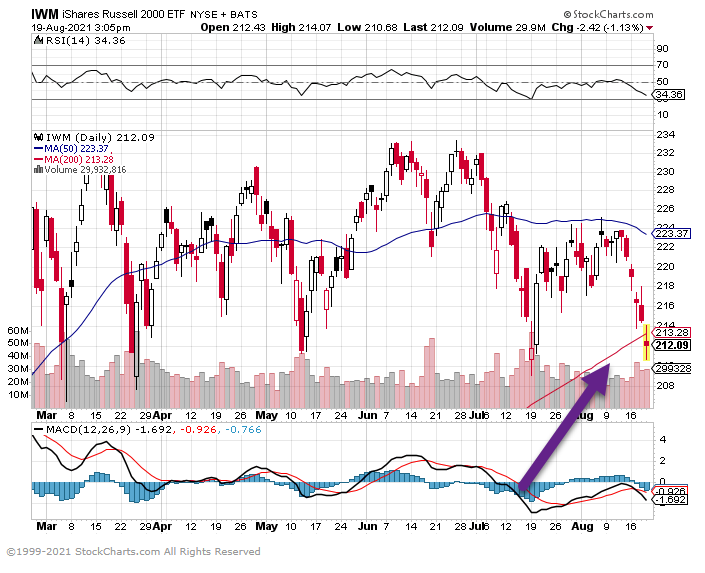

1.Russell 2000 Small Cap Closes Below 200 Day.

2.AMAZON -15% from Highs Closes Below 200 Day Moving Average.

AMZN back to May levels.

Coinbase reported earnings this week an the numbers were staggering…

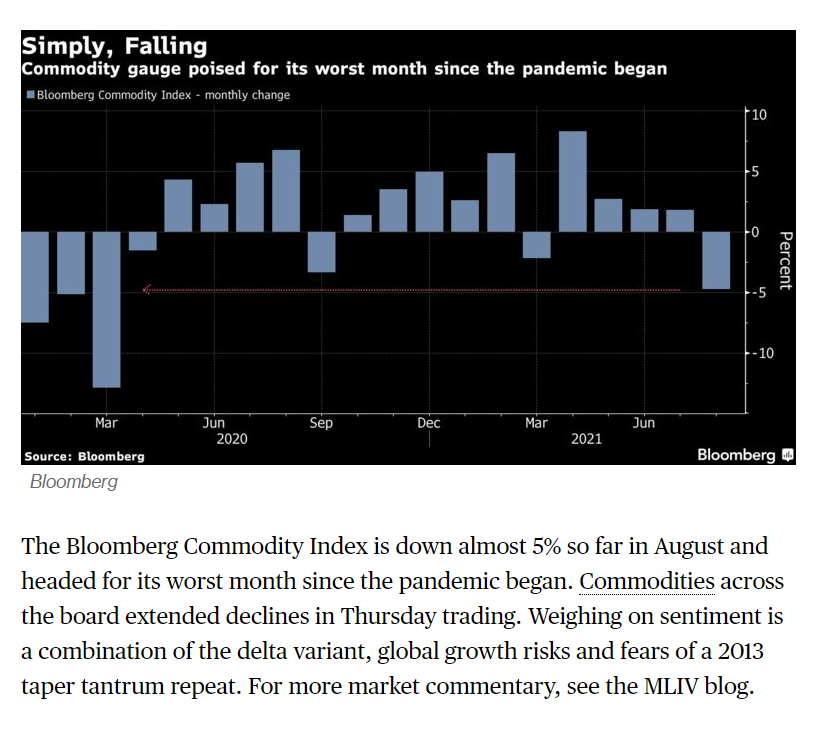

3.Commodities Worse Month Since Pandemic…-5% in August.

Commodities Head for Worst Monthly Drop Since March 2020: Chart By Nour Al Ali https://www.bloomberg.com/news/articles/2021-08-19/commodities-head-for-worst-monthly-drop-since-march-2020-chart?utm_source=twitter&cmpid=socialflow-twitter-business&utm_campaign=socialflow-organic&utm_content=business&utm_medium=social&sref=GGda9y2L

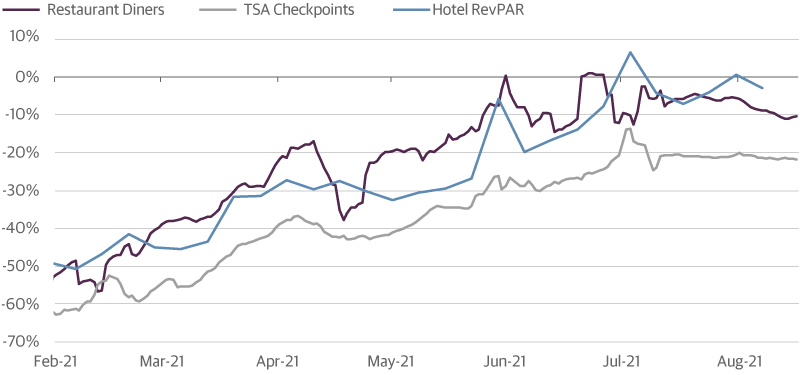

4.Delta Impact on Consumer Behavior Will Delay Tapering Announcement-

The Recovery in COVID-Sensitive Activities Has Stalled

Change Relative to Same Day in 2019

Expectations are mounting for a September announcement of tapering plans by the Federal Reserve (Fed), prompted by the strength of the economy and comments from more hawkish members of the FOMC, particularly Boston Fed President Eric Rosengren. We don’t see that happening.

The Delta variant is throwing a wrench into the forward progress of the economy. Although Fed Chair Powell believes that “it’s not yet clear whether the Delta strain will have important effects on the economy,” our read of the latest data suggests that it is already having a negative impact on consumer behavior.

After a large downside miss to July retail sales, spending on COVID sensitive activities such as restaurants, air travel, and hotels has weakened further in August. High frequency indicators of broader consumer activity such as daily credit card spending also show softening over the past few weeks.

5.Amazon vs. Walmart.

CHARTR–Amazon is officially the world’s biggest retailer outside of China. Data from FactSet reveals that more than $610bn was spent through Amazon in the 12-months that ended in June — overtaking US retail giant Walmart for the first time ever.

Amazon may have only just overtaken Walmart in terms of actual sales, but it’s been the more valuable company for a much longer time, first surpassing Walmart’s market capitalization more than 6 years ago, as investors generously (and correctly) extrapolated Amazon’s trajectory.

Bigger is better

Walmart’s strategy over the last half-a-century has been to become the ultimate big-box retailer. Bigger stores, more items, lower prices — everything has been about scale. Over time Walmart has grown to over 10,500 retail locations across the world, many of which are absolutely enormous (the largest comes in at 260,000 square feet, which is about 6 acres, or 24,000 square metres).

But even with some of the biggest supply chains and stores in the world, you’ll never be able to compete with the sheer range of items you can sell online. A typical Walmart store might come with 100,000+ items (known as SKUs in the biz), but online that number can reach 5m, 50m or even 100m+.

Margins online are also likely to be better. Even Walmart, which is about as big as you can get as a pure retailer, only squeezed out a relatively slim 5% operating profit margin in its latest quarter, which after interest costs and taxes was a 3% net profit margin. That still translated into a huge amount of profit ($4bn+), but it doesn’t give much room for error.

Walmart goes online

So Walmart was a bit slow to invest in e-commerce seriously, but if they’ve been playing catch-up they’ve been playing it pretty well in the last couple of years. Like pretty much every other retailer, Walmart’s online business got a shot in the arm last year, with e-commerce sales rising 97%.

Although things are slowing down this year (growing just 6% year-on-year) Walmart says the company is still on track to do $75bn in online sales, which is pretty meaningful.

Walmart is even beginning to directly compete with Amazon’s (and others) rapid delivery options, launching an Express Delivery option last year that claims to get groceries and other items to your door in 2 hours or less.

6.Amazon Opening Physical Stores to Compete with Dept. Stores.

New Covid Scare and AMZN Opening Physical Stores…But Retail ETF Holding at Highs

Amazon 19% of RTH ETF….Top 10 Names 70%

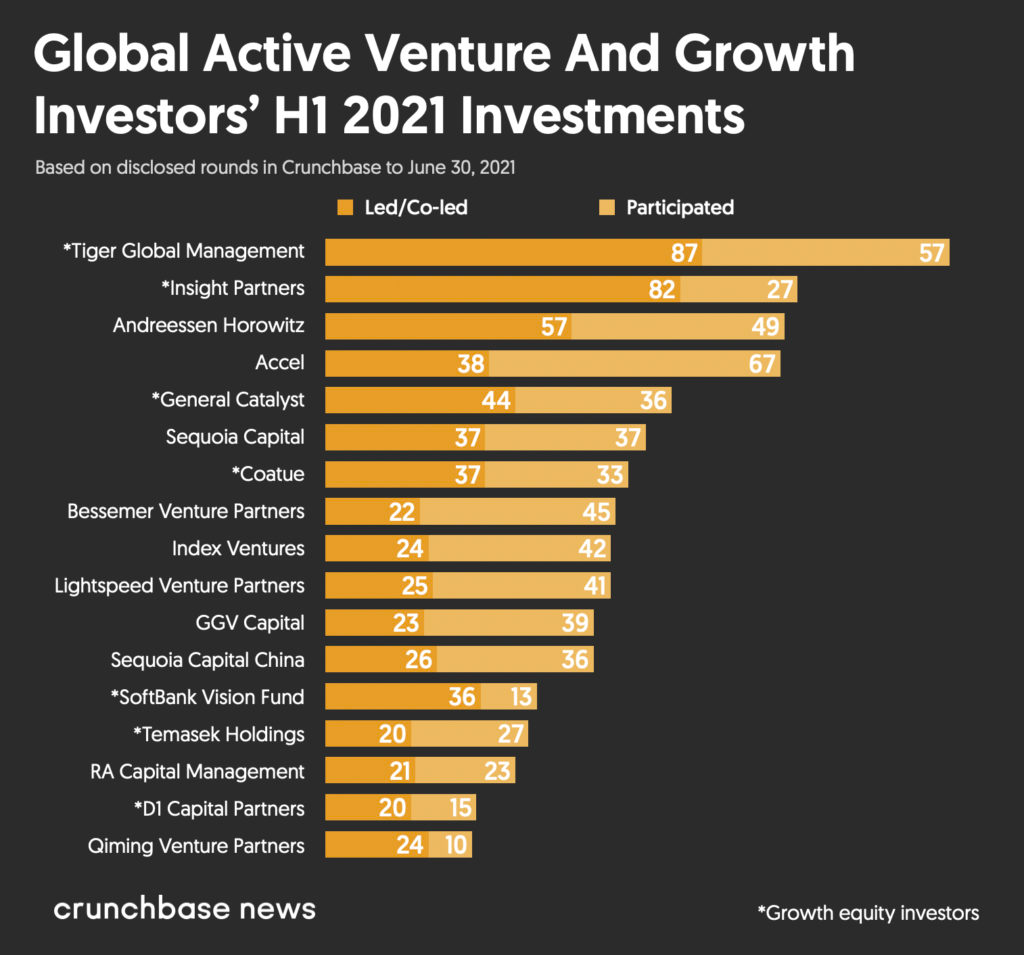

7.First Half 2021 Venture Capital

Increased investing pace

Growth equity investors Tiger Global Management and Insight Partners racked up the most portfolio companies for the first half of the year, according to Crunchbase data.

Tiger Global — whose breakneck investing pace this year we’ve written about previously — added 110 new portfolio companies. It has led 87 rounds in new and existing portfolio companies, averaging more than 14 rounds led per month. The firm has added 58 unicorn companies to its portfolio already this year.

Insight Partners added 71 new portfolio companies in the same timeframe, but led more rounds — totaling 82 for new and existing portfolio companies.

Venture firms Andreessen Horowitz, Accel and growth equity investor General Catalyst round out the top five active investors year to date.

https://news.crunchbase.com/news/global-vc-funding-h1-2021-monthly-recap/

8.40% of World Still No Internet Access

https://datareportal.com/reports/6-in-10-people-around-the-world-now-use-the-internet#:~:text=Internet%20access%20still%20isn’t,world’s%20total%20population%20remains%20offline.

9.International Aid was 43% of Afghanistan GDP 2020

- The IMF is withholding more than $450 million it was supposed to send to Afghanistan on Monday as part of its Covid relief program.

- The US has frozen about $9 billion in international reserves held by Afghanistan’s central bank, and blocked bulk shipments of dollars to the country as the government collapsed over the weekend.

Found at Morning Brew Morning Brew Afghanistan is one of the poorest countries in the world – now things could get even worse-Afghanistan is already one of the world’s poorest countries and the Taliban’s quick march to power likely won’t help matters, with a restoration of the hardline group’s previous ban on allowing women to work the biggest single obstacle to economic growth in future.

Ian King The Taliban, having taken over Afghanistan, will inherit an economy that is among the world’s most ramshackle.

That may surprise many given the billions of dollars spent by the United States and its allies in the country during the last two decades.

Afghanistan live updates: All the latest as the Taliban establish new government

Most of that money, though, was invested in trying to train the Afghan police and military and establish a coherent rule of law.

Despite the construction of a number of high-rise buildings, chiefly in Kabul, rather less was spent on initiatives, such as infrastructure improvements, that would have boosted growth longer term.

That is not to say there was not some improvement after the US and its allies kicked out the Taliban.

According to World Bank data, Afghan GDP – the total value of goods and services produced in an economy – grew from $4.055bn in 2002 to $20.561bn in 2013.

But growth slowed dramatically when, in 2014, most foreign combat troops – a key source of income – left the country with the departure of the UN-backed International Security Assistance Force.

Afghanistan’s GDP growth fell from around 14% in 2012 to as little as 1.5% by 2015.

Image:At least a fifth of Afghan GDP is reckoned to come from the opium trade

There was a subsequent recovery from 2016 onwards but, as of 2020, the economy was still worth just $19.807bn.

It slipped back into recession last year due to the COVID-19 outbreak and an intensification of political unrest that disrupted exports.

The country remains among the poorest in the world.

The latest World Bank data suggests that only six countries worldwide – among them Burundi, Somalia, and Sierra Leone – have a lower GDP per head (roughly speaking the value of a country’s economy divided by its population) than Afghanistan.

At least a fifth of Afghan GDP is reckoned to come from the opium trade, much of which has been controlled by the Taliban, helping arm the group.

Follow the Daily podcast on Apple Podcasts, Google Podcasts, Spotify, Spreaker

In all, agriculture makes up around half of economic activity in Afghanistan, while it also accounts for at least half of all employment in a country where two in five people are jobless.

Apart from opium, wheat is the key agricultural export, although there has also been diversification in recent years into more valuable crops such as walnuts, almonds, pistachios, saffron, pomegranates and raisins, despite increasing amounts of land being given over to opium cultivation.

Moreover, a lack of investment in cold stores and packaging facilities has held back Afghanistan’s ability to make more from fruit and vegetable exports, with at least a quarter of agricultural products reckoned to deteriorate after being harvested to such an extent that they cannot be sold.

Image:Agriculture makes up about half of economic activity

After agriculture, the key source of income for Afghanistan is overseas aid, which has traditionally covered about three-quarters of Afghan government spending.

This, though, has been falling in recent years and can be expected to almost completely dry up now that the Taliban have seized control.

That is not to say that, even under Taliban control, there will not be economic opportunities.

Afghanistan is rich in mineral resources – the value of which was put at $1trn a decade ago – including deposits of lithium and cobalt, both key components in electric vehicle batteries, gold, copper and iron ore.

Those riches were charted by Soviet geologists following the invasion 40 years ago and, more recently, by the Pentagon, which, in an internal document in 2010, suggested Afghanistan had potential to become “the Saudi Arabia of lithium”.

Unfortunately, Afghanistan’s ability to exploit those resources will be hampered by a lack of transport infrastructure, a developed electricity grid and technical expertise, with few mining engineers prepared to set foot in the country even before the Taliban came to power.

Even China Metallurgical Group, which has owned the rights to exploit one of Afghanistan’s biggest copper deposits since 2007, has not done so due to concerns over security.

China, which is already the biggest foreign investor in Afghanistan, would be a logical partner for the Taliban if the country’s considerable mineral reserves are ever to be exploited but it is likely to drive a hard bargain and will require strong guarantees on security.

Ashraf Ghani, the former president, refused a request from China to cut royalty rates some years ago.

Nor have these mineral riches helped Afghanistan much to date.

Much of what mining exists in the country is illegal, not only depriving the government of royalties, but also providing income to insurgents.

Greater than Afghanistan’s mineral wealth is its human capital.

It is a young country, with getting on for two-thirds of the population under the age of 25, as well as an increasingly educated one.

From a situation where one in five Afghans were illiterate after the Taliban were kicked out, there has been a massive expansion in education, with 10 times as many universities as there were in 2001.

Among the key beneficiaries have been women and girls, who were previously deprived of education under the Taliban, but who now once again face the prospect of being banned from either education or employment.

A continuation of the Taliban’s previous ban on allowing women to work would be the biggest single obstacle to economic growth in future.

Others are likely to include the country’s relatively poor health.

Life expectancy is lower than elsewhere in South Asia.

The Taliban takeover does not only have consequences for Afghanistan’s own pitiful economy.

There are also huge economic implications for the country’s neighbours, in particular Pakistan, where there are already estimated to be nearly 1.5 million Afghan refugees.

Millions more can be expected to head off as they seek to escape the Taliban.

Afghanistan’s neighbours to the north, including Uzbekistan and Turkmenistan, will also have similar concerns.

Added to this will be the risk that some projects planned by the Ghani government in partnership with Afghanistan’s neighbours may now not come to fruition.

Chief among these was a railway, running via Kabul, connecting Mazer-i-Sharif, close to the Uzbek border, with Peshawar in Pakistan.

This was expected to be of huge benefit not only to landlocked Afghanistan, but also its neighbours in terms of its ability to transform trade and reduce the cost of doing it.

Afghanistan’s economy was already in a parlous state.

But that is not to say it could not become even weaker under the Taliban.

10.Top 5 Tips from Navy SEALs on Exceptional Leadership

Are Navy SEALs born or made? Cami Rosso

Extreme adversity, obstacles, and unexpected hurdles happen to everyone. How you think and act in the face of seemingly impossible challenges and uncertainty reveals your core character and separates good from exceptional leaders. The U.S. Navy SEALs (Sea, Air, and Land Teams) are legendary for being among the toughest of the tough. Only a tiny elite fraction pass the extreme mental and physical training requisites for Navy SEAL Special Operations forces.

Can you control your emotions and actions, regardless of how difficult the circumstances are? Do you make excuses or are constantly finding ways to solve problems? Are you a person of the highest integrity, honor, and courage? Is your word truly your bond? Do you give up easily, or do you persist without ever giving up until you find innovative ways to achieve goals? When you do achieve a big goal, do you rest on your laurels and past accomplishments, or do you have the discipline, drive, humility, and self-awareness to continue to seek self-improvement?

Not everyone can become a Navy SEAL. However, anyone, including psychologists, CEOs, athletes, startup entrepreneurs, crisis counselors, mental health professionals, business executives, neurosurgeons, emergency room physicians, first responders, and even stay-at-home parents can benefit by applying insights from Navy SEAL leadership when facing extremely challenging problems.

Jason Tuschen, CEO of RANDORI INC, is a recently retired Navy SEAL with 27 years of military and Special Operations experience leading high-performance teams in complex, dynamic and high-risk environments. He has served as the Command Master Chief of Naval Special Warfare Group ONE, a 2,000-person organization. Tuschen co-founded RANDORI INC with fellow Navy SEAL Jason L. Torey, who is the company’s chief operating officer. Torey, a Fellow of The Honor Foundation, has earned both an MBA and a Master of Science and is a doctoral student in executive leadership. RANDORI INC is a San Diego-based company that provides consulting, mentorship, public speaking, talent connection, and executive communication services, based on more than 50 years of combined combat-tested, proven Navy SEAL leadership experience. Together they recently spoke on leadership at the Exponential Medicine conference in San Diego, California. Here is a summary of a few of their insights that can benefit anyone seeking leadership excellence, not just elite warriors.

1. Use Emotional Intelligence

People with high emotional intelligence tend to exhibit greater leadership skills and better mental health. Develop a high level of intuition and self-awareness based on your strengths, weaknesses, motivation, values, and drive. Engage with people no matter what their levels are. Take the time to get to know people and build a genuine relationship. Be empathetic and consider other people’s feelings when communicating and making decisions. It’s hard to develop, but if people respect and trust you, they will follow you. Once you’ve earned their trust, you can never break that trust.

article continues after advertisement

2. Separate passion from emotion

Regulate your emotions. This means finding ways to control or redirect any emotions that can interfere with your focus on obtaining your goal. Separating your passion from emotion does not imply indifference. Don’t be indifferent.

3. Master fear with preparation

First seek to master the basics, then always be anticipating what could go wrong. For each scenario on what could go wrong, have a plan of action for each scenario. Focus on the task, everything else is a distraction. Trust in your training and preparation. Stay focused on your overall goal and recognize that distracting emotions are just noise.

4. To be a good leader, be a good follower

Great leaders are humble. Lead with humility. Have an open mind. Be introspective and reflective. To be a good leader, be a good follower. A good follower is not a blind follower. A good follower seeks to understand the “Why” of a mission or goal. It’s not the same a questioning authority. It is about gathering information and forming an understanding of what the purpose of the mission is, and the required actions to reach the goal. When you become the “why,” because you inspire your team and they believe in you, that’s authentic leadership.

5. Don’t get comfortable.

People tend to be risk-averse and seek comfort. Don’t get comfortable. Instead, seek out the toughest challenges. Find ways to continually expand your limits and improve yourself. At the end of a project, analyze all aspects of what could have been done better. Learn from your mistakes. If you find that things are easy, and you are no longer growing, it’s time to move on and seek out greater challenges.