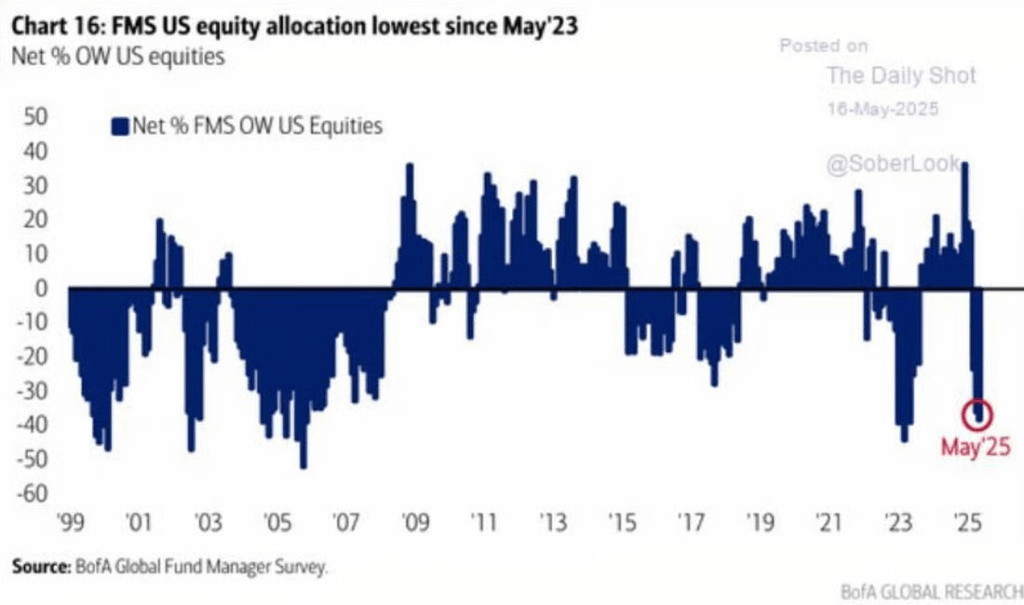

1. Underweight U.S. Equity Exposure from Fund Managers

Fund managers are the most underweight equities since May 2023. Even after the recent run, their allocations have not budged.

Bol

2. Healthcare Sector Sentiment Record Lows

Via Barron’s: Jason Goepfert, founder and senior research analyst at SentimenTrader, notes that the ratio of the price of the healthcare index relative to the S&P 500 fell more than 35% from its most recent high, something that had only occurred seven times before over the past 100 years. That type of relative decline has typically been a good time to buy the sector, which has averaged a return of 17% over the subsequent 12 months.

But wait, there’s more. The Health Care ETF traded at a new 52-week low on May 15 before rallying to finish the day above the previous day’s high. That, too, is a rare occurrence—it’s happened just four other times since the ETF’s inception in 2000. Once again, returns have been quite good. The ETF has averaged a 21% rise over the 12 months following the signal, according to SentimenTrader data, including a 46% rise after getting triggered in 2009. That, too, suggests the sector is oversold and primed for a rally. “Trends in the sector are so bad that they indicate washout conditions, and investors seem to sense snapback potential,” Goepfert writes.

XLV Healthcare ETF Closes Below 200-Week Moving Average on Long-Term Chart

StockCharts

3. IBM Making New Highs

StockCharts

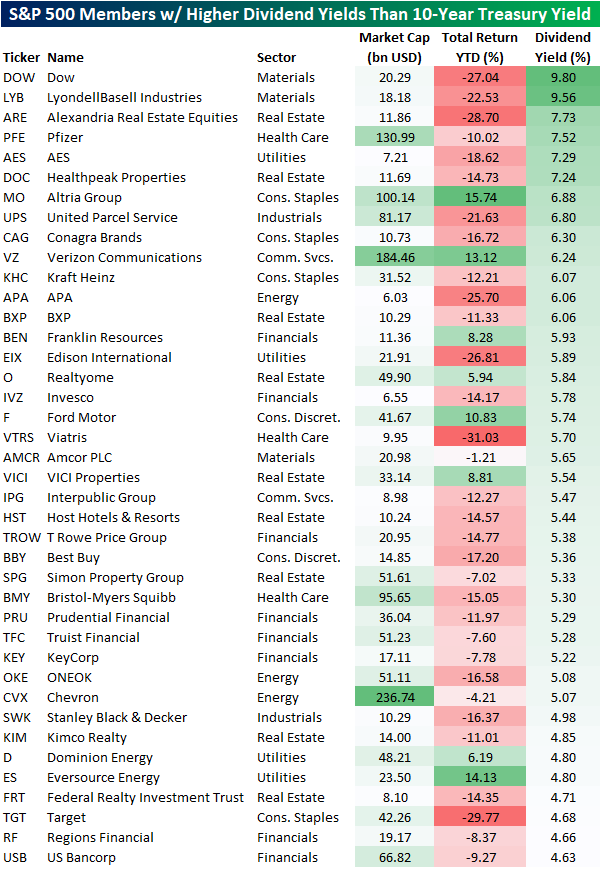

4. S&P Stocks with Dividend Yields Higher than 10-Year Treasury

At the moment, there are 40 S&P 500 stocks with higher dividend yields than the 10-year yield, and we list them below. Two Materials stocks top the list with 9%+ dividend yields and over 20% declines on the year.

Bespoke

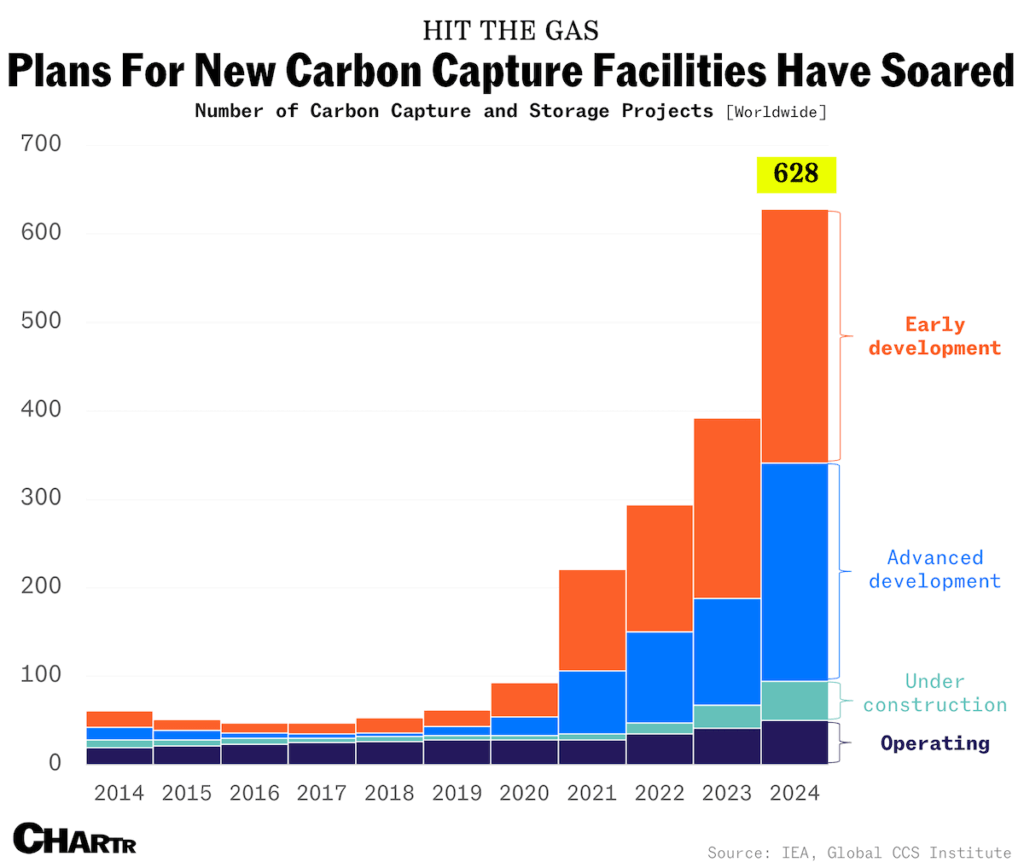

5. Carbon Capture is Big Business

Ready, offset, go: Carbon capture is becoming a big business. Some of the world’s largest (and top-polluting) companies have come to rely on carbon offsets to hit net-zero targets. At present, these offsets are mostly natural solutions like tree-planting projects, but there’s been a huge upswing in CCS systems recently.

Last month, The IEA reported that while the first quarter of 2025 saw over 50 million metric tons of CO2 capture and storage capacity in operation, capacity is projected to grow strongly, reaching ~430 million metric tons by 2030.

A major driving force behind the surge in CCS developments is the eye-watering growth of Big Tech. According to analysis from Carbon Brief, tech companies like Microsoft and Apple generally use higher proportions of removal-based offsets than other industries like oil or airlines, and demand has only increased as these giants have gone all in on energy-guzzling data centers to power AI.

In its global carbon markets outlook for 2025, Bloomberg outlined that new contracted volumes of carbon removal credits increased by 74% last year, predicted that they’ll double this year, and detailed that Microsoft alone bought nearly two-thirds of new contracts last year, or ~5.1 million carbon removal credits.

6. Trump Announces 25-Year Plan to Accelerate Nuclear—Uranium a Couple Ticks from Break-Out to New Highs

StockCharts

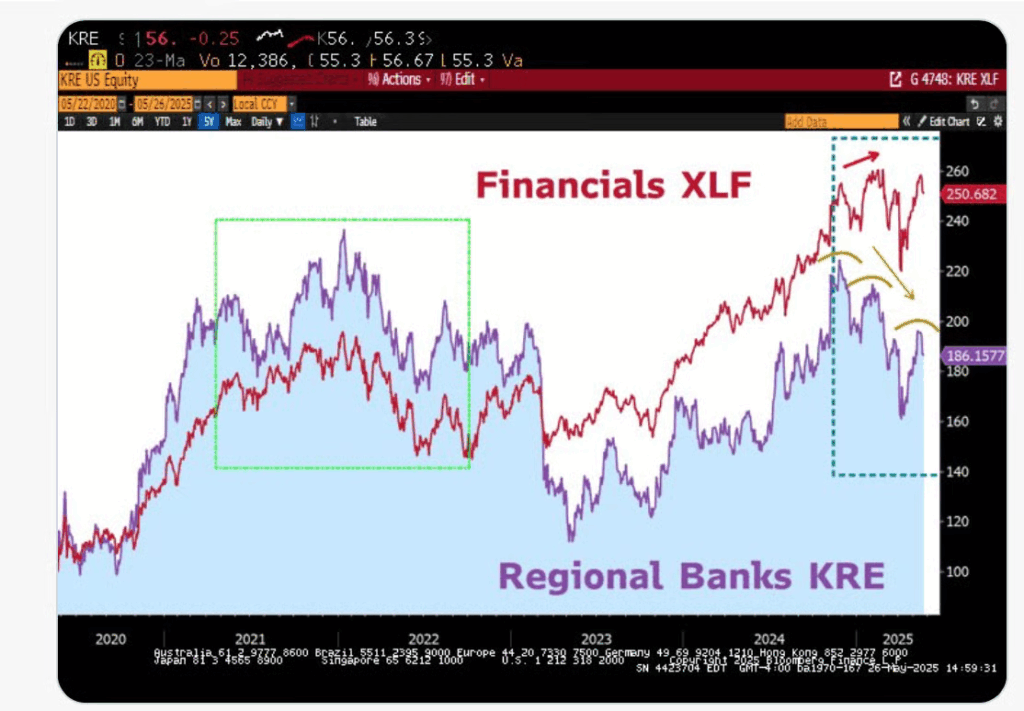

7. Big Financials vs. Small Cap Banks….51% Spread in Returns Since Jan 2022

ConvertBond

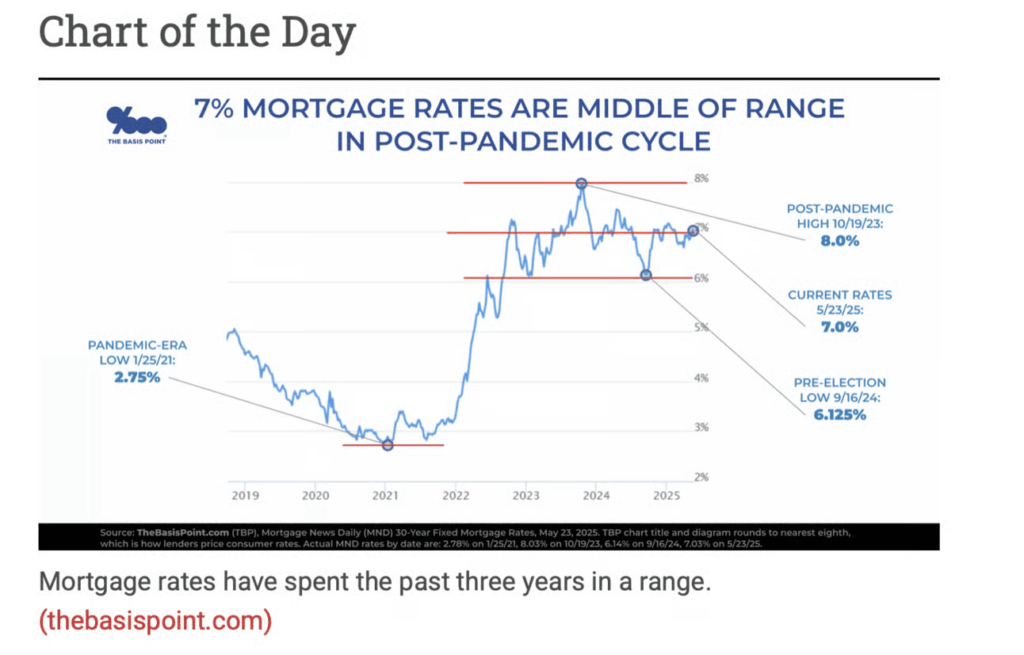

8. Mortgage Rates 3-Year Range

Abnormal Returns

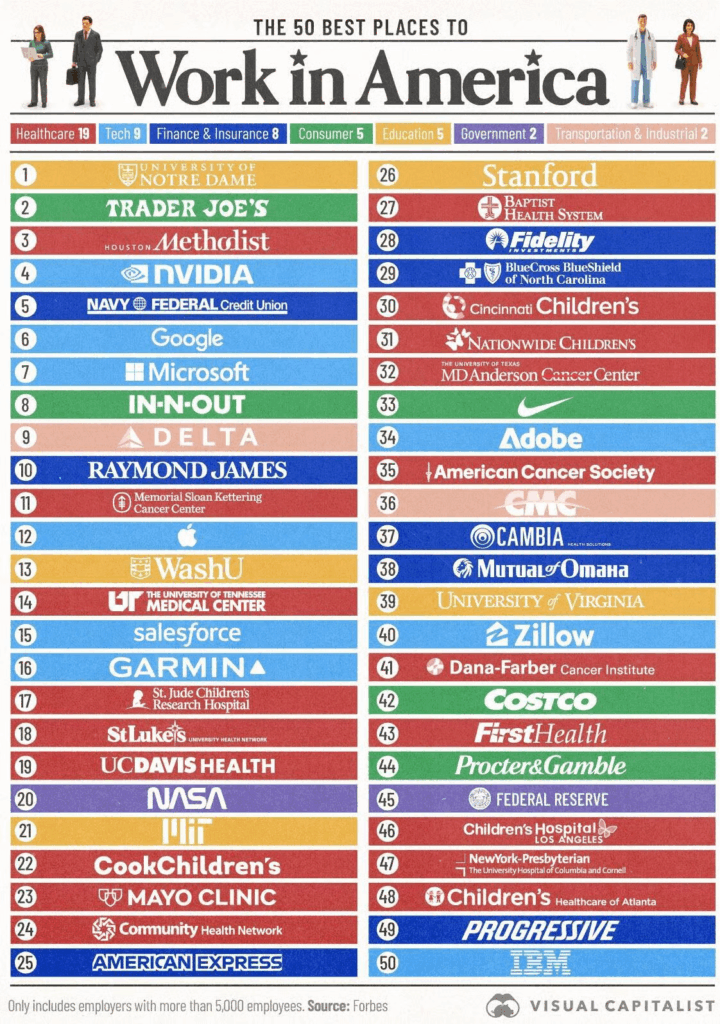

9. Best 50 Places to Work in America

Visual Capitalist

10. This Is Your Job Right Now

Via The Daily Stoic: It’s depressing. It’s confusing. It’s fraught. You don’t like where the world is going. You don’t like what’s happening.

What are we supposed to do? Especially when we are so powerless, as ordinary citizens, people who do not hold office, especially when we are matched against billionaires, against madness, against inertia, against so much.

“Remind yourself that your task is to be a good human being,” Marcus Aurelius writes in Meditations, in reaction, it must be said, against his own dysfunctional and cruel times. “Remind yourself what nature demands of people,” he added. “Then do it, without hesitation, and speak the truth as you see it.”

We are not emperors. We are not senators. But we are human beings, connected to all other human beings. Our job is to do our job—to do it virtuously and honestly. Our job as citizens is to participate in politics—not to cede the field simply because it disappoints and disgusts us. Our job is to help the people we can help closest to us—those who have lost their jobs, those who have been targeted, those who do not have the advantages we have.

And most of all, per the tradition of the Stoic Opposition (which included hallowed figures like Cato and Helvidius and Thrasea and Rutilius Rufus), is to courageously speak the truth as we see it. To not go along with lies. To call things what they are. To condemn what deserves condemnation. To stand up for principles and programs that deserved defense. To say who we are, which is good, which is kind, which is very much not on board with any of this and that even if we can’t stop it, we can say clearly and loudly that we do not accept it being done in our name.