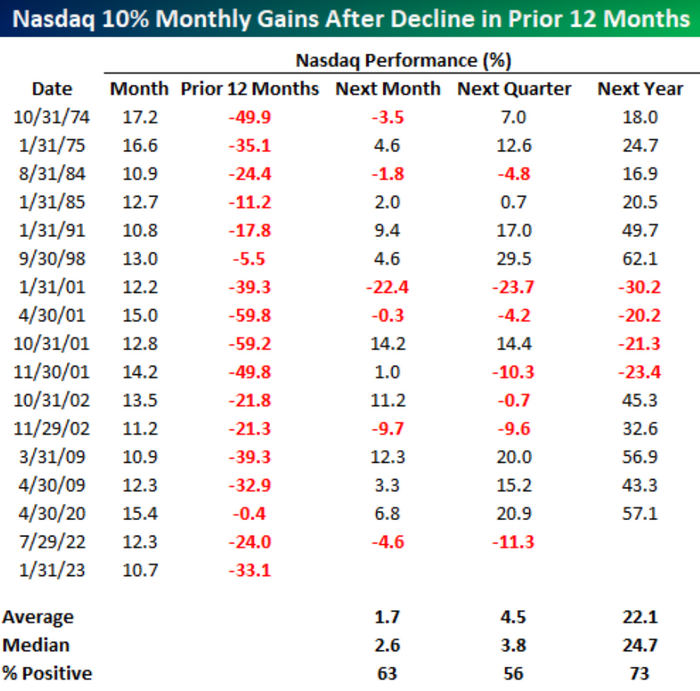

1. History Post Nasdaq 10% Nasdaq Jumps

Marketwatch-Nasdaq jumped over 10% in January. Here’s what history shows happens next to the tech-heavy index

But the number of occurrences drops to just 16 when narrowed to rallies of that magnitude following a 12-month stretch in which the index was down, according to Bespoke. In such cases, the firm found the Nasdaq’s performance then tends to be positive over the next year, except in 2001, “when there were four different 10%+ monthly gains and the Nasdaq was lower one year later after all four of them.”

For example, the chart below shows the Nasdaq jumped 12.2% in January 2001, after plummeting 39.3% over the prior 12 months. The index tumbled 30.2% over the next year.

https://www.marketwatch.com/story/wont-get-fooled-again-nasdaq-jumped-over-10-in-january-heres-what-history-shows-happens-next-to-the-tech-heavy-index-11675271801?mod=home-page

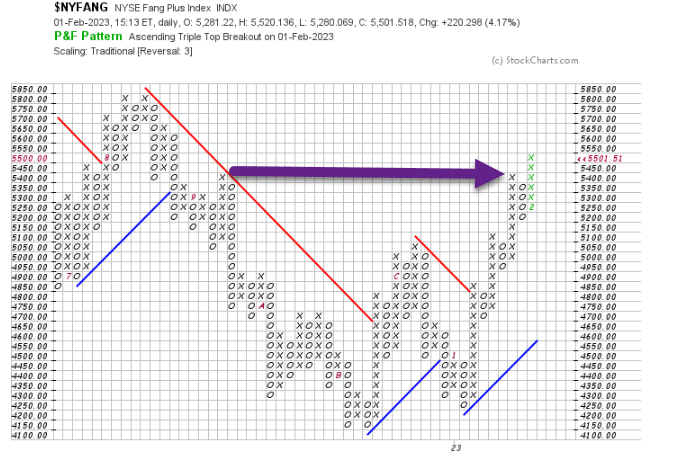

2. FANG ETF breaks above Summer 2022 ….Next Resistance 5800

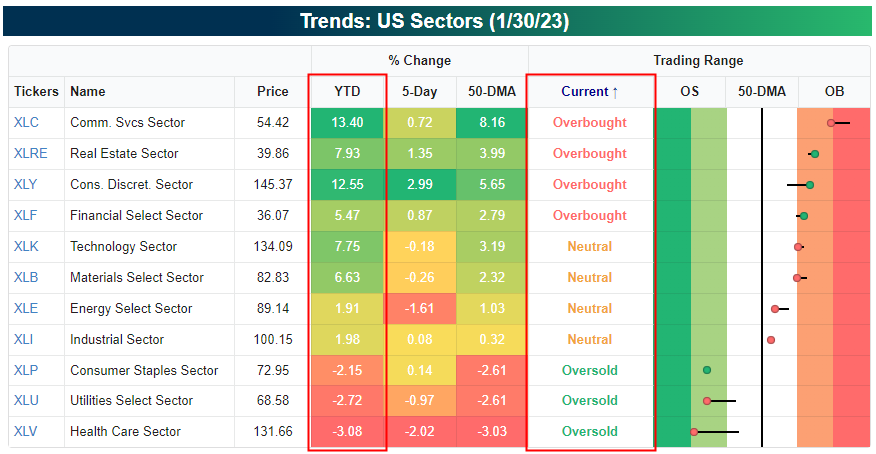

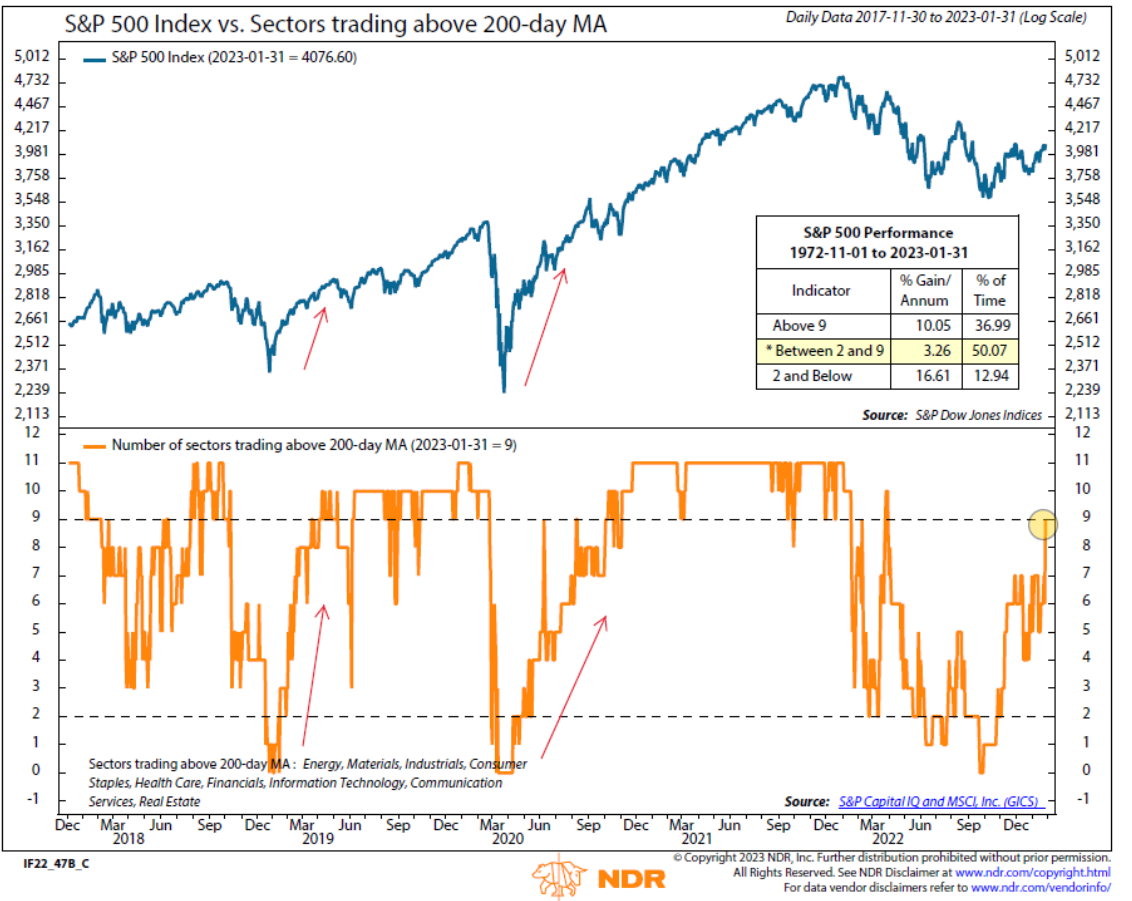

3. 9 Out of 11 S&P Sectors Now Trading Above 200day

Rob Anderson NDR Research https://twitter.com/_rob_

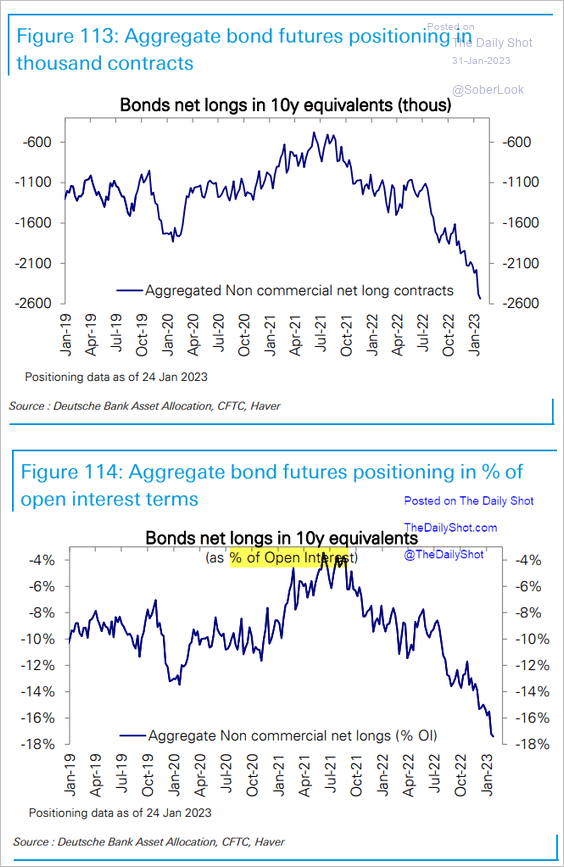

4. TBF Short Bonds ETF Closes Below 200day Moving Average

Another bullish bond signal

5. As You Would Guess…AGG Bond Index 50day about to go thru 200day to upside.

6. Carvana +186% in One Month

https://www.google.com/search?q=cvna+chart&rlz=1C1CHBF_enUS898US898&oq=cvna+chart&aqs=chrome..69i57j0i22i30l4j0i390j69i60l2.2209j0j7&sourceid=chrome&ie=UTF-8

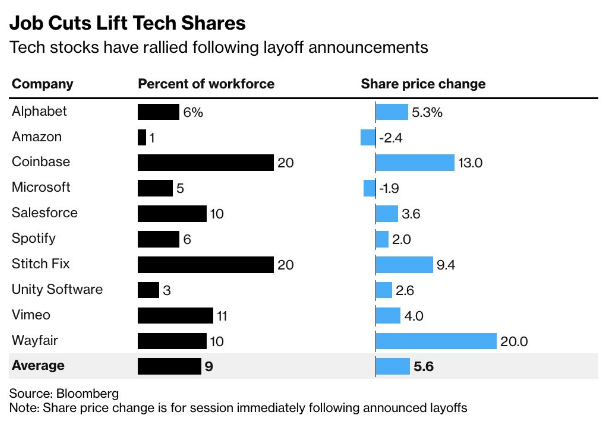

7. Fedex Cutting Senior Staff …Stock Rallies

FDX closes above 200day and fills entire gap from big selloff Sept. 2022

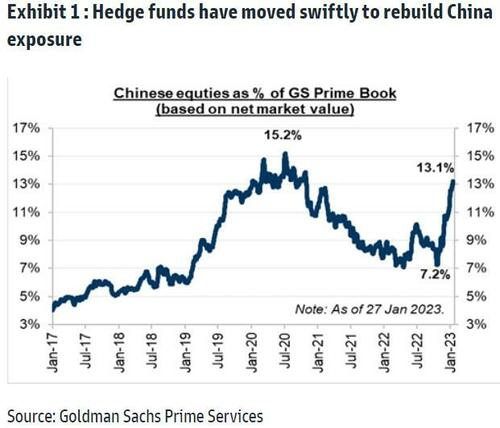

8. KWEB China Internet Stock ETF Double Off Lows

KWEB up 100% from low still not near 200 week moving average.

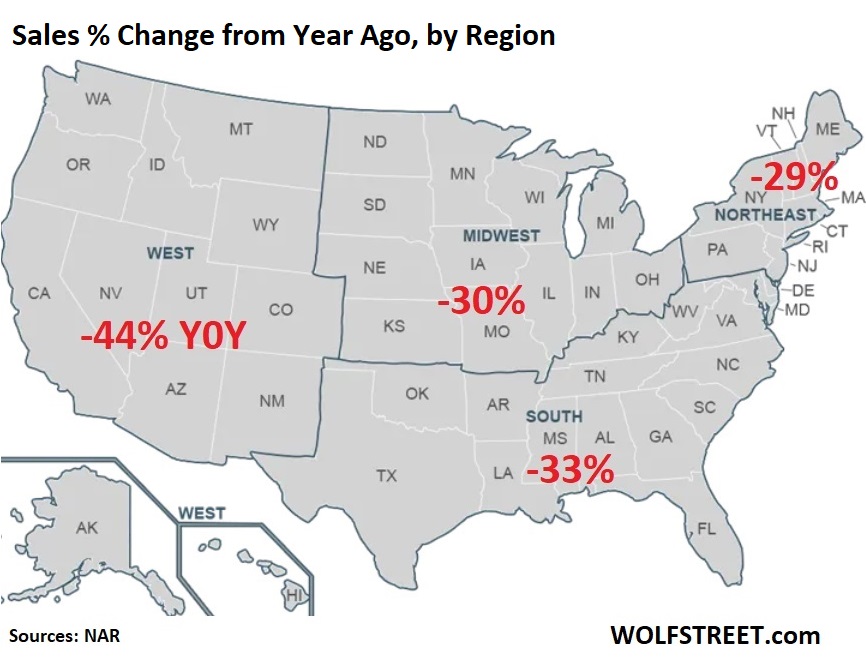

9. Home Sales Reduction by Region

Wolfstreet-Sales plunged in all regions, but plunged the most in the West. Year-over-year percent change (NAR map of regions):

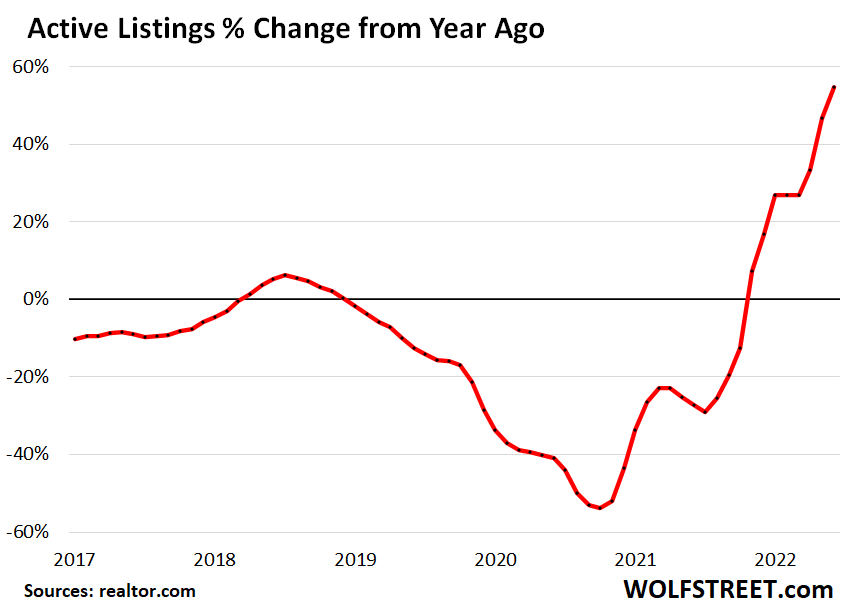

Active listings jumped by 55% from a year ago, to 68,900 in December (active listings = total inventory for sale minus properties with pending sales). Just before the holidays, lots of sellers pull their homes off the market, and then put them back on the market for the spring selling season. This happens every year; active listing start to drop before Thanksgiving and don’t rise again until the spring (data via realtor.com):

https://wolfstreet.com/2023/01/20/prices-of-existing-homes-fall-11-from-peak-sales-hit-lockdown-low-cash-buyers-and-investors-pull-back-hard/

10. You Need These 3 Ingredients to Build Stress Resilience

Psychology Today

A review of empirical research on how to increase resilience. Arash Emamzadeh

- Research indicates that over half of physician visits are due to stress-related issues.

- Though there is much information on stress management and resilience, much of it is unclear or unreliable.

- A recent paper concludes that three building blocks of resilience are equanimity, awareness, and flexible coping strategies.

These days, we may be experiencing high levels of stress–due to the pandemic, supply-chain disruptions, inflation, recession, international conflicts, and other issues affecting our health, work, and relationships. Therefore, building stress resilience (the ability to adjust and adapt in response to stress) has become more important.

A recent paper by Steffen and Bartlett (2022), published in Policy Insights From the Behavioral and Brain Sciences, evaluates the empirical evidence on coping with stress and discusses three science-based practices that promote resilience.

Before discussing the three practices, here is a quick word on stress.

Stress: Good or Bad?

Stress can be healthy and promote well-being if:

· It is experienced positively (as a challenge and opportunity than a threat).

· It occurs during activities that are freely chosen, enjoyable, and meaningful.

However, when severe, prolonged, and without a recovery period, stress can be harmful and detrimental to health.

Unmanageable stress (called distress) is associated with many negative physical health and mental health outcomes, including anxiety, depression, high levels of stress hormones (cortisol, adrenaline), inflammation, poor immune response, metabolic dysregulation, obesity, chronic diseases (e.g., heart disease), and early mortality.

As stress becomes chronic, we are more likely to neglect self-care–be it regular exercise, eating nutritious food, or getting sufficient sleep–and cope with stress in unhealthy ways.

Some examples of unhealthy coping strategies are emotional eating, compulsive pornography use, co

Given the importance of effective coping with chronic stress, what follows is a review of three empirically supported practices that, according to Steffen and Bartlett, are effective in promoting stress resilience.

The First Building Block of Resilience: Awareness

Coping successfully with stress is possible only if one is aware of it.

So, the natural tendency to avoid stress may prevent us from understanding when and where stress occurs, how it manifests in the body, and the best way to manage it.

Research shows resilient people, though not more worried, are more mindful and aware of stress. This is due to their attitude:

Only when coupled with curiosity and openness (

One way to increase awareness of stress is by using biofeedback. Biofeedback training helps people become more conscious of the fight-or-flight response and learn to regulate its effects, such as reducing high muscle tension, heart rate, and blood pressure.

Heart rate variability (HRV) biofeedback is particularly effective for reducing stress, anxiety, and depression. The intervention involves learning to breathe slowly and regularly, roughly six breaths per minute, called resonance frequency breathing.

The Second Building Block of Resilience: Equanimity

A completely stress-free life lacks challenge and excitement. In fact, regular exposure to moderate stress is not only pleasurable but also promotes healthy functioning.

Healthy functioning requires physiological balance, meaning time for engagement but also rest. When there is balance, exposure to stress and the use of effective coping strategies can strengthen the “coping muscles” and make us more resilient.

How a stressor is perceived or interpreted is key. Therefore, building resilience requires a change in perceptions. One approach is to develop a sense of equanimity.

Equanimity means being able to remain in, or quickly return to, a state of psychological stability and calmness. It does not mean indifference or avoidance but a kind of mental balance that encourages responding to all experiences–whether positive, negative, or neutral–with the same level of interest.

The good news is that mindfulness meditation can cultivate

The Third Building Block of Resilience: Flexible Coping

Rigid and maladaptive patterns of behavior, especially compulsive avoidance, are common in mental health conditions such as anxiety disorders, mood disorders, obsessive-

This is not surprising because avoidant coping can reduce distress, often immediately. Yet, over time, it tends to amplify fear and lower the quality of life.

Indeed, rigid and maladaptive thinking patterns (including cognitive distortions) are detrimental to resilience.

This brings us to the third building block of resilience, called flexible coping.

Perhaps the best way to enhance flexible coping involves cognitive behavioral therapy (CBT) or CBT self-help techniques.

CBT can improve resilience by teaching effective techniques for reframing negative thoughts and behaving more flexibly in stressful situations.

Exposure therapy and behavioral activation techniques facilitate confronting safe but feared or avoided stimuli (e.g., flying, elevators, social events), identifying what one finds rewarding, and engaging in valued and enjoyable activities regularly.

Our lives are filled with stress and worry. Indeed, research indicates that over half of physician visits are due to stress-related issues.

So, increasing resilience is very important.

Three simple resilience-building skills

1. Increase your awareness of stress and its manifestations while adopting an attitude of openness and curiosity.

2. Develop equanimity, a balanced state of mind with neither attachment nor aversion toward experiences.

3. Increase coping flexibility by evaluating your coping strategies and modifying or replacing them depending on how successful they are in managing specific problems.

You may find HRV biofeedback, mindfulness meditation, psychotherapy, or self-help CBT techniques helpful in strengthening these skills and becoming more resilient.