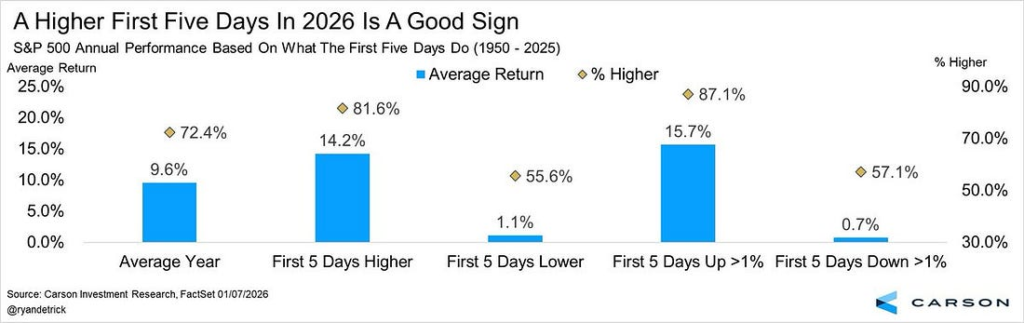

1. History of +1% Starts to the Year

Good Start, Good Year: the strong start to 2026 bodes well for the rest of the year, as Ryan Detrick Notes: “The S&P 500 is up more than 1% after the first 5 days of 2026. Historically, when this happens, the full year is positive more than 87% of the time and up nearly 16% on average.”Thinking it through, the main logic to this statistical boon is probably a combination of momentum effects and the absence of bad macro/fundamental news.

Ryan Detrick

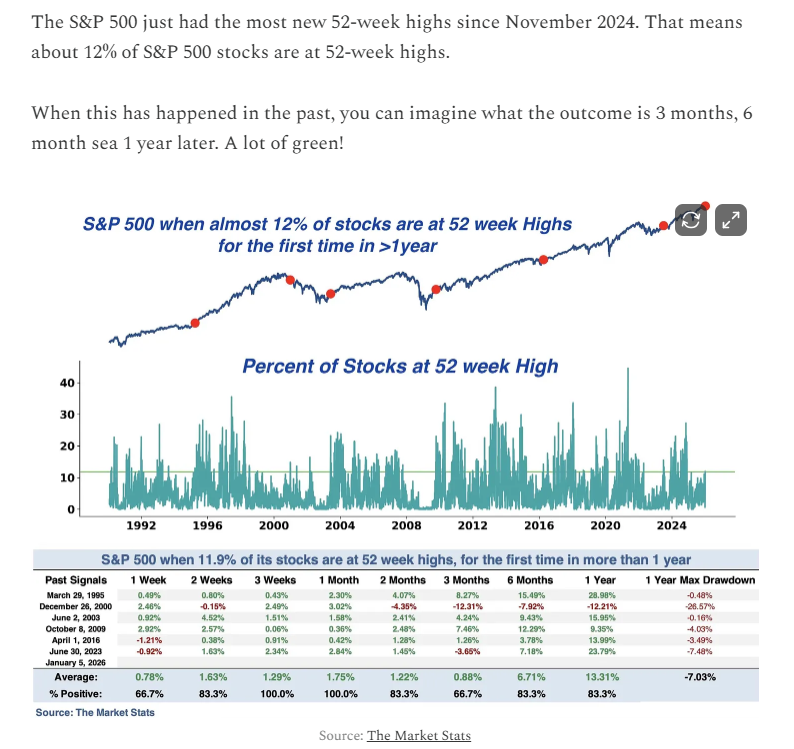

2. 12% of S&P 500 at 52-Week Highs

Spilled Coffee

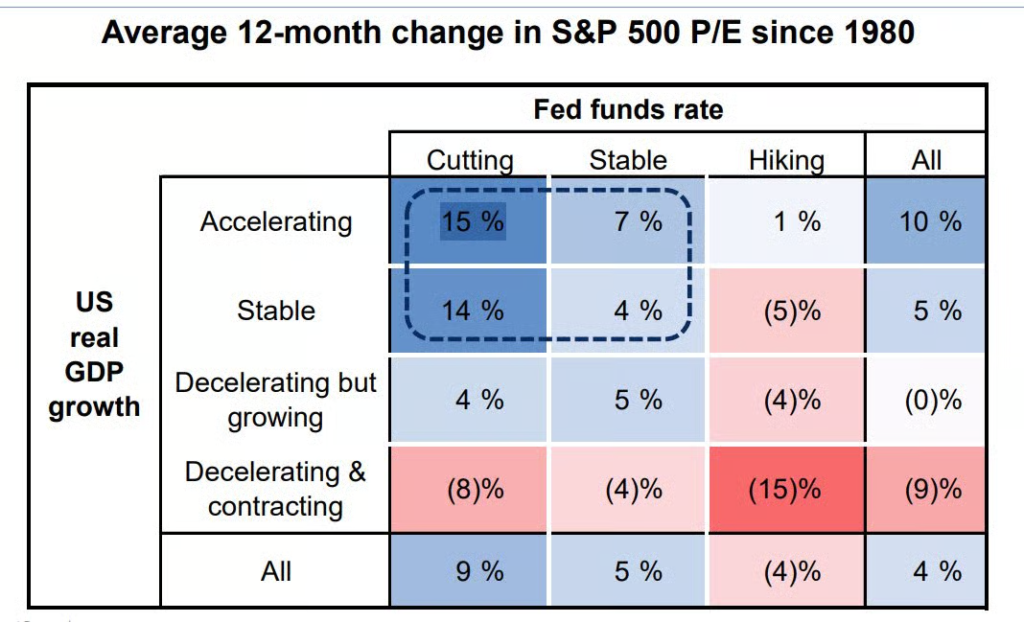

3. GDP x FFR vs. SPX P/E. “Accelerating/stable GDP growth with Fed cutting supports multiple expansion…best combination”

Goldman Sachs via @mikezaccardi

Daily Chartbook

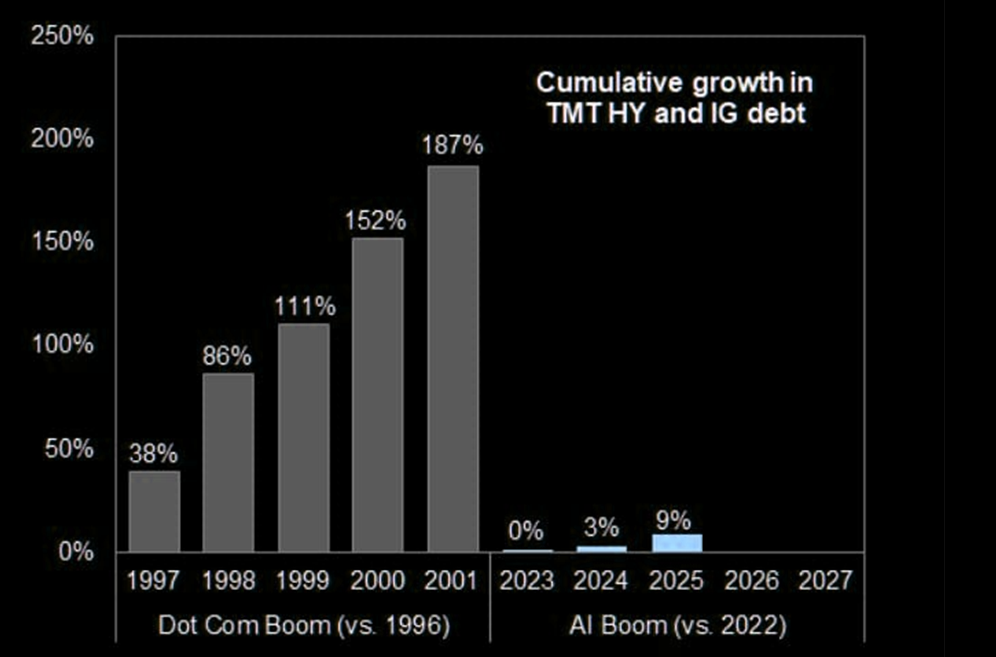

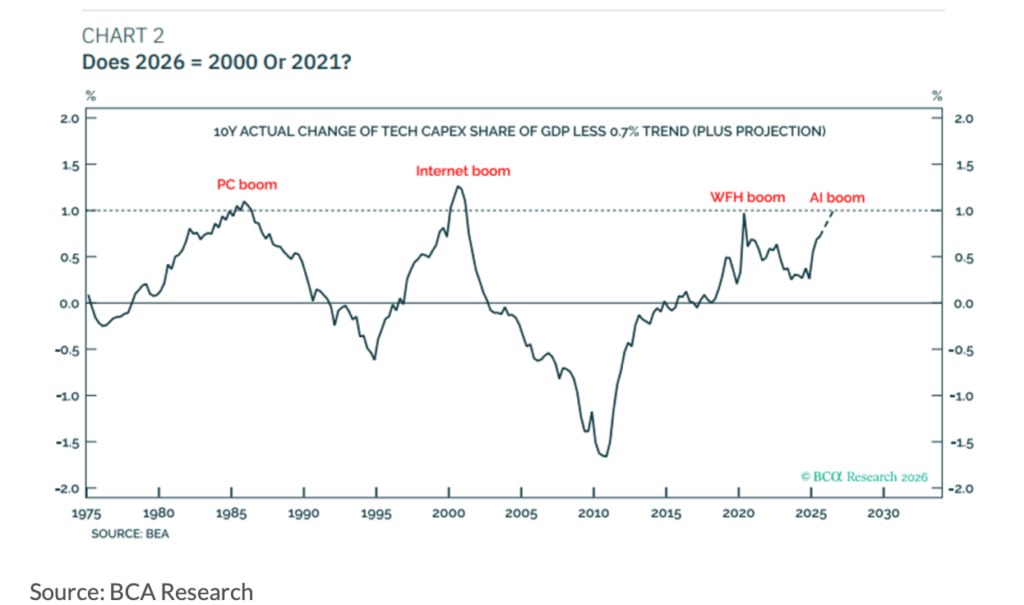

4. Tech Debt 2026 vs. 1999…Not An Issue Yet

At least no debt, yet TMT debt growth – this is the key difference between the Dot Com and AI CAPEX booms.

Goldman

5. Tech Capital Spending is Back to Previous Highs But They are Using Cash

BCA Research

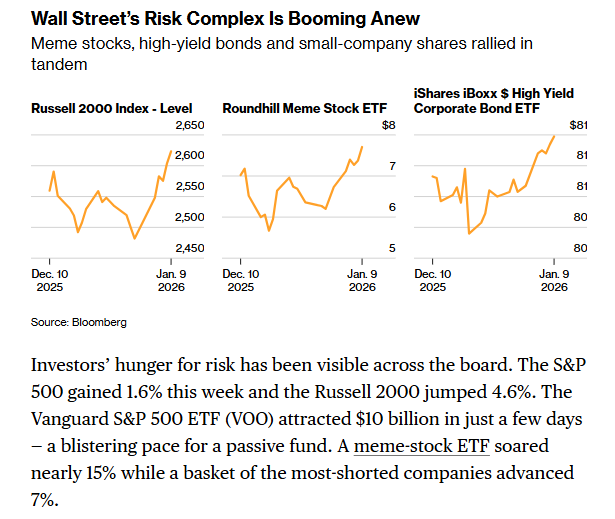

6. Risk-On Small Cap, Meme ETF, High Yield Bonds

Bloomberg

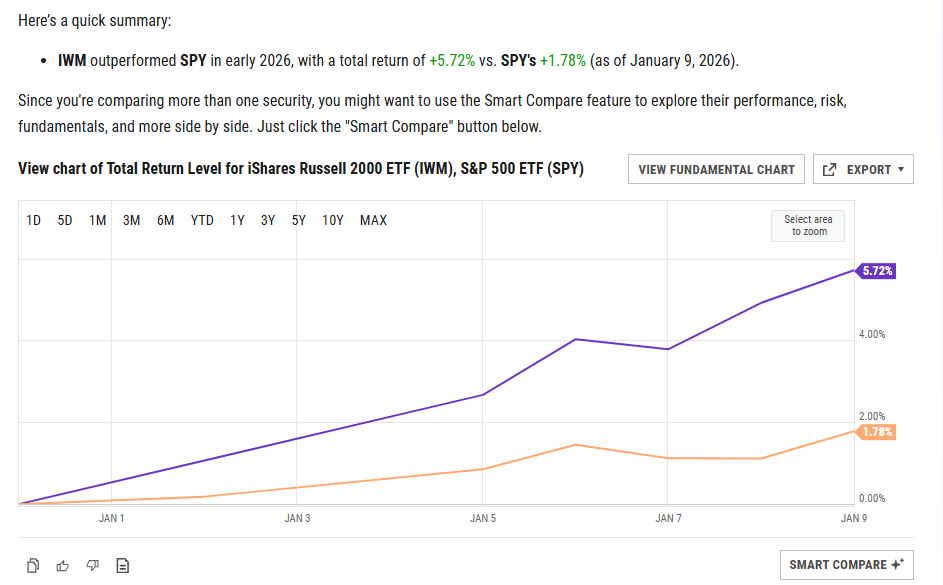

7. IWM Small Cap +5.72% vs. S&P +1.78% to Start 2026

YCharts

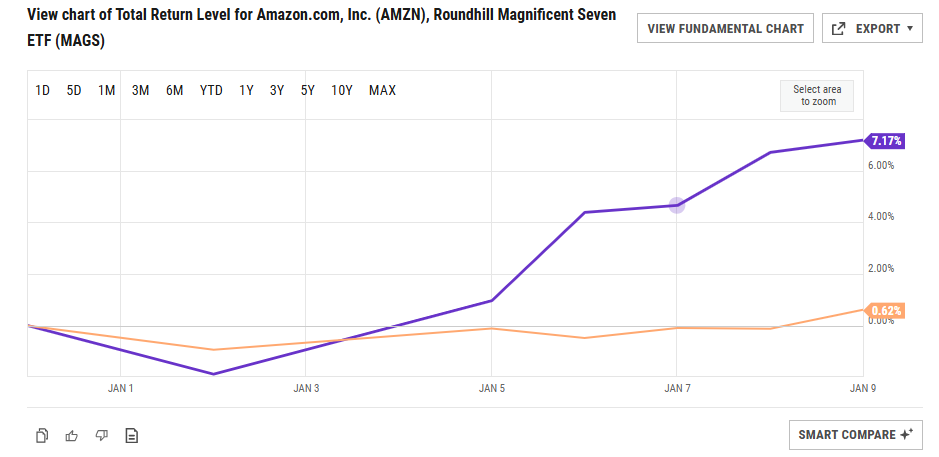

8. AMZN Dominating Large Tech to Start 2026…AMZN +7% vs. MAGS (Mag 7 ETF) Flat

9. How Often are Housing Returns Positive?

Ben Carlson

10. Room temperature-Seth’s Blog

Left alone, a cup of coffee will gradually cool until it reaches room temperature.

Stable systems regress to the mean. Things level out on their way to average, which maintains the stability of the system.

The same pressures are put on any individual in our culture.

Sooner or later, unless you push back, you’ll end up at room temperature.

(As I write this, the built-in grammar tool has made suggestions to every single sentence, pushing to make it sound less like me and more like normal.)