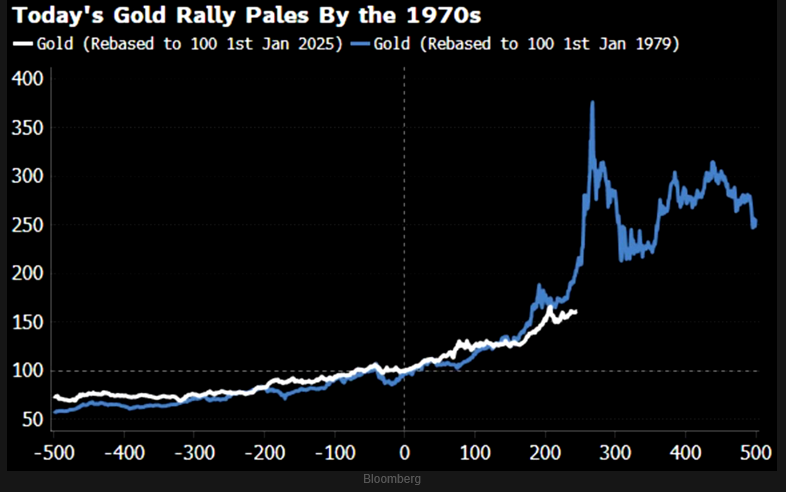

1. Gold Price Today vs. 1970’s

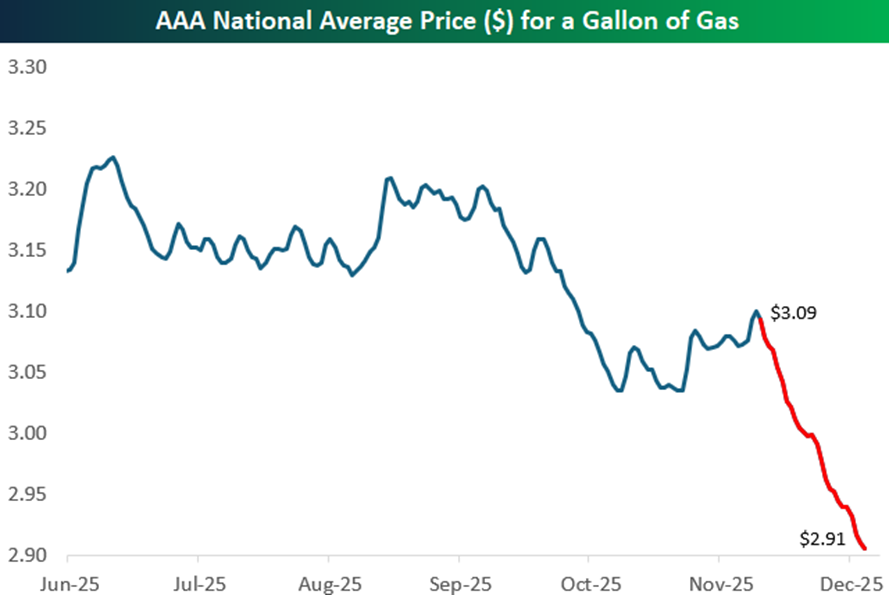

2. Crude Oil 52-Week Lows

Bespoke Investments As mentioned above, crude oil prices are down over 1% this morning, and while not quite at 52-week lows on an intraday basis, if these losses hold, it will mark a new 52-week closing low. After briefly trading over $80 per barrel in January, prices have been in a steady decline almost all year. The only exception was back in June when prices briefly spiked after Israel launched airstrikes on Iranian nuclear facilities.

Even though crude oil is sinking towards new 52-week lows, the S&P 500 Energy sector has been holding up relatively well. While it’s underperforming the S&P 500 on a YTD basis, it’s still much closer to 52-week highs than 52-week lows. That may be partly due to the strength of natural gas, although even that commodity has weakened in the last few days, falling from $5.25 MMBtu on 12/5, down to $3.94 this morning…

Bespoke

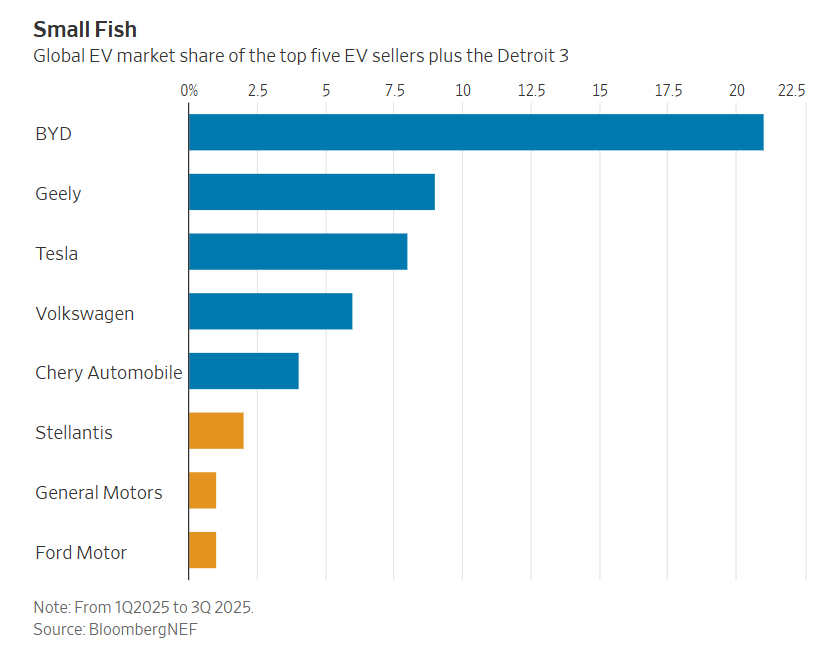

3. Big American Auto Non-Player in EV

WSJ-American automakers want to boost their profits by selling high-margin gas guzzlers today, all while not falling behind on electric-vehicle technology. It will be difficult to do both.

Look at the list of regulatory changes this year, and it is all but impossible for U.S. automakers to not lean into selling big SUVs and trucks. Car manufacturers no longer face penalties for failing to meet federal fuel-economy standards, which are themselves also being revised to become less stringent. The $7,500 tax credit for buying EVs expired. California no longer has the ability to set its own tailpipe-emissions standards, which were a big driver of EV investment. BloombergNEF estimates that 24% fewer EVs will be sold in the U.S. in the fourth quarter of 2025 compared with a year earlier.

It isn’t just the U.S. The European Union, U.K. and Canada are all pulling back or rethinking their ambitious EV mandates.

WSJ

4. CoreWeave -55% in 6 Months

Google Finance

5. Invitation Homes Started Buying Houses in 2012…Back to 2023 Lows…50day thru 200day to Downside

StockCharts

6. COIN Stock Negative For 2025….Sideways 2 Years.

Stockcharts

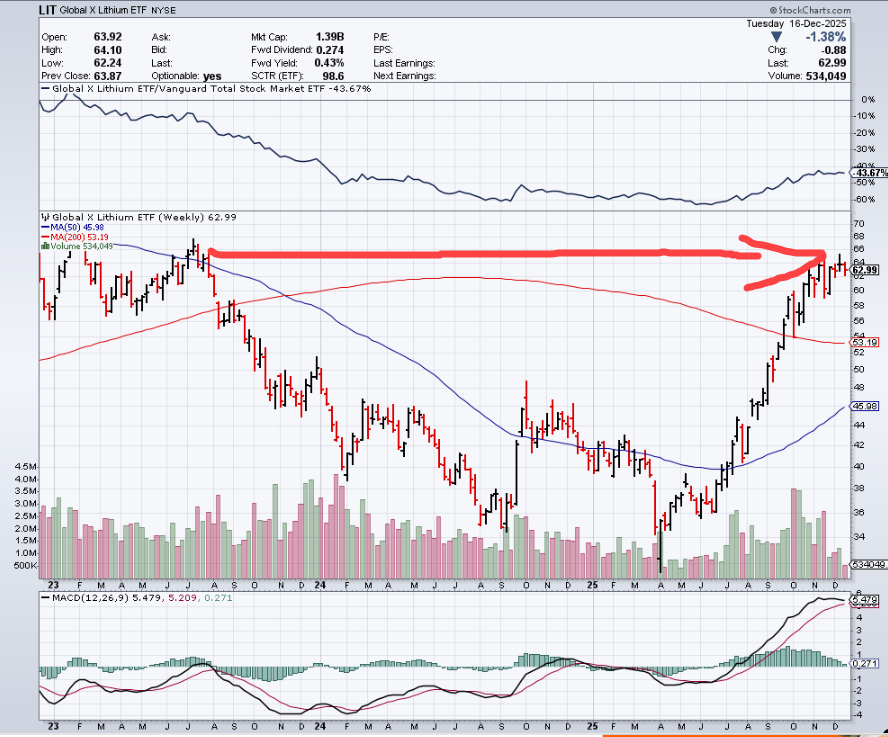

7. Lithium Stocks Up this Morning….LIT ETF Doubled Off Bottom Back to 2023 Levels.

CNBC Lithium stocks — Lithium prices soared in China after the government announced plans to revoke mining, sending miners stocks higher. Atlas Lithium jumped nearly 9%, while Albemarle and Sociedad Quimica y Minera de Chile each rose about 4%. Lithium Argentina gained 5% and Lithium Americas added nearly 2%.https://www.cnbc.com/2025/12/17/stocks-making-the-biggest-moves-premarket-.html

Stockcharts

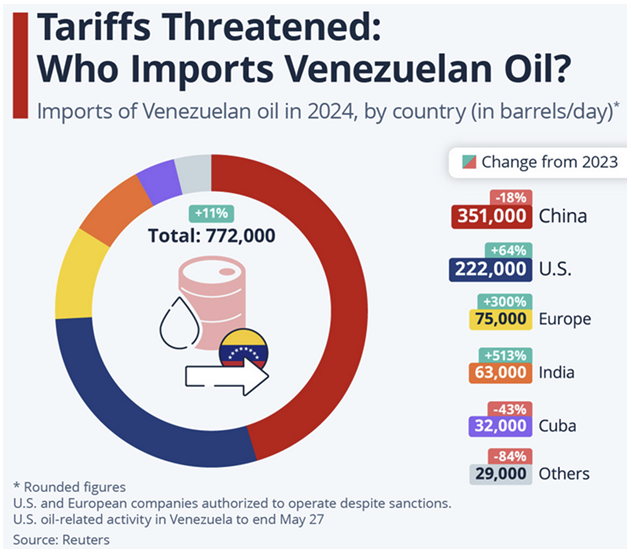

8. Who Imports Venezuelan Oil?

Statista

9. Largest Asset Managers….Vanguard Behind Blackrock.

Inves7

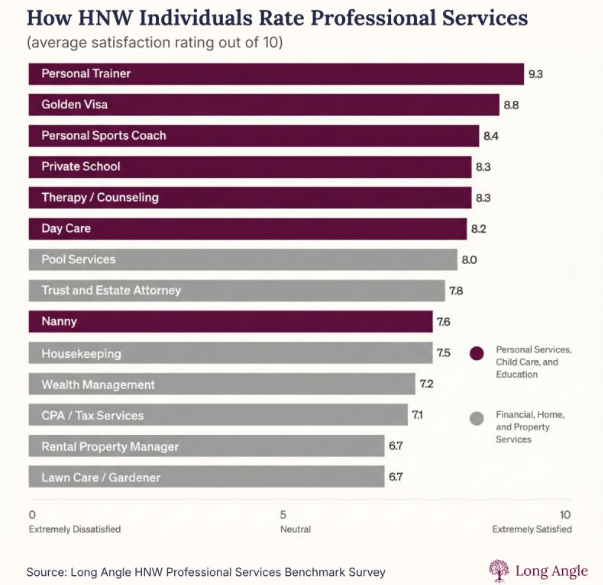

10. How High Net Worth Advisors Rate Professional Traders.

Chris Bendtsen