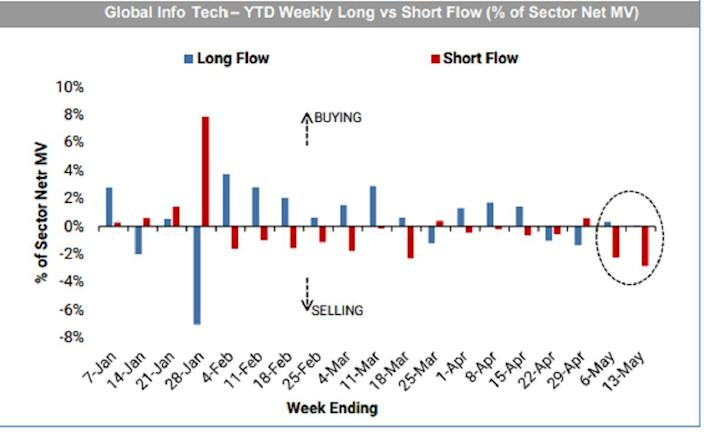

1. Global Tech…YTD Long vs. Short Flow….Hedgies Pressing Shorts

Short Sellers Ride Tech Rout Doubling Down on Biggest Losers

https://finance.yahoo.com/news/short-sellers-ride-tech-rout-145556689.html

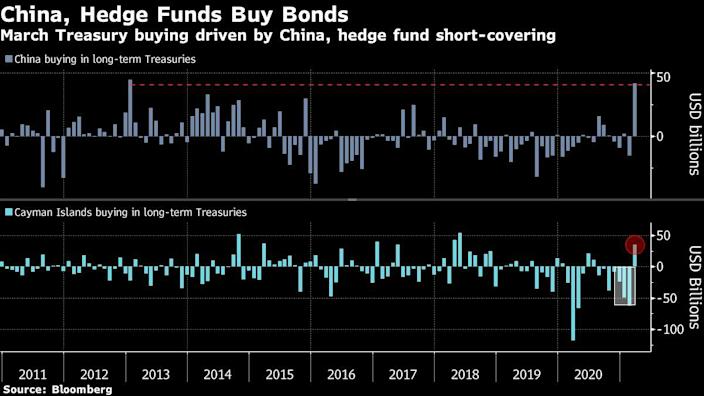

2. Meanwhile…Hedge Funds and China Buying Bonds

Fear was inflation would cause China to sell U.S. Treasuries but not happening yet

Stephen Spratt

Mon, May 17, 2021, 11:08 PM

(Bloomberg) — As U.S. Treasuries sold off in March, global investors had one thing on their mind: buy.

Foreign funds bought $118.9 billion of Treasuries in the month, the most on record based on data going back to 2016, according to the Treasury Department’s release on Tuesday.

The purchases — with strong demand seen from China and the Cayman Islands — took place as benchmark 10-year yields surged to the highest since the pandemic began, with some investors dumping the bonds on expectation of higher inflation. Since then, the yields have tracked lower as the Federal Reserve pushed back on tapering talk.

“This demand is nothing short of impressive, knowing that 10-year yields rose 30 basis points over the month of March,” JPMorgan Chase & Co. strategists led by Jay Barry wrote in a client note.

Hedge Funds Nailed Treasuries Rout With $100 Billion in Sales

The Cayman Islands, seen as a proxy for hedge funds and other leveraged accounts, bought $34.9 billion of U.S. sovereign bonds, after selling more than $100 billion in the first two months of the year. This likely reflects short covering as yields moved “aggressively higher” in March, according to Barry.

The strongest demand came from China, with purchases hitting $41.6 billion in March, the most since the record reached in January 2013, according to data going back to 1985.

China Bought Most Treasuries in Eight Years as Yields Climbed

“At the country level, our valuation-adjusted estimates suggest that China was the largest net buyer of long-term Treasuries overall in March,” Goldman Sachs Group Inc. strategists including Vickie Chang wrote in a client note. On a valuation-adjusted basis, this marked a fourth consecutive month of Chinese buying in long-term Treasuries, Chang said.

While monthly net purchase data shows significant changes in Treasury holdings, a list of major foreign holders reflect only modest adjustments, with the discrepancy primarily due to the latter data set also including holdings of Treasury Bills and certificates.

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.

https://finance.yahoo.com/news/hedge-funds-china-drive-record-030845936.html

3.Fastest Gain in Retail Sales 14 Month Period Since 1978-1979

Post Traumatic Shopping

Posted May 18, 2021 by Joshua M Brown

That adrenaline rush from a near-miss. Makes you feel so alive. You just survived a pandemic. Kept your job too. And your portfolio survived. More adrenaline, your brokerage account is bigger than ever. Retirement accounts too. Mix in some dopamine as well. Let’s go shopping. Revenge shopping. I’m bout to be stuntin’ on fools all summer.

Brian Wesbury from First Trust tells us that retail sales are now higher than if there had been NO PANDEMIC AT ALL. POW!

massive government “stimulus” checks have put the economy in a strange position, where retail sales are far above where they would be if COVID had never happened, even as the production side of the economy remains relatively weak.

Friday’s report on the retail sector showed that retail sales were unchanged in April, remaining at essentially the same lofty level they were in March. However, the lack of an increase in April shouldn’t have been much of a surprise. Even with no increase in April, retail sales were 17.9% higher than they were in February 2020, pre-COVID. To put this in perspective, that’s the fastest gain for any 14-month period since 1978-79. A key difference? That period in 1978-79 had double-digit inflation, versus the 3.1% increase in consumer prices since February 2020.

Another way to think about how high retail sales have been lately is that if COVID had never happened and sales since February 2020 had increased at a more normal 4.5% per year pace, it would have taken until November 2023 for retail sales to reach where they were in March and April this year. In other words, sales have arrived at the recent level about two and half years ahead of schedule.

That’s crazy. But understandable. You want to look good for the Summer of Love, don’t you?

https://thereformedbroker.com/2021/05/18/post-traumatic-shopping/

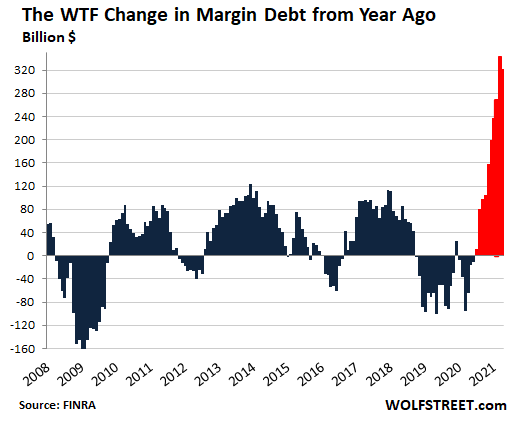

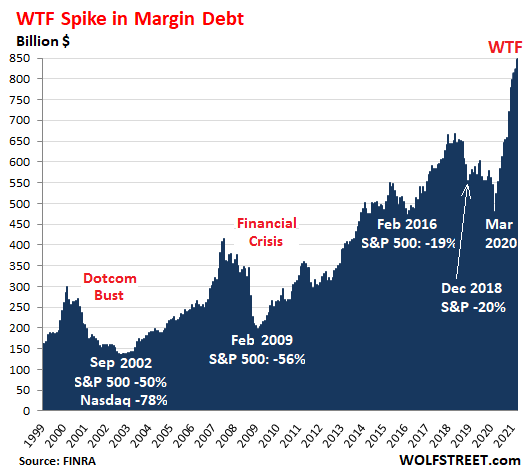

4. Known Stock Market Leverage Hits WTF High.

by Wolf Richter • May 18, 2021 • 83 Comments

Margin debt is just the visible tip of the iceberg of leverage, and it reached the zoo-has-gone-nuts level.

By Wolf Richter for WOLF STREET.

Stock market margin debt jumped by another $25 billion in April, to a historic high of $847 billion, according to FINRA data. It has exploded by $188 billion in six months, and by 61% year-over-year, and by 55% from February 2020:

Excess leverage is the precise and predictable result of the policies the Fed is promoting out of one side of its mouth with its interest rate repression and asset purchases.

Out of the other side of its mouth, the Fed – via its blissfully ignored Financial Stability Report – is warning about leverage, stock market leverage, and particularly the vast and unknown parts of leverage among hedge funds and insurance companies.

It named names: The family office Archegos, a private hedge fund that has to disclose very little, and that then blew up because none of the brokers providing it with leverage knew about the other brokers also providing leverage, and no one knew how much total leverage the outfit had. The amount of leverage didn’t come out until it blew up.

And this form of hidden leverage is not included in the known stock market margin debt reported monthly by FINRA, based on reports by its member brokerage firms.

This known stock market leverage is an indicator of the trend in leverage, the tip of the iceberg. History shows that a big surge in margin balances preceded and perhaps was a precondition for the biggest stock market declines.

In April, it exploded to a new WTF high of $847 billion, up by $188 billion in six months, having ascended to the zoo-has-gone-nuts level:

In this type of chart that covers two decades during which the purchasing power of the dollar has dropped, long-term increases in absolute dollar amounts are not the focal point; but the steep increases in margin debt before the selloffs are.

5. Chip Crisis in ‘Danger Zone’ as Wait Times Reach New Record

Ian King and Debby Wu 4 hrs ago|

(Bloomberg) — Shortages in the semiconductor industry, which have already slammed automakers and consumer electronics companies, are getting even worse, complicating the global economy’s recovery from the coronavirus pandemic.

Chip lead times, the gap between ordering a chip and taking delivery, increased to 17 weeks in April, indicating users are getting more desperate to secure supply, according to research by Susquehanna Financial Group. That is the longest wait since the firm began tracking the data in 2017, in what it describes as the “danger zone.”

“All major product categories up considerably,” Susquehanna analyst Chris Rolland wrote in a note Tuesday, citing power management and analog chip lead times among others. “These were some of the largest increases since we started tracking the data.”

6.Softbank Talking SPAC IPO After Record Profits

SoftBank Broke Profit Records. Can It Keep Up the Pace?

What a difference a year makes.

By Andrew Ross Sorkin, Jason Karaian, Sarah Kessler, Michael J. de la Merced, Lauren Hirsch and Ephrat Livni

SoftBank is riding high — for now

A year ago, SoftBank disclosed its biggest-ever operating loss, and its voluble founder, Masa Son, spoke ruefully of the “valley of coronavirus” that ensnared its investments. Now, thanks to huge I.P.O.s, the tech giant is setting a different — and much happier — record.

SoftBank just broke profit records for a listed Japanese company. It earned 1.93 trillion yen ($17.7 billion) in three months ended March 31, bringing its fiscal-year profit to $46 billion. That’s a huge turnaround for the company, which has staked its future on its ability to identify and bet on the most promising tech companies through its Vision Funds.

SoftBank Group’s net income

Fiscal years ending March. 1 trillion yen = 9.2 billion U.S. dollars.

Source: FactSet

By The New York Times

A few wagers paid off handsomely. The I.P.O.s of the Korean e-commerce giant Coupang (which contributed $24.5 billion in paper profit), DoorDash and other companies powered the Vision Funds’ nearly $21 billion in earnings for the quarter. In a show of confidence, SoftBank said it was tripling its contributions to its second Vision Fund, to $30 billion. (Unlike the first Vision Fund, which has $100 billion and a variety of investors, the second is solely company money.)

- Son professed nonchalance over the volatility of SoftBank’s performance at an investor presentation today: “I’m not overjoyed or depressed so easily, just stay calm,” he said.

Can SoftBank keep it up? While the Vision Fund reaped the reward of big bets over the past year — and some portfolio companies yet to list, like ByteDance and Didi, could generate similar returns — other investments, like the British lender Greensill Capital, imploded. And Son has yet to commit to renewing the biggest driver of SoftBank’s rising stock price in recent months: its enormous buyback program, in which the company bought some $23 billion of its own shares.

7. Millennials 54% of Mortgage Applications Last Year

HPI Top 10 Metros Change

The CoreLogic HPI provides measures for multiple market segments, referred to as tiers, based on property type, price, time between sales, loan type (conforming vs. non-conforming) and distressed sales. Broad national coverage is available from the national level down to ZIP Code, including non-disclosure states.

These large cities continue to experience price increases in March, with Phoenix leading the way at 18.3% year over year.

https://www.corelogic.com/insights-download/home-price-index.aspx

8. Record Jolts Job Openings and Jobs Hard to Find….Wage Inflation?

The Flour Layers Of Inflationby Matt Lloyd of Advisors Asset Management, 5/18/21

https://www.advisorperspectives.com/commentaries/2021/05/18/the-flour-layers-of-inflation

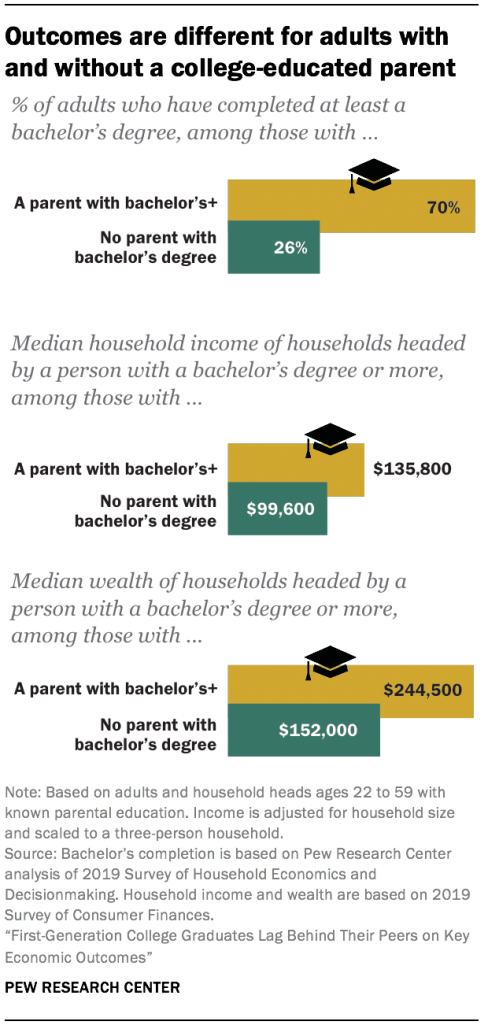

9. Parents with or without College Degrees…Big Spread in Results

10.5 Best Industries for Starting a Business in 2021

These are the sectors every aspiring entrepreneur should know about this year.

In periods of dramatic change, entrepreneurship thrives. When the Covid-19 pandemic altered so many aspects of our lives, it also accelerated the growth of some nascent industries, and opened up new niches in which quick-thinking founders could start and grow successful businesses. After combing through the latest data and speaking to experts, we’ve compiled those promising sectors for Inc.‘s annual Best Industries report. Read on to learn which industries will give rise to the next generation of fast-growing startups.

DTC Home Improvement / Plant-Based Hair Extensions / Digital Accessibility Services/ Virtual Reality Workplace Training / Remote Patient-Monitoring

Virtual Reality Workplace Training

Virtual reality and augmented reality tools were already on their way to being integrated into the workplace when the Covid-19 pandemic accelerated their adoption. Startups are now developing simulations to train workers in a range ofhard and soft skills, from installing solar panels and fielding customer service complaints to identifying workplace bias and leading with empathy.

Venture capital interest in the sector remains strong. Global VC investment in AR and VR startups reached a record $8.5 billion across 600 deals in 2019, according to research company PitchBook. And VR promises to train more people in less time than in-person or online training. What’s more, simulations let learners practice scenarios that would be difficult or dangerous to replicate in real life–and the data they collect can give employers a clearer view of workers’ progress.

Look inside the virtual-reality workplace training industry: How to Make Diversity, Equity, and Inclusion a Reality With Virtual Reality

Direct-to-Consumer Home Improvement

If the original DTC home-goods companies targeted urban apartment dwellers, selling mattresses, furniture, and houseplants, the next wave is moving to the suburbs. Americans are resettling outside cities and embracing DTC brands for their home-improvement projects instead of shopping at retail giants such as Home Depot and Lowe’s.

Younger consumers in particular are gravitating toward more personalized brands with the aesthetics and convenience they’re used to. Home improvement-focused startups selling directly to consumers include Clare (paint), Block (bathroom remodeling), and the Inside (custom upholstery), and they’re raking in millions in venture capital.

Look inside the direct-to-consumer home improvement industry: Why This Serial Entrepreneur Thinks There’s a Gold Mine in Your Back Yard

Patient-Monitoring Tools

The demand for remote health care services during the pandemic has been a proving ground for the telehealth industry. Remote patient-monitoring devices and software are a crucial component of telehealth, as the ability to track patient health remotely has been critical for the growing population of older patients and those with chronic conditions.

Recent investments in the industry suggest a bright future for companies with the best technology. Preventice Solutions, a remote cardiac solutions company, raised a $137 million Series B round last July. Biofourmis, which makes wearables and software for remote monitoring of patients with cancer and other chronic conditions, raised $100 million last September. Total telehealth industry revenue is projected to grow at an annualized rate of 8.3 percent, to $4.8 billion by 2025, according to market research firm IBISWorld.

Look inside the patient monitoring tools industry: Smart Socks? How This Tech Startup Is Targeting a Common Medical Problem

Plant-Based Hair Extensions

Plastic braids, or braiding hair,are popular among Black women, but they can cause painful itchiness and irritation. Plant-based hair extensions, a new twist featuring materials like banana fiber, offer a potential solution to this problem and come at a time when consumers are increasingly seeking plant-based products.

The market opportunity for plant-based hair extensions is significant, as Black Americans spent $473 million on hair care in 2017, according to market research firm Nielsen. The U.S. wig and hairpiece market, valued at $391 million in 2020, is expected to reach $410 million by 2025, according to IBISWorld.

Look inside the plant-based hair extensions industry: A New Twist on the Natural Hair Movement: Plant-Based Hair Extensions

Digital Accessibility Services

When large swaths of global commerce moved online, many businesses created websites and apps on the fly, without much regard for accessibility. The result has been major compliance problems: Last year saw 3,550 lawsuits alleging digital violations of the Americans With Disabilities Act, a 23 percent increase over 2019, according to a study by digital accessibility company UsableNet.

Adding features such as closed captioning on videos for deaf and hearing-impaired users and alt text on images for blind and visually impaired users who use screen readers signals that your organization cares about the 61 million Americans with disabilities, whether they’re your customers or potential employees. There are plenty of automated solutions to audit your website for ADA compliance, but these services are estimated to miss up to 80 percent of the issues facing disabled users. Startups that can help software engineers find and fix accessibility problems on their websites and apps have a rare opportunity to solve a widespread problem.

https://www.inc.com/best-industries-2021.html

Disclosure

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.

Material compiled by Lansing Street Advisors is based on publicly available data at the time of compilation. Lansing Street Advisors makes no warranties or representation of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use such data.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contain within should not be relied upon in assessing whether or not to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results.

Lansing Street Advisors is a registered investment adviser with the State of Pennsylvania..