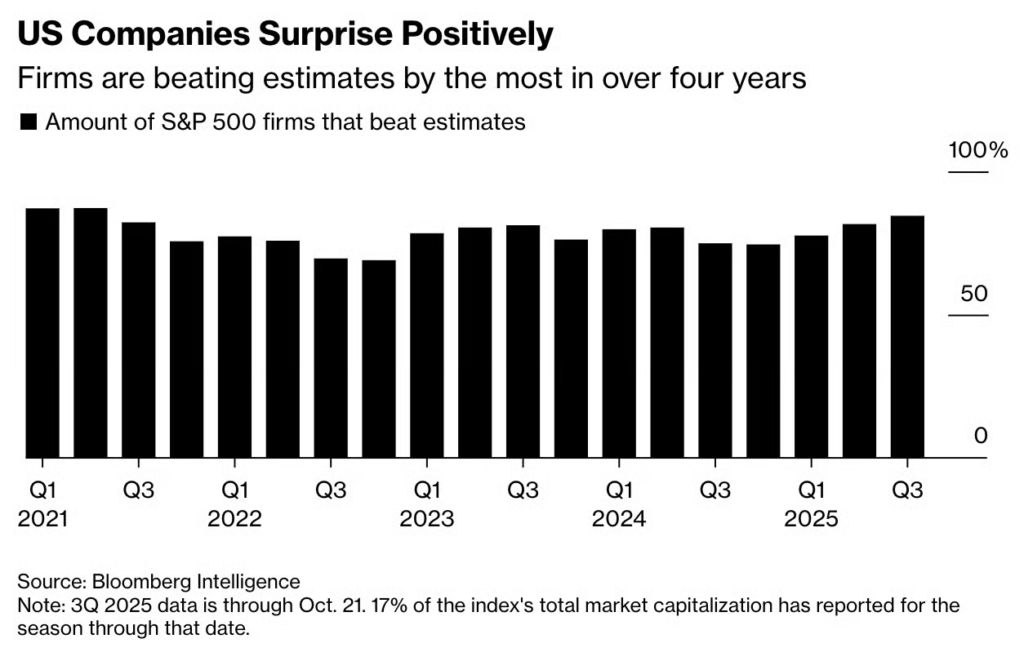

1. More Earnings Stats

Beat rate. “The proportion of US companies beating earnings expectations this quarter is the highest in more than four years … About 85% of S&P 500 firms to have reported third-quarter earnings so far have surpassed profit estimates, on course for the best performance since 2021.”

Farah Elbahrawy – Bloomberg

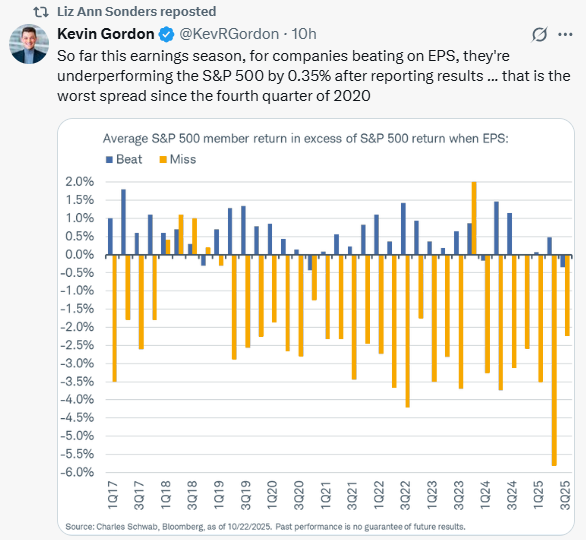

2.Companies Beating Earnings are Underperforming

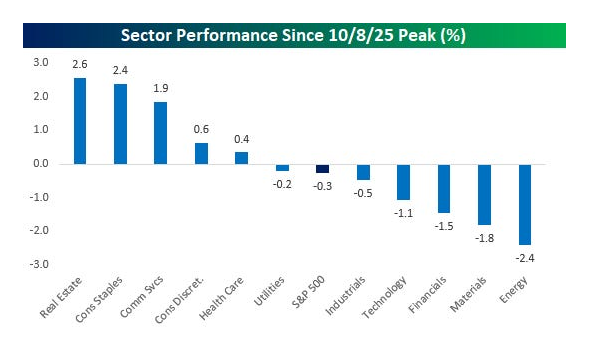

3.Sector Performance Since Highs on 10/8

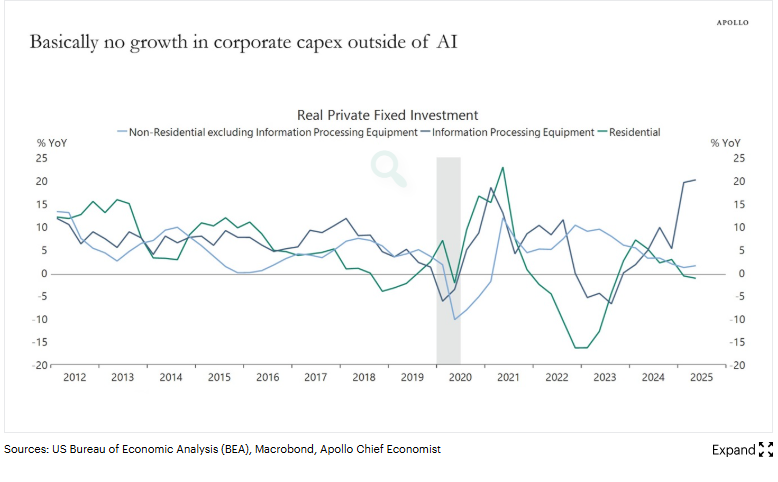

4.Capex is Flat Outside of AI Build Out

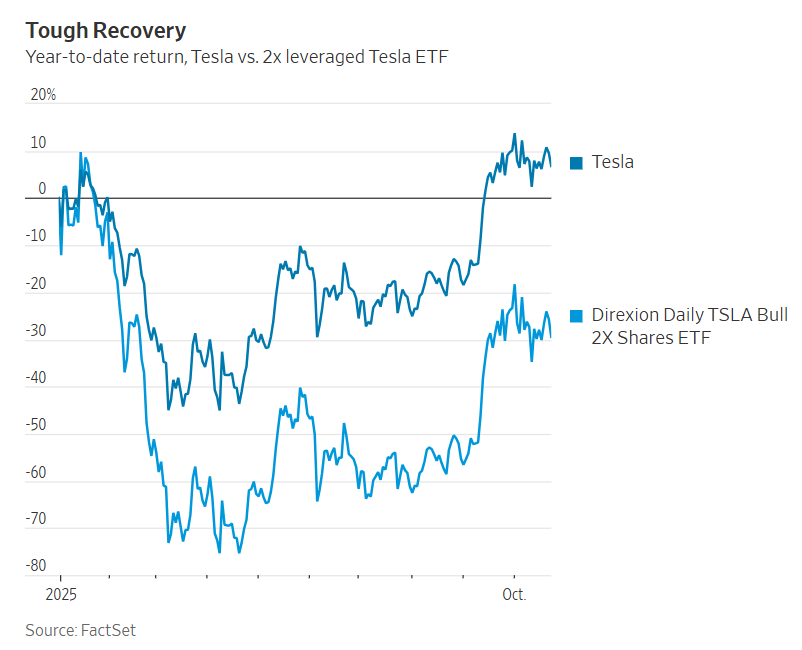

5.Single Stock Leverage ETFs Trailing Stocks

WSJ Jack Pitcher The brutal divergence in performance is caused by what traders call “volatility decay,” or the tendency of price fluctuations to erode the long-term returns of a leveraged fund, even if the underlying asset goes up. And it is why leveraged-fund managers are quick to warn that their funds shouldn’t be held for long periods.

“Everything that is problematic about these funds is more problematic the more leverage or volatility you add to them,” said Dave Nadig, an industry veteran and director of research at ETF.com.

Money managers say that most leveraged funds aim to amplify returns for a single day, and shouldn’t be held for longer periods.

One of the most popular funds provides an extreme example. Last November, two recently launched ETFs that offered to double the daily returns of bitcoin-linked stock MicroStrategy (now known as Strategy), began to soar. The outsize gains attracted attention on social media, and thrill-seeking individual investors began to pile in at a pace never seen before for a leveraged single-stock fund.

Many of those investors are now sitting on huge losses, despite the fact that the underlying Strategy shares are up over the past year. Strategy shares rose 28% in the 12 months ended Wednesday, while one of the leveraged funds, the Defiance Daily Target 2x Long MSTR ETF, plunged 65%.

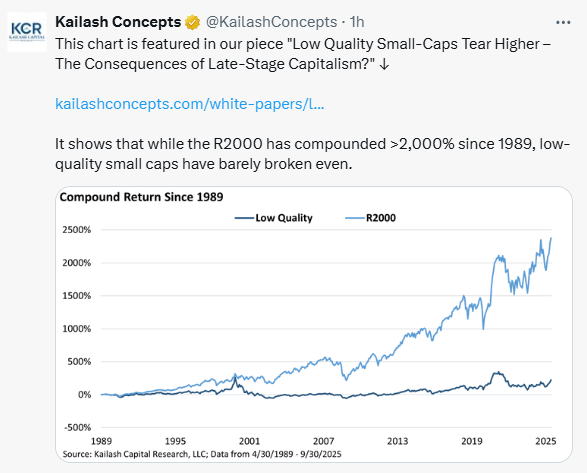

6.Low Quality Small Cap Rallying But See Long-Term

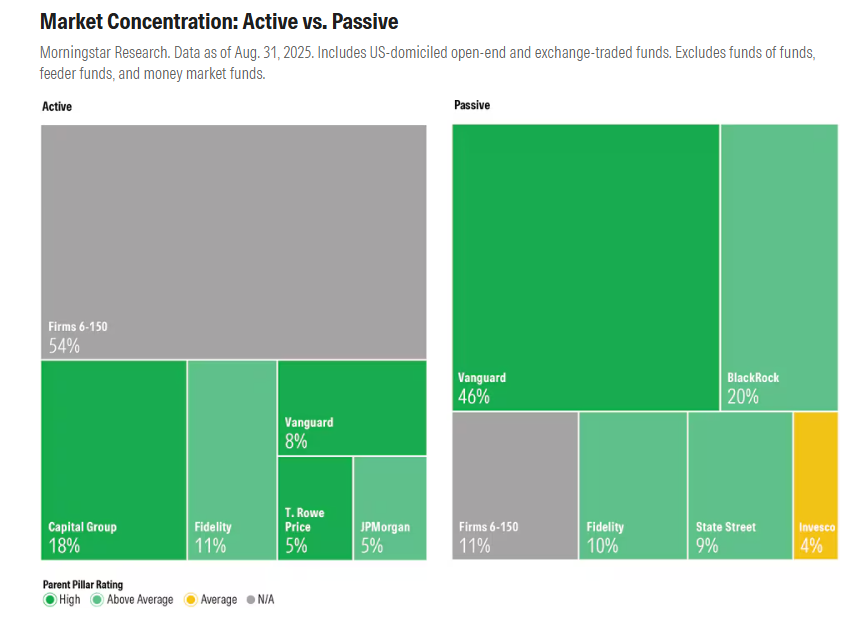

7.Dominant Active and Passive Managers…Vanguard and Blackrock 66% of Passive Combined

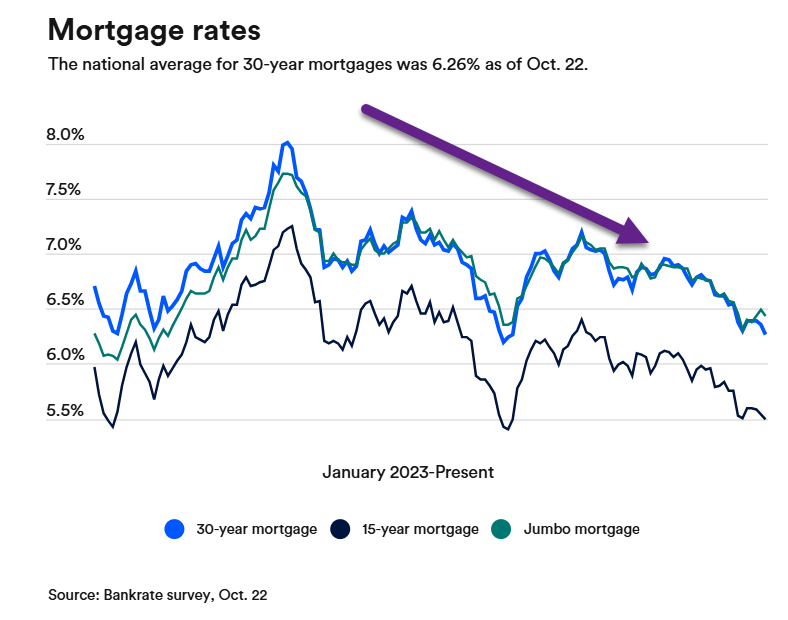

8.Mortgage Rates Closing in on 6%

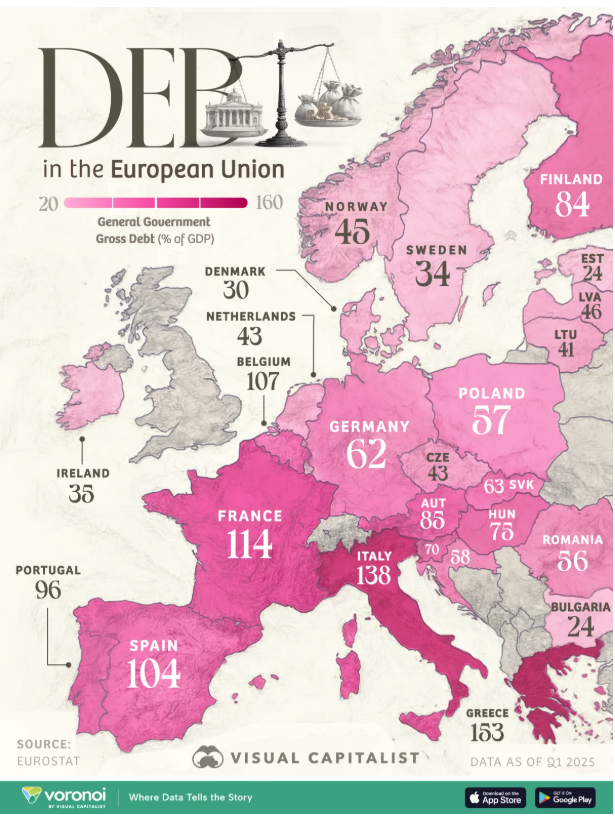

9.Debt to GDP Europe

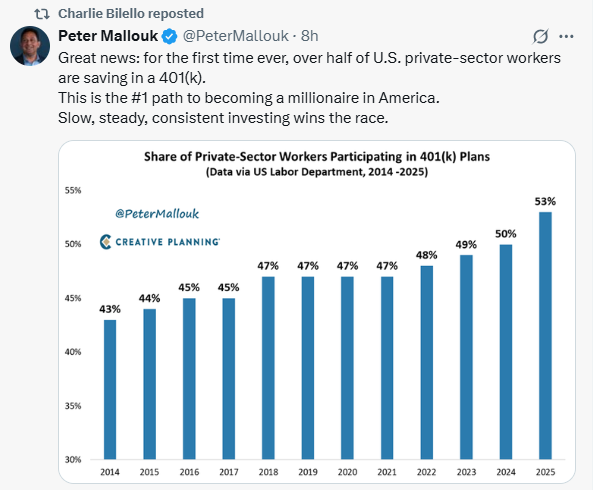

10.As Stated in My Quarterly Letter.. The U.S. is a Now a Stock Market Nations….Half of Private Sector Employees in 401k