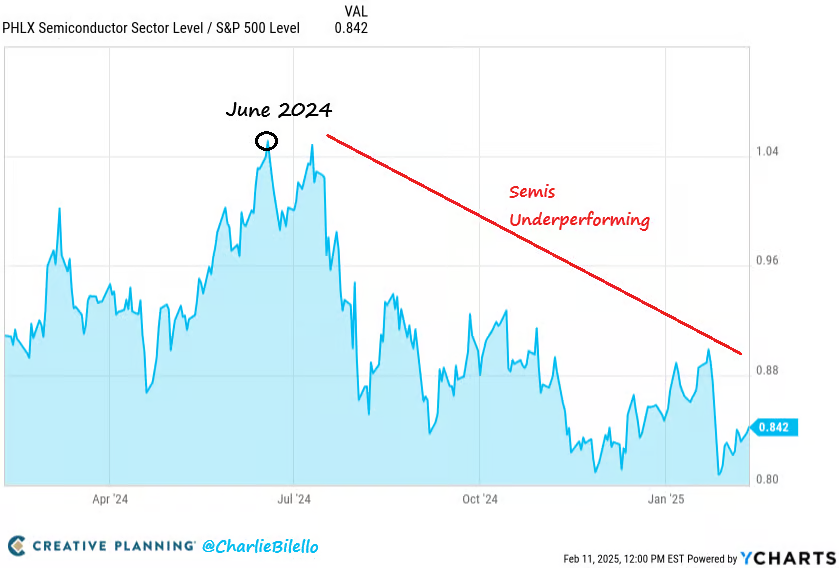

1. Semiconductor Index Underperformed S&P on One-Year Basis

Within technology, semiconductors had been the strongest industry group, outperforming everything by a wide margin. But that too has flipped, with semiconductor relative strength peaking last June. Semis have actually underperformed the S&P 500 over the past year, a fact that would likely surprise many.

Biello

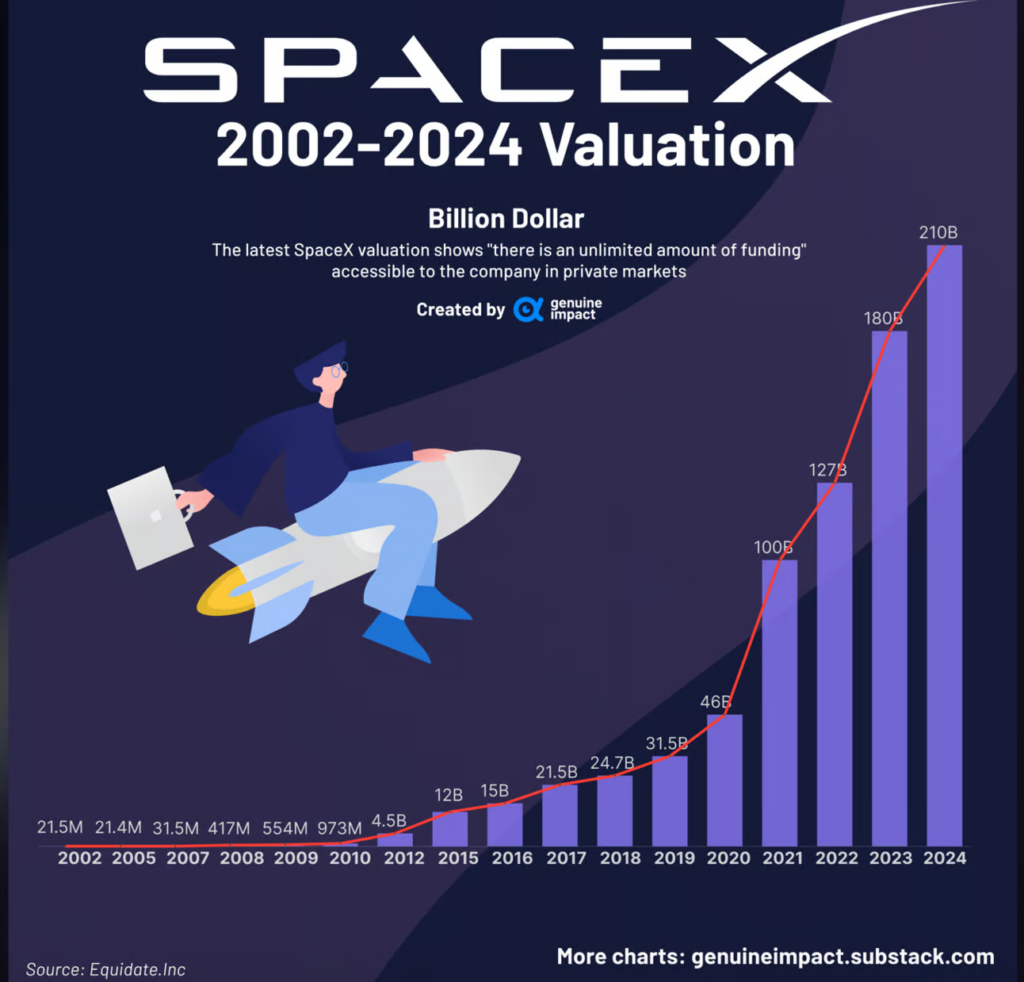

2. Elon Musk Companies and Government Subsidies

His space exploration company SpaceX has received over $20 billion from the federal government over the past 15 years, according to federal spending records. SpaceX CEO Gwynne Shotwell has said that the company has $22 billion in government contracts, Reuters reported.

EV company Tesla, whose stock makes up the bulk of Musk’s nearly $400 billion net worth, has benefited from $2.8 billion in tax subsidies or grants, according to subsidy tracker Good Jobs First. The Los Angeles Times calculated in 2015 that Musk’s empire of companies, which includes Tesla, SpaceX, SolarCity and The Boring Company, took in nearly $5 billion in tax breaks.

Tesla, SpaceX, and DOGE did not reply to a request for comment from Fortune.

Fortune

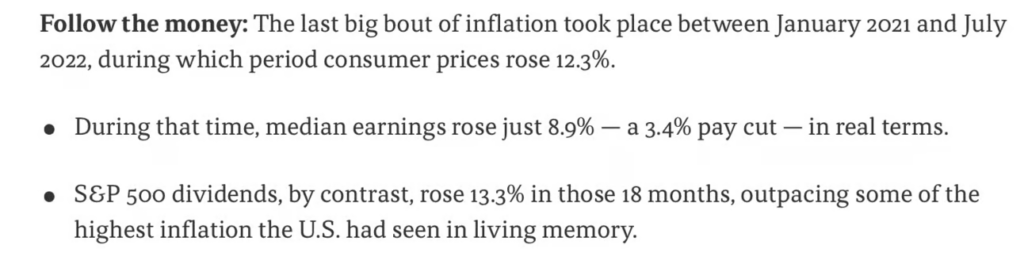

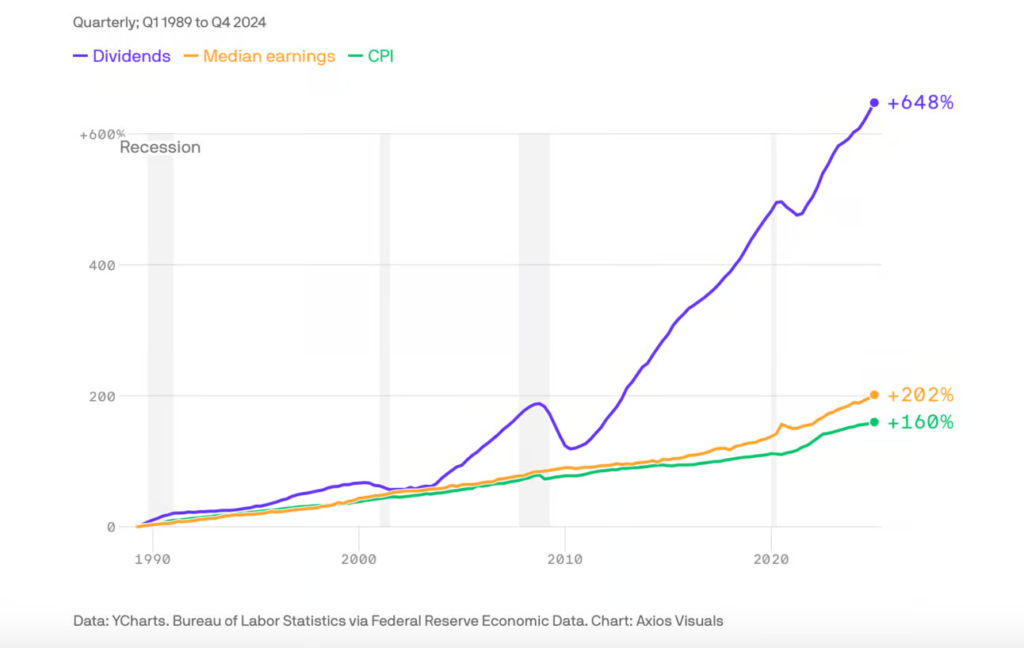

3. Hedge Inflation with Stocks. Change in S&P 500 Dividends, Median Earnings, and Consumer Prices

Axios

Abnormal Returns

4. SMCI Bounced at 200-Week Moving Average…Still More than Halfway Off Highs

Stock Charts

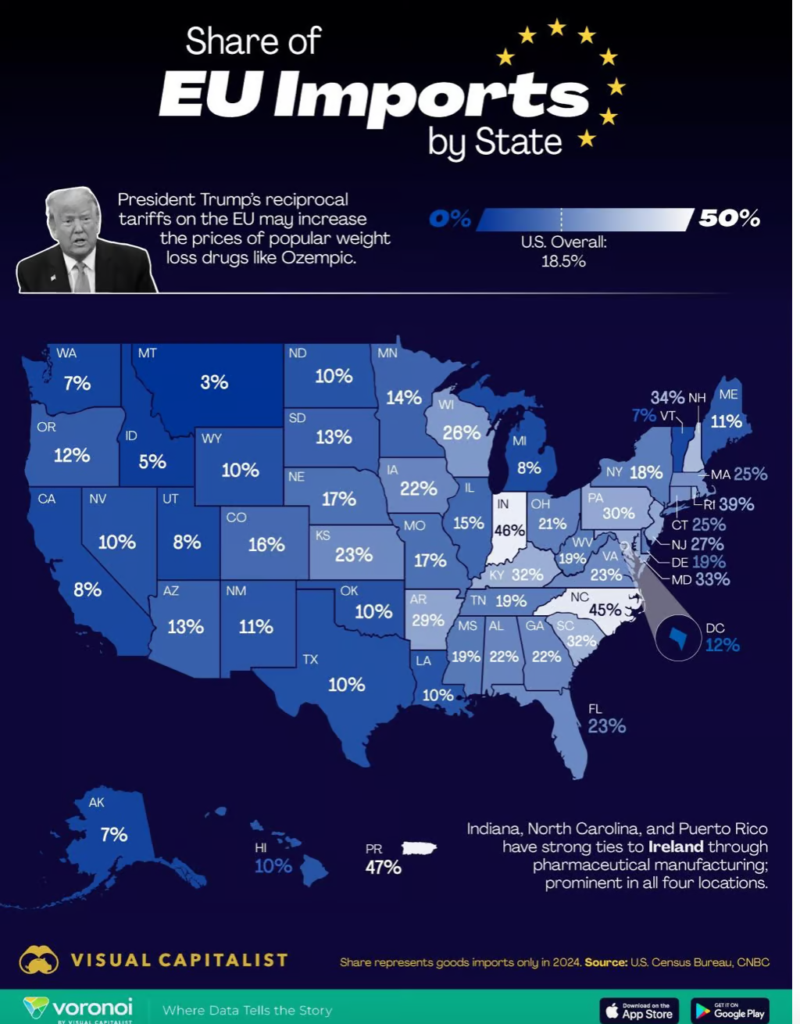

5. Share of EU Imports by State

Visual Capitalist

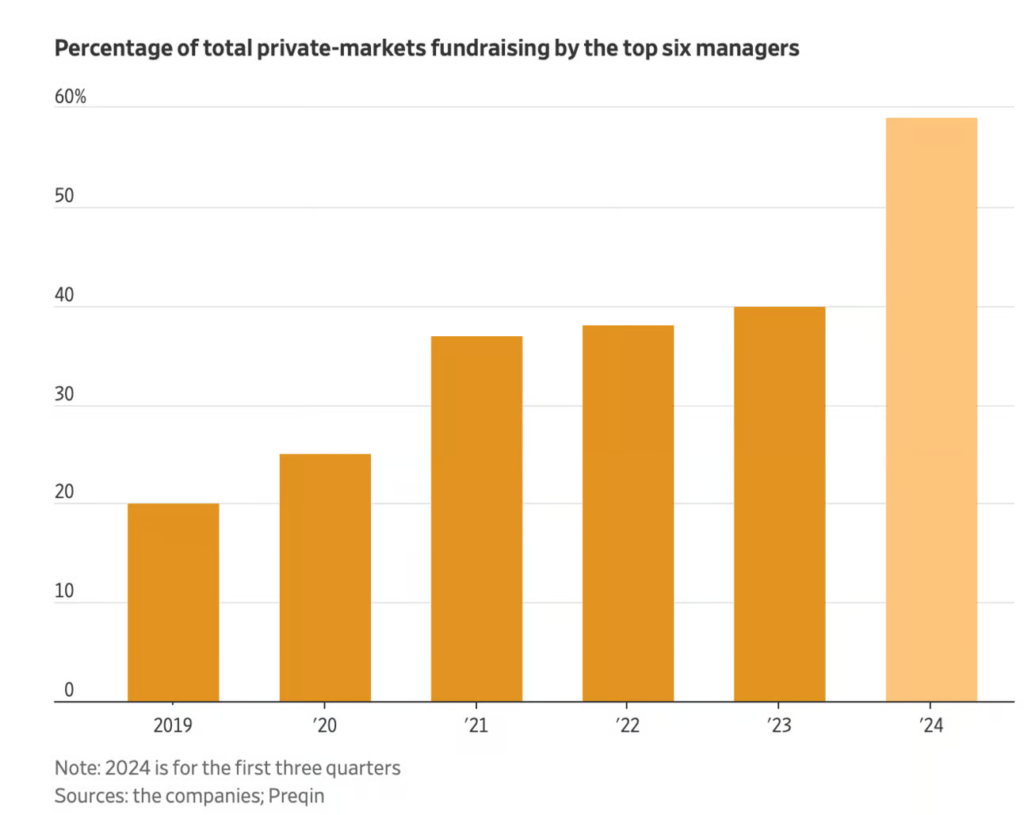

6. The Big 6 Private Equity Firms Dominate

Meanwhile, the big are getting bigger by raking in money from insurance companies and individual investors. The top six private-markets managers—Apollo, Blackstone, Ares Management, KKR, Carlyle and Brookfield Asset Management—were responsible for nearly 60% of the industry’s total fundraising in the first three quarters of 2024, according to company filings and data compiled by Preqin. The figure is up from about 20% in 2019 and includes areas such as credit and infrastructure.

WSJ

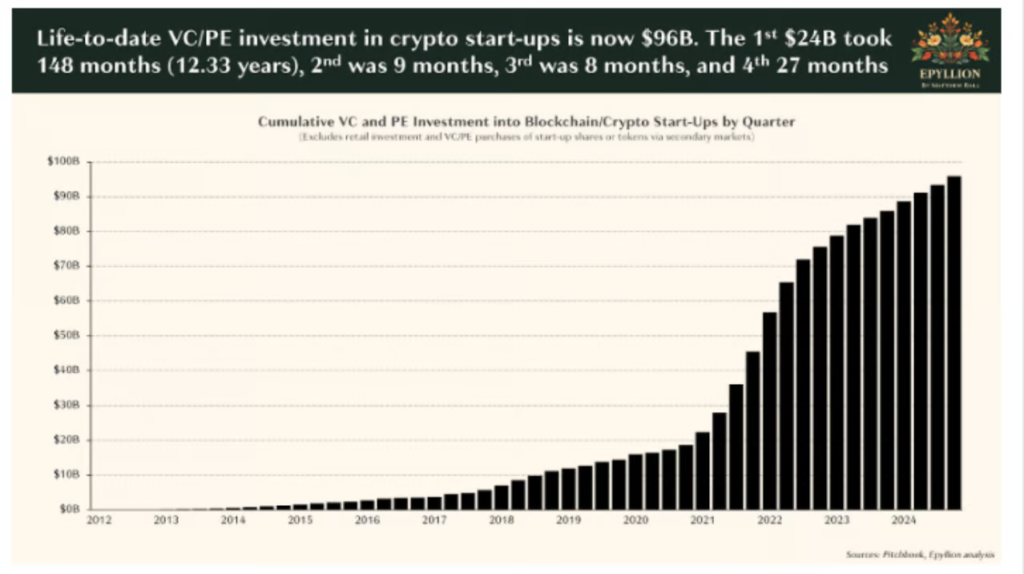

7. Venture and Private Investment in Crypto

The Irrelevant Investor

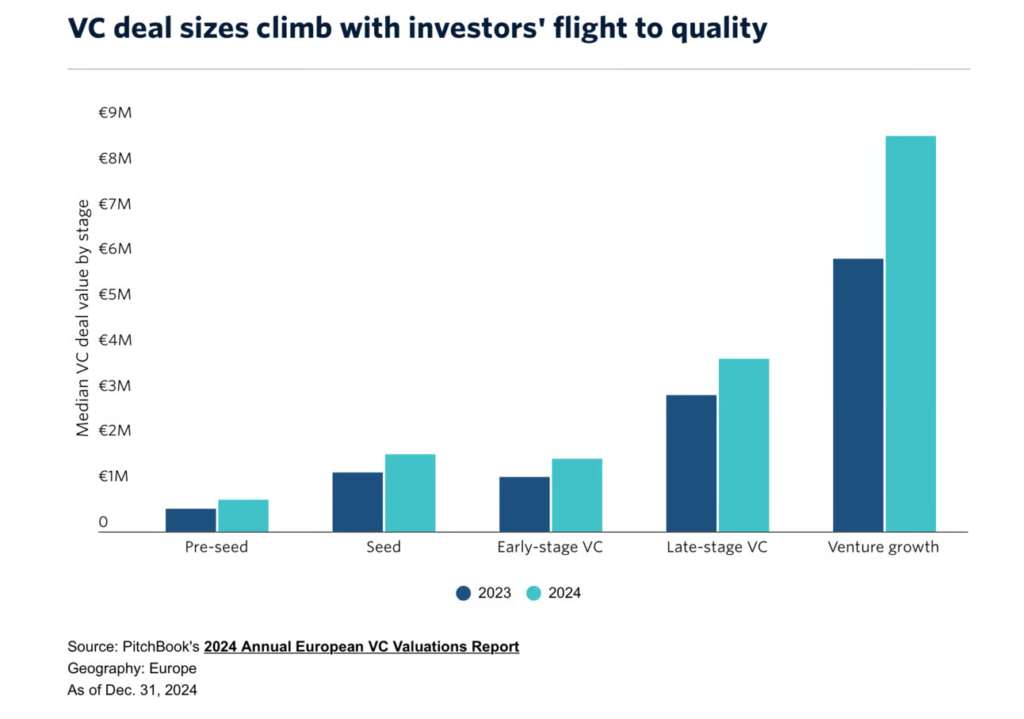

8. Europe VC Valuations Also Moving Higher

Despite a lackluster year for VC dealmaking, European startups that raised capital in 2024 received more money and at higher valuations than before. Here are five charts from PitchBook’s 2024 Annual European VC Valuations Report detailing how price tags and deal sizes moved last year.

PitchBook

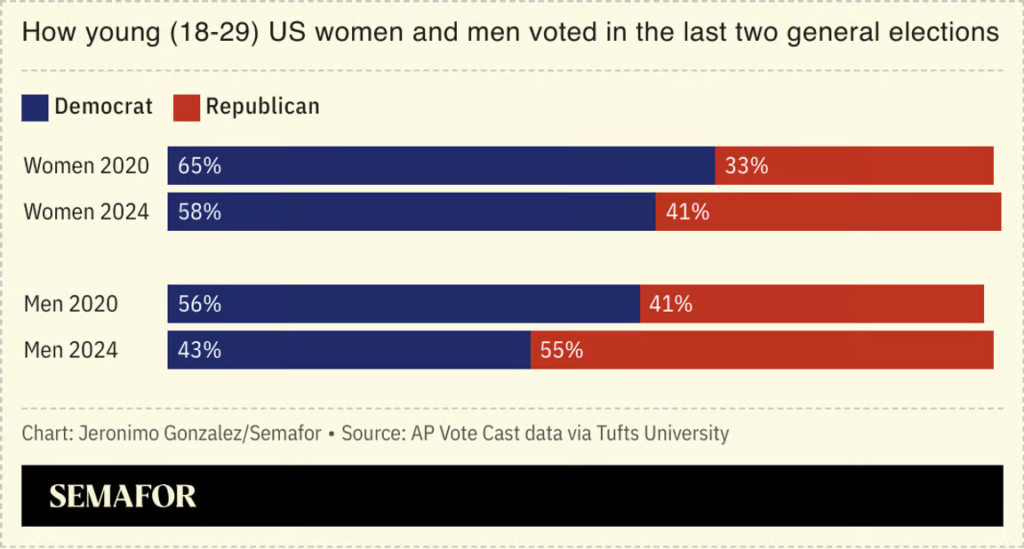

9. Male Vote 2020 vs. 2024

The COVID-19 pandemic reduced young people’s trust in authority and pushed them further to the right, a political writer argued. US youths have traditionally been progressive. But in 2024 they were nearly evenly split between Donald Trump and Joe Biden, and Europe has seen a similar shift. One possible explanation is a global protest vote against inflation: Many incumbents were voted out in 2024 as prices soared. But Derek Thompson argued in The Atlantic that the pandemic reduced physical-world socialization, pushing young men in particular into online echo chambers: Thompson said that youths who experience pandemics “have less confidence in their scientific and political leadership,” which can persist for years because political ideology tends to solidify in one’s 20s.

Semafor

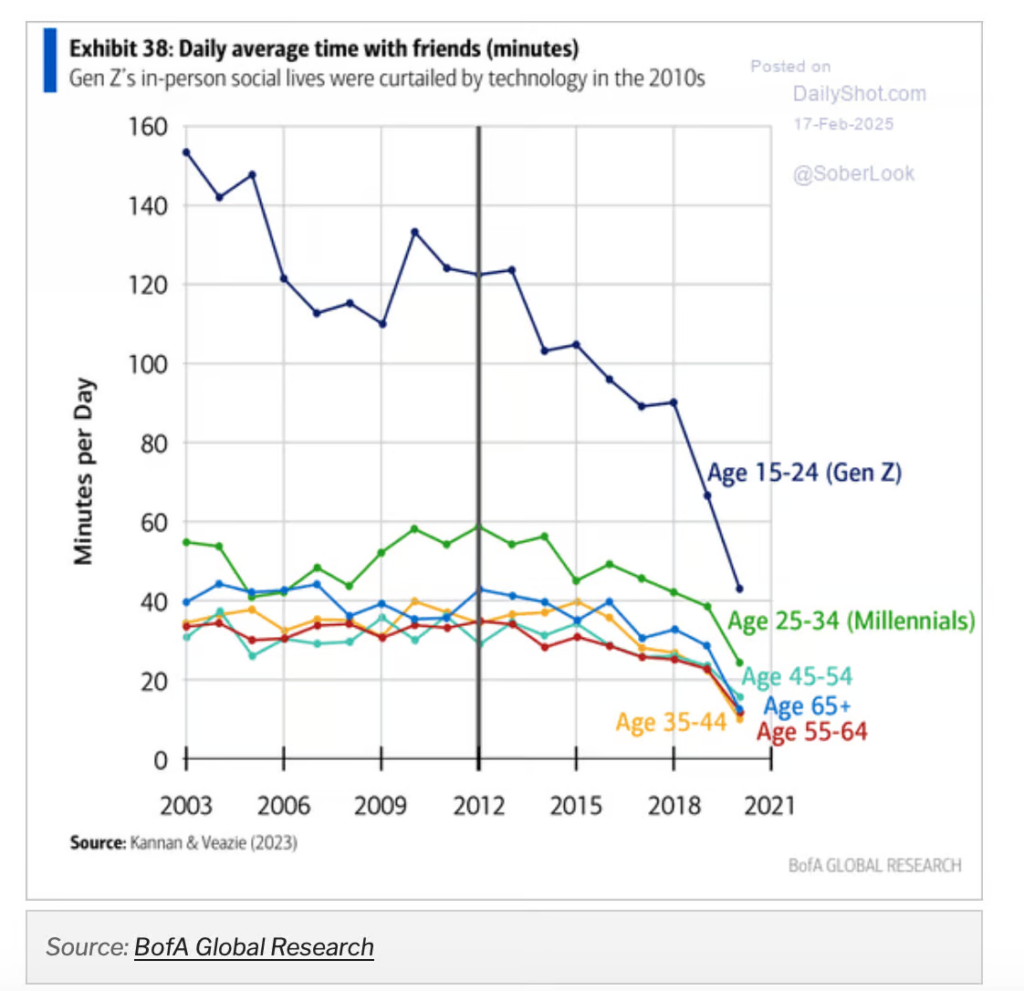

10. Average Time Spent with Friends Plummets

Daily Shot Brief