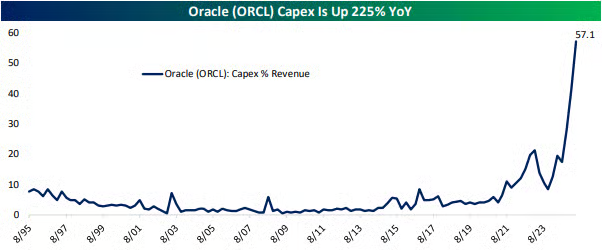

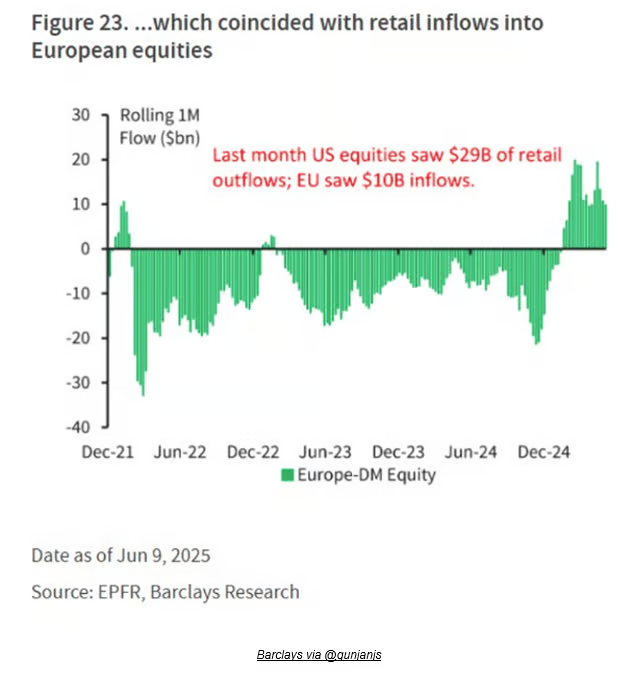

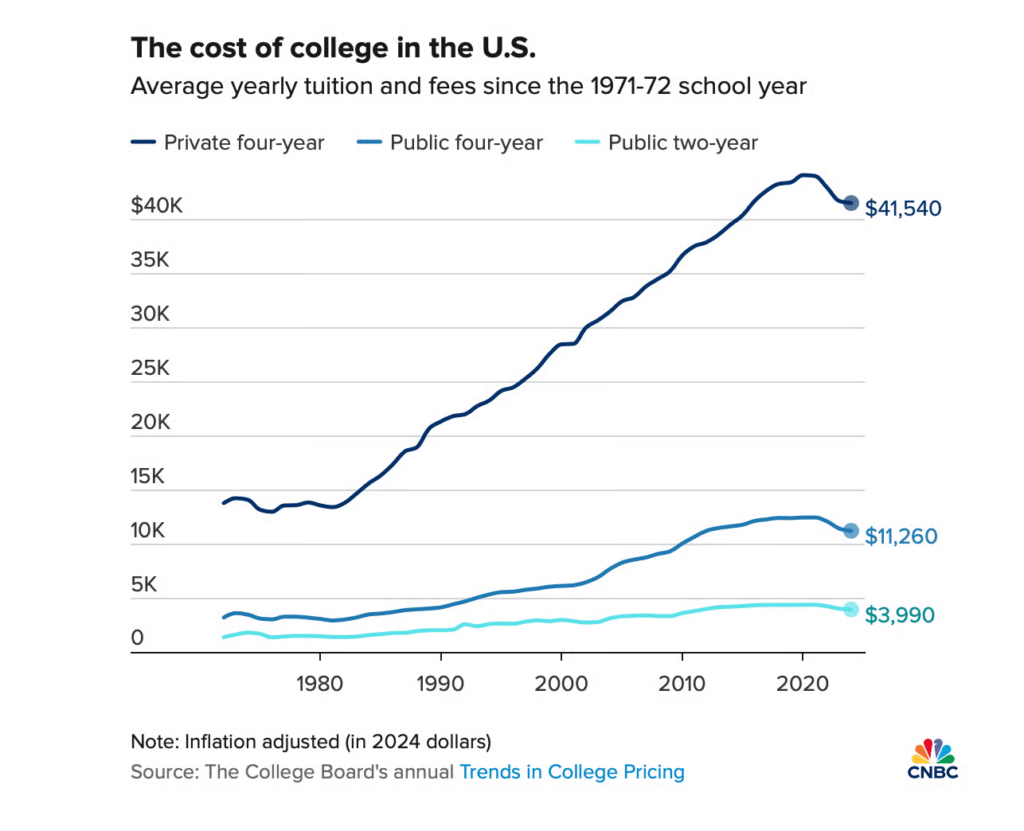

1. International Equities Outperforming for 3 Years

Ben Carlson Blog–We’re now looking at nearly three years of outperformance for international equities. It feels like this is a recent phenomenon but Jeffrey Kleintop has a chart that shows foreign stocks have been outperforming for longer than you think. This chart shows European stocks versus U.S. stocks going back to the bottom of the 2022 bear market:

A Wealth of Common Sense

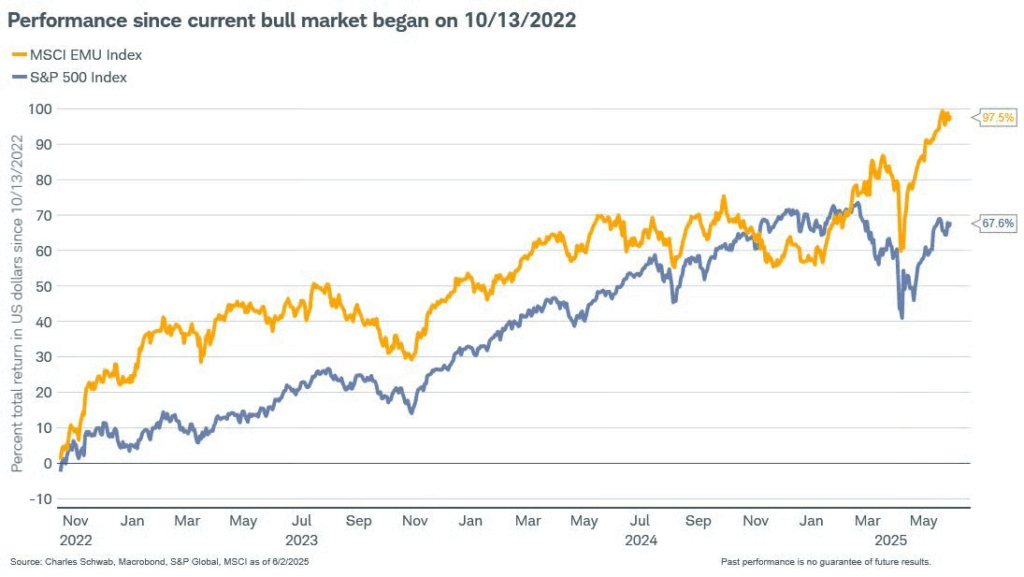

2. Oil Traders More Cautious than Previous Attacks

Bloomberg

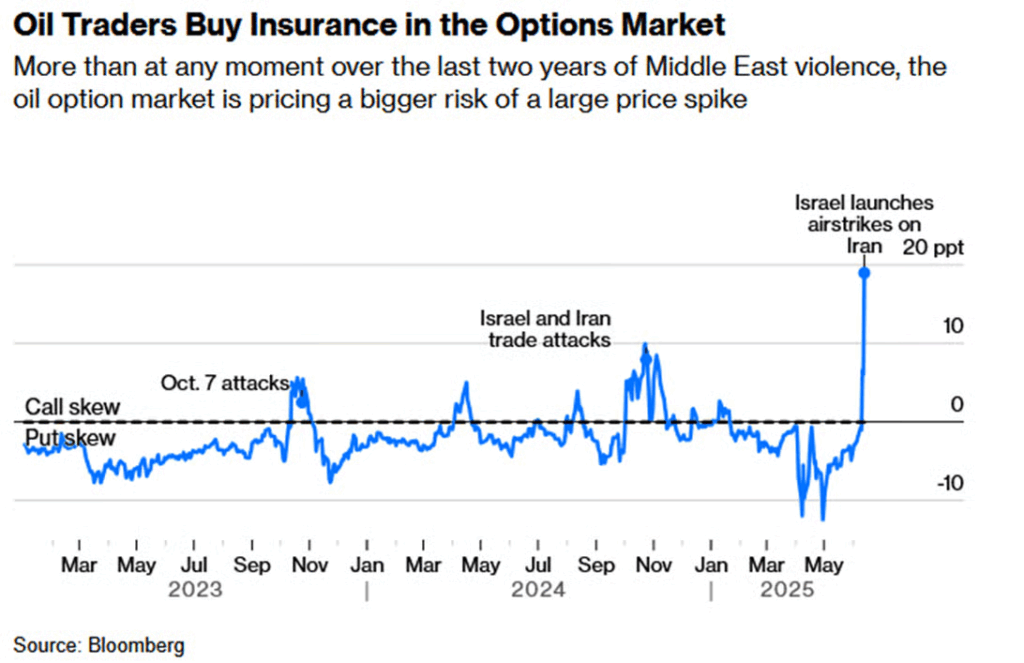

3. Summary of Fast Track Nuclear

Image Source: Duke Energy; Leadlag Report

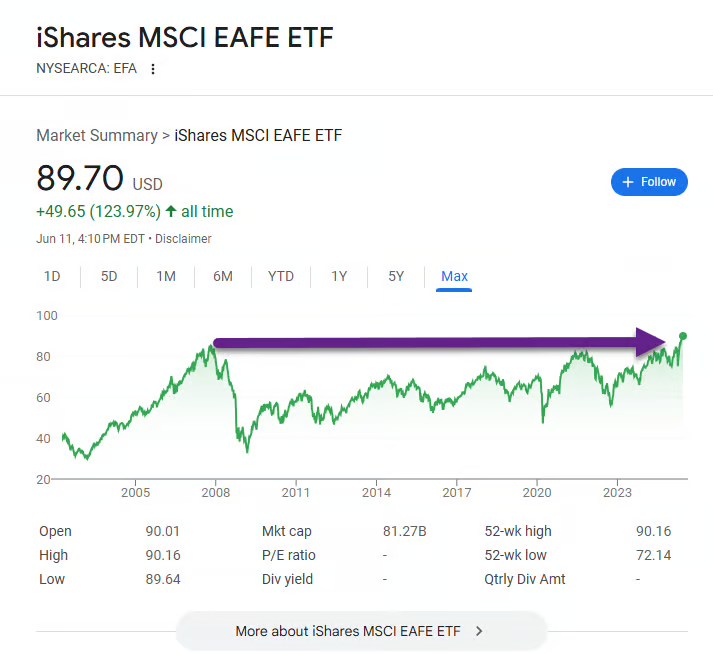

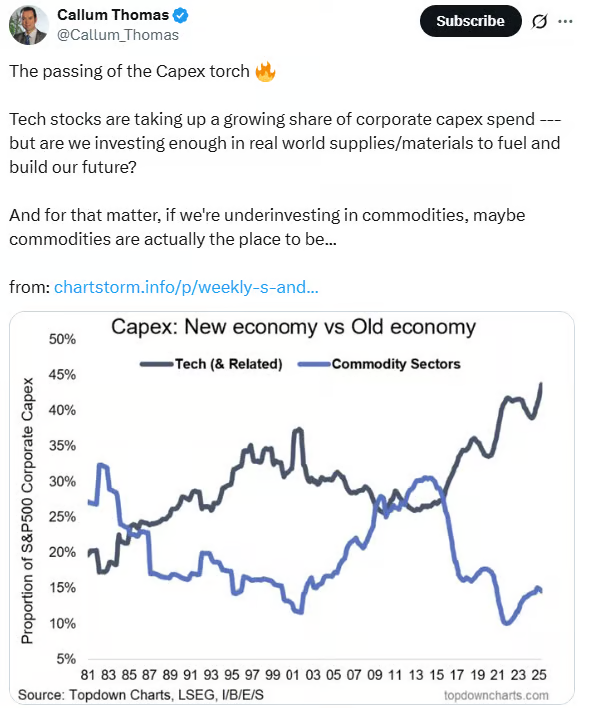

4. Massive Capital Spending on Commodities by Tech Companies

Callum Thomas

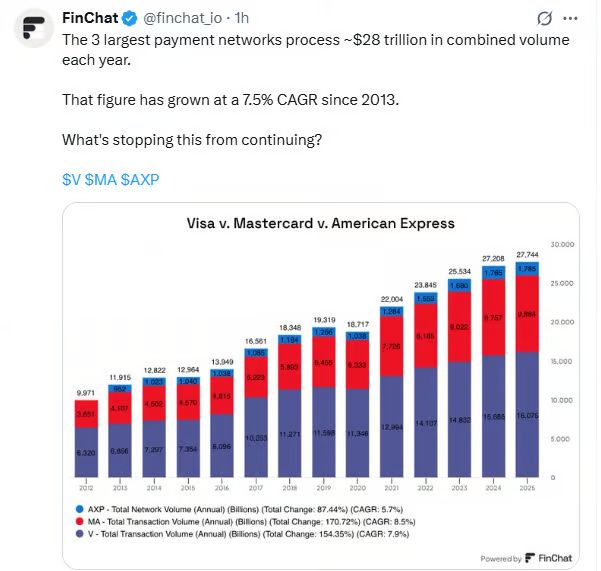

5. Visa, Mastercard and AMEX Process $28 Trillion Each Year

FinChart

6. Intel 25-Year Returns

Barchart

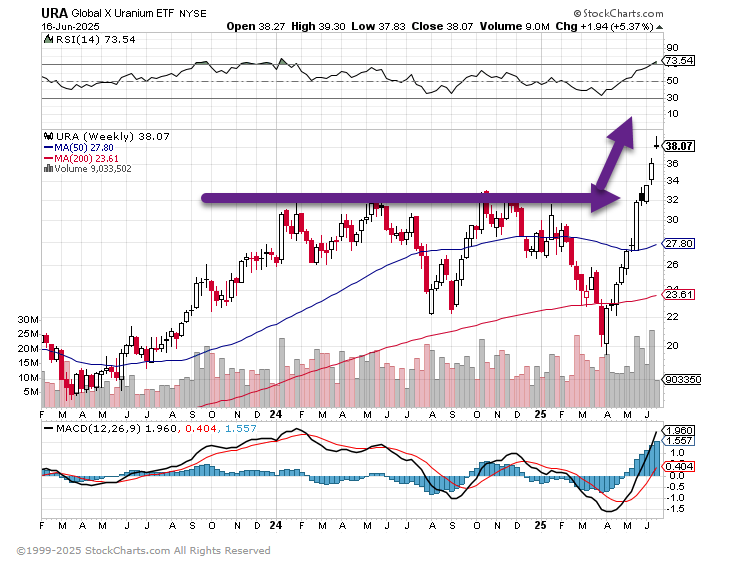

7. Uranium ETF Clean Breakout

StockCharts

8. Mayo Clinic Hiring More Radiologist Post AI

Your A.I. Radiologist Will Not Be With You Soon

Experts predicted that artificial intelligence would steal radiology jobs. But at the Mayo Clinic, the technology has been more friend than foe.

Via the NYT: Dr. Theodora Potretzke, a radiologist at the Mayo Clinic, helped develop an A.I. tool that saves her 15 to 30 minutes each time she examines a kidney image.

Credit…Jenn Ackerman for The New York Times

Nine years ago, one of the world’s leading artificial intelligence scientists singled out an endangered occupational species.

“People should stop training radiologists now,” Geoffrey Hinton said, adding that it was “just completely obvious” that within five years A.I. would outperform humans in that field.

Today, radiologists — the physician specialists in medical imaging who look inside the body to diagnose and treat disease — are still in high demand. A recent study from the American College of Radiology projected a steadily growing work force through 2055.

Dr. Hinton, who was awarded a Nobel Prize in Physics last year for pioneering research in A.I., was broadly correct that the technology would have a significant impact — just not as a job killer.

That’s true for radiologists at the Mayo Clinic, one of the nation’s premier medical systems, whose main campus is in Rochester, Minn. There, in recent years, they have begun using A.I. to sharpen images, automate routine tasks, identify medical abnormalities and predict disease. A.I. can also serve as “a second set of eyes.”

“But would it replace radiologists? We didn’t think so,” said Dr. Matthew Callstrom, the Mayo Clinic’s chair of radiology, recalling the 2016 prediction. “We knew how hard it is and all that is involved.”

Computer scientists, labor experts and policymakers have long debated how A.I. will ultimately play out in the work force. Will it be a clever helper, enhancing human performance, or a robotic surrogate, displacing millions of workers?

The debate has intensified as the leading-edge technology behind chatbots appears to be improving faster than anticipated. Leaders at OpenAI, Anthropic and other companies in Silicon Valley now predict that A.I. will eclipse humans in most cognitive tasks within a few years. But many researchers foresee a more gradual transformation in line with seismic inventions of the past, like electricity or the internet.

The predicted extinction of radiologists provides a telling case study. So far, A.I. is proving to be a powerful medical tool to increase efficiency and magnify human abilities, rather than take anyone’s job.

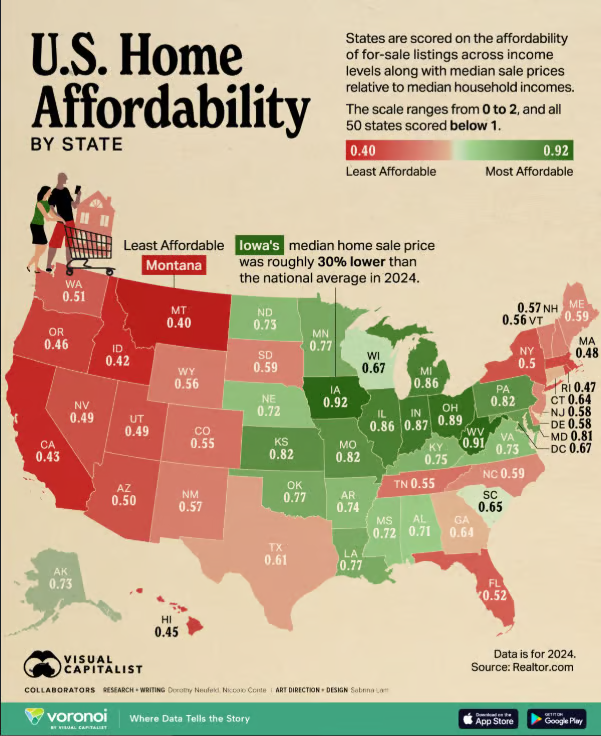

9. U.S. Housing Affordability by State

Visual Capitalist

10. Charlie Munger Notes

Notes from a Charlie Munger interview.

David Senra• 1st Founder at Founders Podcast

1. I can’t think of a single example where keeping it simple has worked against us.

2. When people use the word common sense what they mean is uncommon sense. The standard human condition is ignorance and stupidity.

3. Q: Why is it that people can’t think clearly about investing or other decisions in their life?

A: They don’t think very well about sex or gambling either. The standard human condition is a lot of miscognition. You can improve your life by eliminating your miscognitions.

4. The economy sometimes booms and sometimes it doesn’t. You have to live through both episodes. Our attitude is we just keep swimming.

5. If you live long enough a lot of good things happen and a lot of bad things happen.

6. I would say that the chief advantage Berkshire has had in accumulating a good record is that we have avoided pompous, bureaucratic systems. We give power to very talented people and let them make very quick decisions.

7. In big bureaucracies they think the work is done when you get the work out of your inbox and into someone else’s. That is not getting it done. If everybody is in a big committee meeting all the time you are worn out at the end for the day and you haven’t done anything.

8. If we find things that are intelligent to do we do it. If we can’t find anything we let the cash build up. What the hell is wrong with that?

9. I’m ashamed of missing Google. We could have seen it if we looked at our own companies. Their [Google’s] advertising was working way better than other advertising. We weren’t paying enough attention.

10. I’m a huge admirer of Jeff Bezos. He is a perfectly amazing human leader.

11. Q: What do you think of those tech unicorns going public and not having any profitability?

A: There are a whole lot of things I don’t think about. And one of them is companies that are losing billions of dollars a year and going public. It is not my scene.

12. I think the shareholder meetings work best because they are spontaneous. If we were scripting things I don’t think people would like it.

13. I think my way of thinking will work for anyone. I’m trying to be very rational and disciplined. I’m always being visited by young men who say things like I’m practicing law and I don’t like it. I’d rather be a billionaire, how do I do it? I tell them a story about Mozart. One man came to Mozart and asked him how to write a symphony. Mozart replied, “You are too young to write a symphony.” The man said, “You were writing symphonies when you were 10 years of age, and I am 21.” Mozart said, “Yes, but I didn’t run around asking people how to do it.”