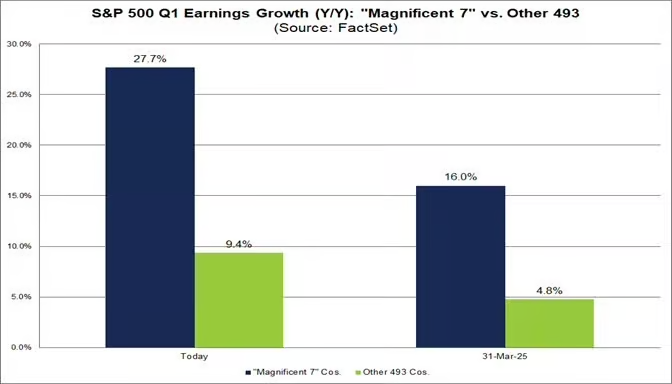

1. Mag 7 Deliver on Earnings Growth

Mag 7 EPS growth. The Mag 7 reported YoY earnings growth of 27.7% in Q1, nearly 3x that of the Other 493.

Factset via The Daily Chartbook

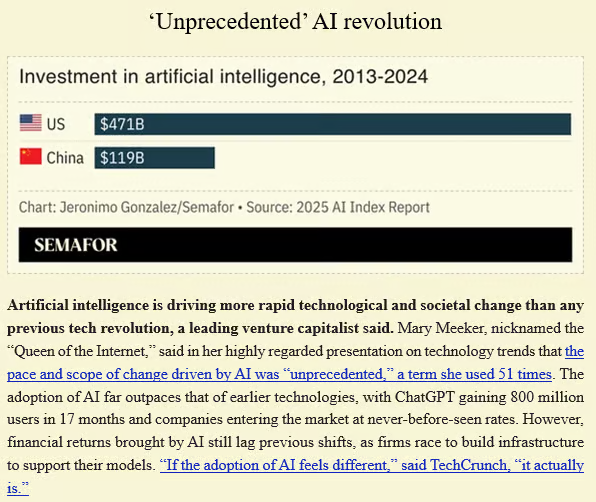

2. U.S. vs. China AI Investment

Semafor

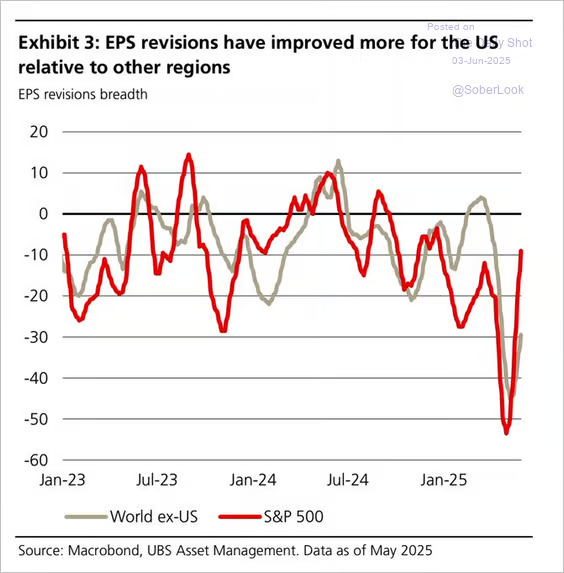

3. Equities: US Earnings Revisions have Rebounded more Quickly Than Those in the Rest of the World

Source: UBS Research; @WallStJesus via Daily Shot Brief

4. URA Uranium Chart Breakout

StockCharts

5. CEG Deal with META…Breakout to New Highs

StockCharts

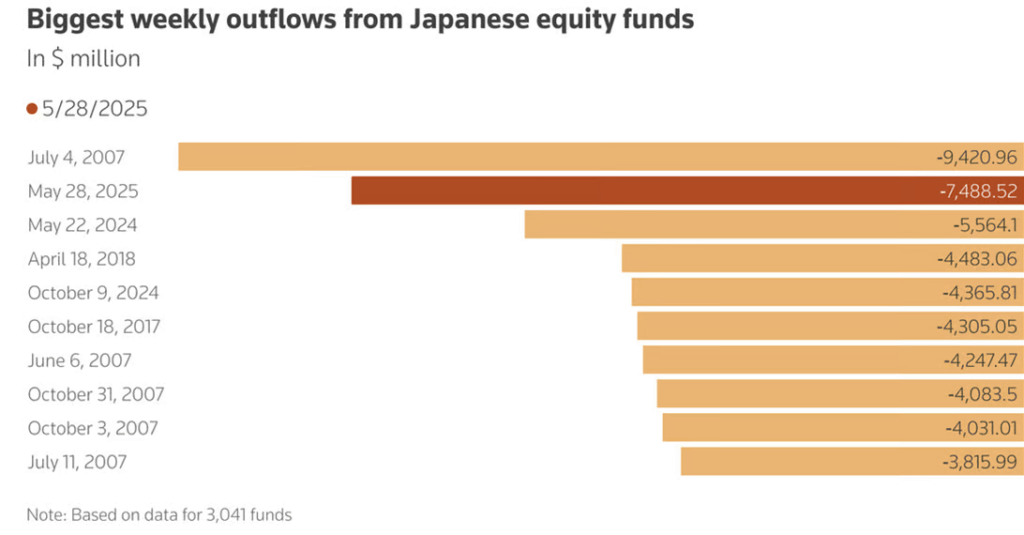

6. Japanese Stocks Sold

Japanese equity funds logged their largest weekly outflows in nearly 18 years in the week to May 28, as investors either booked profits following a rally fueled by the then-easing U.S.-China trade tensions or turned cautious on earnings potential. According to LSEG Lipper data, Japanese equity funds recorded net outflows of $7.49 billion, marking the largest weekly withdrawal since July 4, 2007. Some of the flows could also be due to rebalancing by Japan’s massive life insurance and pension firms as they sell rising stocks and buy bonds to maintain asset ratios, analysts said. Another headwind has been the yen, which has appreciated 10% against the U.S. dollar so far this year, potentially eroding export profitability. LSEG data shows analysts have downgraded forward 12-month earnings estimates for Japanese firms by 1.8% over the past 30 days.

From Dave Lutz at Jones Trading

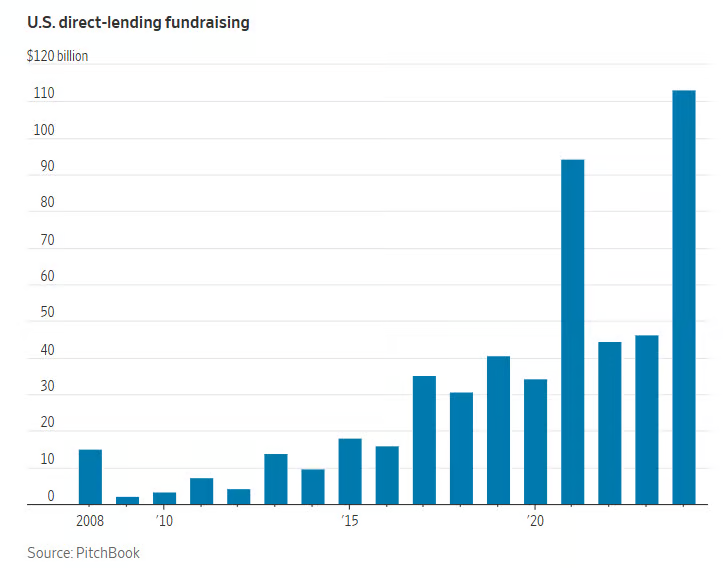

7. U.S. Direct Lending Fundraising Record

Consider an estimate of the future performance of business-development companies. These are listed funds that raise public equity to invest in private loans. Back in 2021, the average BDC’s annualized return on equity was 14.9%, according to figures from a recent letter by Easterly to shareholders of Sixth Street Specialty Lending. But in the letter, Easterly estimated that at the level of base rates expected by the market over three years, plus typical spreads for loans in the fourth quarter of 2024, the forward return on equity for a BDC would be 5.2%.“At these spreads, the sector is not earning its…cost of equity,” he wrote.

WSJ

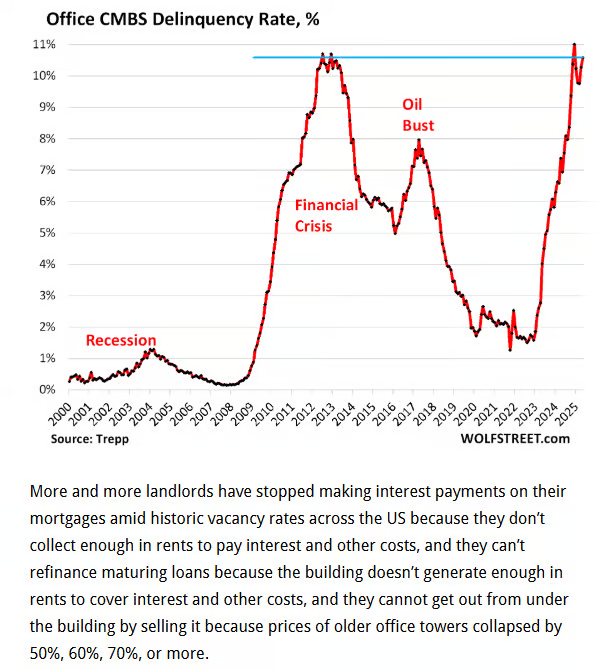

8. Office Delinquency Rate Spikes Back to New Highs

Wolf Street

9. 10 Million Driverless Rides

Morning Brew

Now that Uber and its ilk have made the luxury of a personal driver like Miss Daisy’s available to the masses, the next big thing is starting to gain popularity: not having a driver at all.

Alphabet-owned Waymo recently surpassed 10 million paid driverless rides, and is poised to see 20+ million by the end of the year, the Wall Street Journal reports. And that’s with the self-driving taxis only available in a handful of cities, including tech’s spiritual home of San Francisco. Its rise has been rapid as people in those cities stopped seeing cars with no one in the driver’s seat as a threat and started seeing them as a convenient way to get around. Per the WSJ:

There were 1 million paid Waymo rides as of 2023, and 5 million by the end of 2024.

People were paying for 10,000 Waymo rides per week in August 2023. From there, the number grew from 50,000 per week in May 2024 to 100,000 per week in August of that year. It now sits at more than 250,000 per week.

That means riders beyond early adopters are now willing to hop in a driverless cab. A recent viral post on X suggested that data firm YipitData showed Waymo going from 0% to 27% of San Francisco ride shares between August 2024 and April 2025. Bloomberg reported in April that the same data firm found 20% of Uber rides in Austin during the last week in March were Waymo rides, just weeks after a partnership between the two companies rolled out there.

10. Which Inbox?-Seth’s Blog

It’s easier than ever to fall into an inbox mindset. There are things to do, and we do them.

Inbox zero is the unattainable goal that fills our days.

But it avoids the real question, which is: which inbox are we emptying?

There’s the inbox of urgent texts. Or the inbox of slightly less urgent emails. Or the inbox filled with spam, perhaps hundreds of thousands of emails that aren’t really an inbox.

But what about the inbox of our financial planning? Or the inbox of the people we care about, who might appreciate a hug or a wave?

There’s the inbox of the chronic degeneration of our house or our community or our climate, the one that will respond really well to attention now, not nearly as well later.

And there’s the inbox of peace of mind, the healing and regeneration that happens when we set the other inboxes aside for a bit.