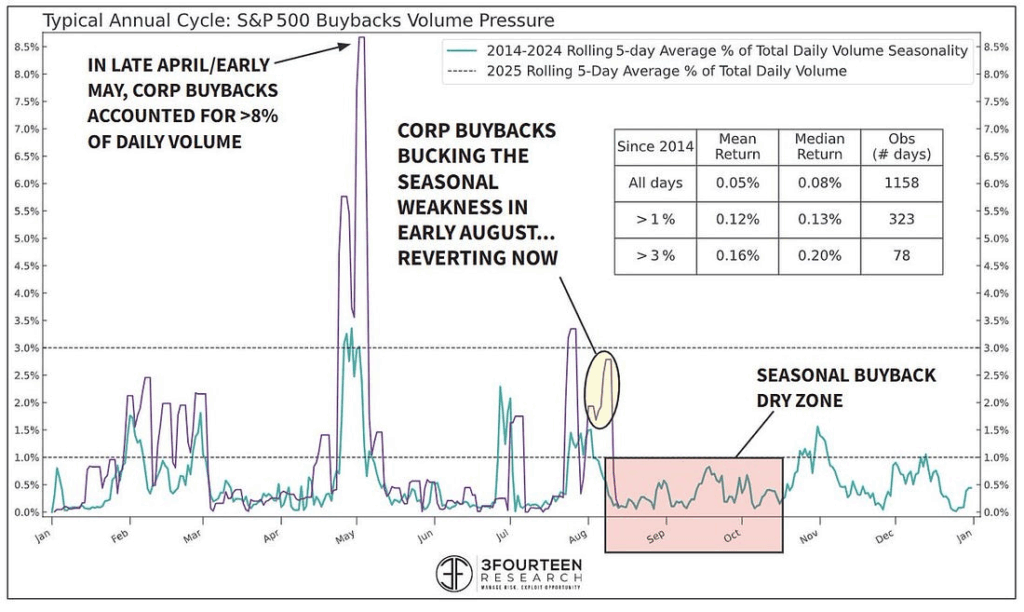

1. Stock Buybacks Due for Seasonal Slowdown

@Callum Thomas (Weekly S&P500 #ChartStorm)Seasonal Buybacks: Interesting snippet on seasonality — the next couple of months have historically been a seasonal dry patch for buybacks. And indeed, it’s Sep/Oct which have historically tended to see the worst seasonal stockmarket performance.

Source: @WarrenPies

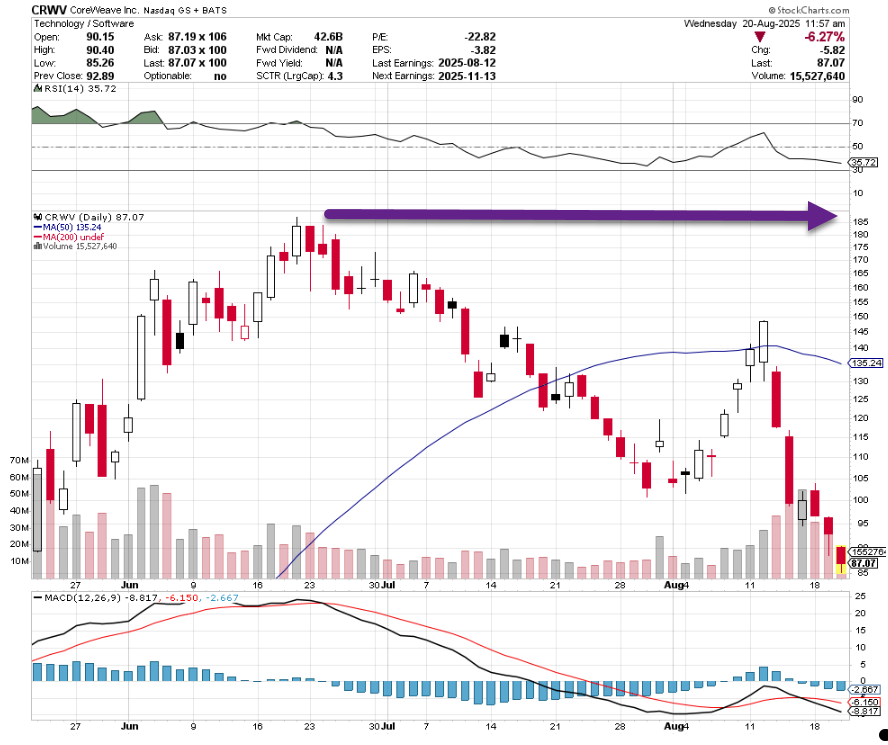

2. First of Hot IPOs 2025-CoreWeave CRWV -50% from Highs

StockCharts

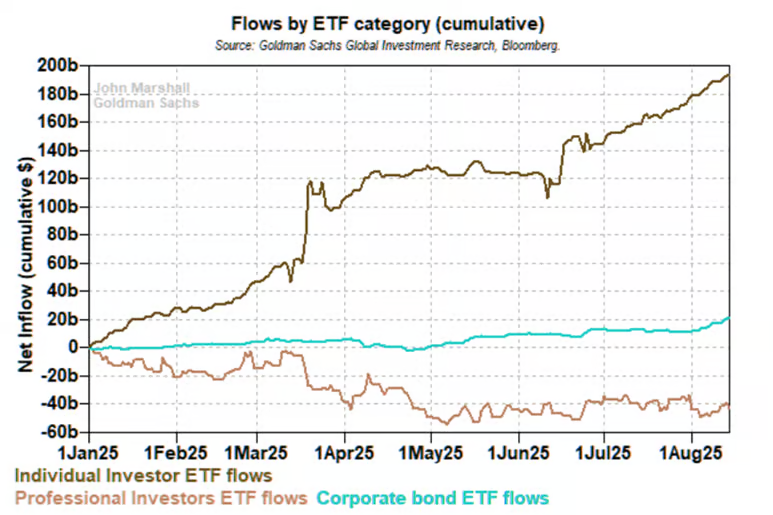

3. Retai Investors Buying 2 Handed—Professional Investors Flat

Retail vs. Pros flows. Retail flows are marching higher, Pros flows have been trending sideways.

John Marshall – Goldman Sachs via Zero Hedge

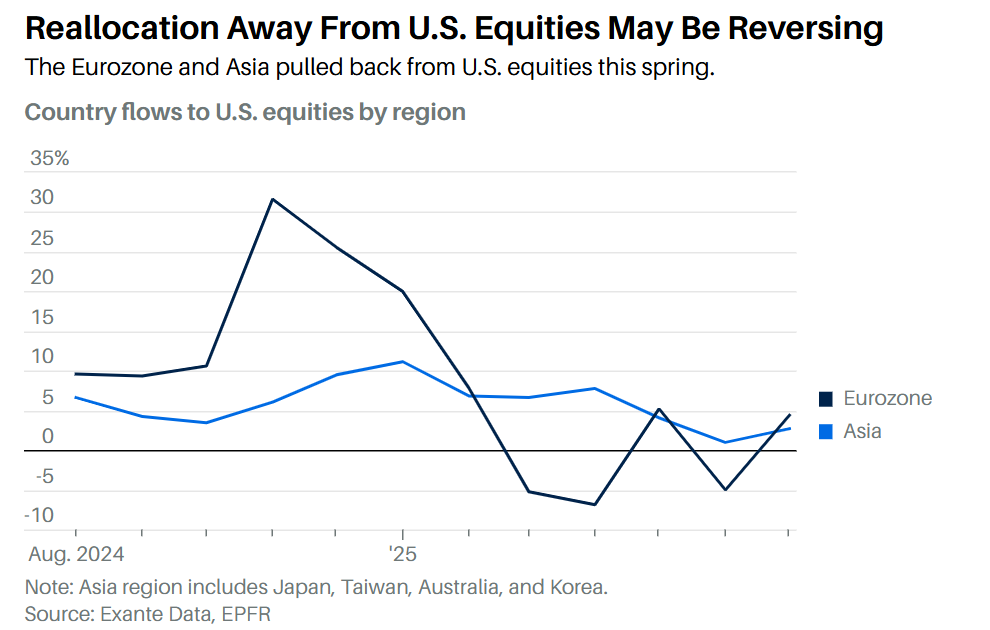

4. Reallocation Away from U.S. Stocks Already Reversing?

Barron’s

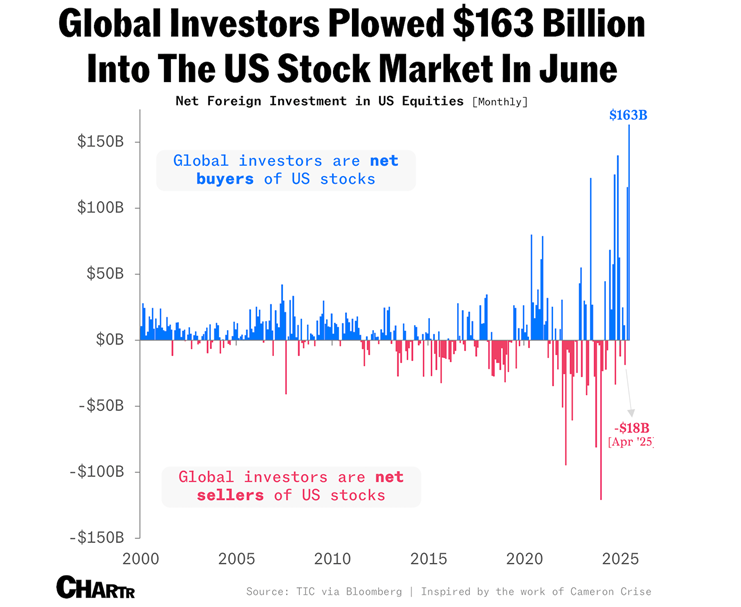

5. Global Investors Bought $163 Billion of U.S. Stocks in June

chartr

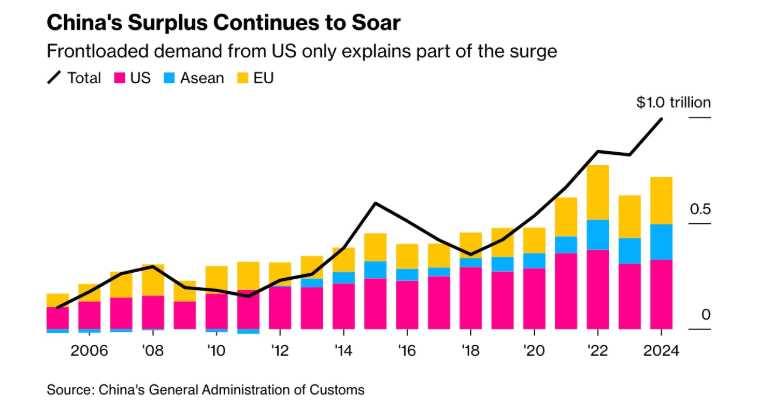

6. China Trade Surplus was $1 Trillion in 2024

Paul Krugman

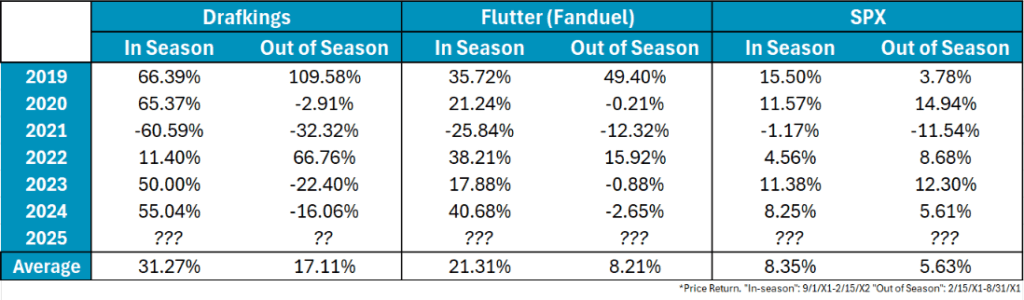

7. Draftkings and Fanduel Performance “in football season” vs. “offseason”

Nasdaq Dorsey Wright

Nasdaq

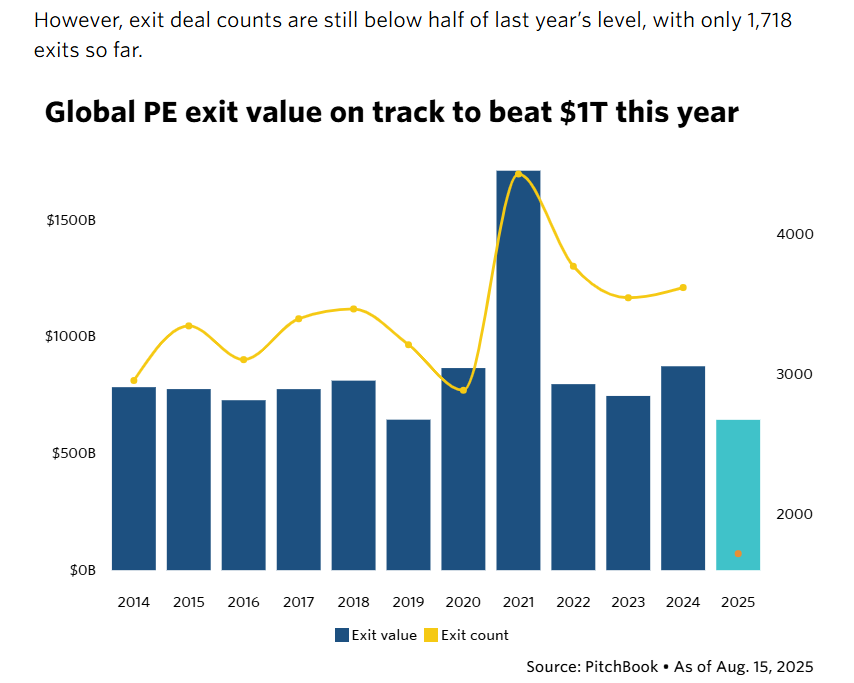

8. Private Equity Exits Running at Half of Last Years Count

WSJ-Following a binge of acquiring companies during the post-Covid deal frenzy, it is generally proving harder to now sell those companies on. There have been some notable initial public offerings this year of private-equity-backed companies, such as the roughly $1.4 billion IPO for cybersecurity company SailPoint. But the overall number of exits in the second quarter—which also includes sales to other financial sponsors or to corporations—slowed to about 10% below the typical prepandemic quarterly average, according to PitchBook.

The private-equity industry globally had an “inventory” of over 30,000 companies through the first quarter of this year, according to PitchBook. At last year’s pace of exits, it would take about eight years to clear that inventory, PitchBook estimates. https://www.wsj.com/finance/investing/private-equity-firms-stocks-are-struggling-despite-getting-into-401-k-s-759ad08d?gaa_at=eafs&gaa_n=ASWzDAhIF3ZRuFiL04sUAndx3YBw69LpEqZrO91c2AULQmFpu1chbIM8hHhIe-1TJos%3D&gaa_ts=68a6112c&gaa_sig=xrBjsViyf_iloYpulhAWnqH8qBeE4uDjpo5ABinCXnCWU7iN7-KoCzusLp2Hk_FEDFSCmSFXWTL5Nkq9nTTzJA%3D%3D

PitchBook

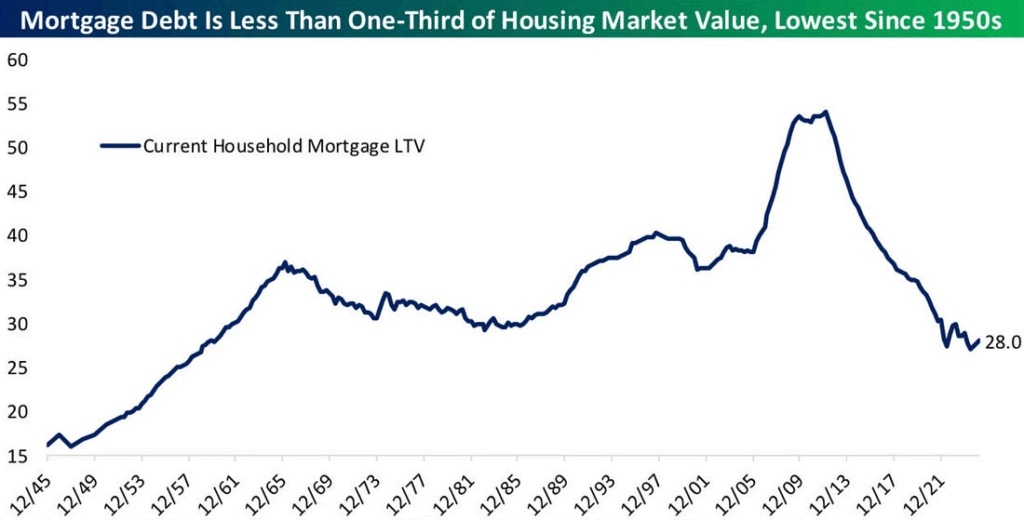

9. Mortgage Debt at Lowest Levels Since the 1950s

Mortgage debt is now 28% of the U.S. housing market value. That’s the lowest level going back to the 1950s.

Source: Bespoke

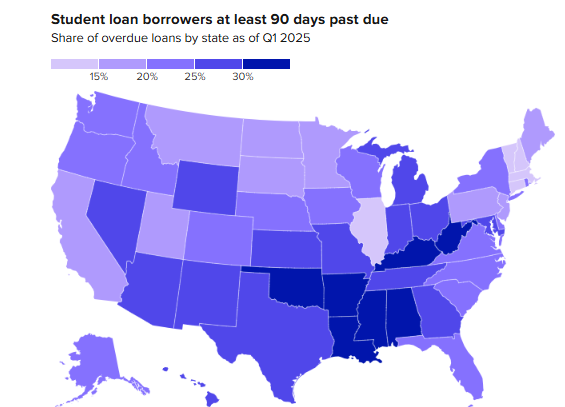

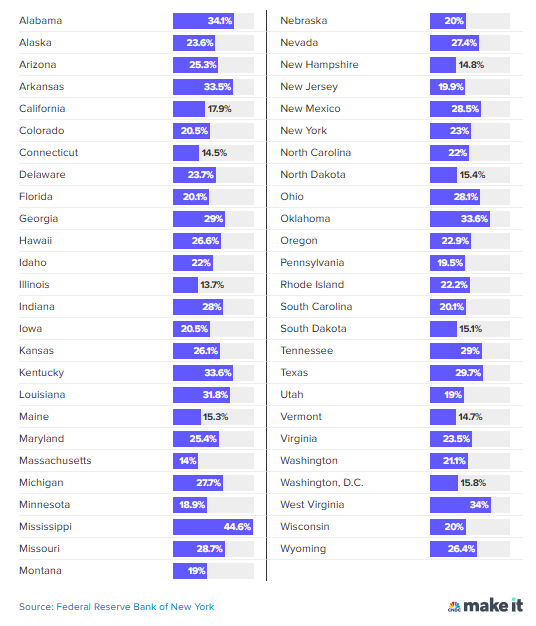

10. Student Loan Defaults Hit 10%

CNBC Kamaron McNair

CNBC LLC