1. U.S. ETFs Attracted $1.4 Trillion in 2025…..1000 New Products Entered the Market

ETF stats. “US-listed ETFs have attracted a staggering $1.4 trillion in 2025, shattering the annual flow record set just last year. At the same time, more than 1,000 new products have entered the market — another unprecedented sum. Trading volume in the ETF market also hit a new yearly high. The last time all three measures hit a record in a single year was in 2021.”

Katie Greifeld – Bloomberg

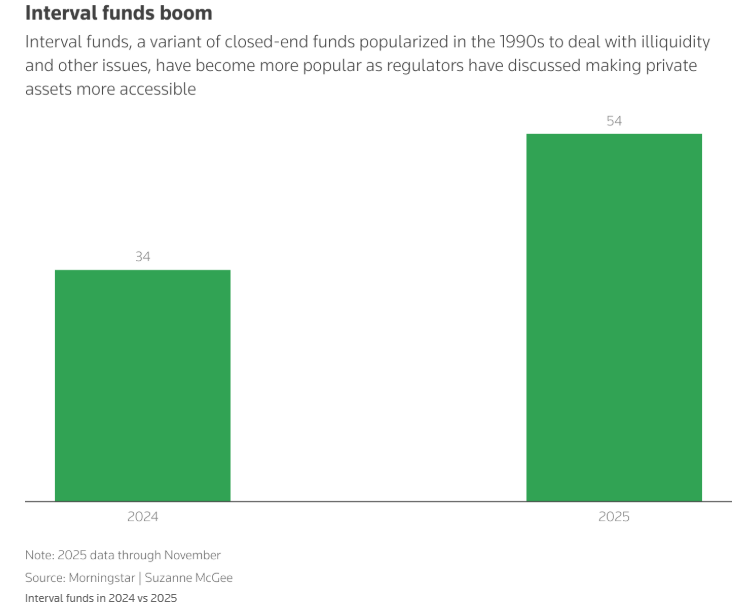

2. Interval Funds Doubled the Number of Launches

Reuters

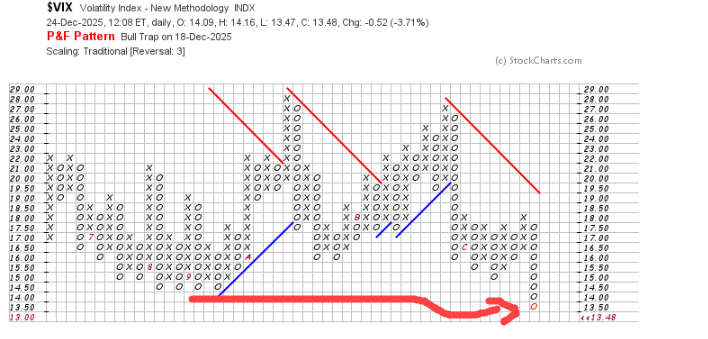

3. VIX Volatility Index Broke to New Lows this Week

StockCharts

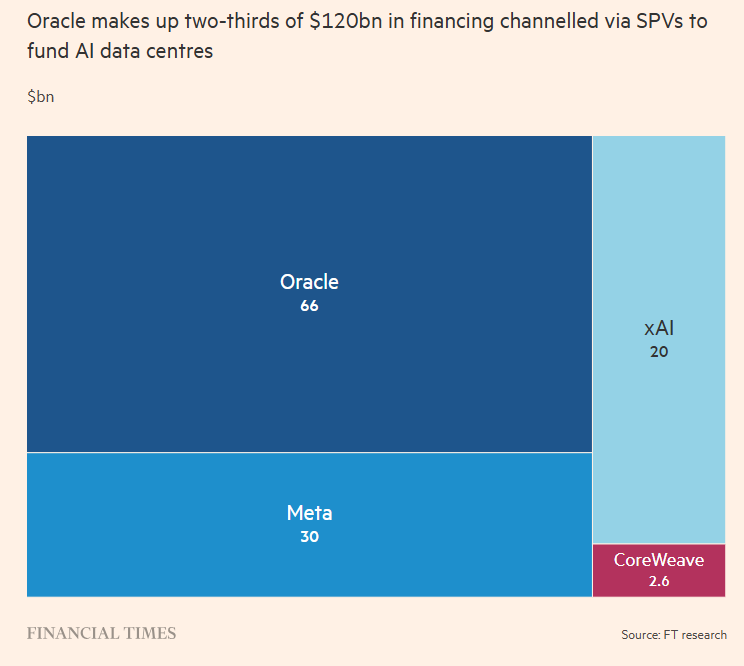

4. Tech Companies Moved $120B of Data Center Spending Off their Balance Sheets

FT-Tech companies have moved more than $120bn of data centre spending off their balance sheets using special purpose vehicles funded by Wall Street investors, adding to concerns about the financial risks of their huge bet on artificial intelligence. Meta, Elon Musk’s xAI, Oracle and data centre operator CoreWeave have led the way on complex financing deals to shield their companies from the large borrowing needed to build AI data centres.

Financial Times

5. Bitcoin Mining ETF WGMI +71% 2025

Bitcoin Miners Thrive Off a New Side Hustle: Retooling Their Data Centers for AI

The pivot to AI has lifted a bitcoin-mining ETF by around 90% this year, even as bitcoin itself has slumped.

Google Finance

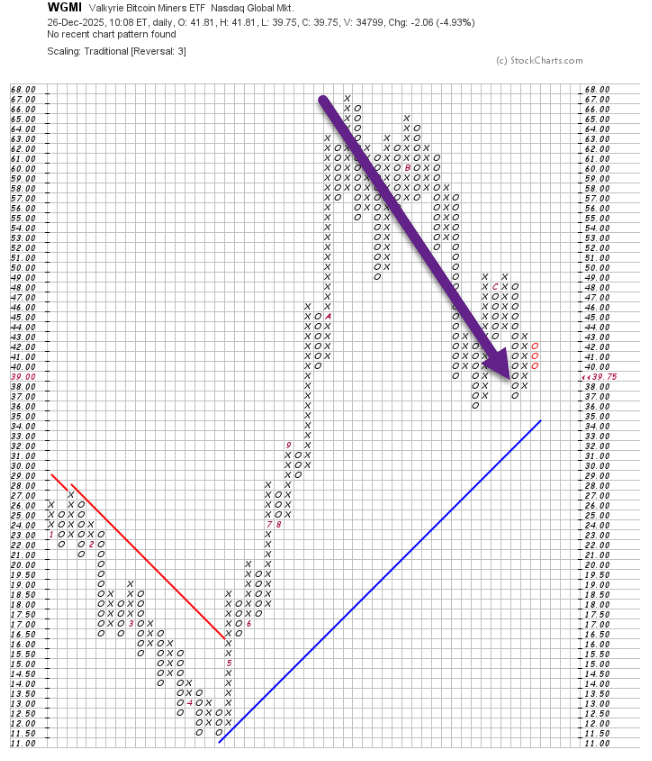

6. WGMI -40% from 2025 Highs

StockCharts

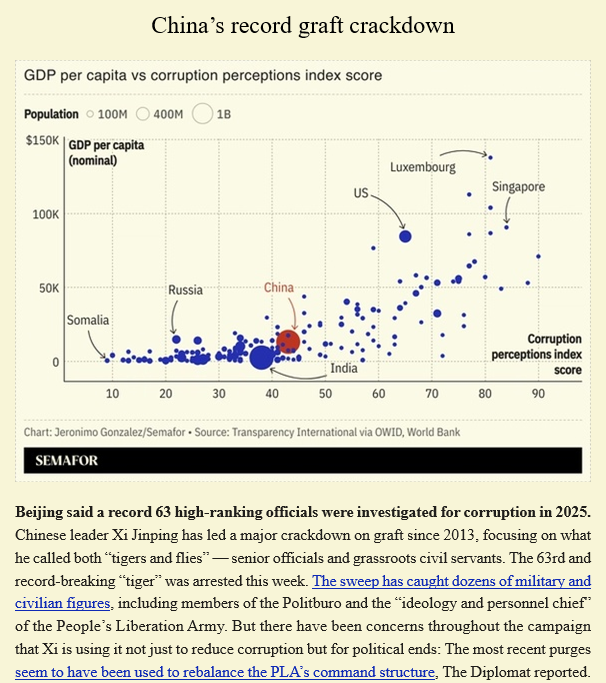

7. China Investigated 63 High-Ranking Party Leaders in 2025

Semafor

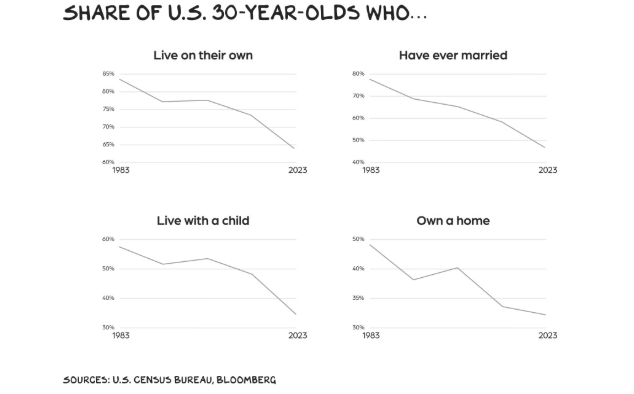

8. Share of U.S. 30-Year Olds Who…Prof G Blog

Prof G Media

9. States Renters vs. Home Owners %

Visual Capitalist

10. Building Health for Future

Mark Hyman