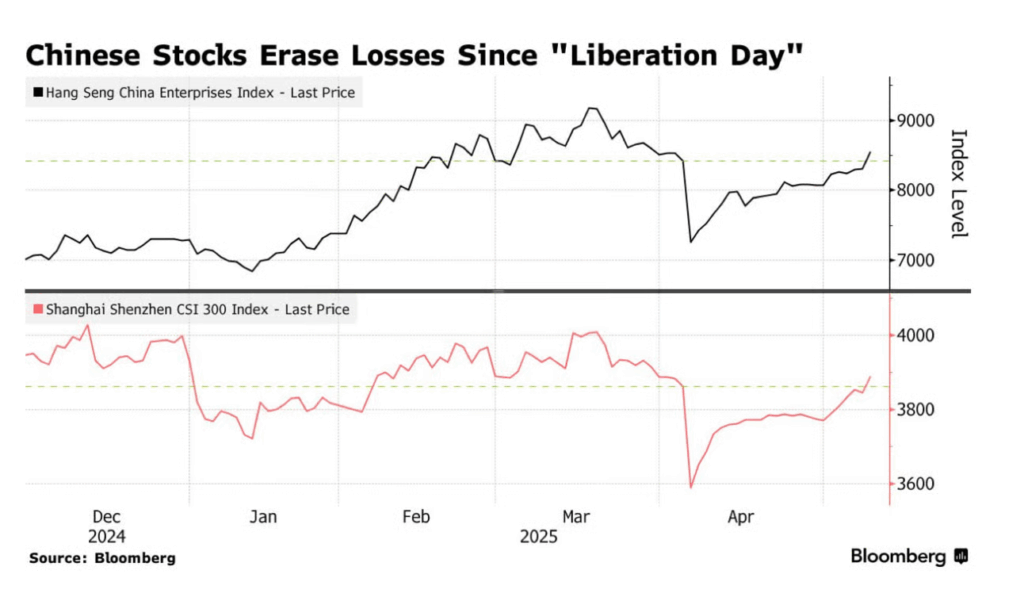

1. Chinese Stocks Erase Losses Since Liberation Day

Bloomberg

2. Japan ETF Breaks Out of Sideways Pattern

StockCharts

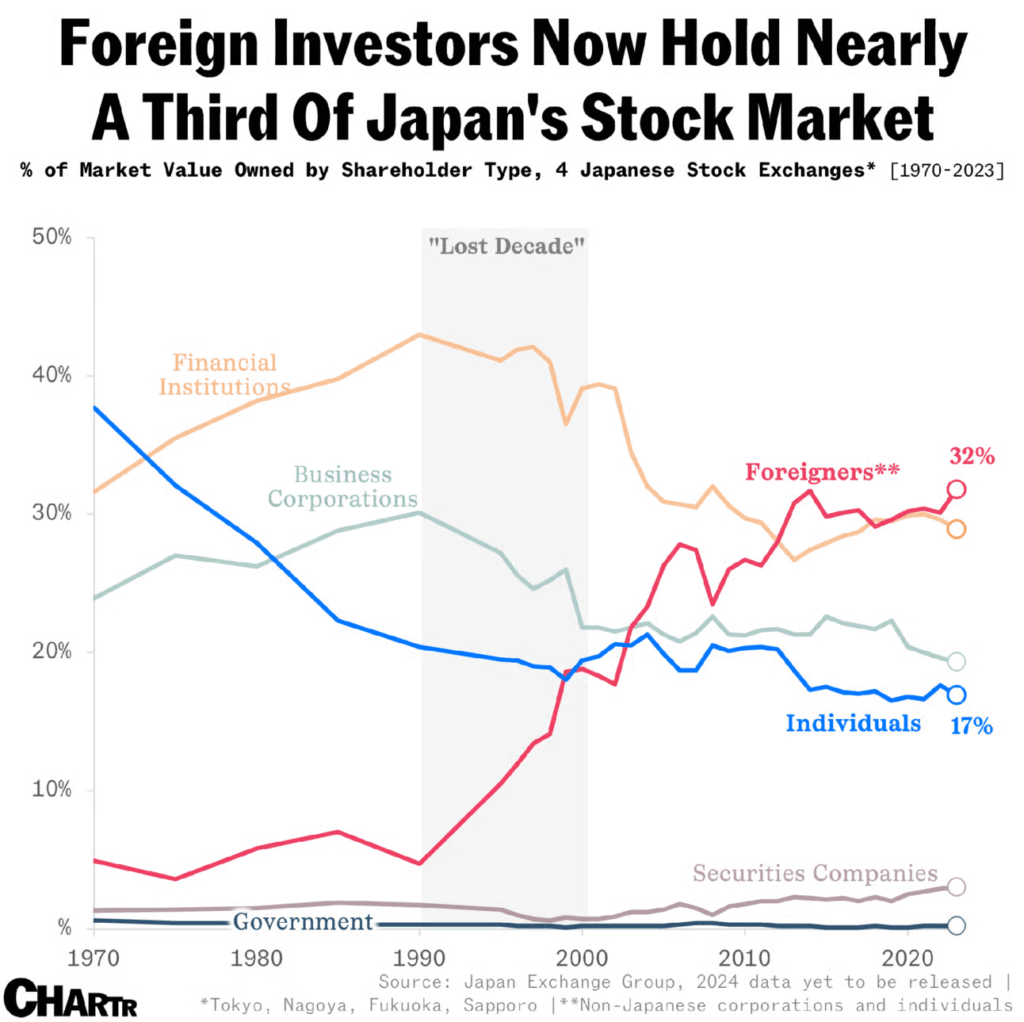

3. Foreign Investors Own 32% of Japan Stocks

According to the Tokyo Stock Exchange’s latest data, foreign investors now own 32% of Japan’s stock market, up sharply from 5% in the 1970s, while locals hold just 17%. And the gap might keep growing: as US stocks slumped amid tariff threats in April, foreign investors pumped a net $8.3 billion (¥1.2 trillion) into Japanese equities — a severe reversal from net outflows in the previous two months, per Japan Exchange Group.

Now, Japan is trying to lure its young, less trauma-ridden locals back into the market. The Tokyo Stock Exchange plans to lower the minimum investment threshold, aiming to make stocks more accessible, while the government expanded tax exemptions for retail investors last year. It’s also promoting financial literacy among millennials and Gen Zs.

All of this might be starting to pay off: according to the Investment Trusts Association, 36% of people in their 20s in Japan invested in mutual funds, stocks, and bonds last year, up nearly 3x from 2016.

Sherwood News

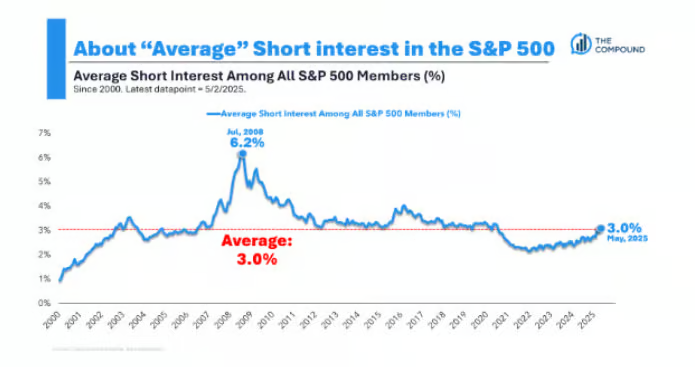

4. Short Interest in Stocks was Below Average 2020-2024…Got Back to Average on Tariffs

The Irrelevant Investor

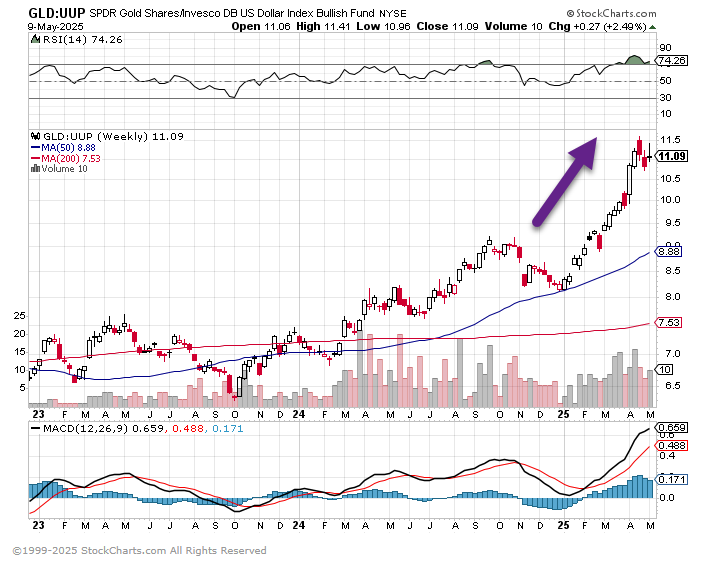

5. Here is the Gold vs. U.S. Dollar Chart…Dollar Rallying on Chinese Trade Deal Today

yahoo!finance

6. Trump Exec Order to Lower Drug Prices…XLV will Open Below Long-Term 200 Week Moving Average….Next Support 2023 Levels

StockCharts

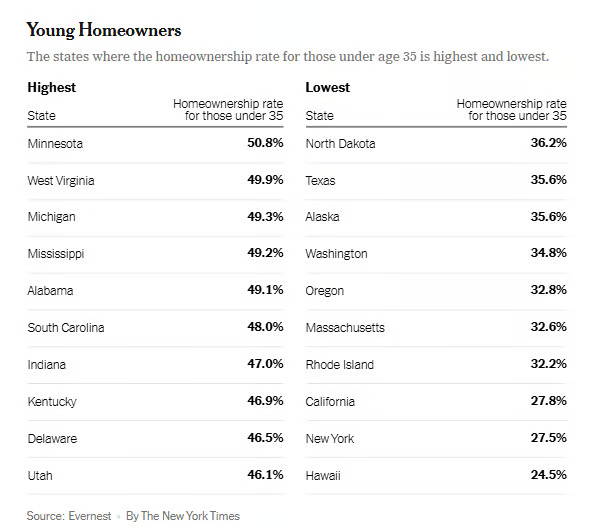

7. Where Can Younger Buyers Afford Homes?

NY Times

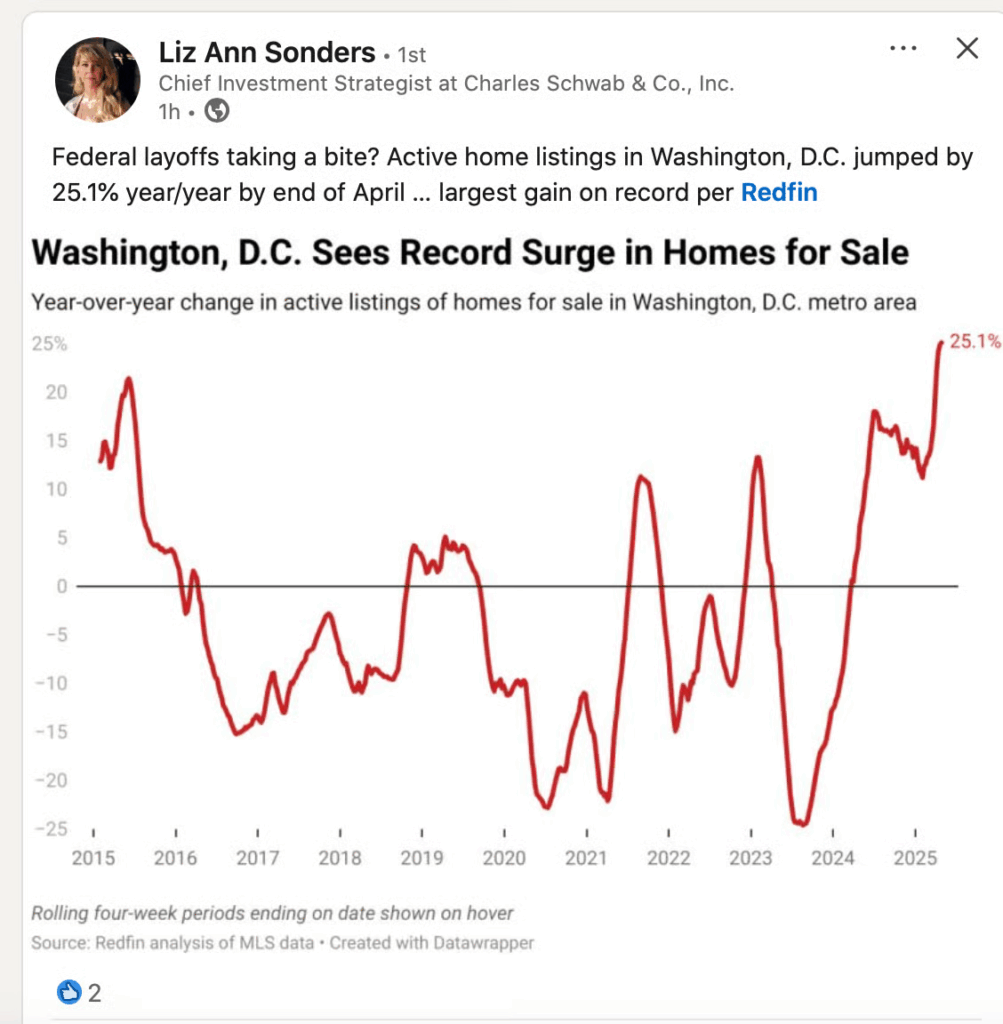

8. Washington DC Homes for Sale

Liz Ann Sonders

9. Wit and Wisdom from Warren Buffett

Via Ted Merz: Few people are as quotable as Warren Buffett.

I attended the Berkshire Hathaway annual meeting this weekend. It ended Saturday afternoon in dramatic fashion with the 94-year old money manager announcing he was stepping down after 60 years. The crowd gave him a standing ovation.

Before the bombshell announcement, Buffett spent four-and-a-half hours dropping wit and wisdom in a way only he can do.

I find that sometimes quotes convey the feeling from the room much better than a narrative article so I compiled a list of my favorites from the meeting.

It’s worth reminding readers that all of these comments came on the fly in response to specific questions from shareholders about business and life.

“People have emotions but you have to check them at the door when you invest.”

“The world is not going to adapt to you, you need to adapt to the world.”

“Everyone has setbacks, it’s part of life. You certainly have a setback when you die.”

“You get a few breaks in life in the people who you will meet. You need a handful of them. And when you have them, you treasure them.”

“Patience is not a constant asset or liability. You don’t want to be patient when the time comes to act.”

“If every time you swung you hit a homerun the game wouldn’t be very interesting.”

“Make the most of the people you meet who are going to make you a better person and forget about the rest frankly.”

“Every now and again you get an extraordinary opportunity. Most of the time you don’t have much of an edge.”

“If you are in something in which you are going to lose you should quit.”

“We are not in the business of solving unsolvable problems.”

“Don’t take a position on anything unless you can argue the opposite just as well.”

“Values change and they don’t always change upward.”

“If you need lots of money you should probably behave in a way that encourages them to give you money.”

“I was born in 1930 and things got much more attractive over the next two years and I didn’t do anything about it. That was the opportunity of a lifetime and I blew it by worrying about the kid in the next crib.”

“If Berkshire went down 50 percent I would regard that as a fantastic opportunity.”

“I don’t get fearful the way other people are afraid in a financial way.”

“It’s not that I don’t have emotions, but I don’t have emotions about the price of stocks.”

“It’s always better to make a lot of money without putting up capital.”

“You can’t blame humans for behaving like humans but you should understand their motivations.”

“Look around to see what interests you. I wouldn’t try to be someone else.”

“You can’t say the system is a failure but you can say it’s very difficult to make major changes.”

“It’s easier for an organization to see its quality go downward than upward.”

“I’ve already told you more than I know so let’s move on.”

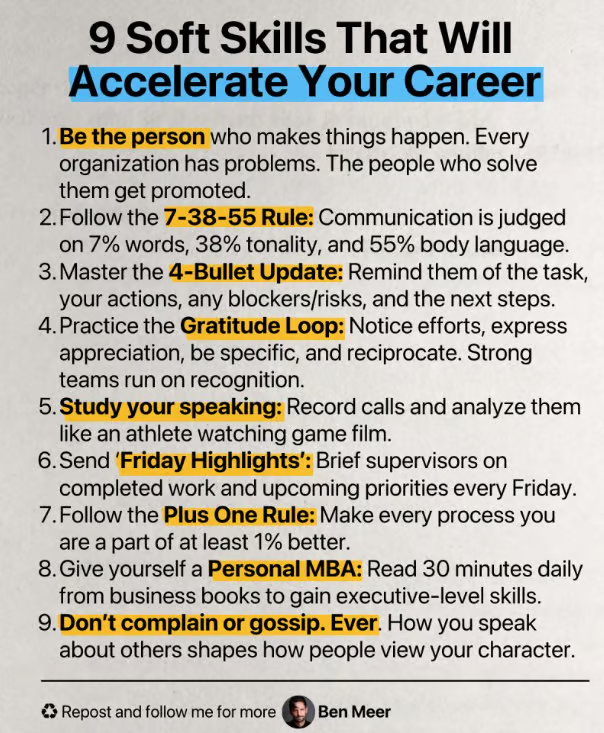

10. Nine Soft Skills for Career

Ben Meer