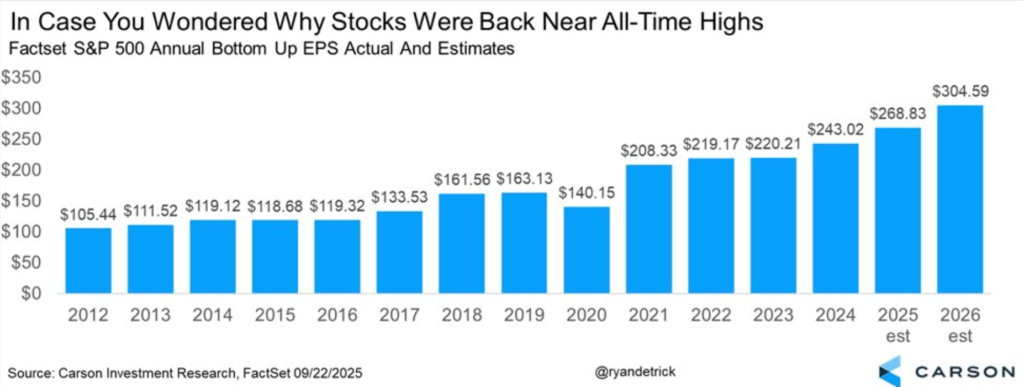

1. Earnings are Doing the Work

The Irrelevant Investor

2. Another Look at Earnings

@ryandetrick

3. Remember Gold was Most Short-Term Overbought in History….It Has Not Even Broken Its 20-day in Green Yet

StockCharts

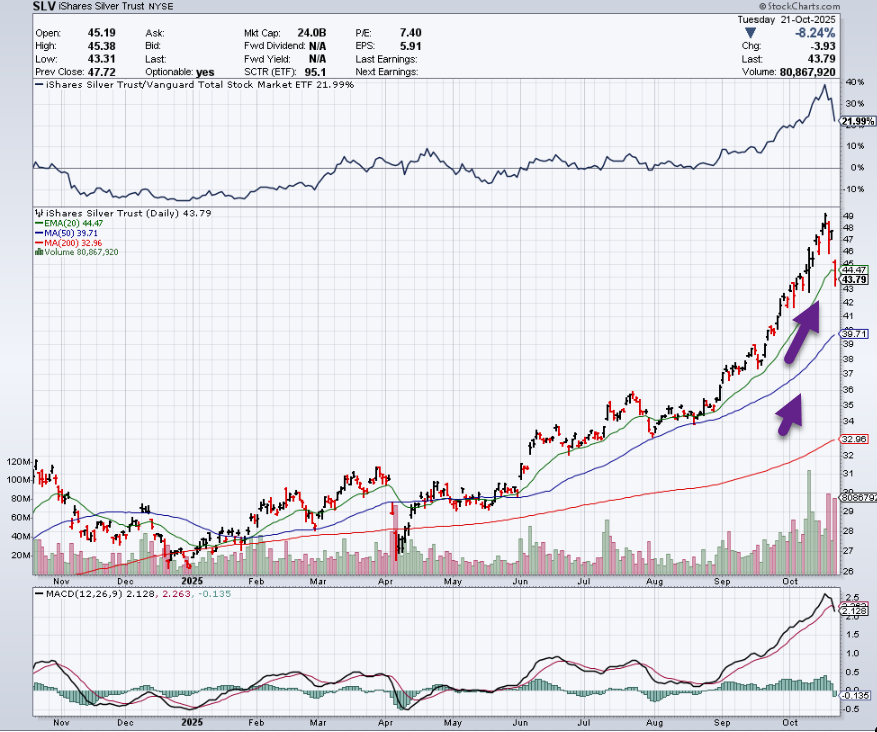

4. Silver Closed Below 20Day Still Well Above 50day/200day

StockCharts

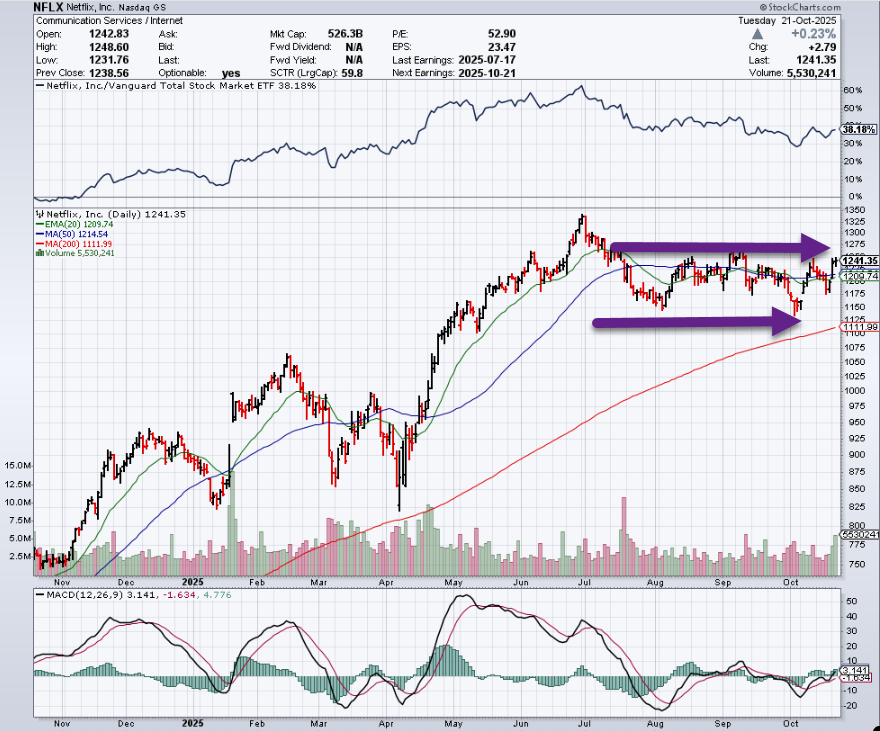

5. Going into Earnings Last Night…NFLX was Below Highs, Trading Sideways 3 Months

StockCharts

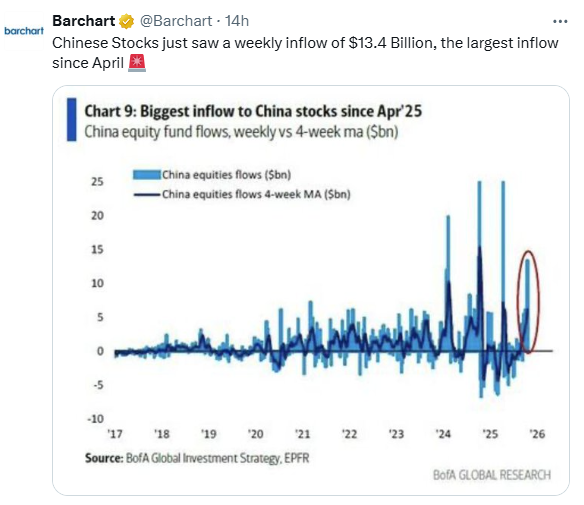

6. Chinese Stocks Massive Inflows

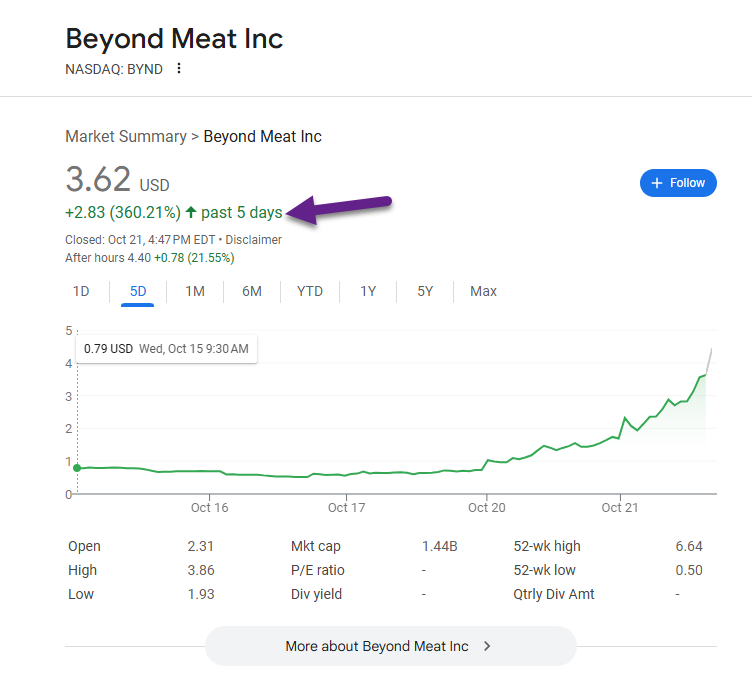

7. New MEME Stock Beyond Meat +360% 5 Days

Google Finance

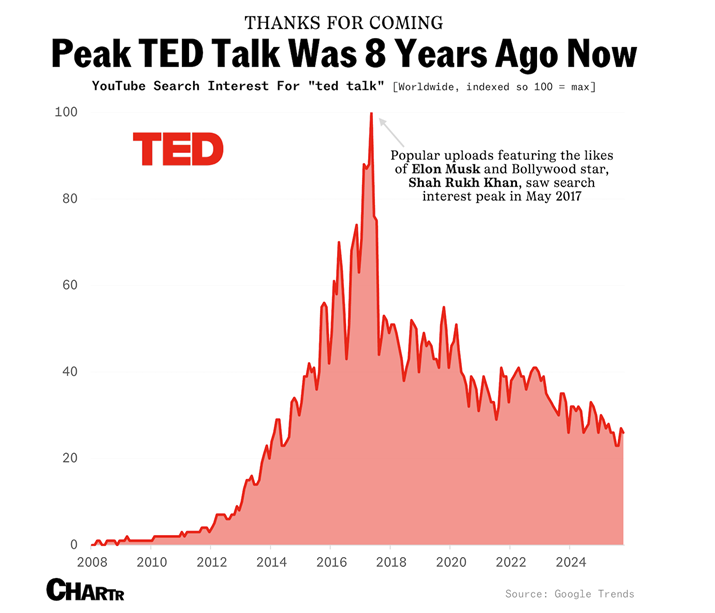

8. Peak TED Talk 8 Years Ago

chartr

9. The Quiet Expansion of the USA’s Bitcoin Balance Sheet

It’s not every day the U.S. government quietly adds $15 billion in Bitcoin to its balance sheet – without authorizing a single purchase.

Last week, the Department of Justice announced the largest crypto forfeiture in U.S. history: roughly 127,000 BTC linked to an international fraud network led by Cambodian billionaire Chen Zhi. The Bitcoin was recovered from unhosted wallets and is now in federal custody.

At first glance, it’s a simple enforcement story. But look a little closer, and it’s something more consequential – a real-world example of how Washington’s Strategic Bitcoin Reserve (SBR) may begin to take shape in practice. Under the framework established by President Trump’s executive order, seized Bitcoin doesn’t just sit idle. It’s classified as a strategic national asset, meaning each enforcement action now doubles as a form of accumulation.

From Seizure to Strategy

Senator Cynthia Lummis was quick to connect the dots. In a post on X, she wrote:

“The seizure of 127,000 bitcoin underscores two urgent priorities for Congress: first, passing clear digital-asset market-structure legislation to ensure law enforcement can act decisively against bad actors while protecting innovation. Second, codifying how seized bitcoin is stored, returned to victims, and safeguarded for future generations.”

Her statement gets to the heart of what’s unfolding: the U.S. government isn’t just seizing Bitcoin – it’s beginning to define what national ownership looks like. And under the Strategic Bitcoin Reserve, that process is no longer ad hoc. It’s structured, audited, and explicitly designed to treat Bitcoin as a long-term strategic holding rather than an expendable asset.

Today, the United States holds approximately 325,447 BTC, worth roughly $36.3 billion at current prices – more than most public companies and sovereign treasuries combined. None of it was purchased. It’s the cumulative result of years of enforcement actions, now woven into an official framework that treats those assets as part of a reserve strategy. https://thecryptoadvisor.substack.com/

10. Foggy Mirror-Seth’s Blog

It’s easy to believe we have an accurate understanding of ourselves. After all, we spend a lot of time looking in the mirror.

It might be worth wondering about why the mirror is deemed to be accurate at reflecting what we see as our flaws, real or metaphorical, but indistinct and a little fuzzy when we consider our opportunities, assets and contributions.

When we remind ourselves what we have to offer, it’s more likely we use those resources, but rehearsing our defects simply holds us back.

Amplifying one’s flaws is a non-productive hobby. https://seths.blog