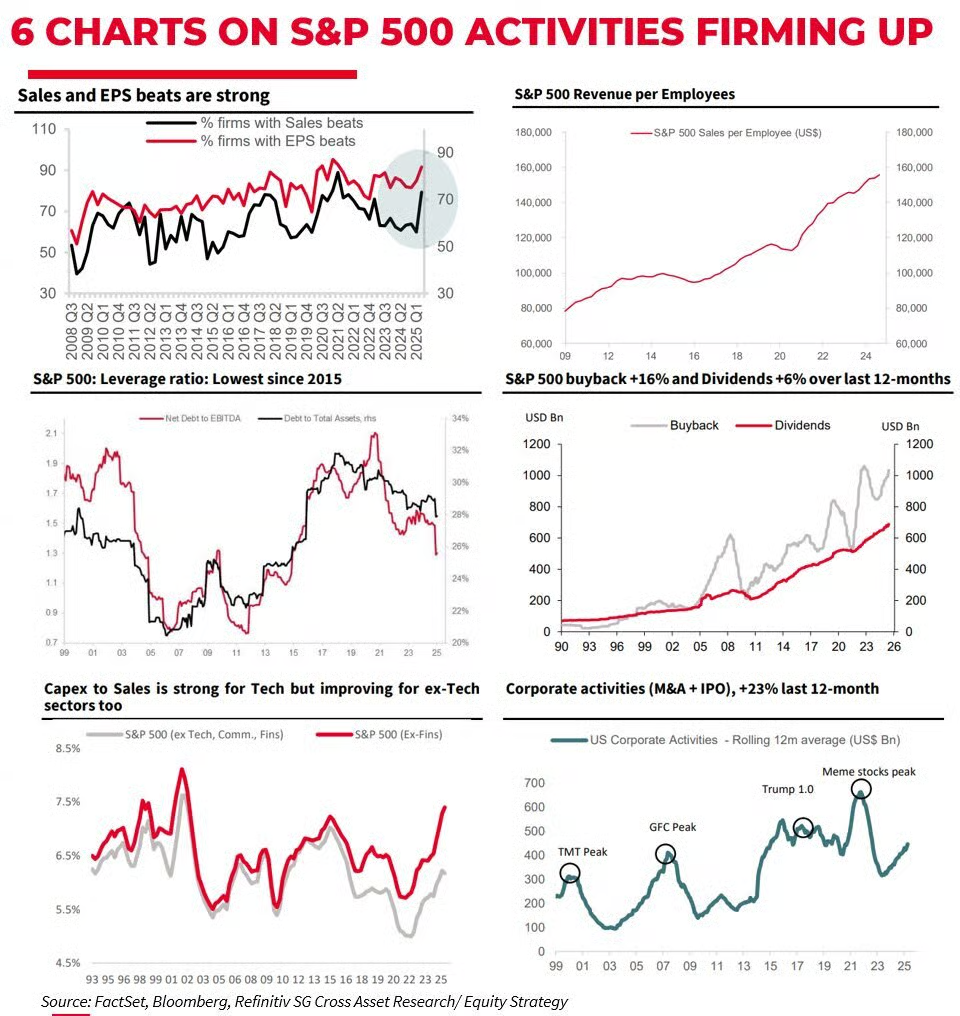

1. S&P Index Charts

Corporate momentum. “Corporate Activities [are] firming up: S&P 500 revenue per employee hits new highs; Capex to sales is rising across sectors and leverage is at its lowest since 2014; Buybacks are up 16%, and dividends up 6% over 12 months; M&A and IPO value up +23% over last 12 months.”

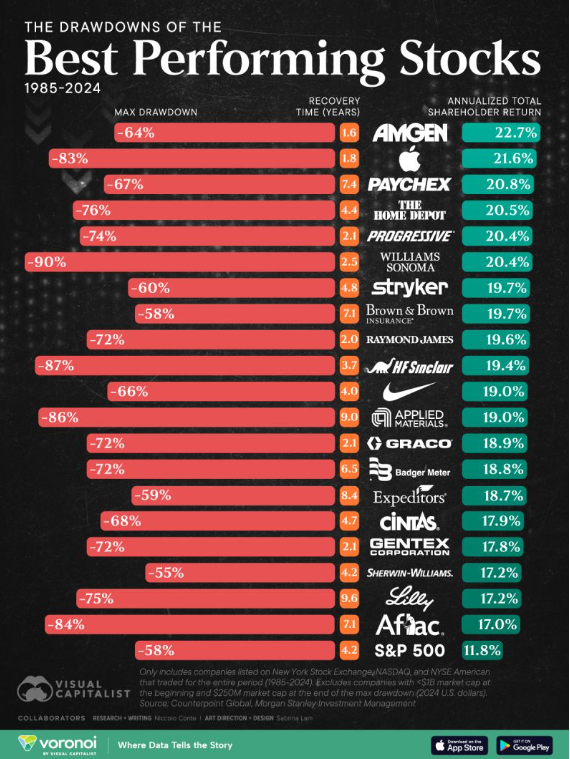

2. Best Performing Stocks Still Have Massive Drawdowns.

https://www.visualcapitalist.com

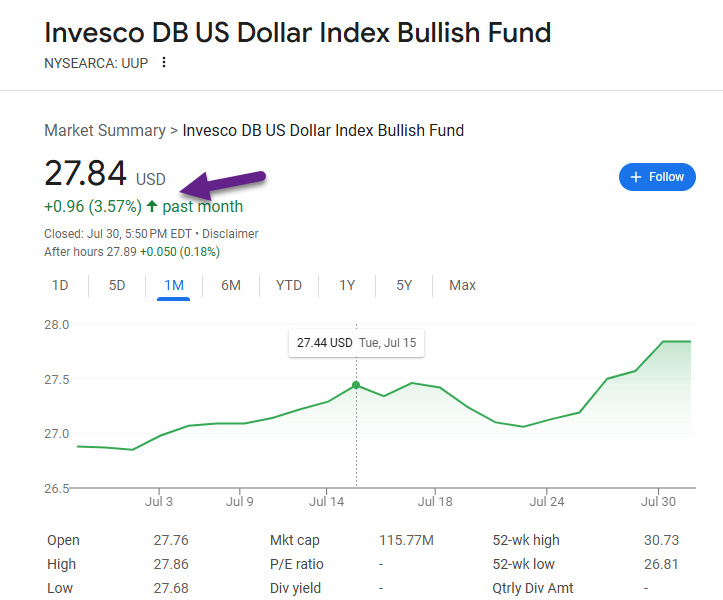

3. Dollar Rallies 3.5% One Month…Sentiment Hit Max Bearishness

4. Copper -18% Yesterday…Closes Below 200-Day

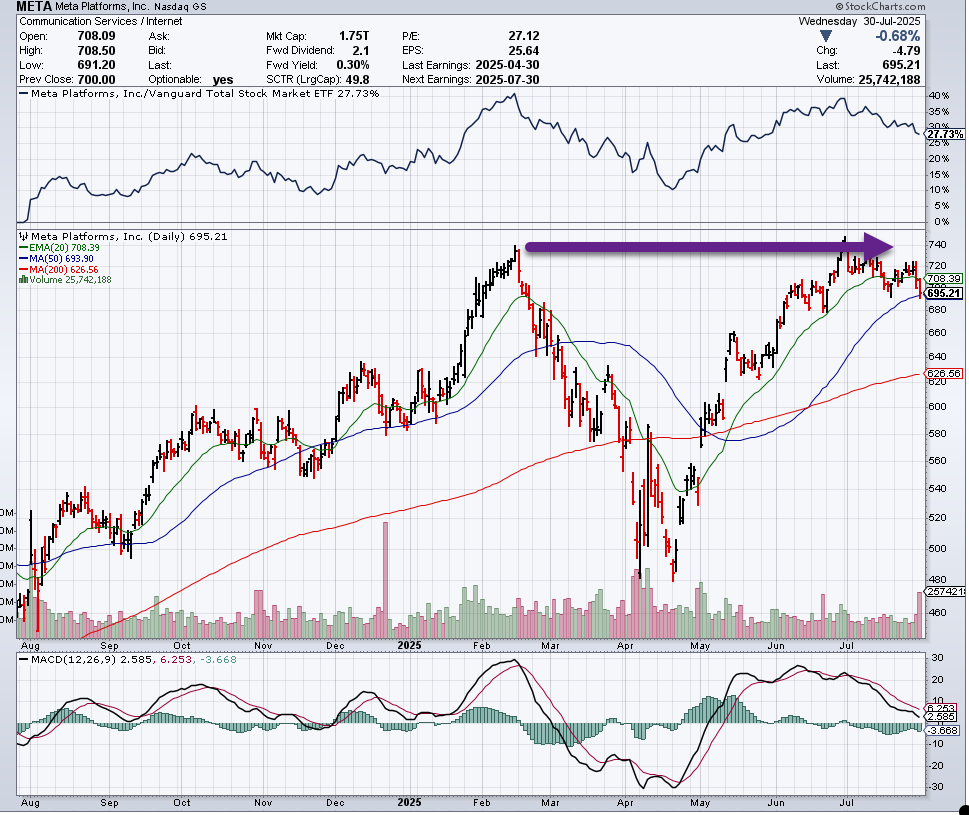

5. META Got Stuck at Previous Highs Going into Last Night’s Number….Blows Thru

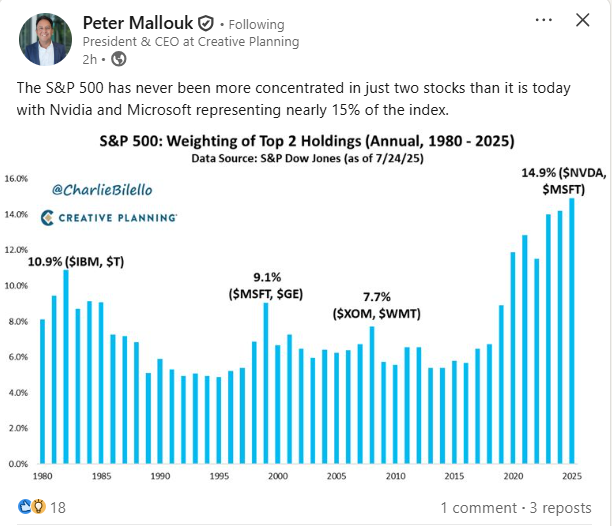

6. MSFT Good Earnings…MSFT/NVDA 15% of S&P

https://www.linkedin.com/in/peter-mallouk

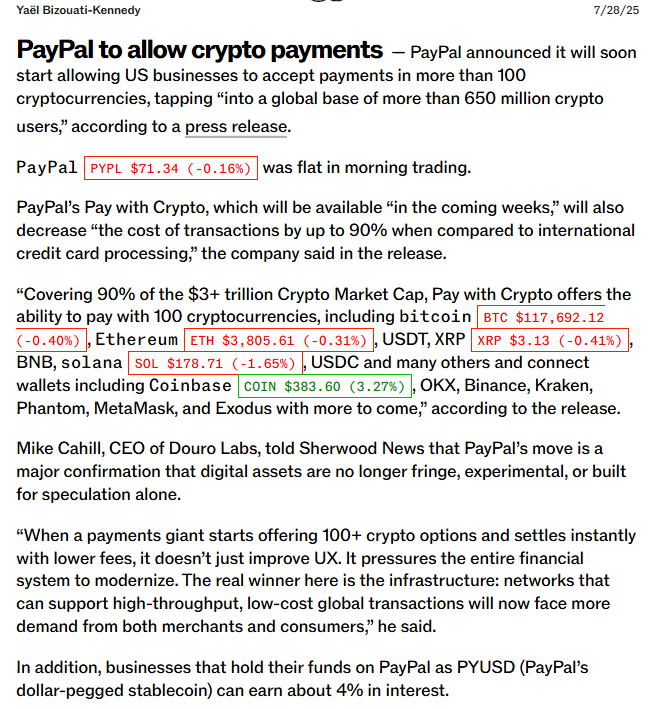

7. PayPal to Allow Payments in 100 Crypto Currencies.

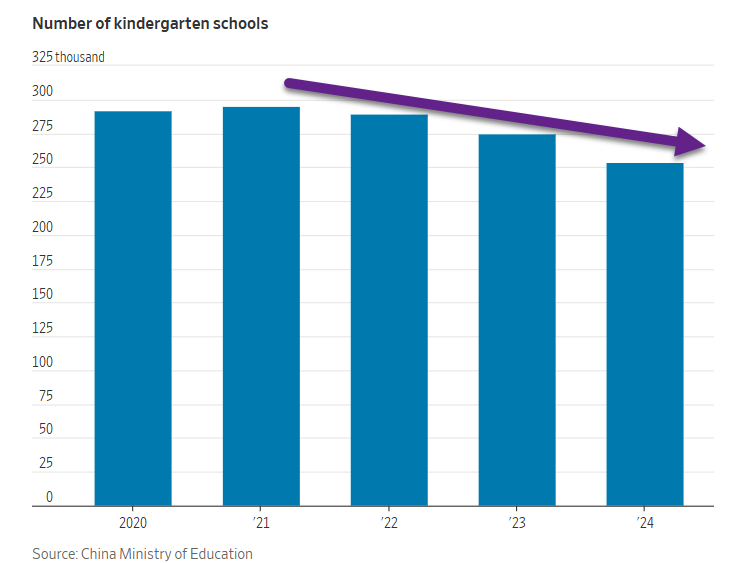

8. Demographics are Destiny—China Closes 20,000 Kindergartens Last Year.

WSJ Kiki Wang, 28, a teacher from Jiangsu, was laid off last month. “It’s not that you are not a good teacher, it’s just we don’t have enough kids,” she recalls her principal telling her. She says she doesn’t know what to do next and is posting on social media for advice. More than 20,000 kindergartens closed last year in China, with nearly 250,000 teachers losing their jobs, government data show. In China, kindergartens are akin to preschools in the U.S., serving children ages 3 to 5.

https://www.wsj.com/world/china/chinas-new-plan-to-encourage-more-births-is-underwhelming-c8d23df4

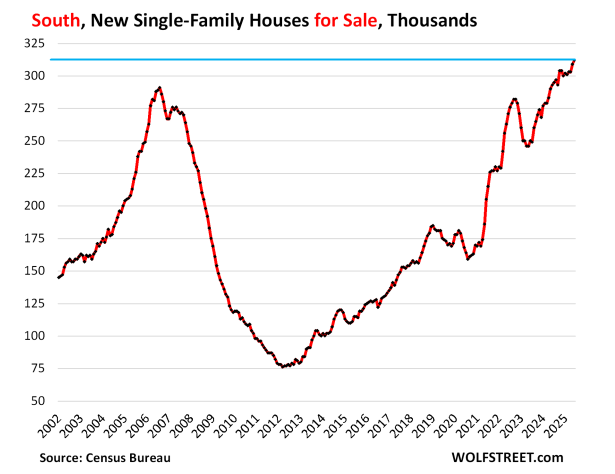

9. Single Family Homes for Sale in South Above 2008 Levels.

In the South, dominated by Texas and Florida, inventories of new houses for sale spiked to a record of 312,000 in June, up by 6.5% from the already above-Housing-Bust-peak level a year ago, and up by 78% from June 2019.

The Census region accounted for 61% of total US new-home inventory, and also for 61% of total US new-home sales (a map of the four Census regions is below the article at the top of the comments).

Sales dropped by 6% year-over-year to 33,000 new homes, and by 15% from June 2019, despite the massive incentives by homebuilders.

10. Housing Market Nobility-Ben Carlson.

Posted July 27, 2025 by Ben Carlson

Right or wrong, our economic system invariably creates haves and have-nots.

It’s a feature not a bug.

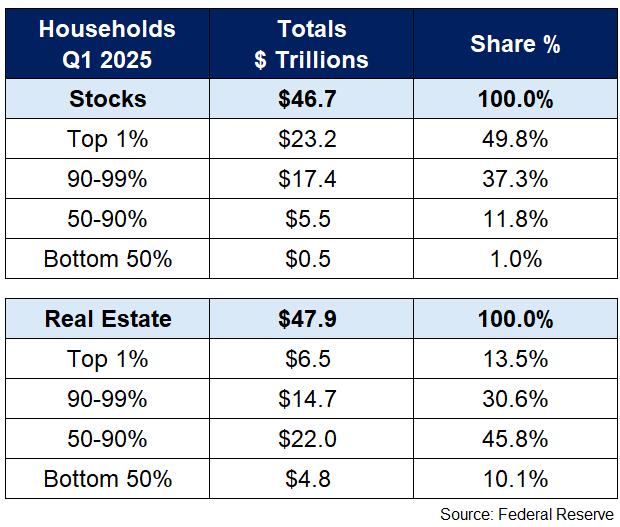

This feature has always been more prevalent in the stock market than the housing market:

The bottom 90% owns just 12.8% of the stock market1 but 56% of the housing market. The top 1% owns 50% of the stock market and less than 14% of the housing market.

The largest financial asset for the majority of middle-class households is their home.

My worry about the current housing situation is that it’s going to make it much harder for people in the middle class to keep up.

This is already starting to show up in the data.

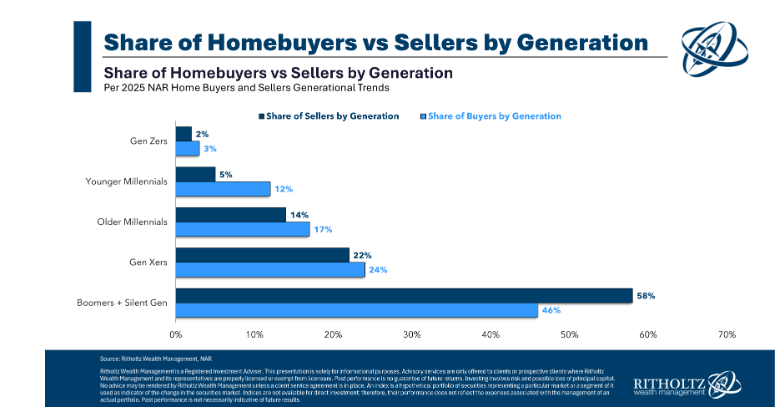

Baby boomers make up by far the largest share of home purchases and sales:

Older people are responsible for nearly 60% of all housing sales and close to half of all purchases. This makes sense when you consider 40% of all homeowners have no mortgage.

Boomers have tons of equity to play around with, so high prices and mortgage rates don’t matter to them as much as they do to young people.

https://awealthofcommonsense.com/2025/07/housing-market-nobility/