Market Ever.

From Irrelevant Investor Blog https://theirrelevantinvestor.com/2023/10/11/animal-spirits-5/

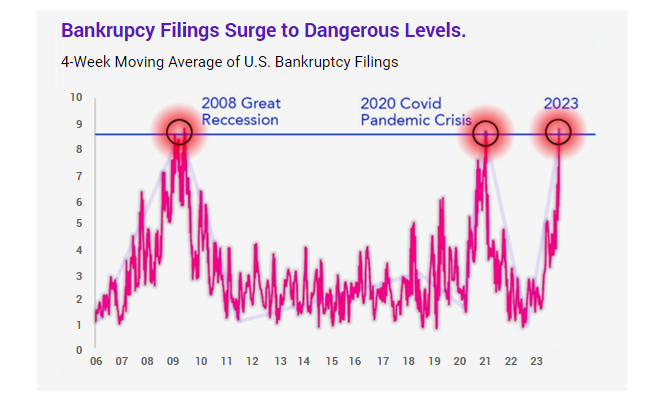

3. One Data Point for Bears.

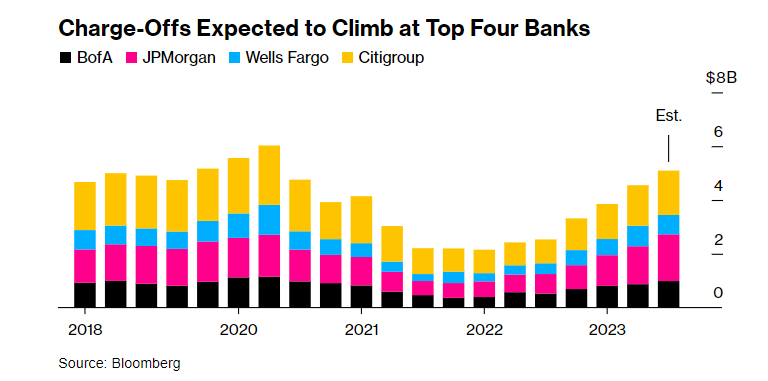

4. Large Bank Write Offs

Bloomberg By Shelly Hagan The biggest US banks are poised to write off more bad loans than they have since the early days of the pandemic as higher-for-longer interest rates and a potential economic downturn are putting borrowers in a bind. JPMorgan Chase & Co., Citigroup Inc. and Wells Fargo & Co., which report third-quarter results Friday, will join Bank of America Corp. — which comes Tuesday — in posting roughly $5.3 billion in combined third-quarter net charge-offs, the highest for the group since the second quarter of 2020, according to data compiled by Bloomberg.

5. Aerospace and Defense ETF Bounces From Israel Attack…Still Well Below Highs.

ITA down for the year…no bull run post Ukraine…50day thru 200day downside bearish end of September.

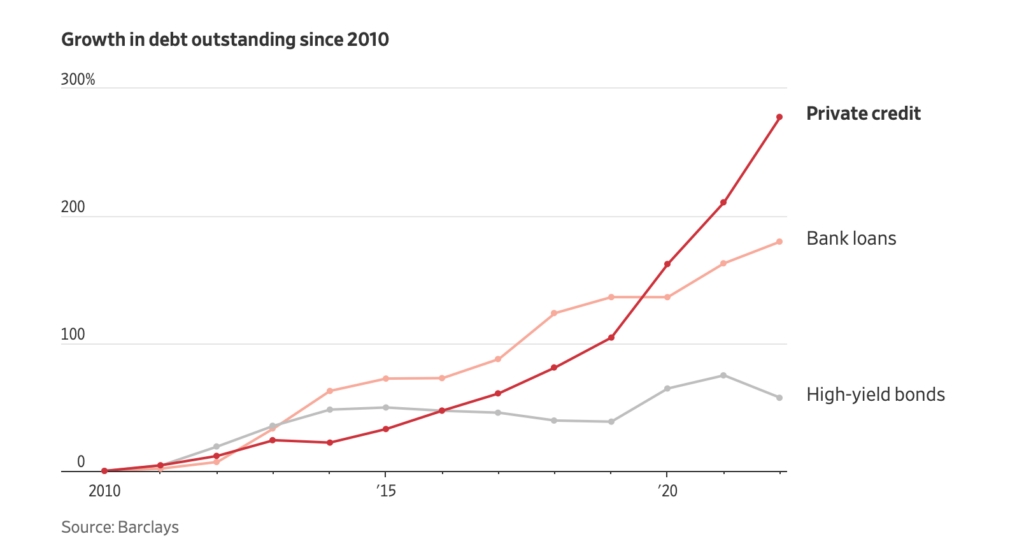

6. Private Credit The New Kings of Wall Street.

WSJ By Matt Wirz High interest rates, driven by the Federal Reserve’s higher-for-longer policy, are shaking up how corporate loans get done. Soaring rates brought down banks such as Credit Suisse and Silicon Valley Bank and forced others to reduce lending. As those lenders stepped back, private-credit fund managers stepped up, financing one jumbo loan for American corporations after another.

This shift is accelerating a trend more than a decade in the making. Hedge funds, private-equity funds and other alternative-investment firms have been siphoning away money and talent from banks since a regulatory crackdown after the 2008-09 financial crisis. Lately, many on Wall Street say the balance of power—and risk—has hit a tipping point.

“There’s been a steady progression, but since Covid and the banking crisis this year we’ve really seen the banks rein in risk,” said David Snyderman, head of alternative credit and fixed income at Magnetar Capital.

https://www.wsj.com/finance/fed-rate-hikes-lending-banks-hedge-funds-896cb20b

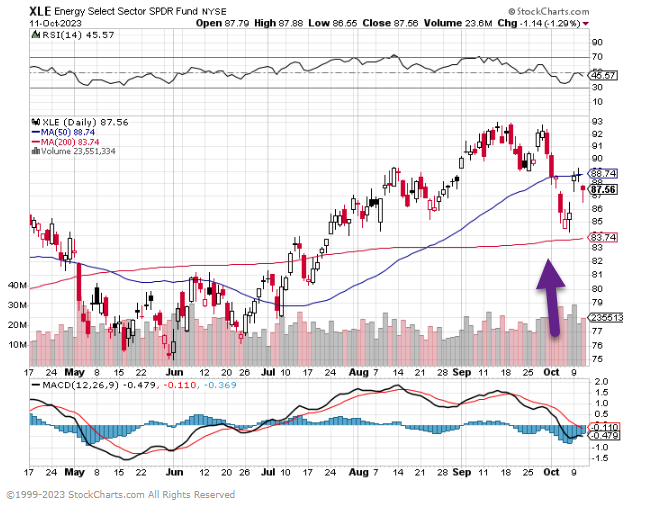

7. Energy ETF Held 200-Day.

XLE bounced at 200-day…watch list chart….last time it broke 200-day it stayed below for 3 months

Zerohedge WTI was hovering just below $84 ahead of the API print and extended losses after the big draw…

https://www.zerohedge.com/energy/wti-extends-losses-after-api-reports-massive-crude-inventory-build

8. Homebuilders Held 200-Day with 8% Mortgage Rates

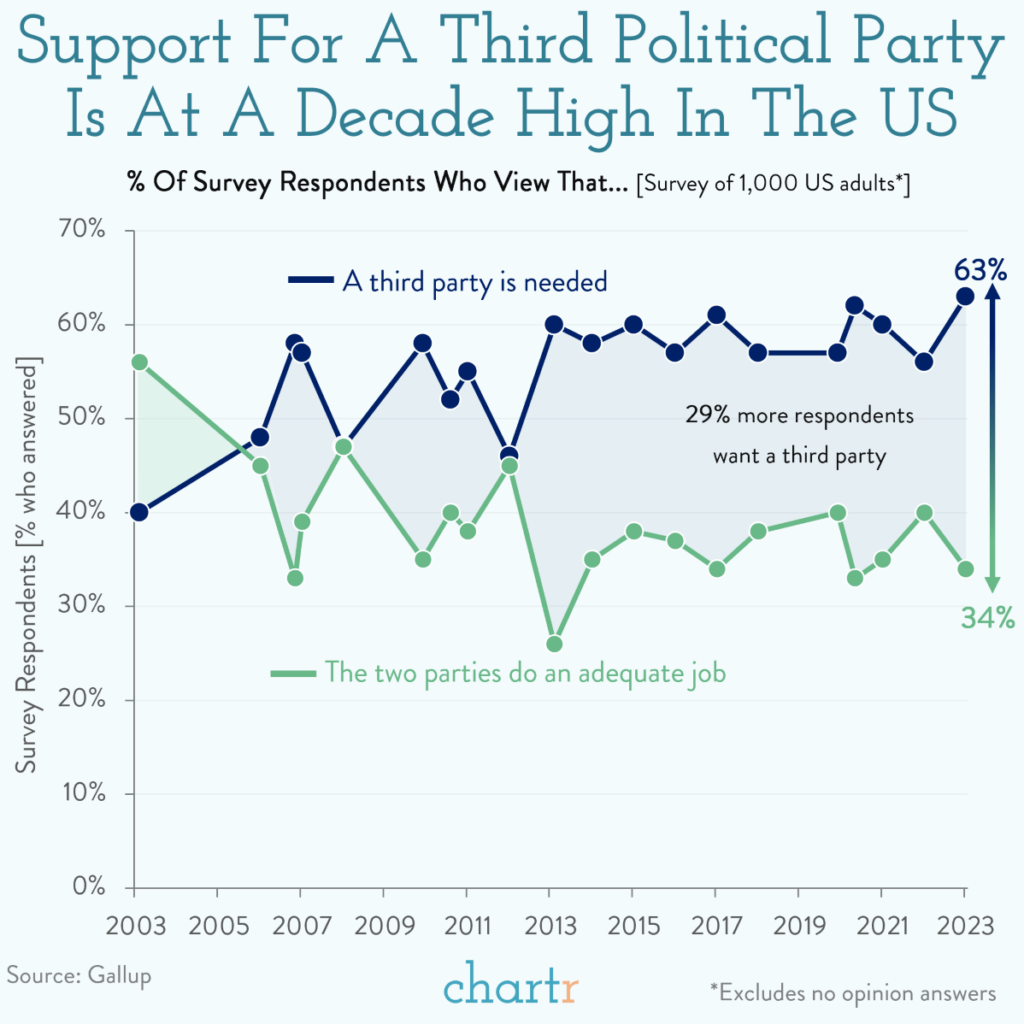

9. Third Political Party Support Hits Record Highs

10. Understanding and Overcoming FOBO (Fear of Better Options)

Darius Foroux FOBO or Fear of Better Options is a psychological phenomenon where someone avoids making a decision out of fear that there may be a better option.

FOBO is the nagging feeling that there might be a better choice out there, which leads to analysis paralysis.

Can you relate to the following? You’ve had a long day and decide to watch something nice on Netflix.

You keep browsing the hundreds of attractive movies and TV shows you haven’t seen and finally end up NOT watching something because you wasted an hour trying to decide.

Now, that’s not the end of the world. But when we let FOBO creep into our lives, it bleeds into more important areas.

Having FOBO makes decision-making stressful not just for us but for the people around us too.

By understanding the root causes of FOBO and having an effective strategy, you can regain control over your decisions and lead a more productive and stress-free life.

FOBO is as old as humanity

US venture capitalist, Patrick McGinnis, the one who coined the terms FOBO and FOMO (Fear of Missing Out), suggests that FOBO is not a new human behavior.1

“These feelings are biologically part of who we are. I call it the biology of wanting the best. Our ancestors a million years ago were programmed to wait for the best because it meant they were more likely to succeed.”

However, the widespread adoption of advanced technology and the internet has accelerated FOMO and FOBO. We can now easily compare ourselves with others (which brings out feelings of FOMO) and overwhelm ourselves with choices (leading to FOBO).

As McGinnis pointed out:

“Go on Amazon to buy a pair of white shoelaces and you have over 200 choices, whereas 50 years ago you would go to Woolworths and choose between three… The other factor – which is more emotional – is that FOBO is driven by narcissism, because when you have FOBO, you’re prioritizing your own interests far above anyone else’s, leaving everyone around you in limbo.”

McGinnis relates FOBO to the natural “fear of letting go.”

To choose something, people have to let go of other options. When you overthink things, it becomes easier to mourn “what could have been.” And it gets harder to decide.

Are you a maximizer or satisficer?

Some psychologists have found a basis for the FOBO phenomenon. When it comes to decision-making, people can be divided into two groups: “Maximizers” or “satisficers”.2

Maximizers are people who make choices based on maximum benefit in the long term, while satisficers choose depending on what benefits them now.

For example, maximizers may pay more for a larger car than they actually need in case they want a bigger one later. While a satisficer is likely to pick the car that is good for now. Maximizers also tend to focus more on what was lost rather than what they already have.

Both groups have been studied extensively, but one study aimed to explore whether “maximizers show less commitment to their choices than satisficers in a way that leaves them less satisfied.”3

In other words, are maximizers more likely to be unhappy with their choice once they finally make it? The study’s conclusion: Absolutely yes. The researchers concluded:

“Maximizers miss out on the psychological benefits of commitment… High-level maximizers certainly cause themselves a lot of grief.”

Commitment is the path to genuine joy

Back in college, I had many classmates who didn’t know what they wanted. They kept changing courses, trying to “find” themselves.

Those folks eventually ended up hopping from one degree to the other, never finishing anything.

Here’s the thing: Most of us won’t know what we want. This applies to both big and small decisions.

Which course should you take in college? Should you pursue grad school? Is it a good idea to start a side business? What would you want for dinner: Italian or Chinese?

I learned from experience that the best way to know what you truly want is to choose the closest thing that feels right for you. And then commit to it.

Maybe it works out. Or maybe not. But you can always pivot later. That’s the key.

Throughout my entire time in business school, I was convinced I would work for a large corporation. I thought I would get a traineeship and then spend the rest of my career climbing the corporate ladder to eventually become a bank CEO or something.

But as I was writing my master’s thesis in 2010, I realized that wasn’t the right option. The European economy was decimated and the chances of me landing a decent job were slim.

At the same time, my father wanted to start a business, so we ended up doing it together. Years later, I still ended up getting a corporate job, then quit only a year later to become a full-time writer.

I applied my entrepreneurship skills to my writing. And I’ve been doing that now since 2015.

If you had asked me ten years ago whether I’d known this is what I would want to do with my life — my younger self would likely say no!

But things worked out because I committed to all my choices.

That’s one other thing I learned about succeeding. It’s all about consistency.

So choose something you can be consistent about. And stick with it. When you do that, the best option automatically comes to you. And you don’t even have to chase it.

https://dariusforoux.com/fear-of-better-options/ Found at Abnormal Returns Blog www.abnormalreturns.com