Topley’s Top Ten – May 19, 2020

1.Gold ETFs Take in More Money Than 2009 Crisis…$14.5B in Less Than 5 Months.

Gold ETFs Luring Record Amounts of Cash Despite Risk-Asset RallyBy Claire Ballentine and Justina Vasquez

Funds take in $14.5 billion on inflation, stock pullback fears

· Money continues to pour in as equities regain 30% from lows

Continue readingTopley’s Top Ten – May 18, 2020

1.Huge Spread Between Gold Performance and Commodity Indexes.

YTD—GLD +15% vs. Commodity Index (DBC) -30%

Topley’s Top Ten – May 14, 2020

1.Sector and Industry Returns Since 2/19/20

Bespoke-Some Stocks Moving Above February Highs

Wed, May 13, 2020

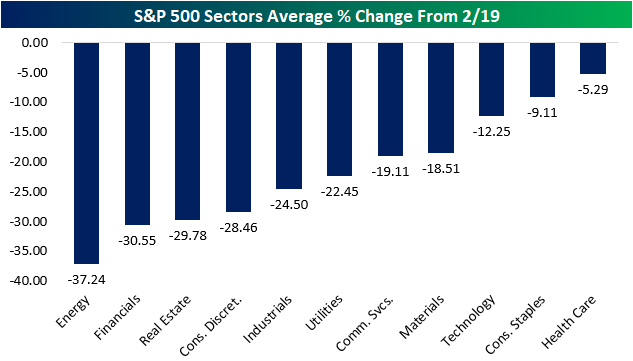

In last night’s Closer, we noted that as of yesterday’s close, the S&P 500 (SPY) sat over 15% away from its 2/19 all time high. But as for the index’s individual stocks, about 12.4% have retaken their 2/19 levels. As shown in the chart below, Health Care sector stocks on average are the closest at 5.29% below their levels on 2/19. Consumer Staples are the only other stocks that are less than 10% away from those levels on an average basis. Conversely, Energy, Financials, and Real Estate have the furthest to go, all down around 30% or more.

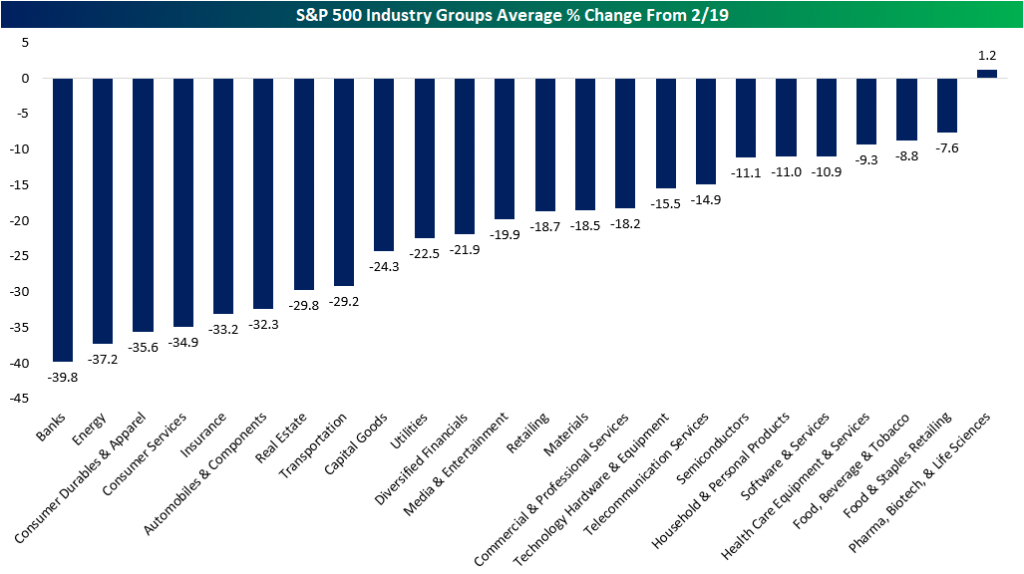

Meanwhile taking a look across industries, there is only one group of stocks that’s currently above its 2/19 levels on an average basis: Pharmaceuticals, Biotechnology, & Life Sciences. While stocks of that industry have pushed above by 1.2% on average, the other groups are not even close with the next closest to doing so being Food & Staples Retailing at 7.6% below 2/19 levels. In addition to Food & Staples Retailing, Food, Beverage, & Tobacco, and Health Care Equipment & Services are the only others that are even within 10% away. On the other end of the spectrum, Banks, Energy, and Consumer Durables & Apparel are down the most.