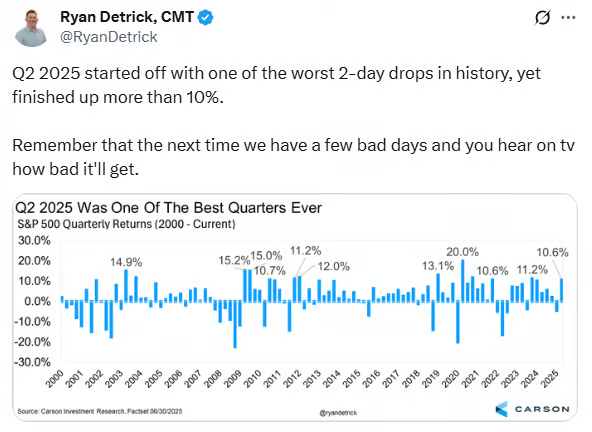

1. Q2 Top Decile Performance

Ryan Detrick

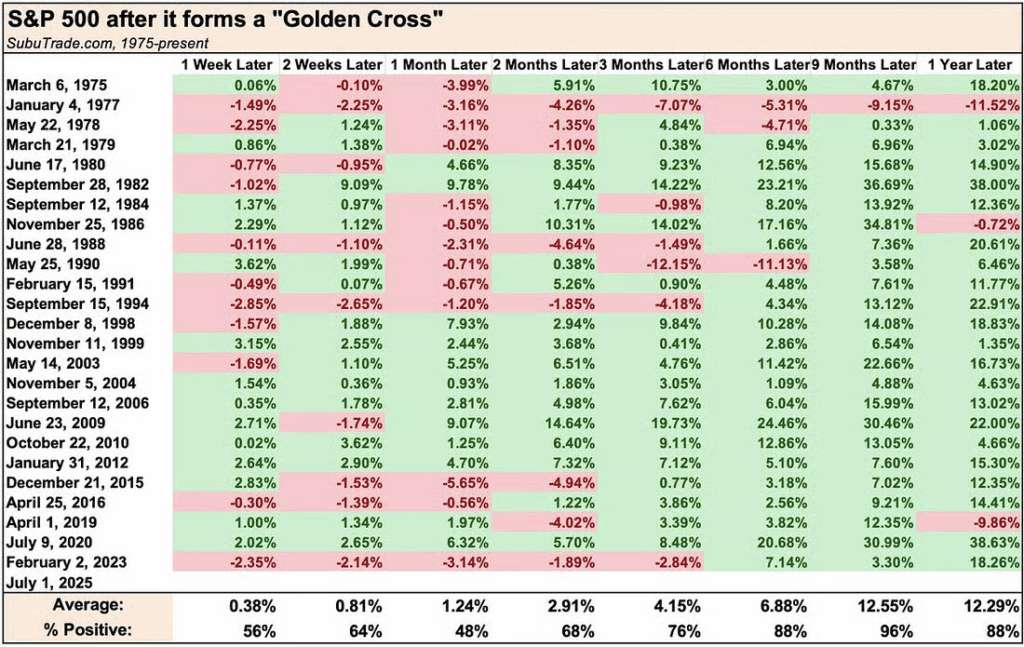

2. Last Week Top 10 Showed the 50day Crossing thru 200day to Upside…History of Bullish Signal

@Callum Thomas (Weekly S&P500 #ChartStorm) Golden Cross — more history: And here’s some more history and stats on the Golden Cross… one thing to note from this is that there are a couple of exceptions to its positive performance, and mileage does vary even when it correctly flags upside, and of course you do see more variation in short-term vs longer-term returns subsequent to the signal activating.

Subu Trade

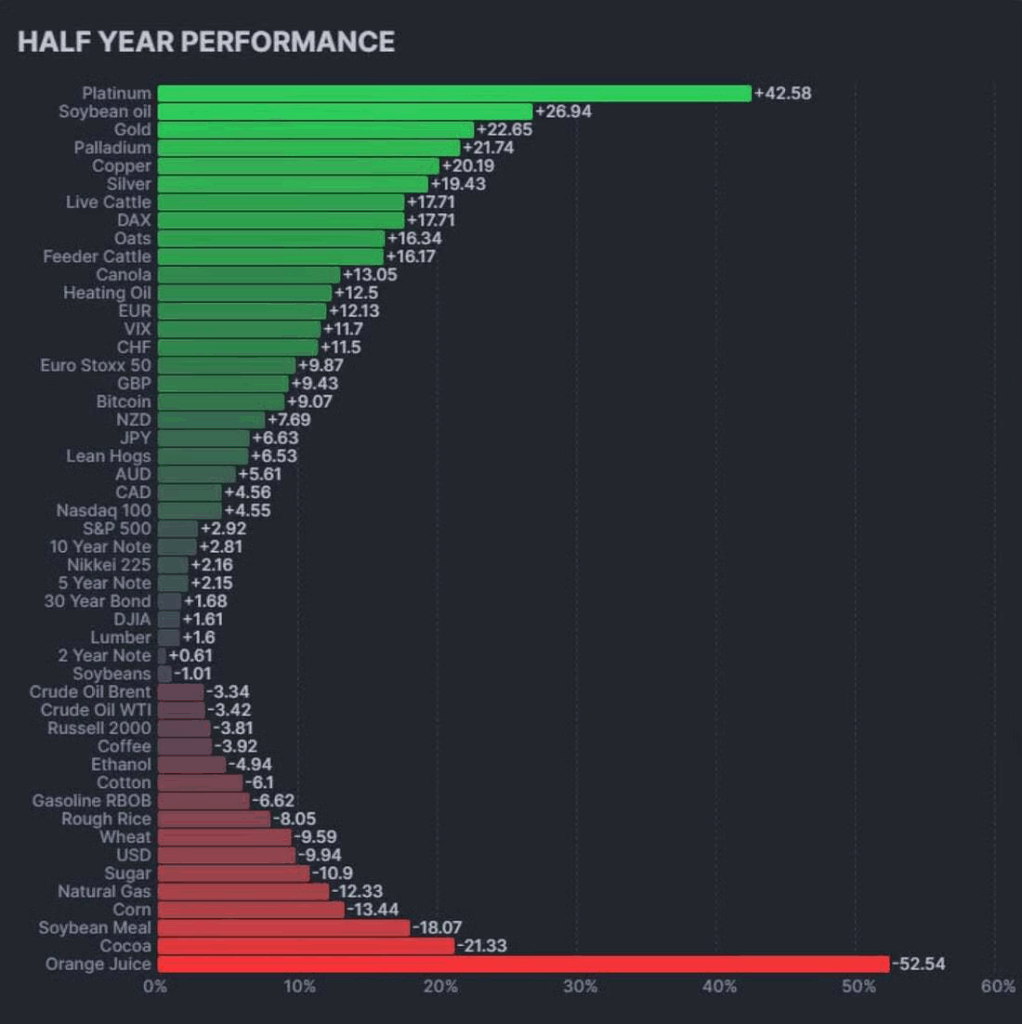

3. 1st Half Recap-All Asset Classes

Spilled Coffee: At the half way point of the year, platinum, soybean oil and gold lead the returns. Orange juice and cocoa have had a rough 2025.

Mike Zaccardi

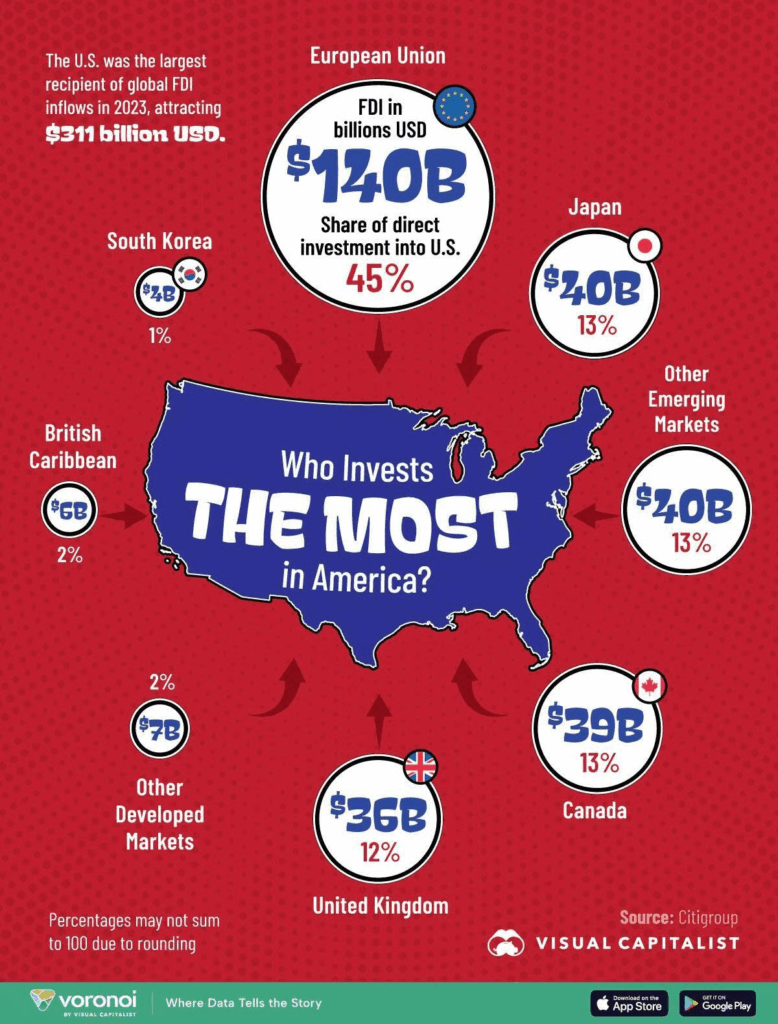

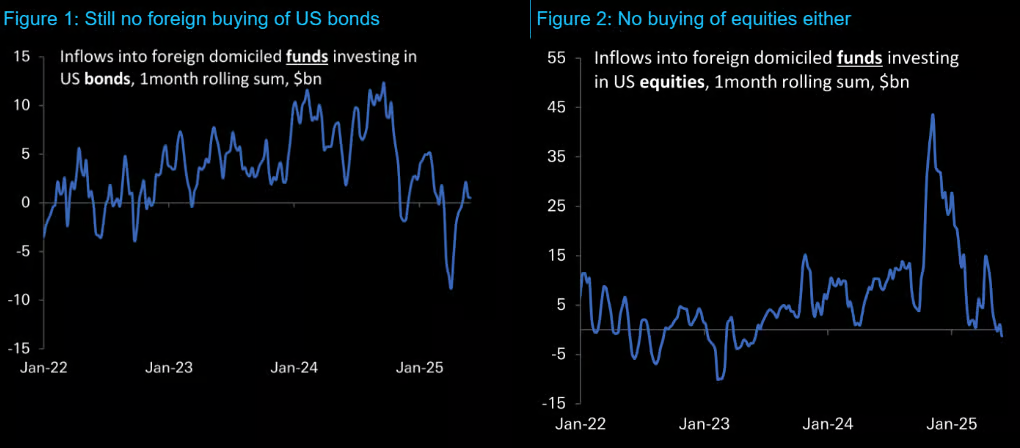

4. Inflows Stopped from Foreign Investors…Keep in Mind Pre-Election International Retail was Max-US Stocks

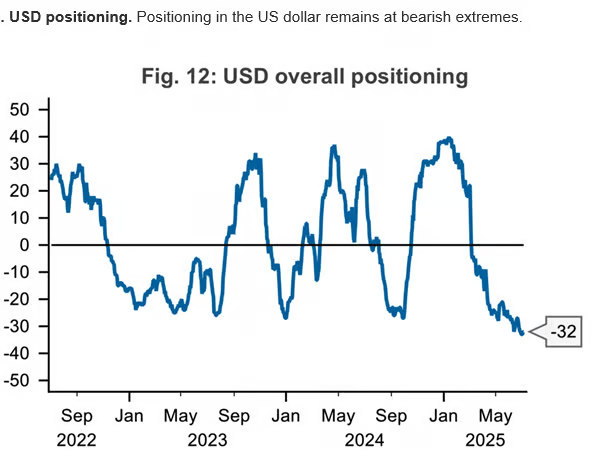

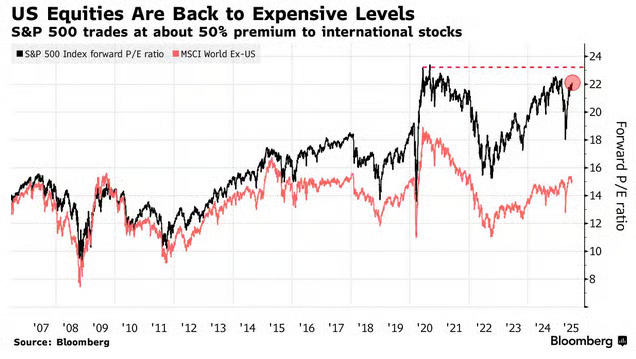

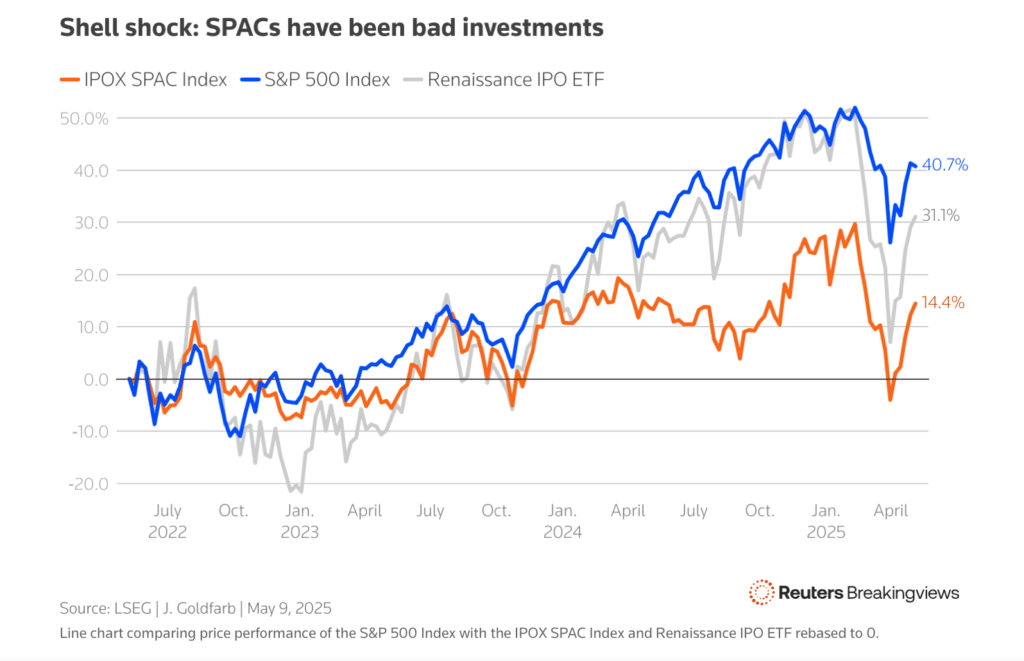

DB noted, the buyer strike on US assets continues. April TIC data doesn’t disprove de-dollarization―foreigners don’t need to sell US assets to weaken the dollar, only to stop buying. High-frequency flow data and ETF/EPFR databases show almost no foreign buying of US bonds or equities in recent months. Domestic investors may be driving the rally, but foreigners remain on the sidelines.

Zachary Goldberg Jefferies

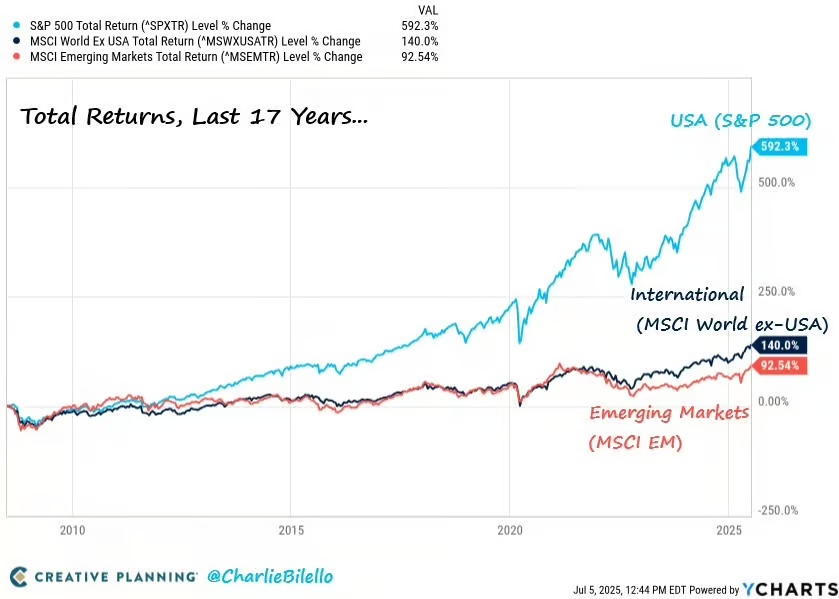

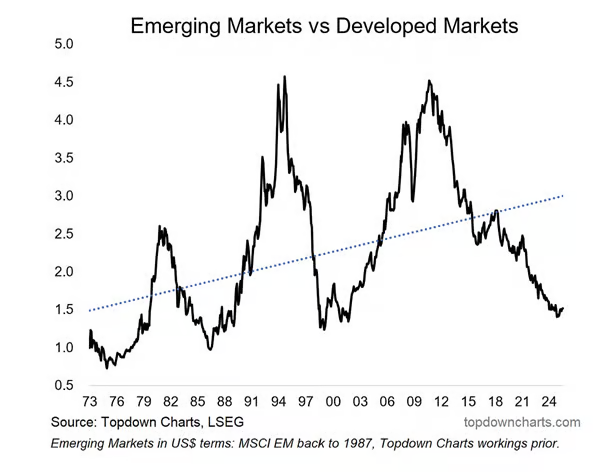

5. We Know U.S. Stocks Have Record Spread vs. Emerging Markets…But Developed International vs. Emerging Close to Record Spread As Well

Topdown Charts

6. Growth Stocks Back in Lead….Berkshire Breaks 200day to Downside

StockCharts

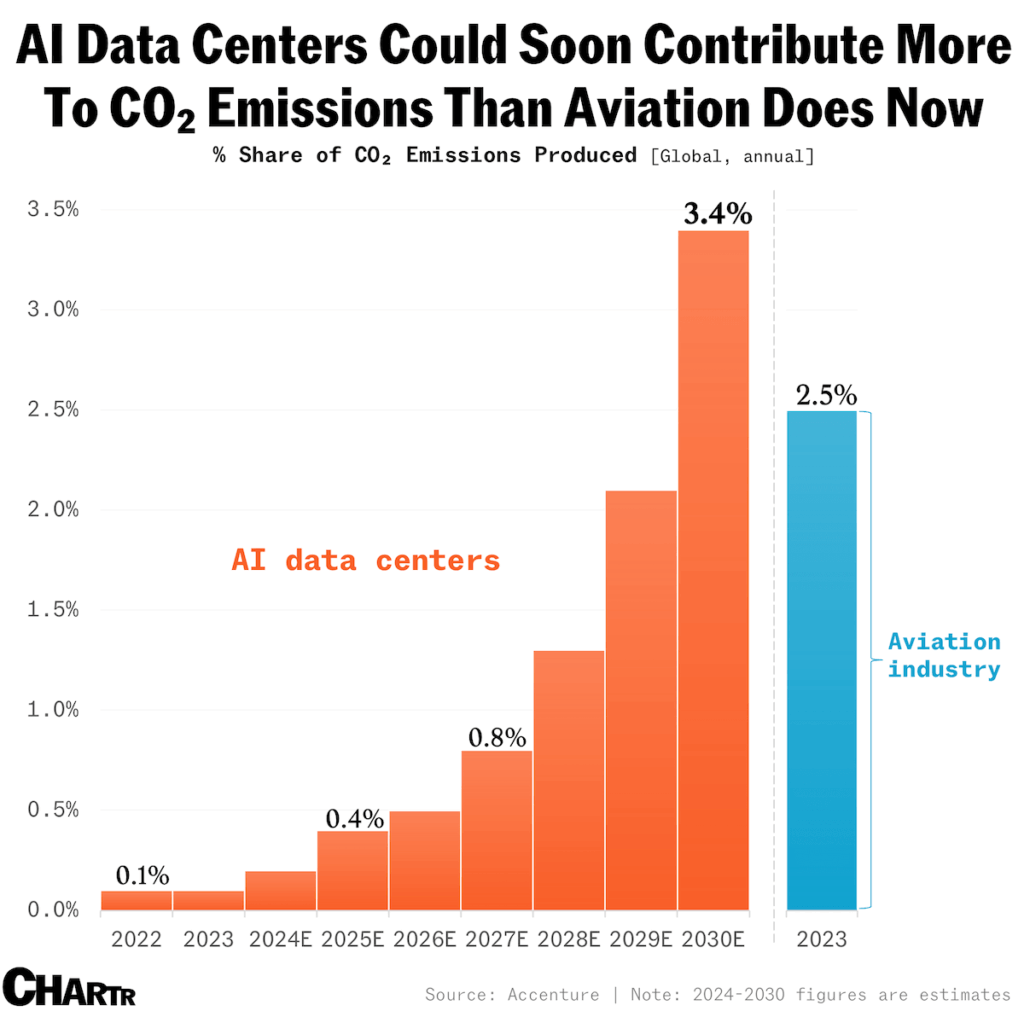

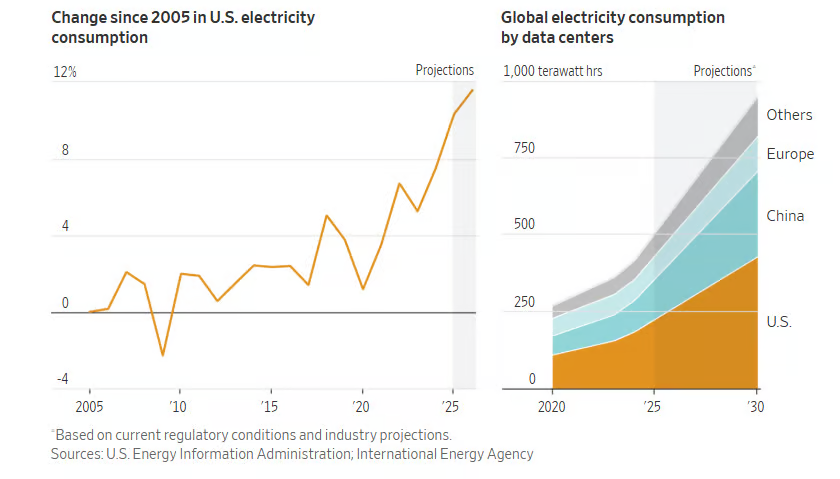

7. Five-Year Jump in U.S. Electricity Consumption

WSJ

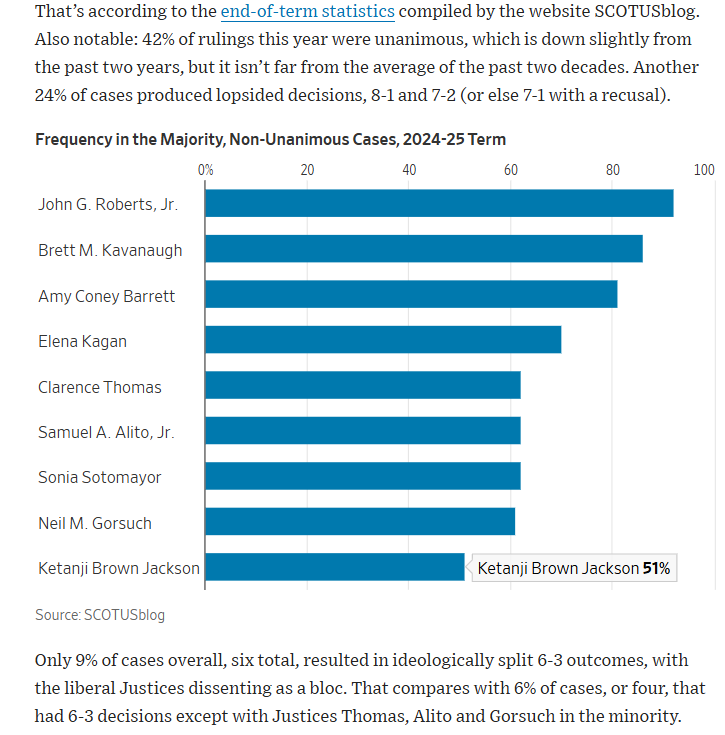

8. Supreme Court-Last 2 Years…42% of Rulings Unanimous and only 9% of Cases were Ideological 6-3 Split

WSJ

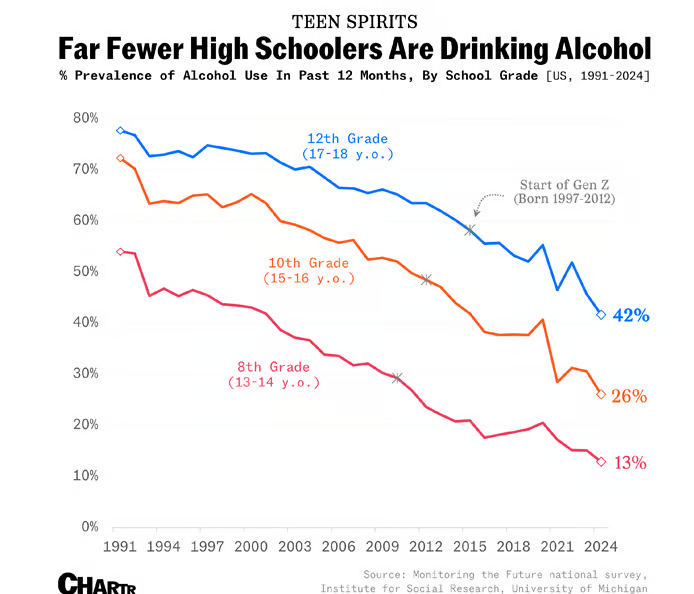

9. Far Fewer Teens are Drinking Alcohol

Sherwood

10. Myths and Facts About Dopamine

Psychology Today: Here’s Lerner, in her own words, on various myths about dopamine.

5 Myths About Dopamine

Myth #1: Dopamine equals pleasure.

False. While dopamine is often released when something pleasurable happens, its biggest role is in reinforcement learning—helping us learn from behaviors or cues that predict outcomes. Pleasure is not a necessary feature of this learning process.

Myth #2: More dopamine, more happiness.

False. Since low levels of dopamine are associated with depression, people might conclude that higher dopamine levels will lead to happiness. And dopamine does play a role in motivation, which could be related to happiness.

But there’s a difference between the motivation to pursue a reward and the actual happiness you derive from receiving the reward. Dopamine is about the motivation to pursue rewards. It’s not the happiness of it—it’s the willingness and the drive to engage in things that might bring that feeling.

Myth #3: Scrolling is rewarding because it produces dopamine.

Not exactly. Dopamine does different things across different brain circuits. When scrolling for the next interesting post or the next “like,” dopamine helps detect reward prediction errors—the moments when something unexpectedly good could happen.

Social media acts like a slot machine, where uncertainty and surprise engage the dopamine system. Because dopamine reinforces behavior, you want to do it again. You think that your scrolling caused the unexpected reward, which motivates you to re-engage in that behavior.

Dopamine is about that surprise and motivation, especially from behaviors that involve uncertainty about what reward you’ll find. We obviously feel the burst of pleasure, but other neurotransmitters (serotonin and norepinephrine) are also responsible for it.

Myth #4: A dopamine detox can be beneficial.

It’s complicated. “Dopamine detox” refers to the idea that temporarily refraining from daily pleasures can reset the brain’s reward sensitivity, reduce our dependence on instant gratification, and ultimately, help us lead happier lives.

In a way, it’s a strategy for managing hedonic adaptation—our tendency to get used to things over time. Repeating the same behaviors can lose their novelty and excitement. If I eat ice cream every day, I might feel more upset if I don’t get it than truly happy when I do. But if I only rarely eat ice cream, it will feel like a special treat, and I’ll be genuinely excited to get it. Refraining from routine pleasures can help us appreciate them.

The myth comes from blaming all of this on dopamine—it’s misleading from a neuroscientific perspective. A more accurate term could be “pleasure detox.” In addition, “dopamine detox” makes it sound like we want to make dopamine go away, which is nonsense.

Myth #5: We can hack the dopamine system.

True. By understanding how dopamine shapes learning and behavior, we could design strategies to train both good and bad habits.

For example, slot machines aren’t inherently interesting; you’re just pulling a lever over and over again. But with just the right level of unpredictability, lights and sounds, and the occasional rewards of winning, slot machines are engineered to keep you engaged.

Similarly, to sustain motivation when developing new habits, try incorporating elements of surprise and novelty. Instead of forcing yourself to do something, keep it engaging enough to want to repeat it. Even when doing the same routine, like going on a daily walk, pay attention to the little surprises. Whether it’s the weather, your mood, or the sounds, there’s always something new to notice. As the Greek philosopher Heraclitus said 2,000 years ago, “You cannot step into the same river twice.” It’s all about how we engage with our experiences.

10 Facts About Dopamine

- Dopamine is ancient. Its function as a neurotransmitter has been conserved through evolution across various species, from worms to humans.

- Compared to the overall size of the human brain, the number of dopamine neurons is relatively small (only about 400,000 to 600,000 out of around 86 billion).

- Dopamine neurons are among the largest and most connected cells in the brain. They are mostly located in the midbrain—the ventral tegmental area and the substantia nigra. In rats, a single dopamine neuron can send out electrical signal branches (axonal arborizations) that are 1 meter in length and form 30 thousand synapses. In humans, this number can reach hundreds of thousands.

- Listening to music can activate the brain’s dopaminergic reward system. Expectation and anticipation are key to the pleasure we experience from music.

- Dysfunctions in dopamine transmission are a feature of various mental, psychiatric, and neurological disorders, including depression, Parkinson’s, ADHD, and substance use disorders.

- Many medications work by altering or stimulating dopamine receptor activity, its synthesis, and reuptake.

- Dopamine rarely acts alone. Whenever dopamine is released into the brain, other neurotransmitters, like glutamate and GABA, are likely being co-released by dopamine neurons. This concept is referred to as dopamine’s “multilingual” nature.

- Dopamine transmission can occur at different speeds. Fast transmission happens when dopamine neurons fire in bursts. Dopamine neurons also fire steadily, like a clock. This tonic firing maintains a baseline level of dopamine on top of which bursts can be layered in response to important or unexpected events, explains Lerner.

- Dopamine levels follow a circadian rhythm—we have higher dopamine levels when we are awake, and lower during sleep.

- Both the amount of dopamine present and its timing are important for when brain plasticity can occur and learning can take place. “Dopamine acts as a dynamic signal to time brain plasticity,” says Lerner.

Dopamine and the Good Life

Dopamine, undoubtedly, plays a central role in a good life. But perhaps not merely in ways we imagine. “Dopamine isn’t good or bad,” notes Lerner. “It trains you to do what you’re trying to do.”

Let’s say you are trying to infuse your days with joy and meaning, connection and purpose. By paying attention to the small pleasures and the unexpected rewards on our journeys, dopamine supports us throughout the pursuit of our goals, not just at the bright lights of the finish line. It’s what makes a lifelong adventure of learning and discovery possible.