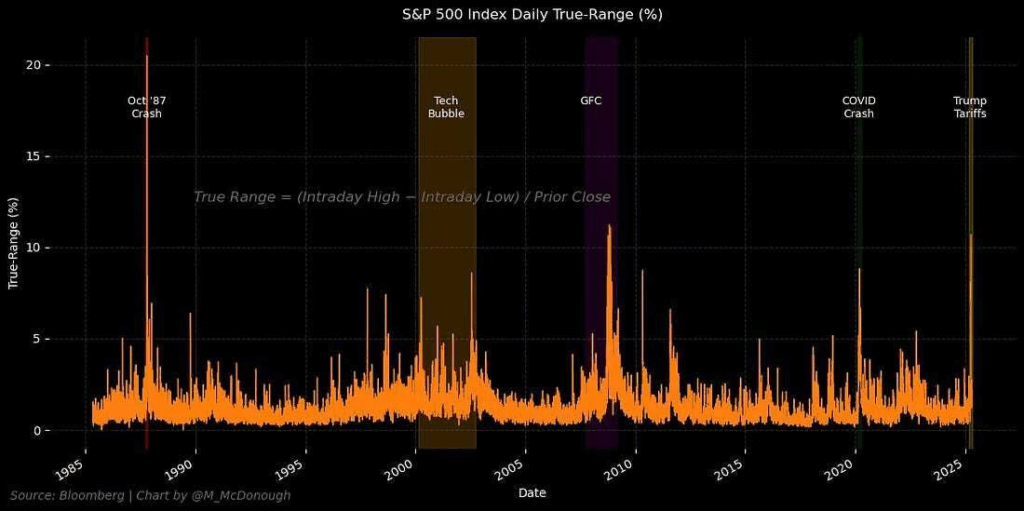

1. Hard to Believe But…April 2025 Volatility was Only Eclipsed by 1987 Crash and GFC

History Books: Here’s one for the history books — the amount of volatility we saw in early April was eclipsed only by the 1987 crash and 2008/09 financial crisis.

Michael McDonough

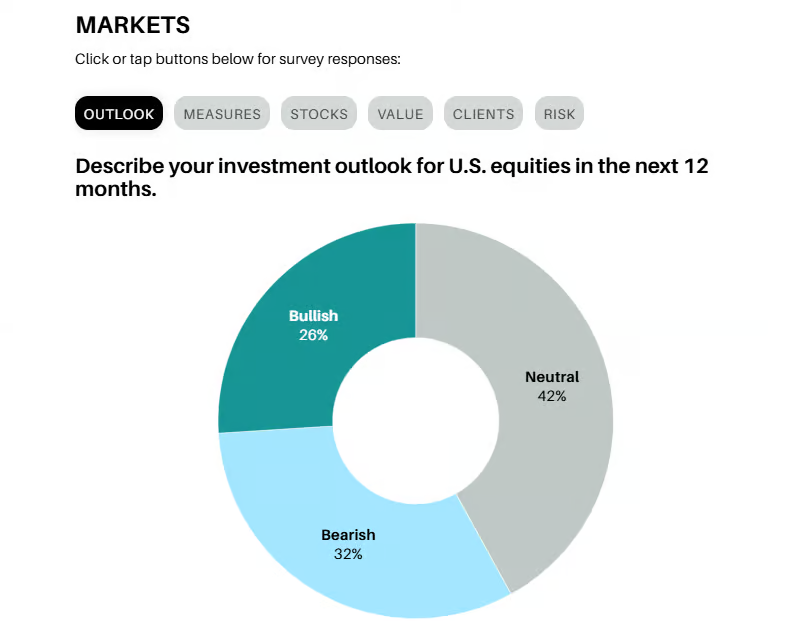

2. Barrons Big Money Poll: Professional Investors the Most Bearish in 28 Years

America’s money managers are more bearish today than they have been in nearly 30 years. Barron’s latest Big Money poll of professional investors finds 32% of respondents bearish on the outlook for stocks over the next 12 months—the highest percentage since at least 1997. Just think about all the crises investors have weathered since then: the bursting of the dot-com bubble, the 9/11 terrorist attacks, the collapse of Lehman Brothers and the 2008-09 financial crisis, the Covid-19 pandemic. And yet the Big Money pros are more anxious now than during any of those painful points for the financial markets, the economy, and the country. The bulls’ ranks also stand at historic levels in our spring survey—historically low, that is. Just 26% of respondents call themselves bullish on the market’s prospects, the smallest percentage since 1997.

Barron’s

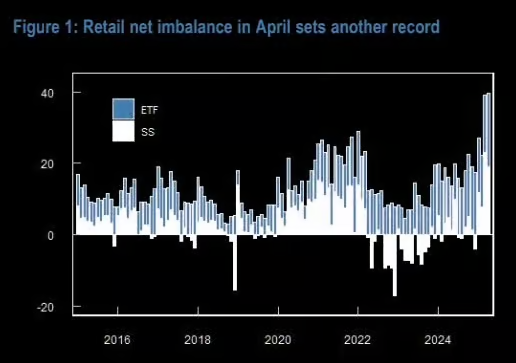

3. April Largest Monthly Positive Inflows by Retail Investors on Record

Retail investors (II) …retail investors tracked by JPMorgan “net bought $40B in April, surpassing last month and setting a new record for the largest monthly inflow.”

The Market Ear

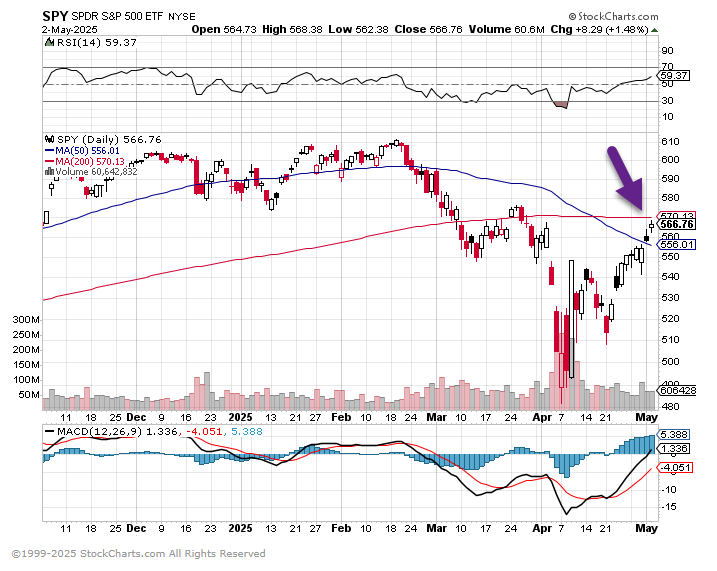

4. S&P 500 Trades Right Back to 200-Day Moving Average

StockCharts

5. Nasdaq QQQ Trades Right Back to 200-Day

StockCharts

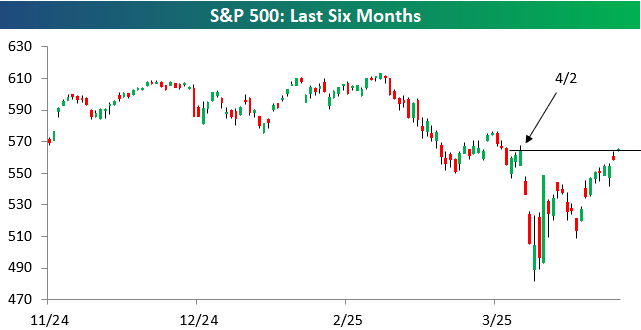

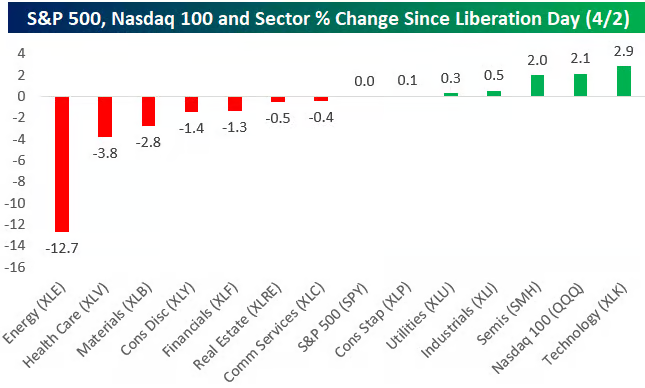

6. Post-Liberation Day Returns

It’s been exactly a month since “Liberation Day” on April 2nd when President Trump announced massive reciprocal tariffs on the rest of the world. At its intraday low on April 8th, the S&P 500 ETF (SPY) was down 14.7% from its closing level on April 2nd. Since that low, SPY has now rallied 17.4%, and as of this morning, SPY has fully recovered all of its post-Liberation Day declines.

Below is a look at the performance of key index and sector ETFs since the close on Liberation Day (4/2). Technology (XLK) is now the best performing sector since 4/2 with a gain of 2.9%, followed by the Nasdaq 100 (QQQ), Semis (SMH), and Industrials (XLI). On the downside, the Energy sector (XLE) has been by far the biggest laggard with a decline of 12.7%.

Besporke

7. Eli Lilly Biggest One-Day Sell Off in 17 Years…P/E has Dropped from 80x to 40x

Bloomberg

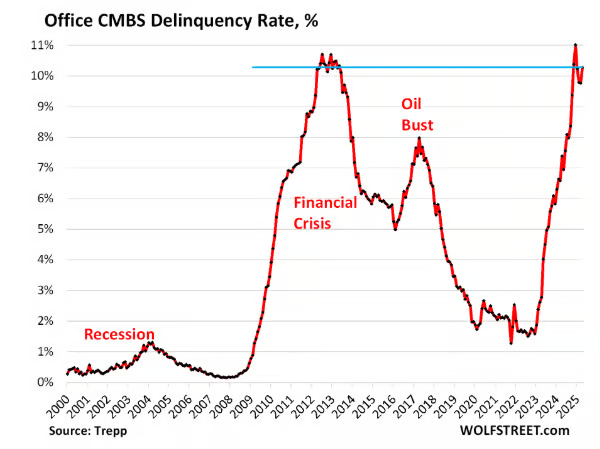

8. Office Delinquencies Turn Back Up

Via WOLF STREET. Delinquencies of office mortgages that were securitized into commercial mortgage-backed securities (CMBS) have been in the red-hot zone since mid-2023 and in December 2024 hit 11.0%, surpassing even the debt-meltdown during the Financial Crisis. Then, during the first three months of 2025, the delinquency rate backed off some, but in April re-spiked by 52 basis points to 10.3%, according to data by Trepp today, which tracks and analyzes CMBS.

The 52-basis-point increase of the delinquency rate represented a U-Turn from the feeble signs of hope earlier this year and put the delinquency rate right back into the peak of the Financial Crisis meltdown.

A flight to quality has divided the office market into two: Amid much reduced demand for office space, vacancies in the latest and greatest buildings allow companies to move from older office towers into new fancy offices, while downsizing space at the same time . But landlords of older properties have trouble finding new tenants to replace them, and their vacancy rates have soared. It’s those older office towers that are on the problem list, not the latest and greatest towers.

Wolf Street

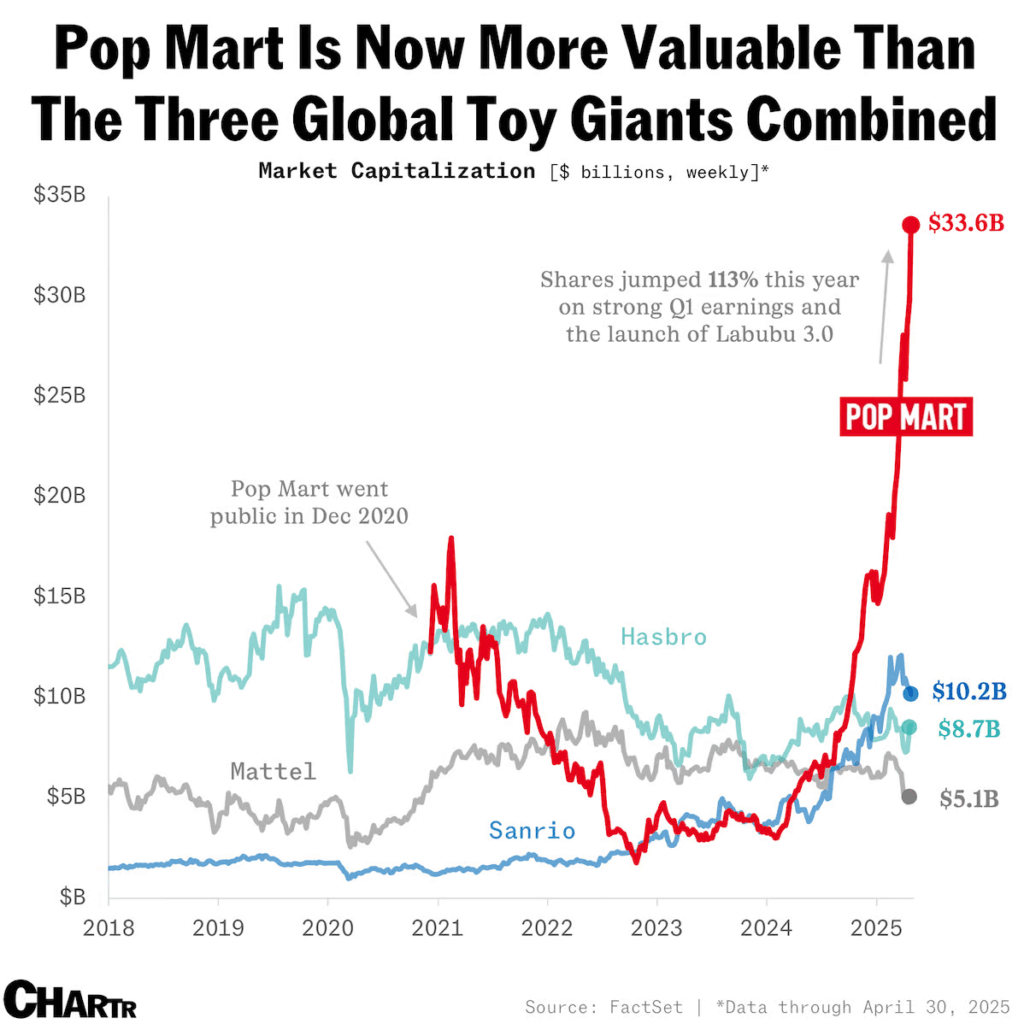

9. The Tesla of the Toy Market—Pop Mart is Worth More than Rival Toy Makers Combined

Although the company’s been on a rocky ride since going public in late 2020 — with revenue not always measuring up to its previously blistering pace — shares have risen ~460% in the past year and hit a record high in the last week, adding $1.6 billion to Pop Mart’s founder’s wealth in a single day. The surge has also seen the company’s market cap roar to $33.6 billion, making it more valuable than Hello Kitty giant Sanrio, Transformers behemoth Hasbro, and Barbie-maker Mattel… combined.

Could the ongoing US-China trade war put a dent in Labubu-mania, or will Pop Mart still look positively dolled-up further into the future?

10. Warren Buffett: ‘The long-term trend is up’

Via TKer — Warren Buffett, CEO of Berkshire Hathaway, remains bullish on the long run. At the same time, he acknowledges that people will continue to be distracted by short-term market moves, which will continue to be unpredictable.

“The long-term trend is up,“ Buffett said at Berkshire’s annual shareholders meeting on Saturday.

“Nobody knows what the market is going to do tomorrow, next week, next month,” he added. “But they spend all their time talking about it, because it’s easy to talk about. But it has no value.”

Buffett was responding to a shareholder’s question about Berkshire’s massive cash pile, which grew to $347 billion in Q1. He reiterated what he said in his annual letter, which was that his preference is not to be sitting in so much cash. But he made clear that holding cash was smarter than making brash acquisitions.

“We would rather have conditions that have developed where we would have like $50 billion or something like that,” he said. “But that just isn’t the way the business works.”

Buffett explained if he acquired businesses or accumulated stock solely for the sake of getting that cash pile down to $50 billion, “That would be the dumbest thing in the world to invest in that manner.”

For now, Buffett believes it’s better to keep dry powder for when Berkshire could be “bombarded with offerings” that offer better risk-reward opportunities than what he’s seeing today.

“We have made a lot of money by not wanting to be fully invested at all times,” he said.

Of course, this strategy is not for everyone. Buffett and Berkshire are in the business of acquiring companies and picking stocks. In fact, Buffett has historically recommended most people to invest in passively managed S&P 500 index funds.

“We don’t think it’s improper for people who are passive investors to just make a few simple investments and sit for their life in them,” he said. “But we’ve made the decision to be in this business. So we think we can do a little better than that.“

Buffett downplays recent market volatility, warns of a ‘hair curler’ event 📉

A shareholder asked Buffett specifically about the market swings we experienced in the past month.

“What has happened in the last 30, 45 days, 100 days … it’s really nothing,” he said. “This is not a huge move. … This has not been a dramatic bear market or anything of the sort.“

Indeed, you can get smoked in the short-term. It’s one of the truths about the stock market.

“If it makes a difference to you whether your stocks are down 15% or not, you need to get a somewhat different investment philosophy,” Buffett said. “The world is not going to adapt to you. You’re going to have to adapt to the world.”

Buffett cautioned that just because he doesn’t think the recent market swings were notable doesn’t mean we won’t get a more violent downturn some time in the future. He said “certainly in the next 20 years” we will get a “hair curler” event.

“The world makes big, big, big mistakes, and surprises happen in dramatic ways,” he said. “The more sophisticated the system gets, the more the surprises can be out of right field. That’s part of the stock market. That’s what makes it a good place to focus your efforts if you have the proper temperament for it — and a terrible place to get involved if you get frightened by markets that decline and get excited when stock markets go up. I don’t mean to sound particularly critical. People have emotions. But you have to check them at the door when you invest.”

Zooming out 🔭

Buffett covered a lot during his five-hour long Q&A. His comments on protectionist trade policy and pessimism toward the U.S. economy were particularly interesting. A lot of media outlets are covering it. I may write about it later.

But the big news out of this year’s event was Buffett’s announcement that he intends to step down as CEO as he makes way for vice chairman Greg Abel to succeed him.

“I think the time has arrived where Greg should become the chief executive officer of the company at year-end,” Buffett said.

Buffett’s time at the helm of Berkshire may be coming to an end. But his timeless investing lessons will surely endure.