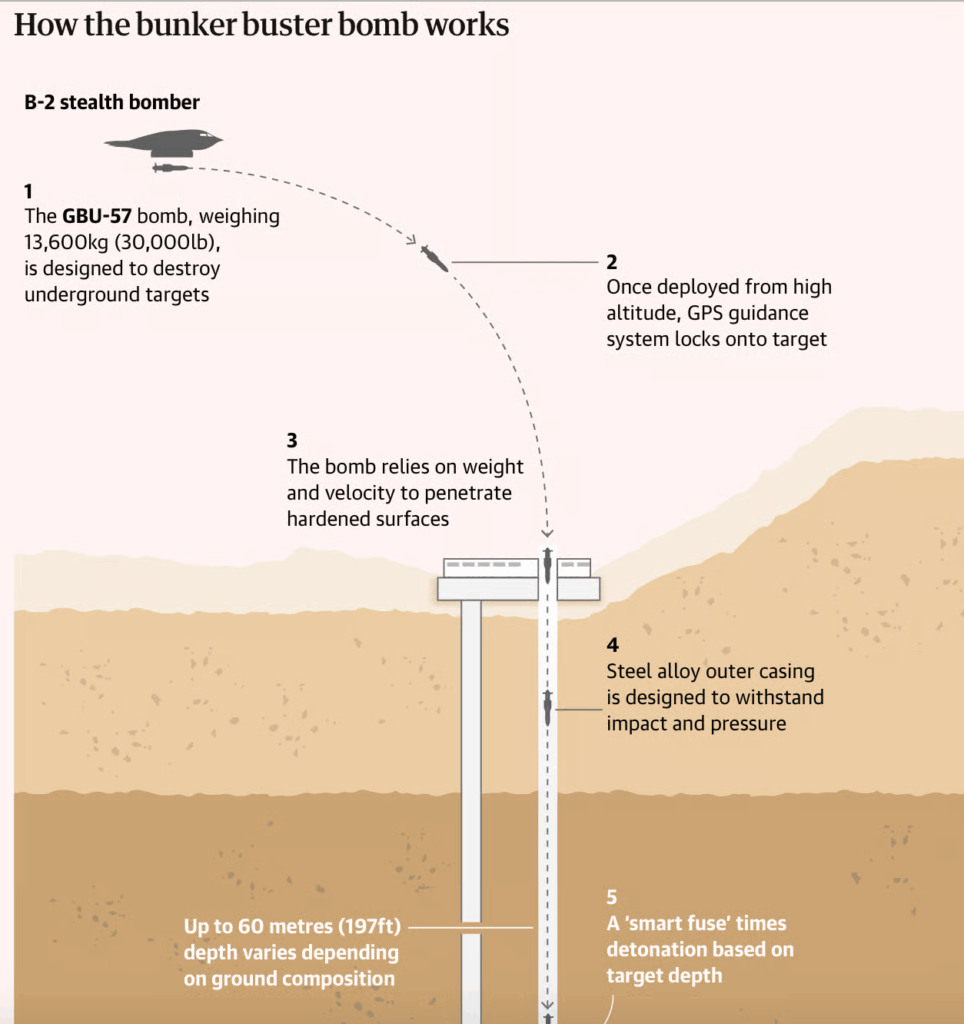

1. How the Bunker Buster Bomb Works

The Guardian

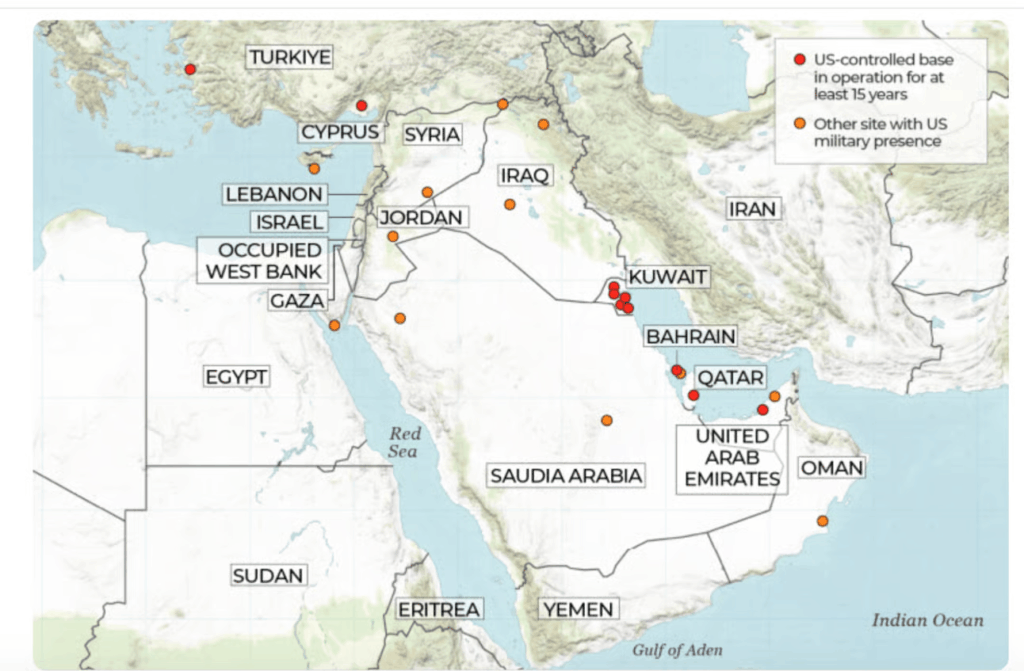

2. America Has 40-50k Troops Across 19 Bases in Middle East

Al Jazeera

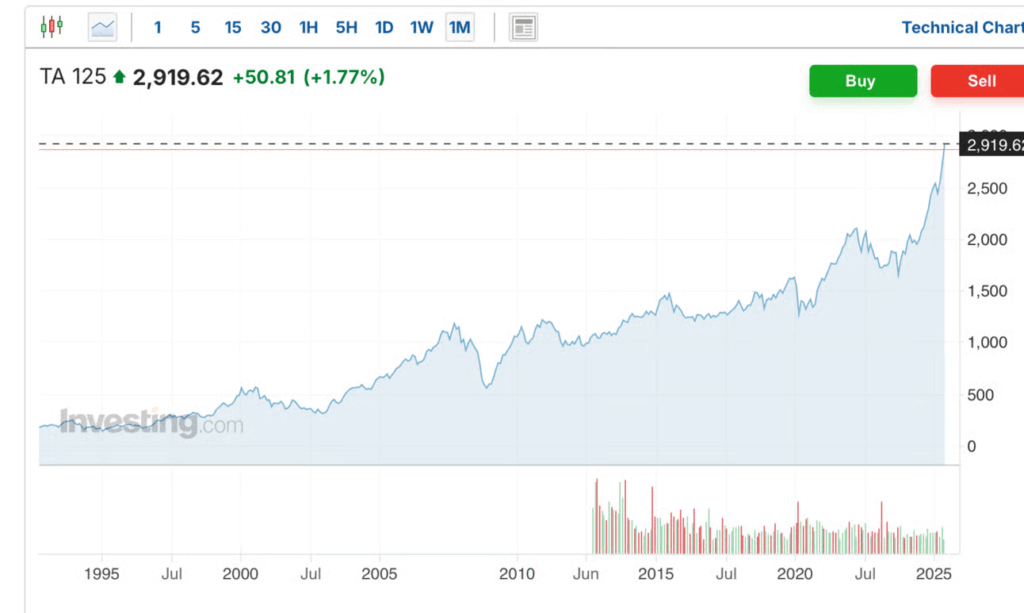

3. Israeli Stock Market Hits All-Time Highs….Tel Aviv 125 Chart

Investing.com

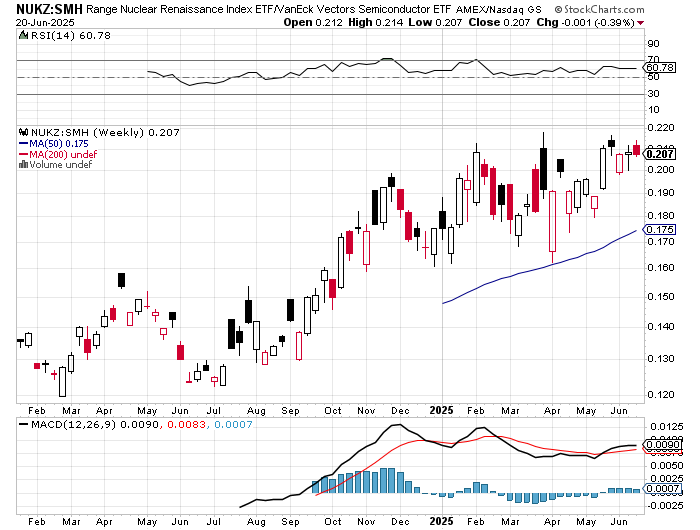

4. This Chart Shows Nuclear Energy ETF (NUKZ) vs. Semiconductor ETF (SMH)…Nuclear Outperforming

StockCharts

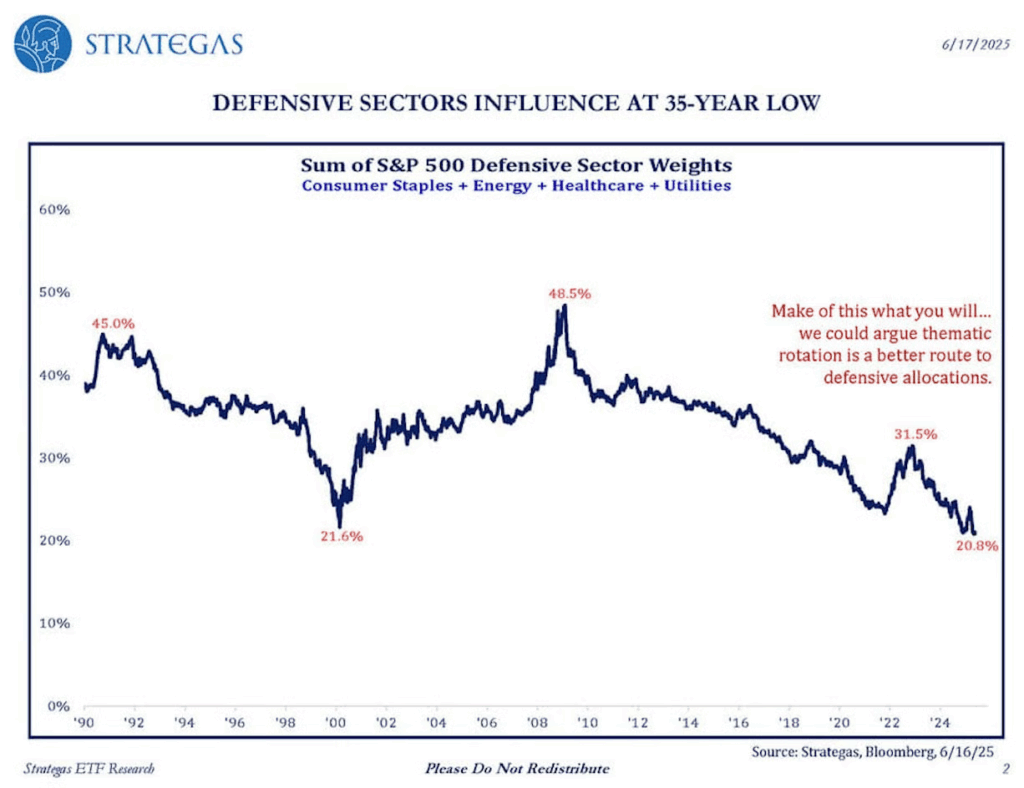

5. Defensive Sectors at 35 Year Low Weight in S&P 500

Defensives vs. SPX. As a share of the S&P 500, the combined weight of Defensive sectors is at a +35-year low.

Daily Chartbook

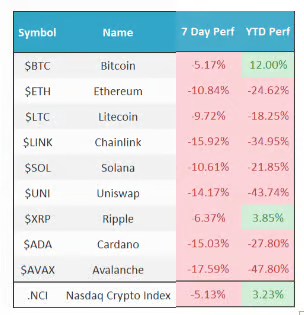

6. Crypto Year-to-Date

Nasdaq Dorsey Wright

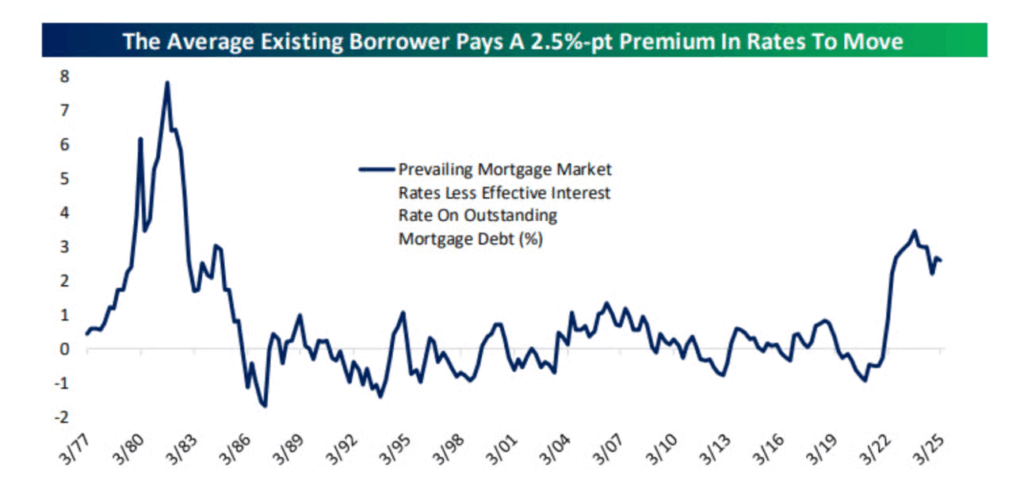

7. The Average Home Owner Pays 2.5% Premium in Rates to Move Right Now

Bespoke

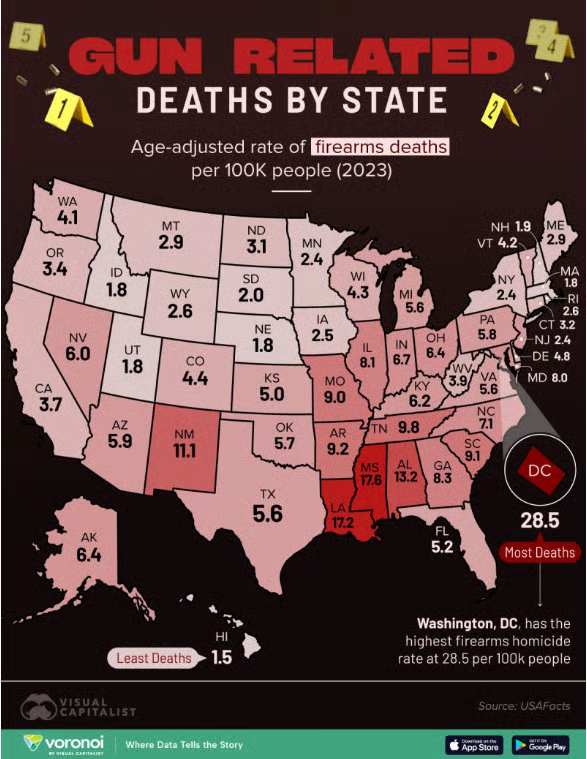

8. Gun Related by State

Visual Capitalist

9. The Greatest Stock Pickers of All-Time-Warren Buffett, Jim Simons and NANCY PELOSI. Pelosi +54% 2024 Crushing All Global Hedge Funds…Huge Start to 2025

NY POST-Pelosi raked in millions last year — and her portfolio out-performed every large hedge fund with stunning returns.

She might be the She-Wolf of Wall Street.

Rep. Nancy Pelosi (D-California) raked in between $7.8 and $42.5 million in 2024 — meaning her estimated net worth with venture capitalist hubby Paul Pelosi could now top out at $413 million, new financial disclosures showed.

The staggering sum is an eye-popping jump from 2023, when financial disclosures showed the couple’s net worth topping out at a possible $370 million. The Pelosi’s added between $7.8 and $42.5 million to their net worth in 2024. Pelosi’s exact net worth is not known because lawmakers are only required to disclose ranges.

Market research firm Quiver Quantitative, which estimates a single figure based on daily stock values it tracks, placed the pair’s 2024 worth at $257 million — up $26 million from a year earlier.

But the value of their various other ventures — which include but are not limited to a Napa Valley winery, ownership in a political data and consulting firm and a stake in a Bay area Italian restaurant — mean Pelosi’s worth could be far higher in the estimated range.

A large chunk of the couple’s fortune has come from a sizable stock portfolio and timely trades, all done in Paul Pelosi’s name.

The former House Speaker, who’s so infamous for trading Missouri Rep. Josh Hawley named a bill after her, and her husband dumped 5,000 shares of Microsoft stock worth an estimated $2.2 million in July — one of their largest sales in three years — a few short months before the FTC announced an antitrust investigation into the tech giant.

They also sold 2,000 shares — worth an estimated $525,000 — of Visa stock, less than three months before the credit card company was hit with a DOJ monopoly lawsuit.

Some have nicknamed Pelosi the “Queen of Stocks.” Getty Images for The Museum of Contemporary Art (MOCA)

Their best trade though might have been exercising a call option in December they bought in late 2023 at an estimated premium of $1.8 million, allowing them to nab 50,000 shares of hot AI chip stock NVIDIA for $12 a pop — less than one tenth of its market price.

In total the couple paid an estimated $2.4 million for the investment, which on paper is now worth more than $7.2 million.

NVIDIA wasn’t their only AI play of 2024.

The couple also paid between $600,000 and $1.25 million for a call option on California cybersecurity company Palo Alto Networks in February, the same week it was revealed the White House briefed lawmakers on a serious national security threat related to Russia.

The shares rose close to 20% in the days after the move.

A bill aiming to ban lawmakers and their spouses from trading individual stocks was named “The PELOSI Act.” Jack Forbes / NY Post Design

The option allowed the pair to scoop up 14,000 shares of Palo Alto in December at a $100 strike price — half its trading value. The company has been crushing earnings over the past year and the investment is now worth around $2.8 million.

But the Queen of Stocks did suffer one setback — when she and Paul Pelosi ditched 2,500 shares of former Department of Government Efficiency boss Elon Musk’s Tesla in June, losing somewhere between $100,000 and $1 million on the trade.

In all, their investment portfolio pulled in an estimated 54% return in 2024, more than double the S&P 500’s 25% gain — and beating every large hedge fund, according to numbers in Bloomberg’s end-of-year tally of hedge funds’ returns.

The couple is already off to a rocking 2025.

In January, they bought call options for then-little-known artificial intelligence health firm, Tempus AI, which has since inked a $200 million deal with AstraZeneca and doubled its stock price.

Pelosi and her good fortune have been at the center of arguments about why Congress shouldn’t be allowed to trade stocks. Ron Sachs – CNP for NY Post

The formidable profits come amid growing calls to ban Congress from trading individual stocks, arguing lawmakers have access to market-moving information ahead of the public.

Pelosi in the past rejected calls for a ban, stating “we’re a free‑market economy.”

She has since softened her stance in the face of growing criticism. When asked in May whether Congress should pass a trading ban, she replied, “If they do, they do.”

“Speaker Pelosi does not own any stocks, and she has no prior knowledge or subsequent involvement in any transactions,” a spokesperson told The Post.

The couple also took out call options for energy company Vistra — whose stock climbed last month after it unveiled a massive $1.9 billion deal to acquire natural gas facilities across the country from a private equity firm, citing rising US power demand.

10. Invest in Your Human Capital for a Good Life

Psychology Today: What economics can teach us about happiness. Insights from economic concepts.

In her search for a more balanced and fulfilling life, van Horen found unexpected wisdom in economic concepts.

Constrained optimization refers to the idea of maximizing satisfaction within our given limits, explains van Horen. In economics, it’s about getting the best possible outcome given constraints like time, money, or other resources. In life, it means making the most of your energy, attention, and circumstances—not by doing more, but by choosing wisely.

Too often, we chase a single goal in isolation. For example, we might pursue career success or financial security, without accounting for what we might have to sacrifice elsewhere, including our health, relationships, or peace of mind. Constrained optimisation invites a shift. Instead of asking, “How can I achieve the most in this area?” it asks, “How can I find the best balance across everything that truly matters to me?”

Opportunity cost is the understanding that every decision comes with a trade-off. Saying yes to one thing means saying no to something else.

“Every action has a cost, even if it’s not always obvious,” says van Horen. “Often, we ignore the cost and focus only on the benefit.”

For example, if you agree to take on a task—perhaps to avoid disappointing others—the opportunity cost might be the time you won’t spend working on something meaningful to you. Placing our options side by side and consciously considering the opportunity cost can help us make more informed decisions. Ask yourself: What am I gaining? What am I giving up in the process? The key, according to van Horen, is awareness: realizing that doing one thing always comes at the expense of something else.

The law of diminishing marginal returns tells us that as you increase the amount of input or effort, the additional benefits or output will gradually decrease. In fact, beyond a certain point, additional effort can backfire, yielding even negative results.

In our striving and overachieving cultures, where perfectionism is pervasive and productivity is often fueled by pushing ourselves harder, slowing down can feel like a radical act.