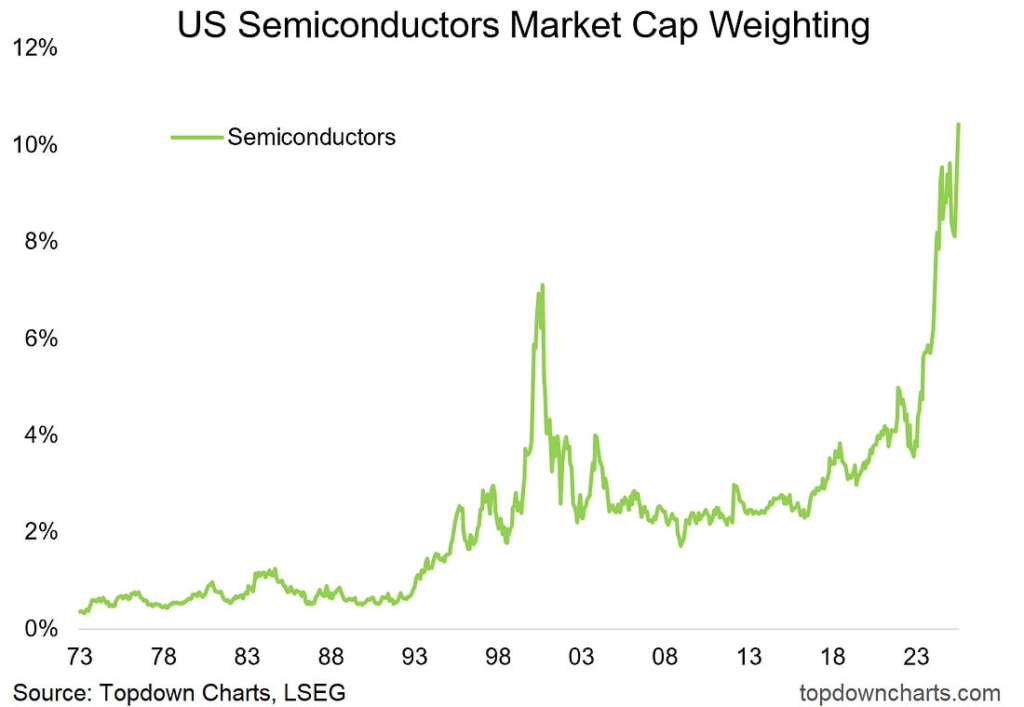

1. Semiconductor Market Cap Surges to New Highs.

Semi Surge: After a period of consolidation around the previous all-time highs, US semiconductor stocks’ market cap weighting has surged onto fresh record highs (looking rather like a bull flag!). So, who knows, maybe we’re still early in the hype cycle? (and maybe that was all just a healthy correction/consolidation…)

Source: Topdown Charts

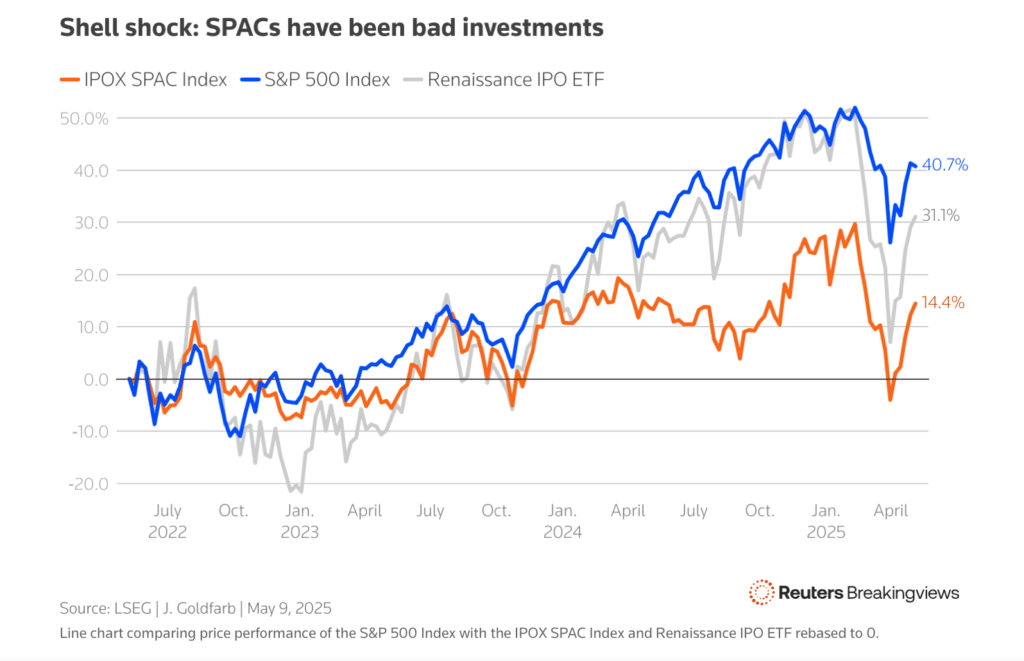

2. SPAC IPOs are Back…Last Batch Massive Outperformance vs. S&P with 90% Below Offering Price.

https://www.reuters.com/breakingviews/spacs-trigger-bad-case-wall-street-amnesia-2025-05-28

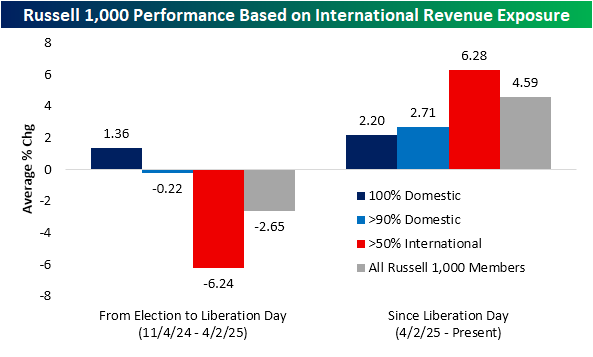

3. International Revenues/Weak Dollar

Equities have returned to record highs, but performance during the fall from grace earlier this year and the subsequent rebound off the April lows has not exactly been even. With tariff headlines being one of the main focuses of the market this year, performance has been sensitive to how exposed a given stock is to international trade. One proxy for this international exposure is the percentage of revenues that a company generates inside versus outside of the US. As shown below, from the election last November through Liberation Day when President Trump first announced reciprocal tariff rates, the best-performing cohort of Russell 1,000 members was those that do not generate any revenues outside of US borders (about 27% of member stocks in the index). That group averaged a 1.36% gain over that span compared to an average loss of 6.24% for the stocks that generate over half of their revenues outside the US (a little less than 20% of member stocks) or a more modest 2.65% average loss for all stocks in the index. Obviously, with the index trading at fresh records, stocks have amazingly been in rally mode in the wake of Liberation Day, with the average Russell 1,000 now sitting on a 4.6% gain in that span. Those internationals that had formerly been hit the hardest have since shifted to the best performers, averaging a 6.28% gain.

https://www.bespokepremium.com/interactive/posts/think-big-blog/international-revenues-2

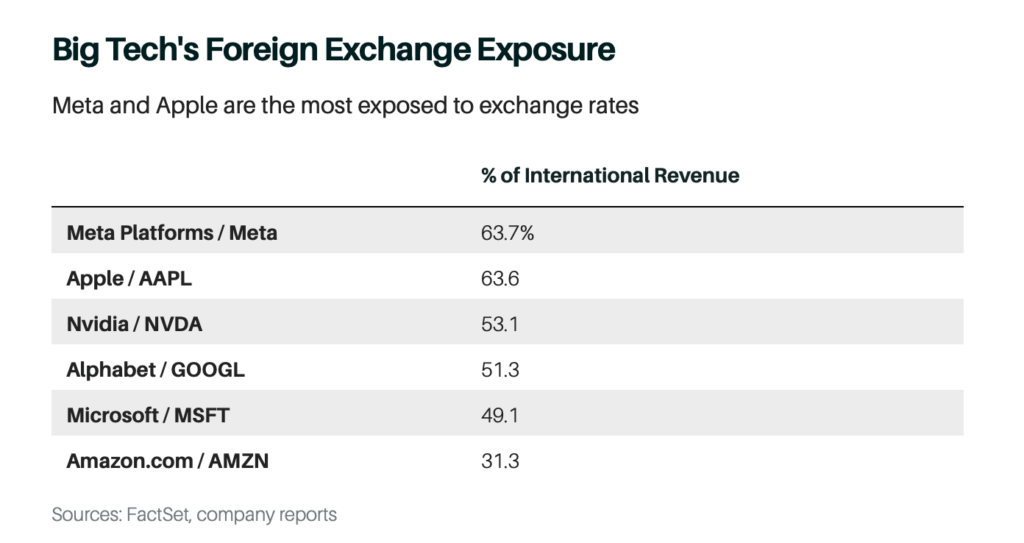

4. Weaker Dollar will Help META and AAPL….Tech International Revenue.

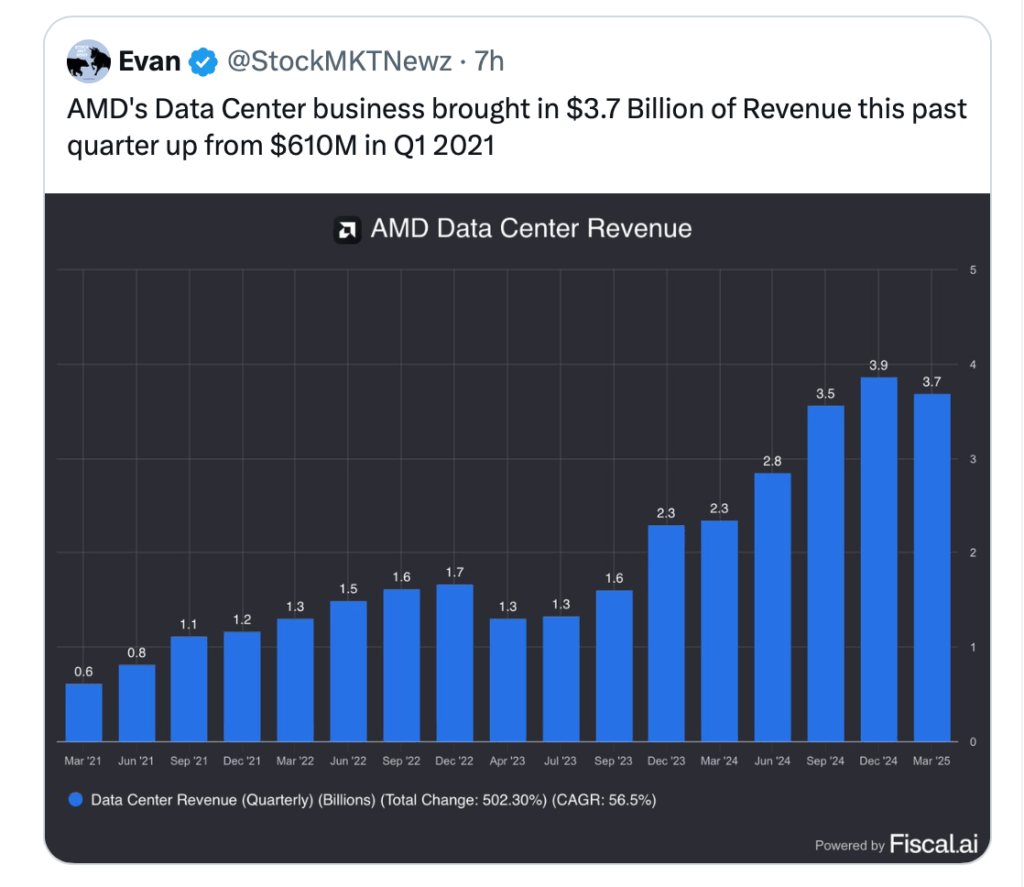

5. AMD Data Center Business Growth.

https://x.com/StockMKTNewz/status/1939337218419839152

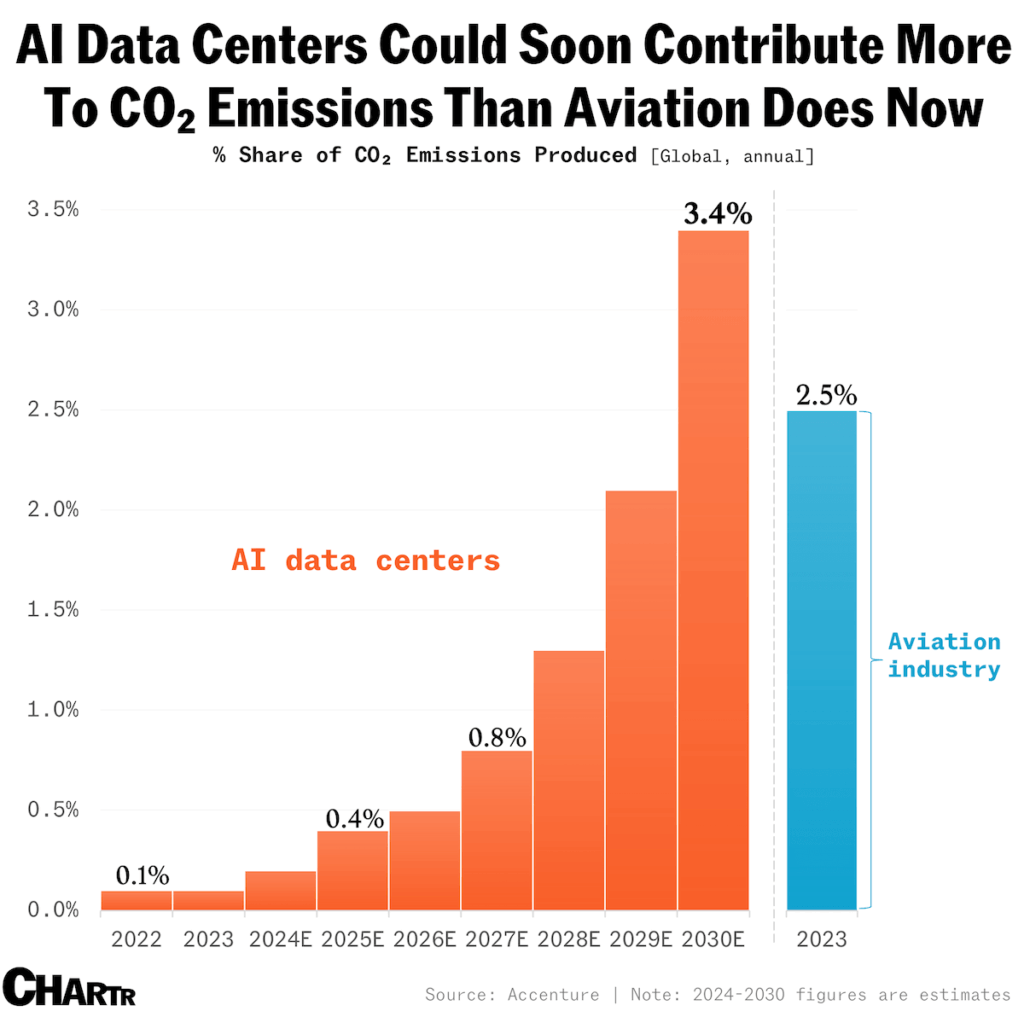

6. AI Data Centers CO2 Emissions.

That’s a considerably greater share of total emissions than the entireaviation industry— a sector often admonished for its carbon footprint — notched at the last count, when the flying business took 2.5% of global CO2 emissions. It would also exceed the emissions contributed by both Germany (1.75%) and Saudi Arabia (1.58%) combined in 2022, per estimates from the IEA.

7. Consumer Spending? Restaurant ETF New Highs.

©1999-2025 StockCharts.com All Rights Reserved

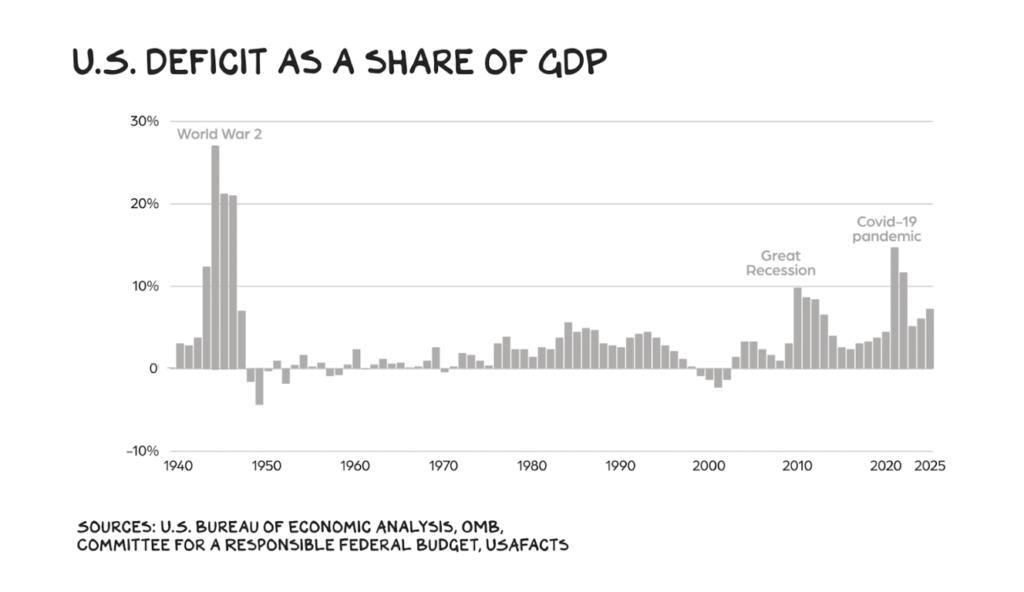

8. U.S. Deficit as a Share of GDP-Prof G Blog

https://www.profgalloway.com/the-grown-up-tax-bill/

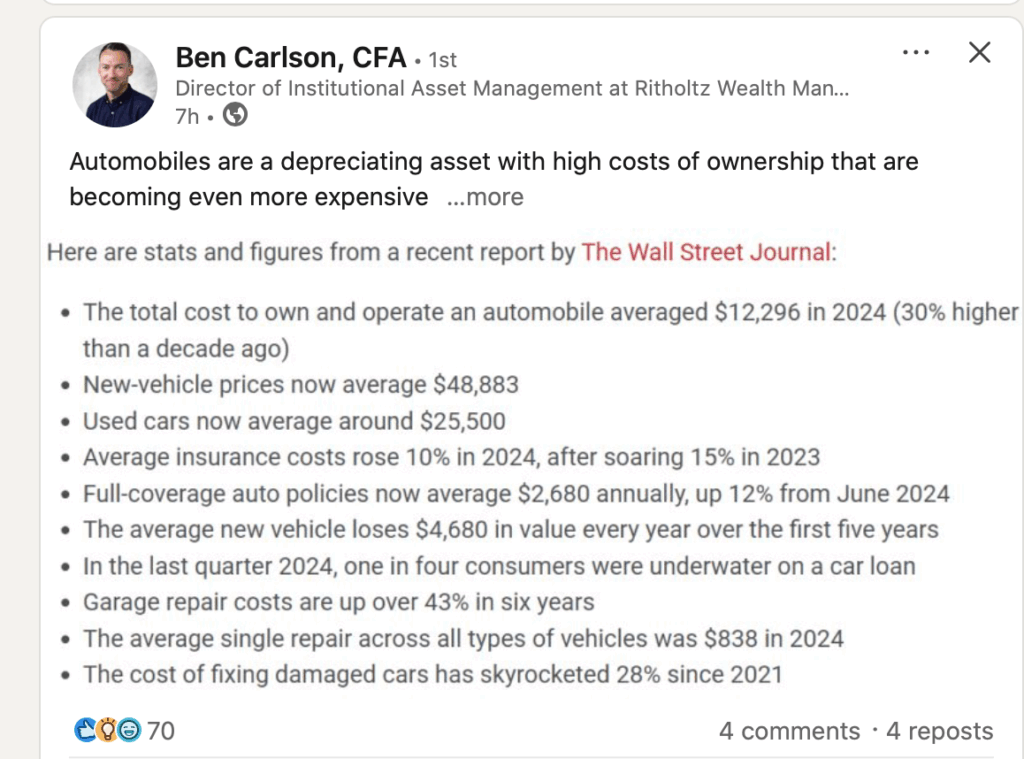

9. Call an UBER.

https://www.linkedin.com/in/ben-carlson-cfa-97661244/

10. Education is Free Learning is Expensive-Seth’s Blog

That’s a complete reversal of how it used to be.

Colleges used to be measured by how many books they had in the library. Access to courses was restricted. If knowledge was power, controlling access was essential.

They even call it the ‘admissions office.’

Part of the status that comes from higher education is that they controlled who could find the information and who was left behind.

Today, of course, all of the information is there, a click away. Billions of people have a smartphone with access to everything ever recorded and written, but also to a trillion dollar AI system that can offer informed guidance.

So why hesitate? Why do we get stuck or avoid even acknowledging that it’s possible?

Because learning is hard. It creates tension. It takes time. Most of all, it requires a commitment to becoming someone else, a bet we’re making that might not turn out the way we hope.

The system has called our bluff. If you want to learn, learn.

But we pay for it with effort.