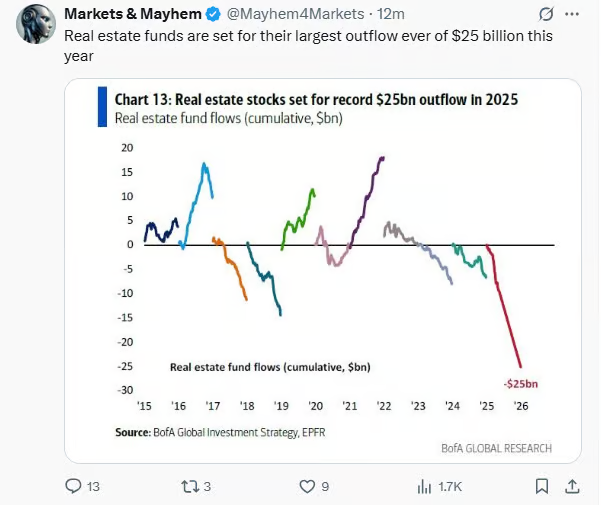

1. Contra Indicator? Real Estate Funds Biggest Outflows Ever

Markets & Mayhem

2. Contra Indicator? Small Caps Biggest Outflows Ever

Markets & Mayhem

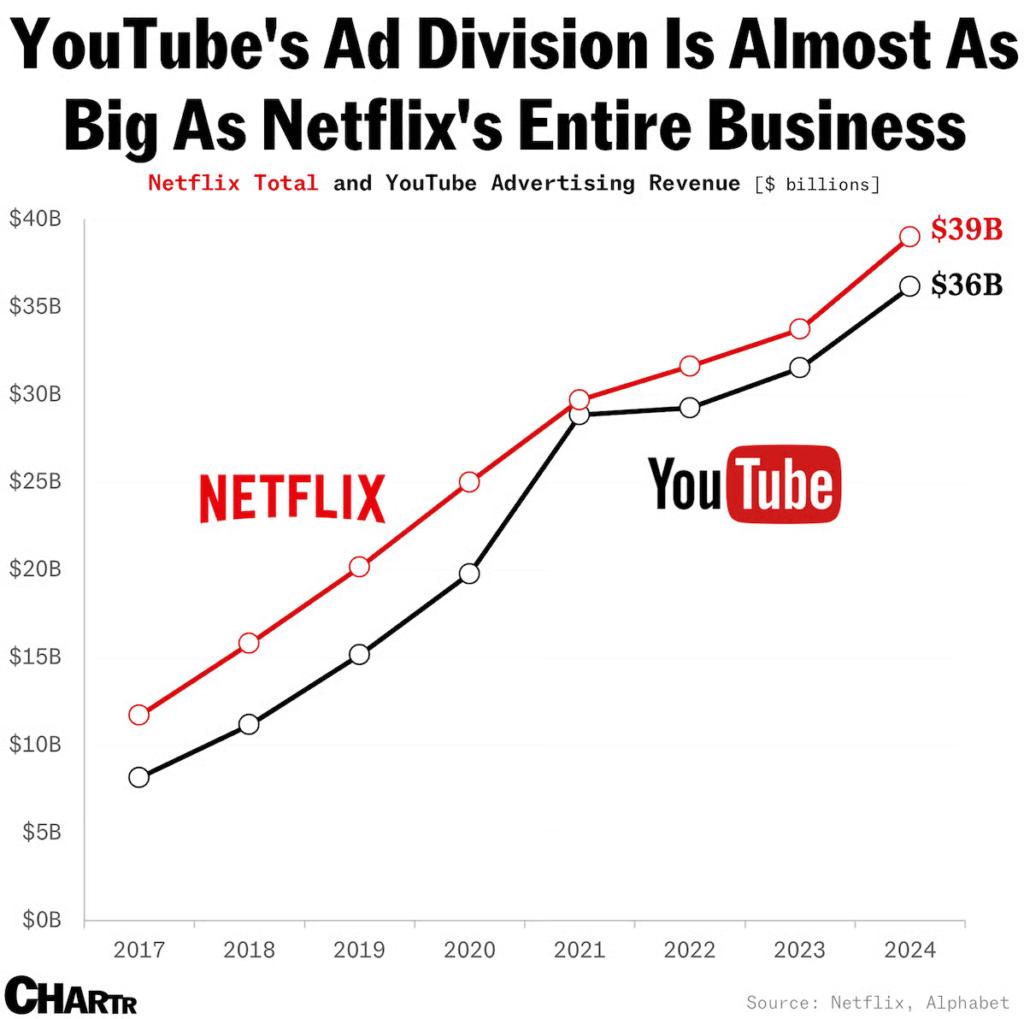

3. YouTube Add Division Almost Bigger than NFLX Entire Business

YouTube wants to monetize its growing TV dominance with AI-powered ad formats

It’s been a big week for TV, with the annual “upfront” period kicking off in New York, where television titans put on extravagant sales presentations to draw in advertising advances.

This year, though, was different. Not only did the uncertainty of looming tariffs tighten the purse strings of some of TV’s biggest spenders, but a growing force in the space threatened both traditional broadcast networks like NBCUniversal and Paramount and streaming giants like Netflix and Amazon.

Indeed, all eyes were on YouTube — the video sharing and social media platform that’s fast becoming the biggest thing on TV (some are even predicting that it will soon surpass Disney to become the biggest media company in the world). In fact, YouTube’s ad business alone is already bringing in close to the massive total revenues that behemoth Netflixhas been notching.

Sherwood

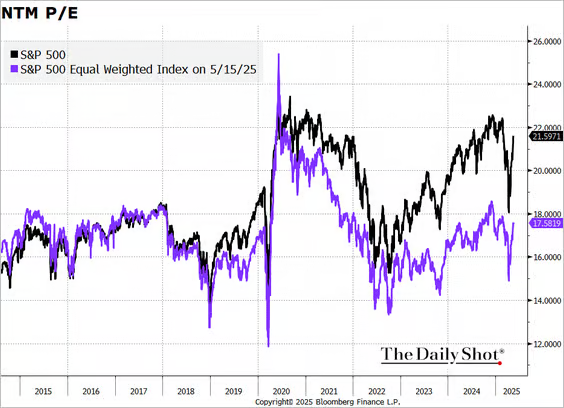

4. S&P Back to Highs in Forward P/E

Equities: The S&P 500 forward P/E ratio is nearing 22x again.

Bloomberg Terminal

5. Global Central Bank Gold Purchases

via MarketWatch

This chart from the fund management company Incrementum shows global central bank purchases over the last 75 years. “For three years in a row, central banks increased their gold reserves by more than 1,000 [metric tons] each year, achieving a special kind of hat-trick,” the firm says in its annual, “In Gold We Trust” report.

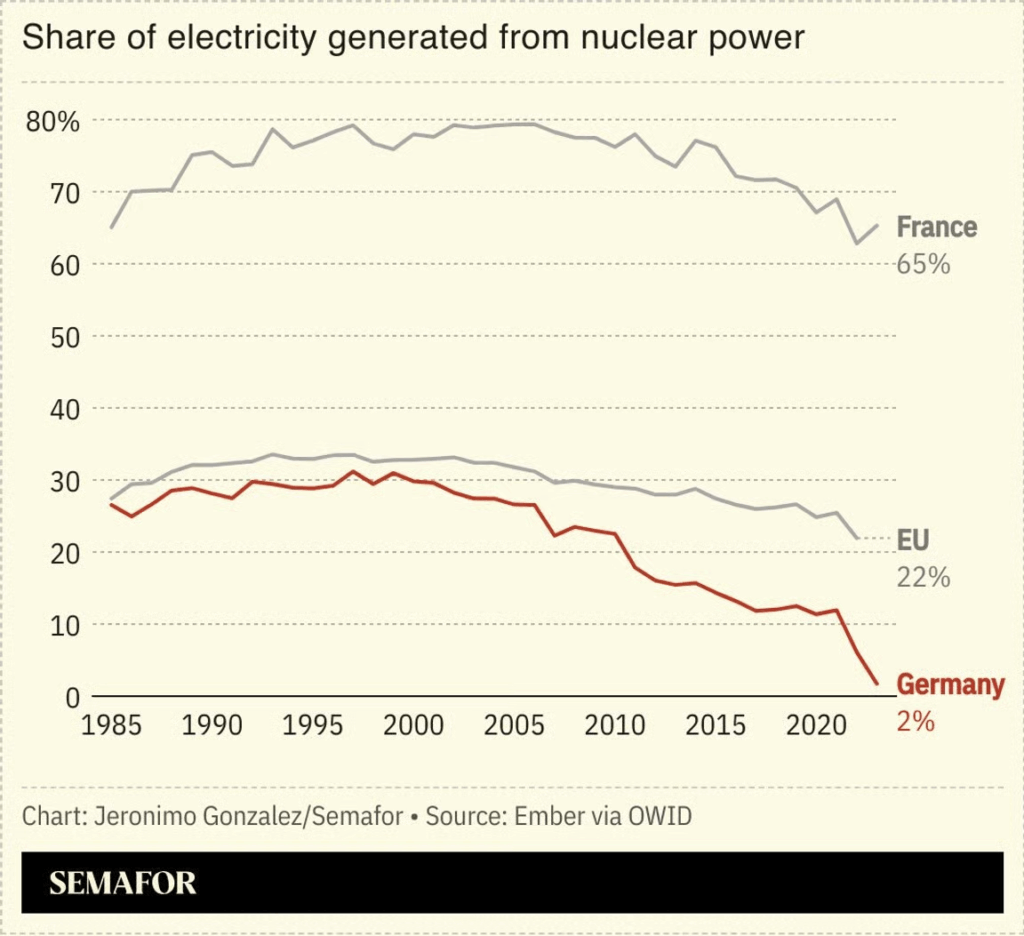

6. Europe Embracing Nuclear

Berlin dropped its opposition to nuclear power, part of a rapprochement with Paris that also marked a potentially major change in European Union energy policy. France is strongly pro-nuclear, while Germany began phasing it out after the 2011 Fukushima incident. But new Chancellor Friedrich Merz has been critical of that decision, and is keen to build bridges with France. He agreed to remove all “biases” against nuclear in EU legislation, leaving it on a par with renewable energy. Europe in general has seen a nuclear revival: A dozen EU members signed a letter backing the technology, the Netherlands and Belgium reversed decisions to shut down reactors, and Denmark may lift a 40-year nuclear moratorium.

Europe shifts on nuclear power

Semafor

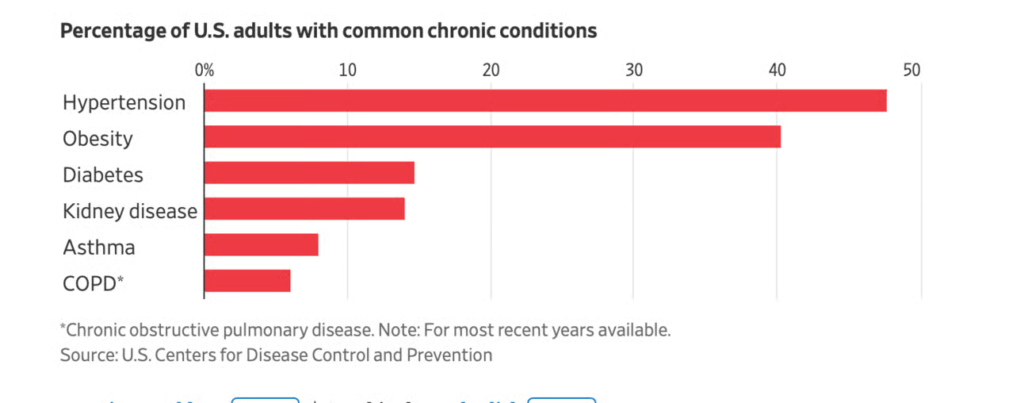

7. Percentage of American Adults with Chronic Health Conditions

WSJ

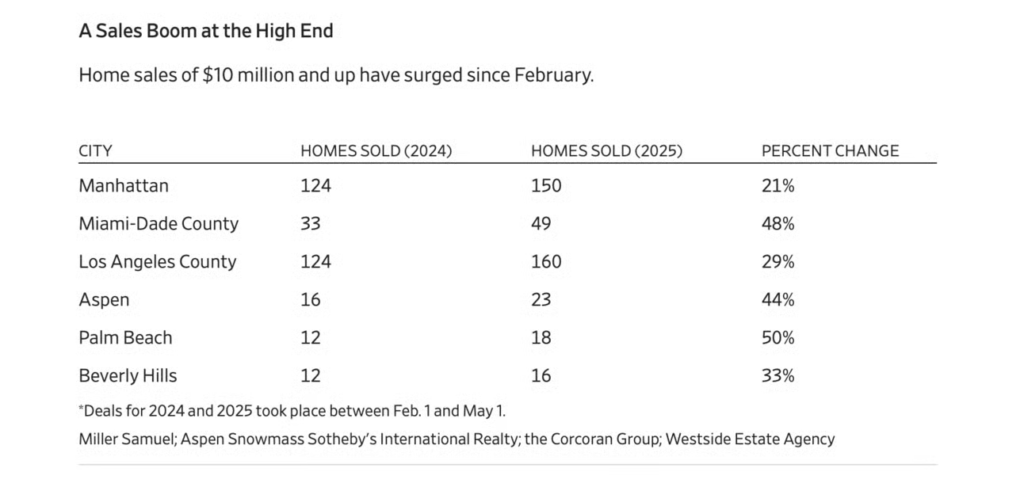

8. Second Home Sales Slowdown Except for $10m Plus

WSJ

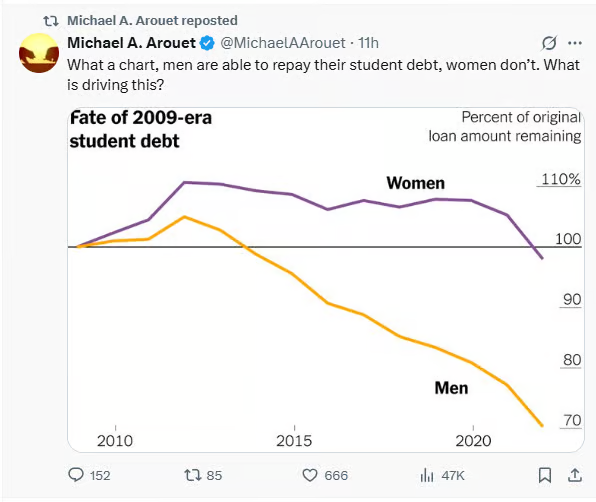

9. Men vs. Women Repayment of Student Debt

Michael Arouet

10. Mark Cuban’s Last ‘Shark Tank’ Episode Airs Today. Here Are 3 of His Best Investments

As the billionaire entrepreneur departs the hit show, we look back at Dude Wipes and other fruitful deals.

Via INC: It’s the end of an era for Shark Tank: On Friday, Mark Cuban’s final episode airs, and the long-standing celebrity investor will finally bid the hit show adieu.

The Cost Plus Drugs founder has said he’s leaving to spend more time with his family. But in his wake he leaves many years of investments in American small businesses, some of which have gone on to become big brands (and others of which have faded into obscurity). Cuban said in 2022 that he had not yet made a net profit on his Shark Tank investments, but at least a handful of the investor’s big deals have become, well, big deals.

Here are some of the most pivotal moves Cuban made during his tenure on the show.

Dude Wipes

A flushable wet wipe hardly sounds like an innovative new product—but in explicitly marketing the toiletry to men, Dude Wipes has carved out a nice niche for itself. Cuban acquired a 25 percent stake in the company for $300,000, with the brand now worth more than $300 million.

It’s an impressive growth story, and one that will be commemorated in Friday’s episode, as Dude Wipes co-founder Ryan Meegan is set to thank Cuban for his support, TV Insider reports. The Shark’s send-off will reportedly find Meegan saying that since his company pitched Cuban, it has “done over half a billion dollars in sales.”

Cuban has previously identified Dude Wipes as one of his favorite investments from Shark Tank, saying the brand is “killing it” and “taking over the toilet paper category.”

Mush

Mush, a brand of packaged overnight oats, has aimed to shake up the world of oatmeal—to sometimes dubious consumer response. Still, it found a fan in Cuban, who won a bidding war to take a 10 percent stake in the brand for $300,000 and an unlimited credit line.

The food startup has since “thrived under Cuban’s guidance,” Yahoo Finance reports, with a valuation of nearly $11 million late last year and an annual growth rate of about 10 percent in the wake of its Shark Tank debut.

What those numbers will look like in the wake of President Trump’s ongoing tariffs push—Mush says it has long sourced its oats from Canada—remains to be seen.

BeatBox Beverages

Even when Cuban was investing $1 million for a one-third stake of the boxed wine company BeatBox Beverages, he had his doubts, warning that the brand’s strategy was wrong. A year later he was appearing on spin-off show Beyond the Tank to advise the BeatBox team on how to best grow their brand.

But his tough love paid off, with the alcohol brand making the Inc. 5000 list in 2019 and now appearing on grocery store shelves nationwide. (It is no longer listed as part of his portfolio on his website, however.)

Last year, Forbes pegged the company at a more than $200 million valuation, with over $100 million in annual sales.