God Only Knows-Beach Boys

God only knows what I would be without you

If you should ever leave me

Though life would still go on, believe me

The world could show nothing to me

So what good would living do me

God only knows what I’d be without you

God only knows what I’d be without you

God only knows what I’d be without you

God only knows what I’d be without you

God only knows what I’d be without you (God only knows)

God only knows what I’d be without you (what… More

Source: LyricFind

Introduction

In honor of Americans heading to beaches for the summer under the new hybrid work rules, I went with the Beach Boys this quarter. God only knows where the following markets would be without low interest rates: stock market, bond market, commercial real estate market, housing market, private equity market, NFT market, baseball card market, Bitcoin, Crypto, commodities, etc., etc., etc. God only knows where we would be without low interest rates.

For 10 plus years, pundits have predicted interest rates rising only to see them break 1% during the height of Covid. The foreseeable future of all investable markets is now focused on rising interest rates and rising inflation. My guess is the generational low was made in the 10- year treasury at .52 basis points during Covid.

In the Q1 letter we discussed the everything rising market but none of that is new to American speculators as the 1998 Forbes cover below portrays a young 20’s kid whipping around stocks as the new road to wealth. A recent 2021 Barron’s cover of teen trading meme stocks struck me as eerily similar. Speculation and new-found vehicles for trading are commonplace. There are always new versions of bets that have existed since the beginning of money.

However, we do have some unprecedented economic events in America such as labor shortage, growth in money supply, and a stimulus 9x the 2008 crisis to citizens with healthy pre-covid balance sheets. A reminder that in 2008 the stimulus went to financial institutions while 2021 the money went straight to consumers. Remember in the first quarter letter, we talked about availability, of which we have massive disposal of cash right now. Where will this sea of liquidity be deployed? Will it create inflation? Inflation is the printing of too much money, leading to too much money chasing too few goods. We now have the biggest

increase in the money supply since WW II, but it’s not yet funneling through the economy.

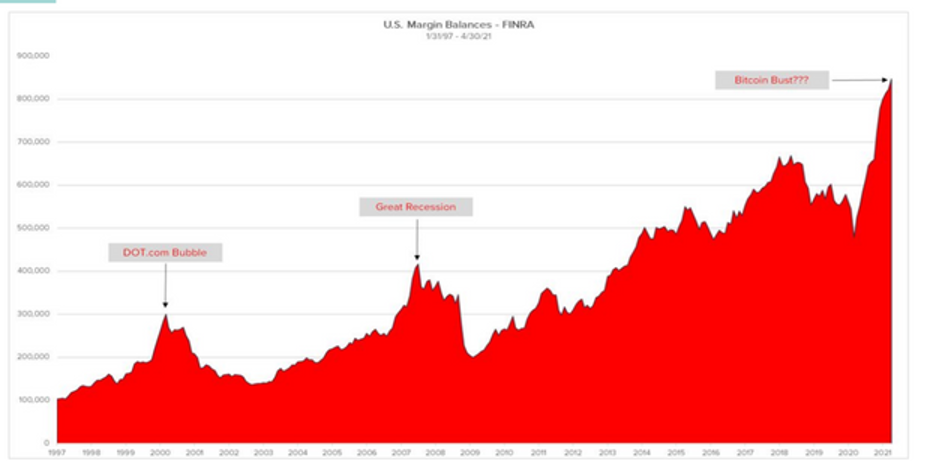

Can we have huge increase in money supply, record low interest rates, record margin borrowing and a shortage of labor without sparking inflation? It is not about lumber or oil but too much money chasing too few goods. As discussed in Q1 letter, Wall Street and the investment public will keep playing until the music stops but the end of the dance is impossible to predict. We will continue to flesh out that theme of interest rates and inflation in today’s letter.

Part I -Market Speculation Always Repeats Itself.

Speculation is nothing new especially as we experienced a 20-year gap in retail stock trading – it takes time to forget. Right now, young people think they were offered a seat on a rocket ship that cannot possibly crash.

Nothing has changed….

Forbes 1998 – A Bunch of Kids are Tormenting Wall Street

Barron’s 2021 – Here Come the Teens: They Can’t Vote, but They’re Old Enough to Buy Stocks.

Part II-Can we pull this off without inflation?

Assets in money market funds at record high

I never thought I would say this in the consumer spending-based U.S. economy but “Money Market Funds Getting Overwhelmed with Wall of Cash.” Dave Lutz at Jones Trading. If government money market funds have to keep investing at zero percent, the economics of the industry “breaks down”, said FT

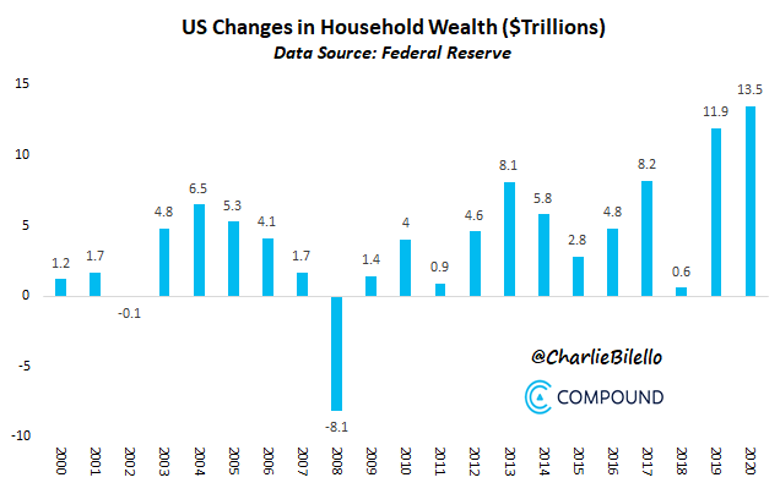

Household Wealth Grew at Record Rate in 2020

Pandemic + Recession = Record Boom in Wealth. Household wealth in the US grew by $13.5 trillion in 2020, the largest annual increase ever recorded.

https://compoundadvisors.com/about

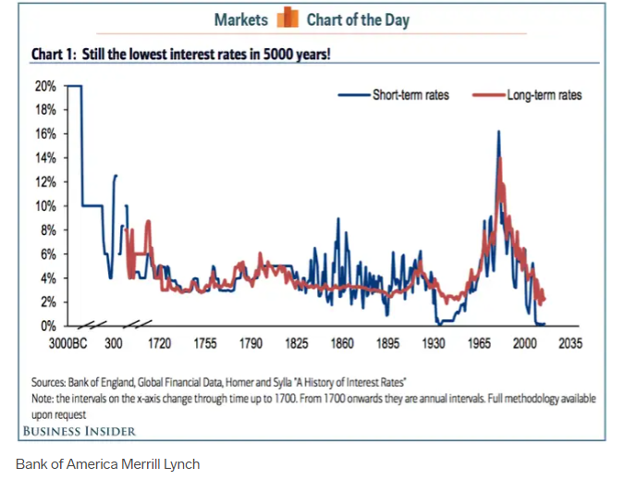

Interest Rates at 5000 Year Low

This massive pile of cash and a record household wealth are matched with another extraordinary event as interest rates hit a 5000-year low.

Haldane’s list of sources for this is staggering. (You can look through them all here.)

https://www.businessinsider.com/chart-5000-years-of-interest-rates-history-2016-6

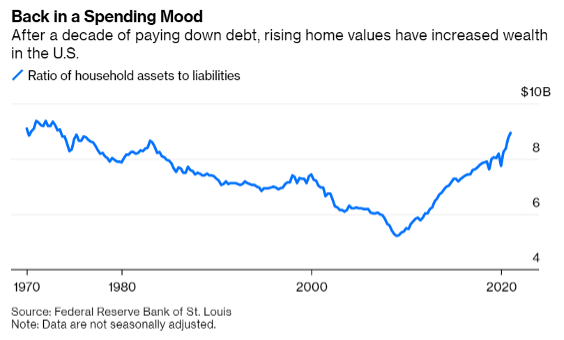

The ratio of assets to liabilities is close to a 50-year high.

The backdrop of record cash plus 5000- year low interest rates become even more interesting when we add that Americans have been paying down debt for 10 years post the 2008 crisis. After the scare of 2008 crisis, Americans have spent the last decade paying down debt and now home prices are rising fast. Bloomberg- By Conor Sen. But what started as balance sheet repair has now turned into something else, in large part due to pandemic-related shifts. Home prices have skyrocketed over the past 18 months and the stock market has risen to all-time highs, inflating the asset side of household balance sheets. The personal savings rate has also been historically elevated because of a combination of fiscal relief measures passed by Congress during the pandemic, and a lack of spending on activities like travel and dining. The net effect is that by the end of the first quarter of 2021, the ratio of household assets to liabilities is close to a 50-year high and continued strong gains in home values and stock prices in the second quarter of 2021 should push it even higher.

| Source: Federal Reserve Bank of St. Louis Note: Data are not seasonally adjusted. Americans Are On the Cusp of Another Borrowing Binge https://www.bloomberg.com/opinion/articles/2021-06-23/americans-are-on-the-cusp-of-another-borrowing-binge?utm_campaign=socialflow-organic&utm_content=view&utm_source=twitter&utm_medium=social&cmpid%3D=socialflow-twitter-view&sref=GGda9y2L |

Margin Borrowing Balances Record $800B

“U.S. margin balances are at record highs right now,” said Darren Schuringa, chief executive of ASYMmetric ETFs, referring to the amount of money investors have borrowed to buy stocks. “That’s No. 1. We’ve never seen it anywhere near $800 billion.”

Record U.S. margin levels

Americans Now Taking Personal Loans to Invest in Stock Market

It seems like buying stocks on margin is not enough for today’s rampant appetite for risk, so retail investors are taking out personal loans to buy stocks.

Source: MagnifyMoney Read full article

https://dailyshotbrief.com/the-daily-shot-brief-june-22nd-2021/

As mentioned in Q1 letter, we also have record amounts of cash on public company balance sheets, at private equity firms and venture capital firms. The question for the next decade is when will this mountain of money flow through the economy – because right now it is stagnant.

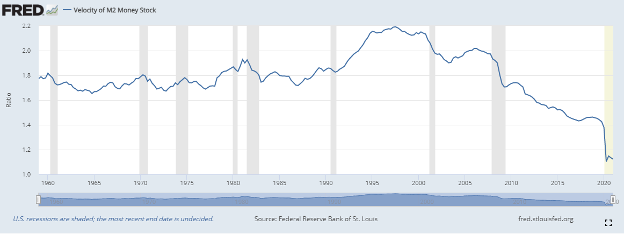

Velocity of money is the rate at which consumers and businesses in an economy collectively spend money and right now it is at 50-year lows. If consumers start spending their savings, and the government keeps borrowing and spending unprecedented amounts, velocity can pick up rapidly. This becomes the de-facto chart to watch for signs of inflation. Keep in mind that with all the talk of the roaring 20’s coming out of Covid, our GDP is still well below pre-pandemic levels.

Velocity of M2 Money Stock

https://fred.stlouisfed.org/series/M2V

The Fed is trying to thread a pass down the middle between two defensive backs perfectly into the hands of receiver. They viewed 2008 crisis response as a learning lesson to go big and go fast and now the investment public awaits the outcome. Can we have record cash, super healthy balance sheets, a rising stock market, and record low interest rates without sparking inflation?

Part III-Major Factors Pointing to Inflation

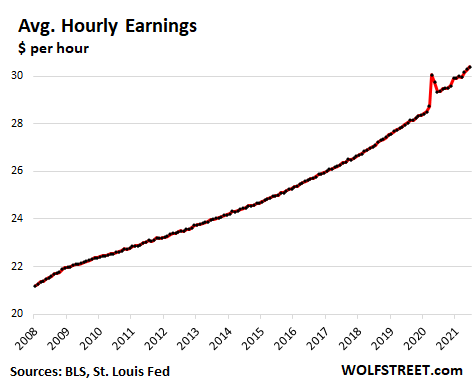

Hourly earnings are hitting a record as lower paid employees are back to work, but wages are still rising. Business owners are paying 20-30% more for labor but they are still short staff.

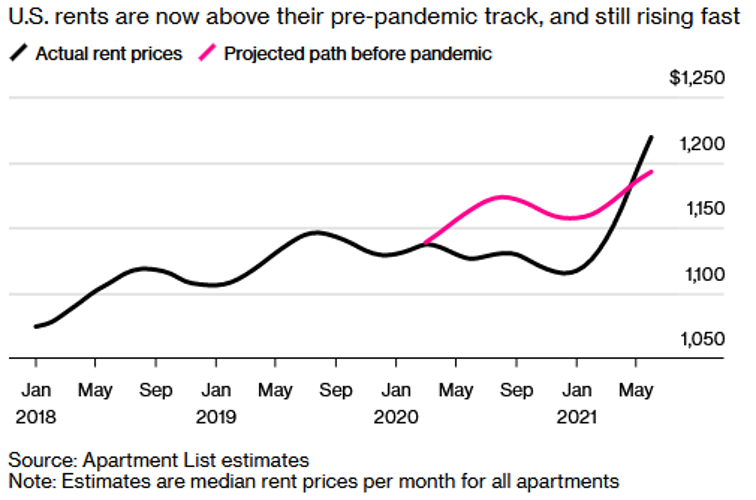

Rents are Higher than Pre-Pandemic- The cost of renting a home is soaring in cities across the U.S., squeezing the finances of low-income households and posing a threat to the consensus that pandemic inflation will soon fade away – The median national rent climbed 9.2% in the first half of 2021, according to Apartment List.

Job openings hit a record 9m plus. Considering we live in the ultimate digital age; I am dumbfounded by the number of “old school” help wanted cardboard signs I see lining commercial corridors across the U.S.

The inflation factors that are dominating the news right now like lumber, energy, car prices are all volatile plus related to post Covid supply chains normalizing. This means we will have to wait until after Summer when government checks are removed, and everyone is back to new post crisis work schedules. However, wages and rents rarely if ever go back down after rising to new levels. Considering 9m job openings, it is hard to see a reduction in labor costs, therefore rents/housing costs will continue to rise.

Conclusion

If nothing else, investing is always interesting, and 2021 post global pandemic is leaving the U.S. in a remarkably historical economic experiment. We are in the early innings of a ballgame that is being created by stimulus like we have never seen. We are also moving into an era of big government that started with a huge increase in the money supply – 9x the size of 2008 housing crisis bailout. On this note, I think we can agree that inflation risks are at the highest levels we have witnessed in 25 years.

Most market predictions die a hard death and none more than rising interest rates. The argument for rates not rising involves demographics, technology, and government debt. The population of the U.S. is aging and slowing, technology helps to lower prices, and record government debt is deflationary. Each one percent rise in the interest rates would increase FY 2021 interest spending by roughly $225 billion at today’s debt levels.

Like the risk of inflation, with mammoth amounts of cash on the sidelines and market speculation hitting records (as measured by margin debt and retail trading), let us also agree that the risk of interest rates rising is at 25-year highs. The Fed will have to raise rates at some point as investors are not known for reducing risk at elevated market valuations – quite the opposite as we can see again with 2021 flows into the stock market surpassing the last 5 years combined.

To close we have inflation and interest rates at the forefront of our watch lists – both are at the highest risk of rising in 25 years. This is more noteworthy than past rising rate environments because all our markets – publicly traded stocks, debt markets, private equity, housing, and commercial real estate – have become addicted to permanently falling rates. We have an entire investing generation across all industries that have never experienced inflation or rising interest rates. God Only Knows!

God only knows what I would be without you

If you should ever leave me

Though life would still go on, believe me

The world could show nothing to me

So what good would living do me

God only knows what I’d be without you

Beach Boys

Two Bonus Charts for Future Discussion

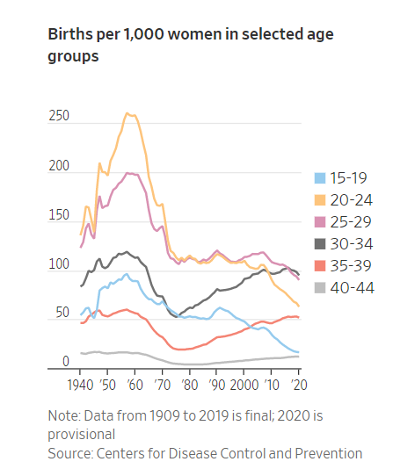

Baby Bust-Economies only advance and prosper with growing populations. The U.S. is experiencing a baby bust but I believe this will reverse itself as Millennials increase household formation.

WSJ-Birth Rate in U.S. Lowest Since 1979-The number of babies born in America last year was the lowest in more than four decades, according to federal figures released Wednesday that show a continuing U.S. fertility slump.

Patent Explosion-I always end the letter with positive note on America. U.S. patents issued breaks out to new record as another tech revolution on the horizon.

https://ritholtz.com/2021/07/10-monday-am-reads-315/

Disclosures

Lansing Street Advisors, LLC is a registered investment advisor with the State of Pennsylvania. You can read more about the Lansing team at www.lansingadv.com.

To the extent that content includes references to securities, those references do not constitute an offer or solicitation to buy, sell or hold such security as information is provided for educational purposes only. Articles should not be considered investment advice and the information contained within should not be relied upon in assessing whether to invest in any securities or asset classes mentioned. Articles have been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Securities discussed may not be suitable for all investors. Please keep in mind that a company’s past financial performance, including the performance of its share price, does not guarantee future results

Material compiled by Lansing is based on publicly available data at the time of compilation. Lansing makes no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and shall not have liability for any damages of any kind relating to the use of such data.

Material for market review represents an assessment of the market environment at a specific point in time and is not intended to be forecast of future events or guarantee of future results.

Indices that may be included herein are unmanaged indices and one cannot directly invest in an index. Index returns do not reflect the impact of any management fees, transaction costs or expenses. The index information included herein is for illustrative purposes only.

The trademarks and service marks contained herein are the property of their respective owners.

Lansing Street Advisors is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

Lansing Street Advisors may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions.