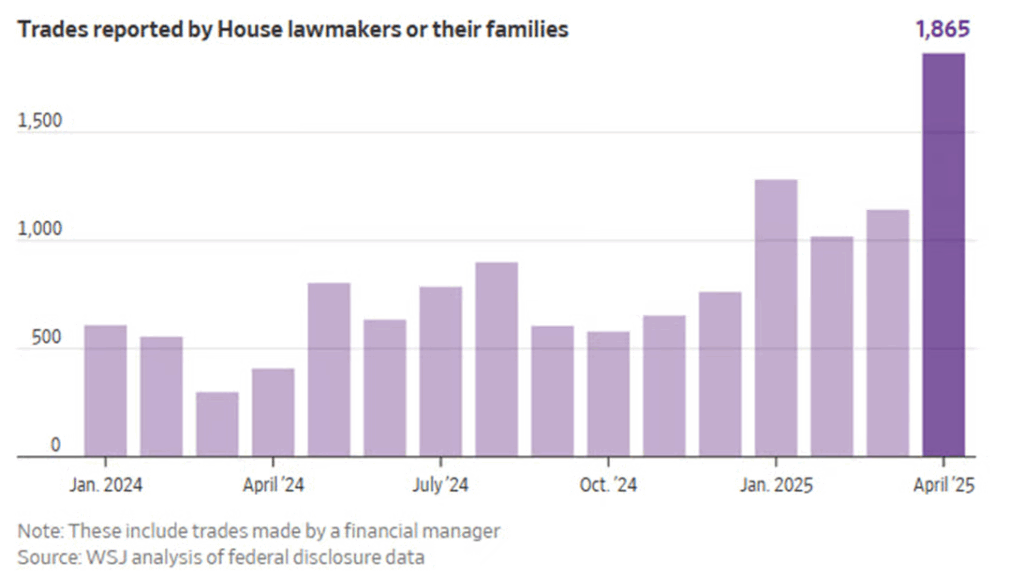

1. American House of Reps Families Trade Like Hedge Funds During Liberation Day Volatility

DAY TRADERS– As markets tanked in the wake of President Trump’s “Liberation Day” tariffs in early April, members of Congress and their families made hundreds of stock trades, shining a spotlight on a controversial practice that some lawmakers have pushed to ban. From April 2, when Trump launched sweeping tariffs to April 8, the day before he paused many of them, more than a dozen House lawmakers and their family members made more than 700 stock trades, according to a WSJ analysis. The trading took place during one of the wildest stretches for global financial markets of the past decade. The S&P 500 tanked more than 4.5% for two consecutive sessions shortly after Liberation Day and recorded the biggest fall since the March 2020 market crash. More than $6 trillion in market value vanished.

Dave Lutz Jones Trading

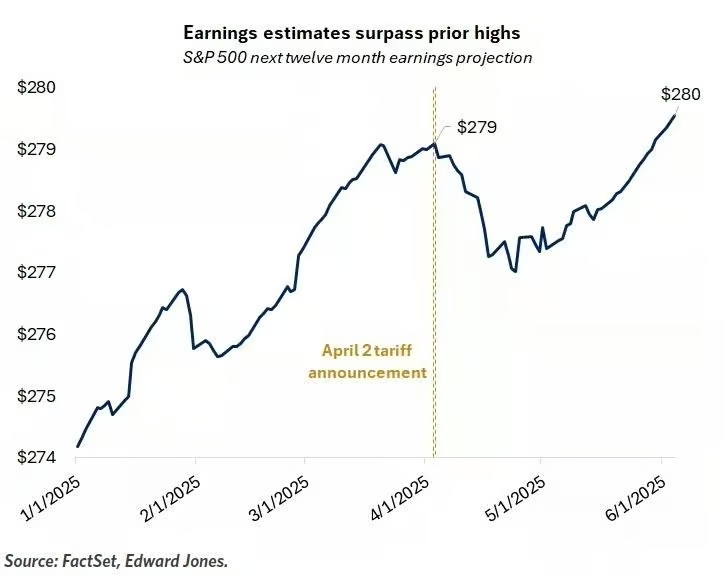

2. Earnings Estimates Moving Higher

SPX NTM EPS. “S&P 500 forward EPS estimate hits a fresh all-time high. $280.”

Edward Jones via @mikezaccardi

3. IWM Small Cap ETF Right Below 200-Day

StockCharts

4. IWC Micro-Cap ETF Closes Above 200-Day

StockCharts

5. Apple Still -20% Off Highs

StockCharts

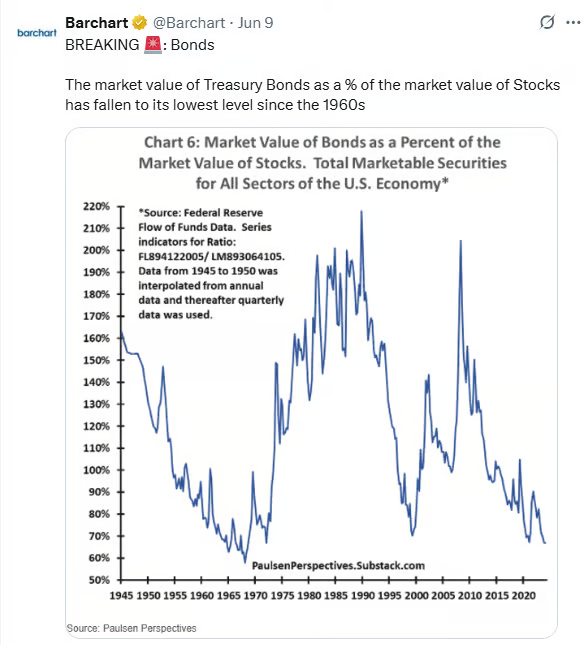

6. Bonds Market Value vs. Stocks Lowest Since 1960s

Barchart

7. Gold Chopping Sideways Since April

ZeroHedge

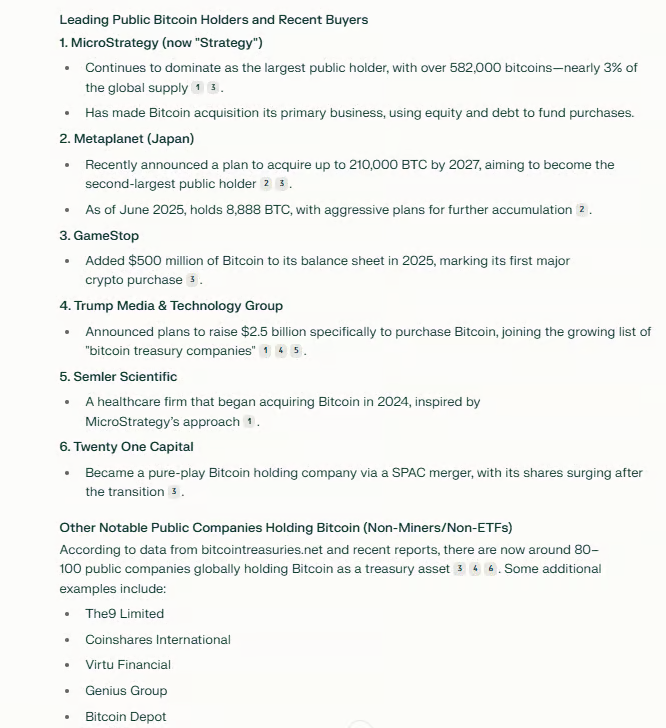

8. Public Companies Holding Bitcoin

Perplexity

9. 75% of Companies Have Already Raised Prices in Response to Tariffs, Fed Survey Finds

Via Barron’s: Early signs indicate that many businesses are quickly raising prices for shoppers to cover most of the higher costs from sweeping U.S. tariffs on imported goods.

Among businesses that are facing higher operational costs due to President Donald Trump’s aggressive tariff policies, roughly 75% are imparting at least some of the their cost increases on consumers, according to an analysis released Wednesday of the New York Fed’s Regional Business Survey of firms in the New York and Northern New Jersey region.

Almost a third of manufacturers and about 45% of service firms report they have fully passed along all their cost increases due to higher tariff rates, the survey said. Meanwhile, another 45% of manufacturers and a third of service firms said they shifted some—but not all—of the cost increases to consumers.

It’s worth noting, however, that the NY Fed conducted the survey between May 2 and May 9. That was before the Trump administration reduced the tariff rate on goods from China to 30% from 145%—and before the recent court rulings around tariffs at the end of May.

The latest survey results found that firms implemented these price increases fairly rapidly.

“Over half of both manufacturers and service firms said they raised prices within a month of experiencing tariff-related cost increases—many within a day or week,” NY researchers found.

Tariffs have a broad impact, with about 90% of manufacturers and 75% of service firms surveyed reporting that they utilize some form of imported goods.

Manufacturers reported that the average tariff rate they paid as of early May was about 35%. Service firms reported an estimated average tariff rate of 26%. That marks a significant increase for both types of businesses from the rates they reported six months ago.

“Firms’ costs of tariffed goods may not have increased by as much as the tariffs, in part, because importers may have switched towards suppliers in other countries or in the United States; foreign suppliers may also have lowered their prices to help offset the tariffs,” NY Fed researchers noted.

10. Behind the Curtain-The Scariest AI Reality

Axios