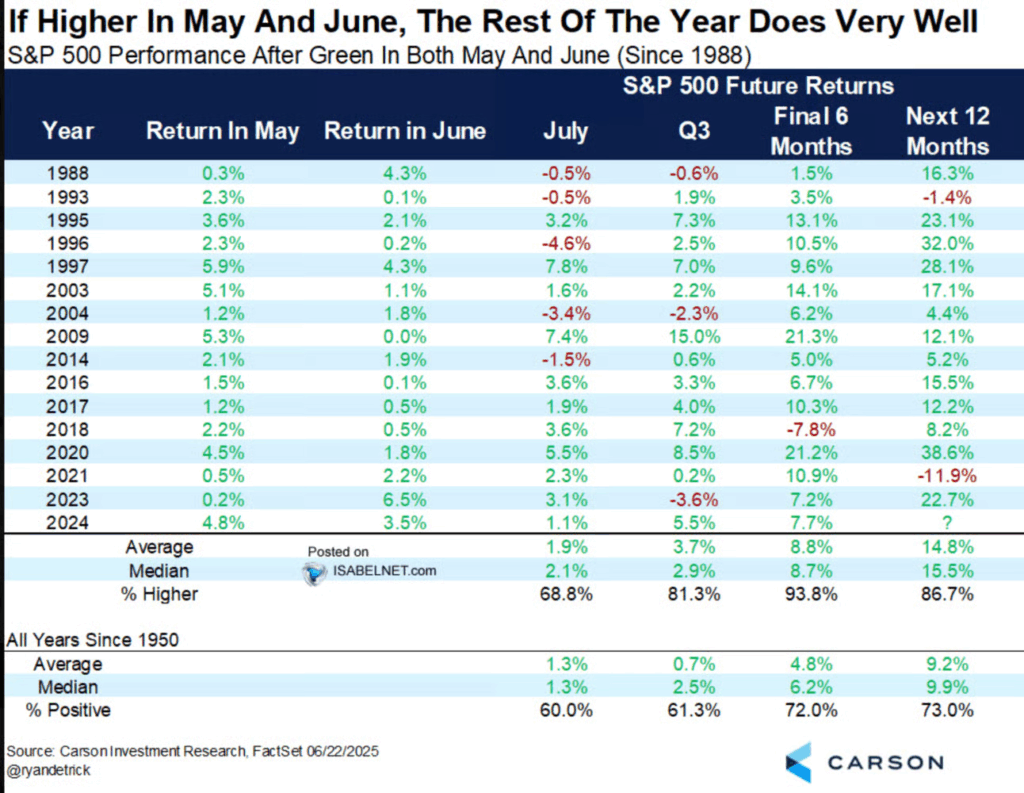

1. May/June Higher Bullish

Ryan Detrick

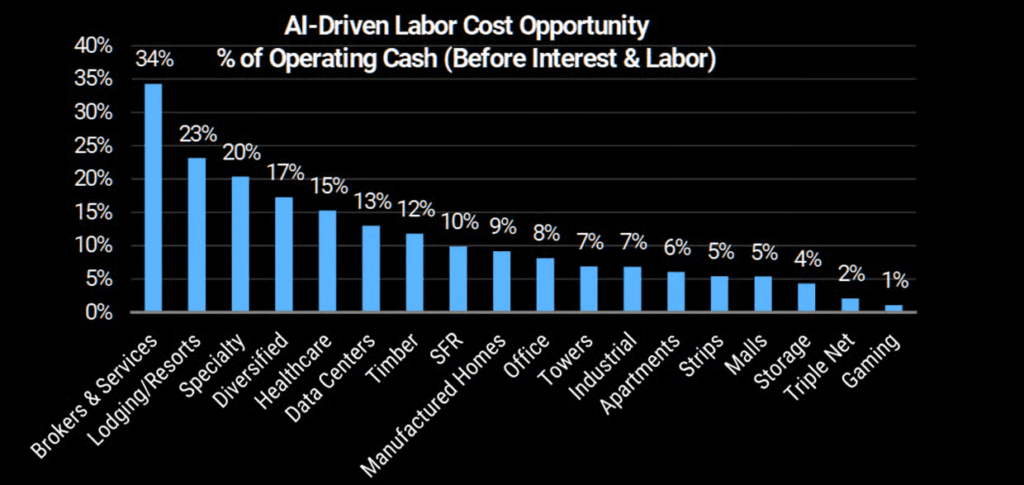

2. Automation Deflationary and Upside Operating Cash Flow

The Upside of Automation…MS shows, the potential operating cash flow upside from GenAI automation.

Zachary Goldberg Jefferies

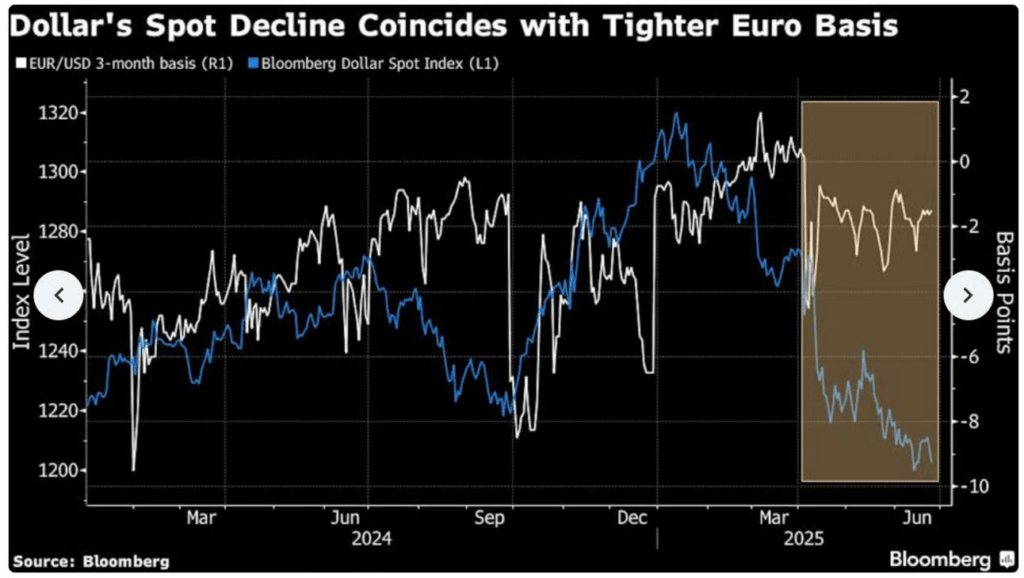

3. Dollars Decline Information

Yahoo!Finance

Analysts at a handful of banks including Morgan Stanley and Goldman Sachs Group Inc. all point to recent shifts in so-called cross-currency basis swaps — a gauge of how much it costs to exchange one currency for another beyond what would normally be implied by borrowing costs in the cash markets. As demand for a particular currency increases, that extra cost or premium rises, and likewise declines or even can go negative when appetite isn’t as strong.

These analysts note that when markets melted down in April following US President Donald Trump’s “Liberation Day” tariff announcement, the preference for dollars as measured by basis swaps was relatively minor and short-lived. Meanwhile, demand for other currencies such as the euro and yen has grown. That stands in sharp contrast to previous scrambles for safety over the last two decades, such as the onset of the pandemic, which saw the dollar command a premium in global funding markets for a sustained period.

Over time, this waning preference for dollar liquidity, particularly relative to the euro, could ultimately make it more expensive to borrow Europe’s common currency relative to the greenback — presenting a challenge for the US currency at a time when its preeminent position in world finance is facing growing doubts.

“Recent cross-currency basis movements suggest investors have less appetite to buy dollar-denominated assets and more appetite to buy those denominated in euro and yen,” the Morgan Stanley team including Koichi Sugisak and Francesco Grechi wrote in a June report. In fact, the US tariff impact appeared to be “triggering a temporary withdrawal from dollar assets,” the Morgan Stanley analysts wrote.

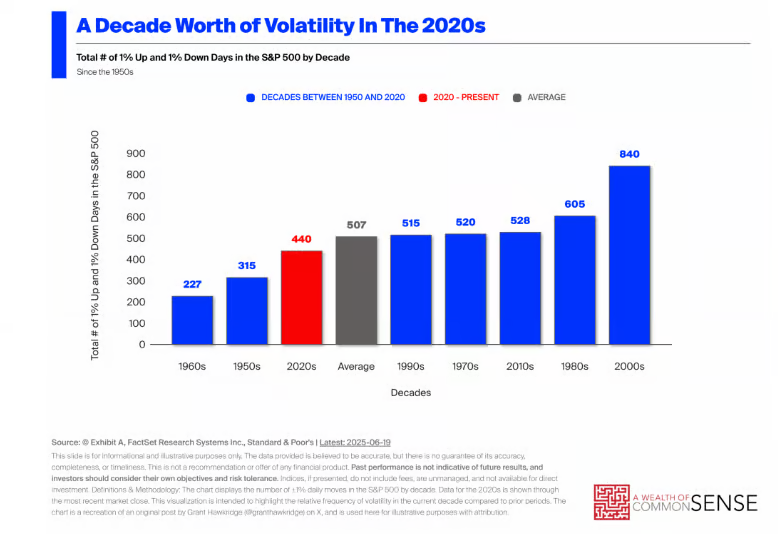

4. A Decade Worth of Volatility in 5 Years

A Wealth of Common Sense

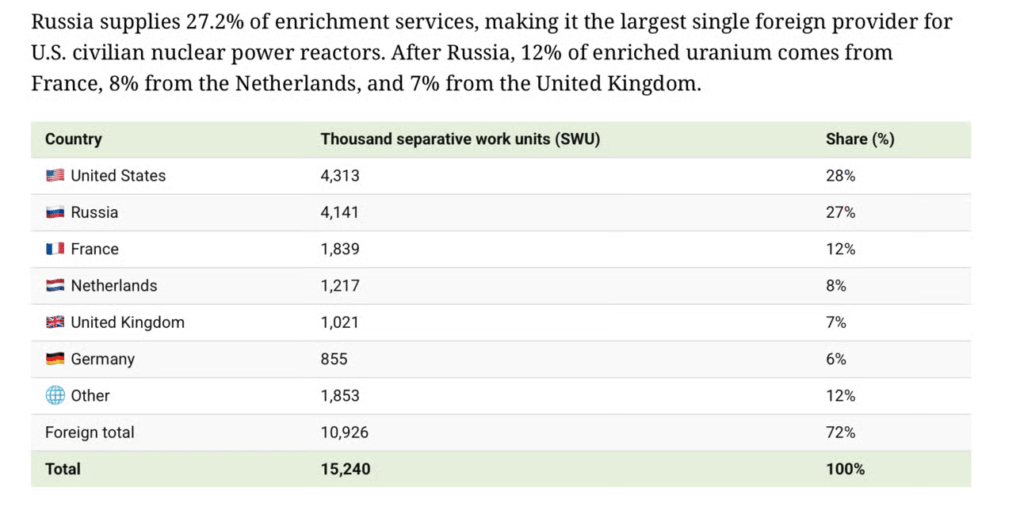

5. Where Does America Get Its Uranium? 27% from Russia

Visual Capitalist

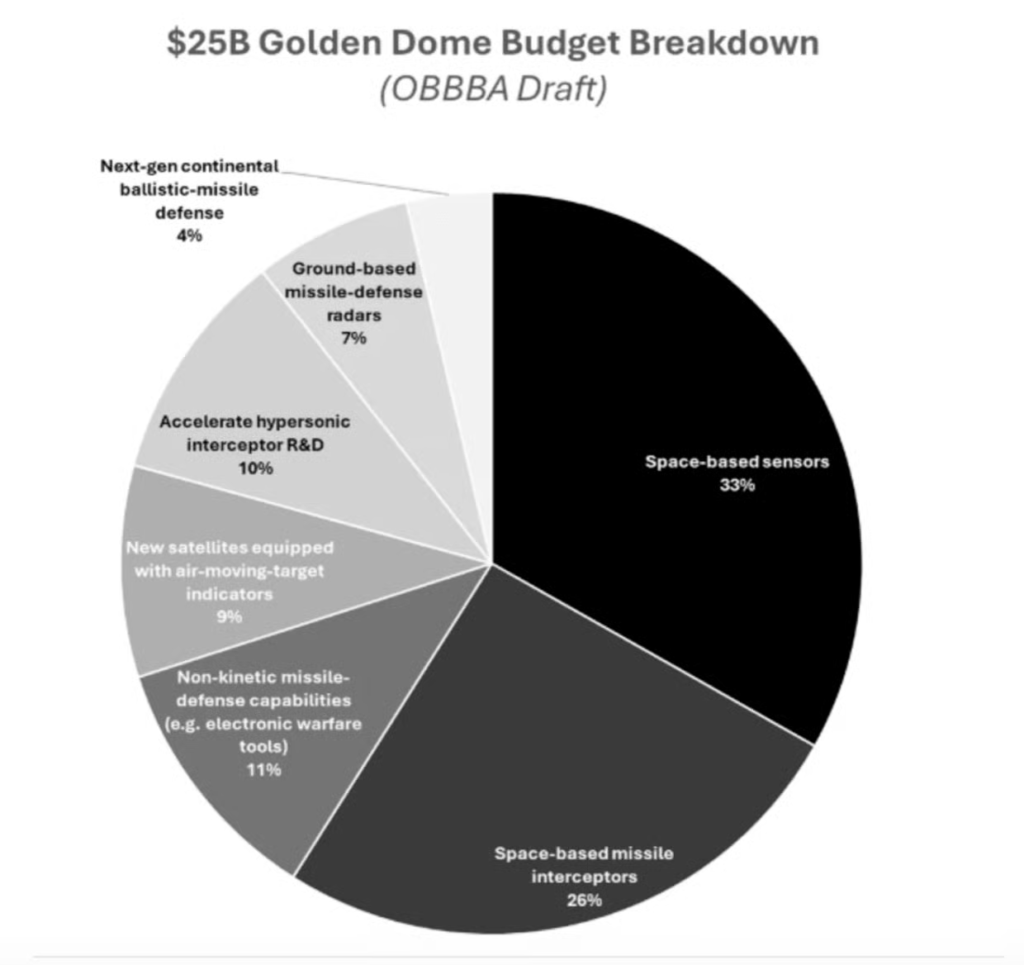

6. American Golden Dome Budget

MarketWatch

7. Big Gap in the Sky

Flightradar

Via Morning Brew: The Israel–Iran conflict has made vast swaths of airspace out of bounds for commercial aircraft in recent days, highlighting how the rising prevalence of wars is scrambling air travel.

A live flight map on FlightRadar24 displays a gaping hole in the plane swarms above Israel, Iraq, and Iran. Many airlines have also nixed flights to nearby hubs like Dubai and Doha as tensions escalate across the region.

Passengers have been stranded, while airlines face revenue losses and higher costs from longer, rerouted flights that burn more fuel. As a tenuous Israel–Iran ceasefire took hold yesterday, air carriers began restoring some flights in the region, while European and US airline stocks rose sharply.

But no-fly zones persist

Aviation issues didn’t start with the most recent conflagration:

- Parts of the Middle East are still off limits to aircraft, while a planeless territory has existed over Ukraine and parts of western Russia since the war between the two countries began in 2022.

- The square mileage of conflict zones has increased by 65% since 2021, according to risk consulting company Verisk Maplecroft.

This makes piloting harder…as flight reroutes lead to more crowded skies, creating congestion and straining control tower resources. Pilots flying near warzones also have to contend with GPS jamming, forcing them to rely on experience to gauge location and altitude.

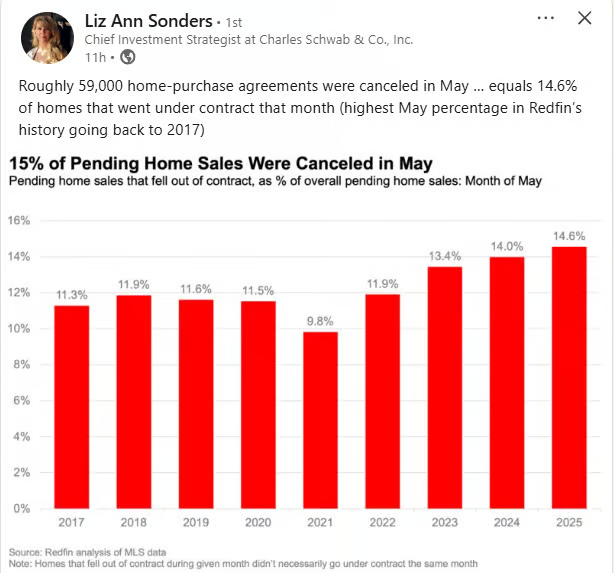

8. 15% of Pending Home Sales Cancelled in May

Liz Ann Sonders

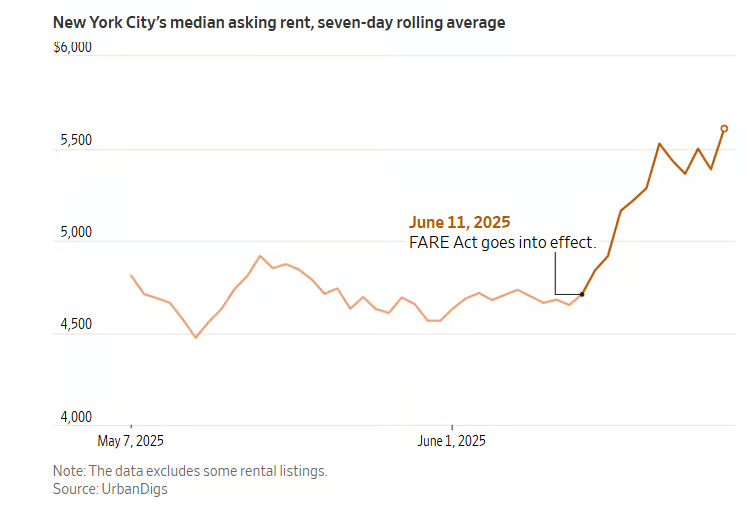

9. Progressive/Leftist Wins NYC Mayoral Primary…See Below

WSJ

Visual Capitaist

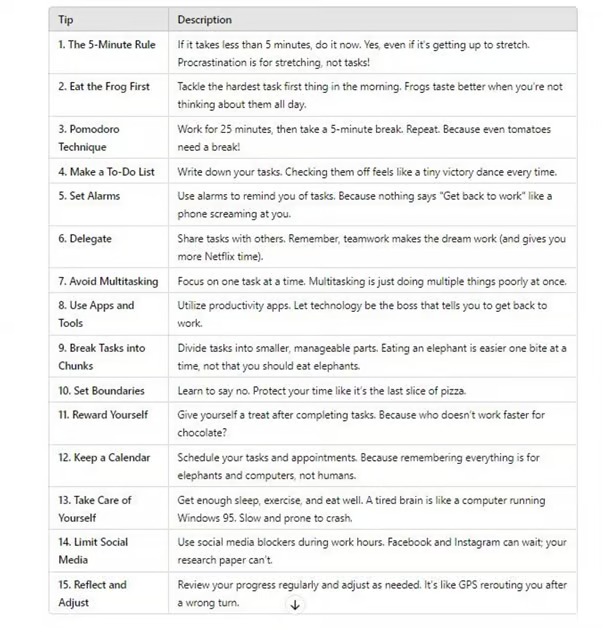

10. Mastering Time Management with Ravi

Reads with Ravi