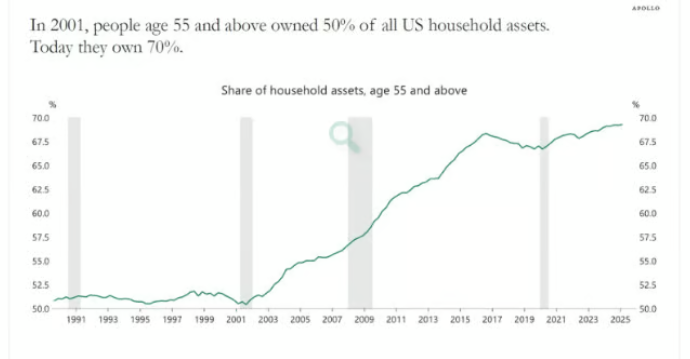

1. Corporate Buybacks Reach Record in July

Bloomberg

2. AMD Did Not Make New Highs in this Rally Before Earnings Yesterday

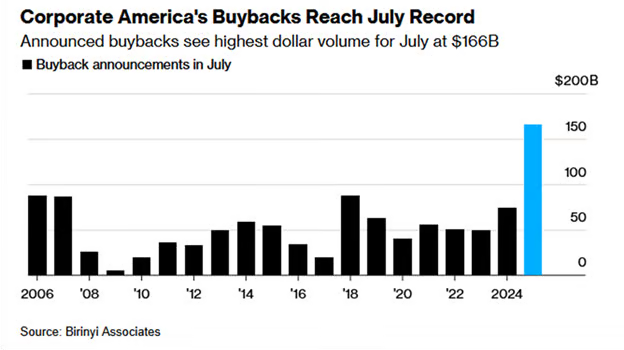

StockCharts

3. SMCI -25% One-Year Chart

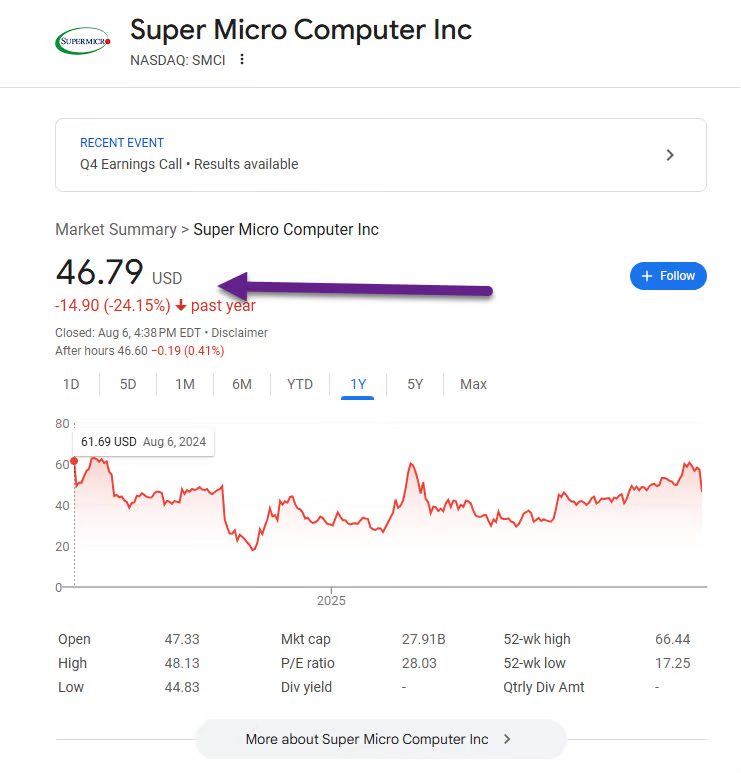

4. Number of Active ETF Launches Skyrockets…Active Management Moving Fully to ETF Model

Russell Investments

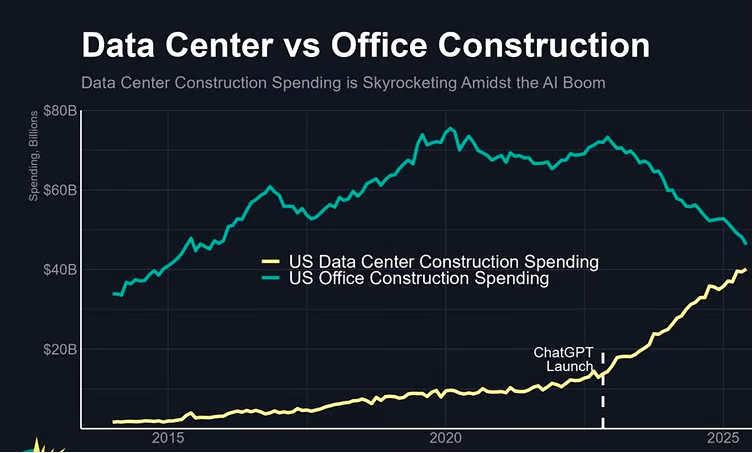

5. Data Centers vs. Office Construction

…Data center construction spending in the US has more than doubled since ChatGPT’s launch. Source: Exponential View

Zach Goldberg Jefferies

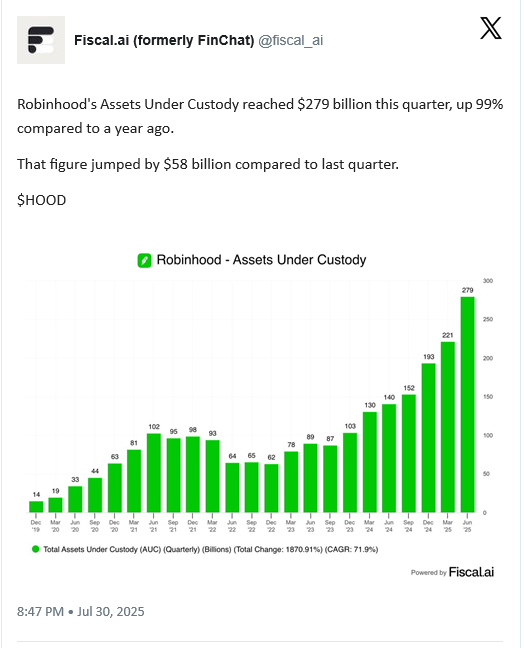

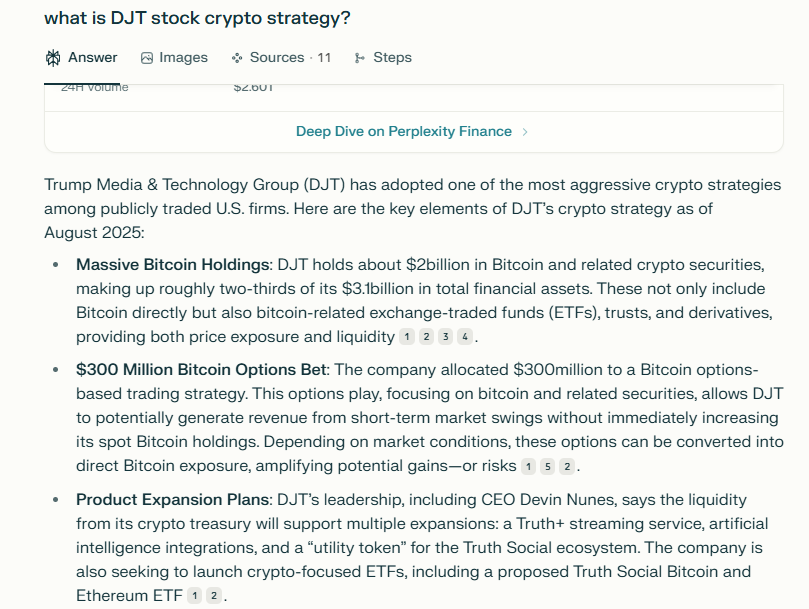

6. 70+ Crypto ETFs Wait SEC Approval

Perplexity

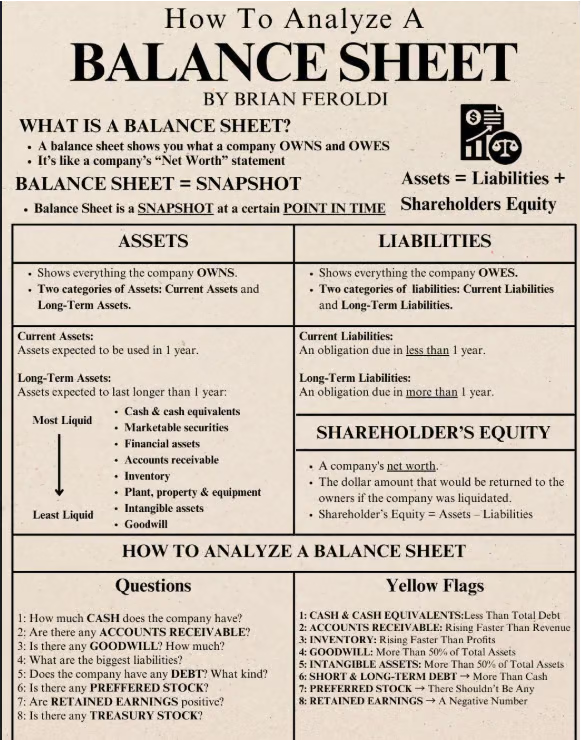

7. How to Analyze a Balance Sheet

Brian Feroldi

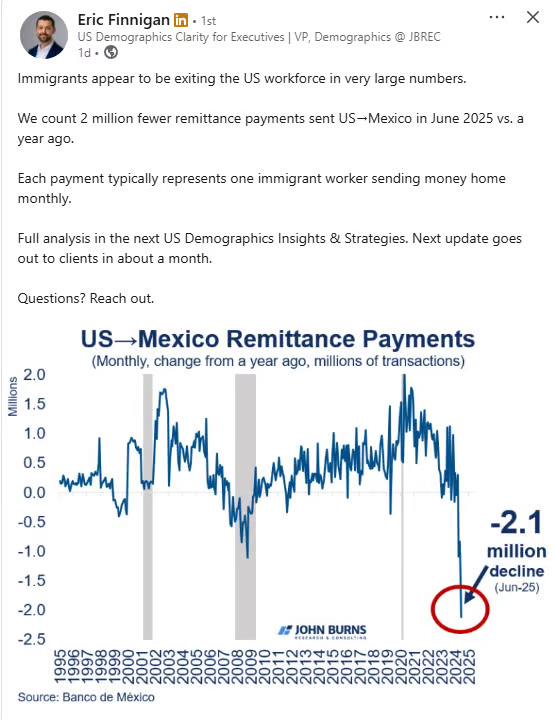

8. Reduction in Mexican Remittance Payments from U.S.

Eric Finnegan

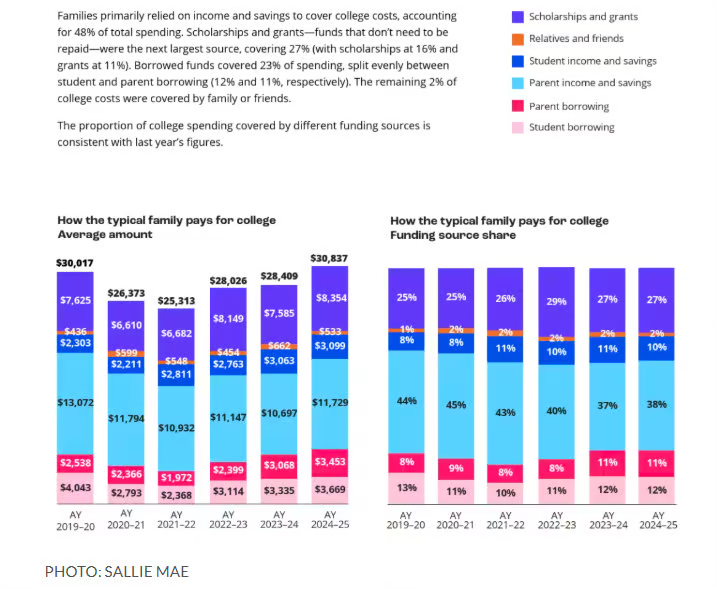

9. How Families Pay for College

Market Watch

10. Born Smart or Built Smart? The Truth About Intelligence and Effort

The Habits that Actually Help Make You Smarter-T. Alexander Puutio Ph.D.

Remember, whether any of the habits below nudge Spearman’s g one inch up or down is beside the point. What matters is that research has shown that they measurably improve performance. And if you’re serious about performing better, you need to get just as serious about the habits that drive it.

First, we know that learning isn’t a brute-force effort. It works best when we interleave what we’re learning, mixing subjects and testing ourselves regularly. It’s more effortful, yes, but much like lifting weights, that struggle is what makes the brain grow.

And sorry, podcast junkies—recent research by Hui and Godfroid showed that reading beats listening for retention, which isn’t all that surprising if you’ve followed the breadcrumbs of how ease in the process of learning often means a deficit in the results.

We also know that chunking helps us remember more, and that the memory palace method can turn almost anyone into a Roman orator, delivering entire speeches without a papyrus in sight. If these feats aren’t effective IQ in action, I don’t know what is.

To really hit home the brain-body duality, we also know that movement sharpens our cognition. Kim and colleagues weren’t exactly burying the lede in their 2011 article “Exercise training increases size of hippocampus and improves memory,” and numerous studies after theirs have shown how aerobic activity can improve executive function. In fact, in older adults, regular mobility is directly linked to better cognitive performance and lower risk of dementia.

If you’re surprised, remember that our brains didn’t evolve to operate in stillness. They evolved to think in motion, walking, navigating, reacting to the world around them. In fact, one of the most overlooked habits for improving cognitive performance is giving your brain the kind of environment it evolved for.

We didn’t get smart by sitting still or memorizing lists. We got smart by exploring the world, spotting patterns, making predictions, and adjusting course when we were wrong. That’s how our neural architecture was built by nature, through movement, curiosity, and conversation.

It’s no wonder then that brains perform better when they’re engaged in real-time experiential learning, in the company of others. People who stay mentally sharp into old age aren’t the ones who passively consume what they’re given; they’re the ones still asking questions about the world, expecting each answer to only beget another question.

What Really Matters About Intelligence

The truth about IQ is that the figure you got from WAIS or Stanford-Binet doesn’t define you, and it never did. What matters is how well you drive the mind you’ve got, and how seriously you take the road ahead.

So, if you want to maintain your edge, seek out novelty. Debate your ideas. Explain something out loud. Step into unfamiliar territory—and remember to sleep well before you do. The brain rewards exploration and punishes stagnation.

And above all, remember that your effective intelligence isn’t fixed. It’s as responsive and powerful when correctly tuned as it is fragile if neglected.

As with most things in life, you’re bound to fall to the level of your habits. And the truth about IQ is that we have much more agency over how it manifests in our lives than most ever dare to imagine.