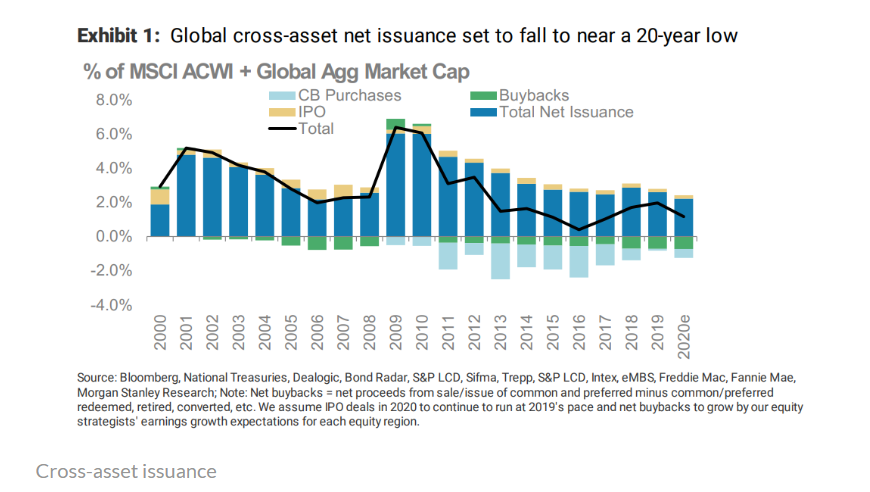

1.Global Supply of Stocks and Bonds at 20 Year Low.

Investors will face the tightest global supply of stocks and bonds in a year since 2000, a silver lining for fund managers that are grappling with the onset of global growth concerns at the start of 2020.

That’s based on calculations from Morgan Stanley strategists who don’t expect a deluge of issuance to be among the problems investors could confront this year. Analysts say too much debt or equity supply can sometimes overwhelm fund managers and other institutional investors, weighing on short-term returns.

“The supply/technical backdrop in 2020 looks manageable, and is not high on our list of full-year concerns,” Morgan Stanley analysts wrote in a late Friday note.

The global supply of stocks and bonds is the tightest in 20 years, says Morgan Stanley—Sunny OH. Marketwatch

Continue reading