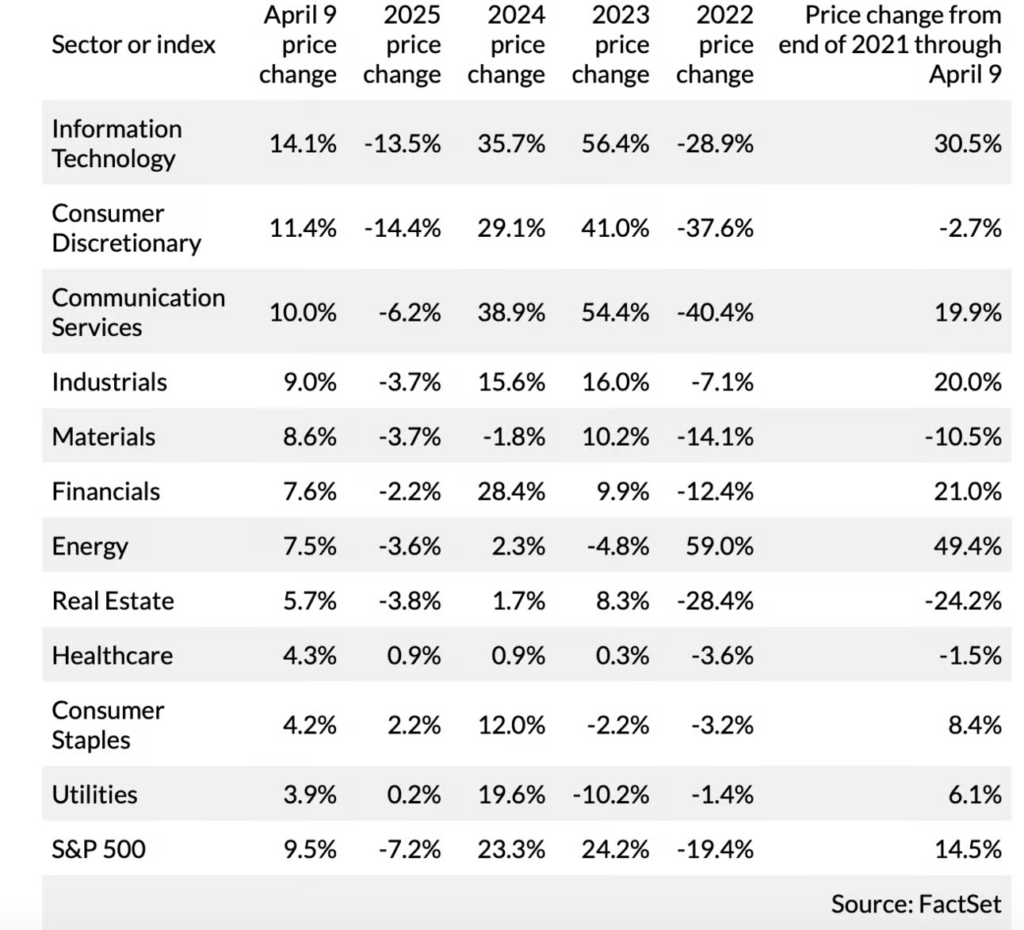

1. Sector Return Grid

MarketWatch

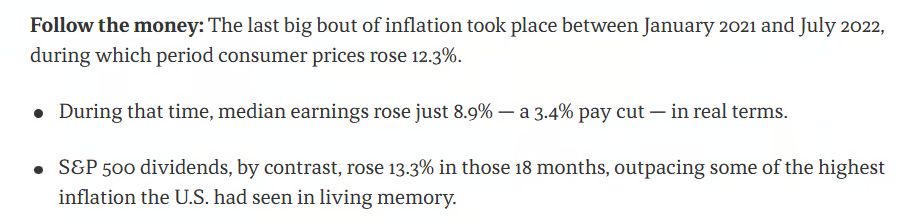

2. Hedge Against Inflation? Stock Dividends

Axios

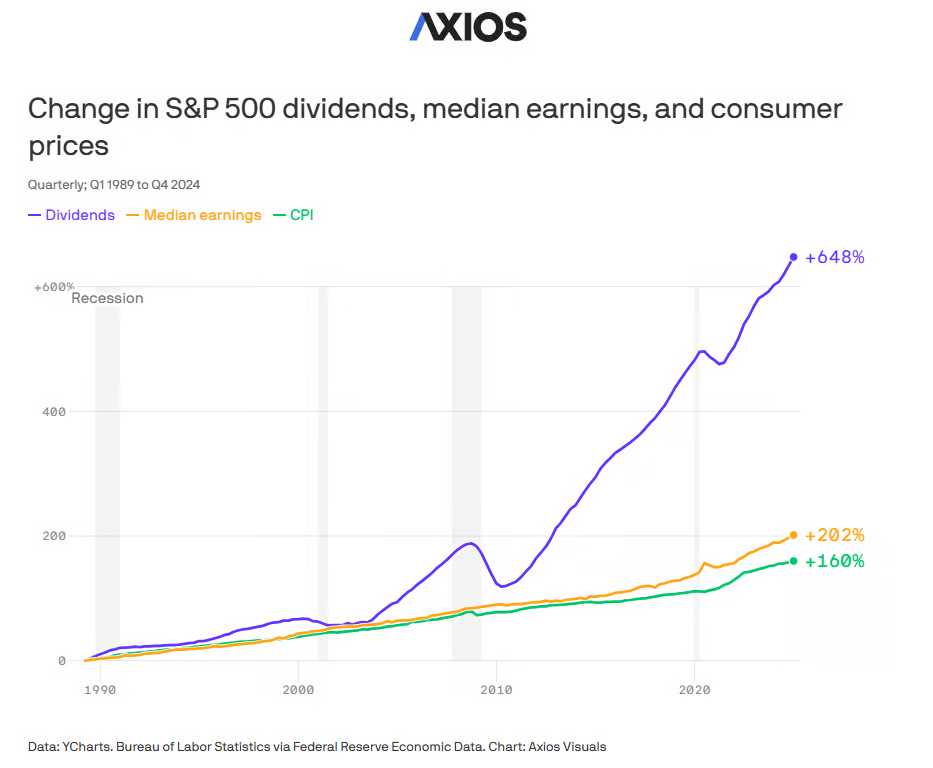

3. 2008 GFC & 2020 Covid Only Periods with Similar Intra-Day Volatility

In yesterday’s session, the SPDR S&P 500 ETF (SPY) traded in an incredible intraday range of 10.8%. Even crazier is that on Tuesday, the intraday range was 7.3% while Monday’s range was 8.6%! Since SPY was launched in 1993, the last three days represent just the sixth time that the ETF has had an intraday range of more than 5% for three or more days. The only periods with as many or more consecutive intraday ranges of at least 5% were in the fourth quarter of 2008 (four separate occurrences) and March 2020. These levels of sustained volatility are truly historic.

Bespoke

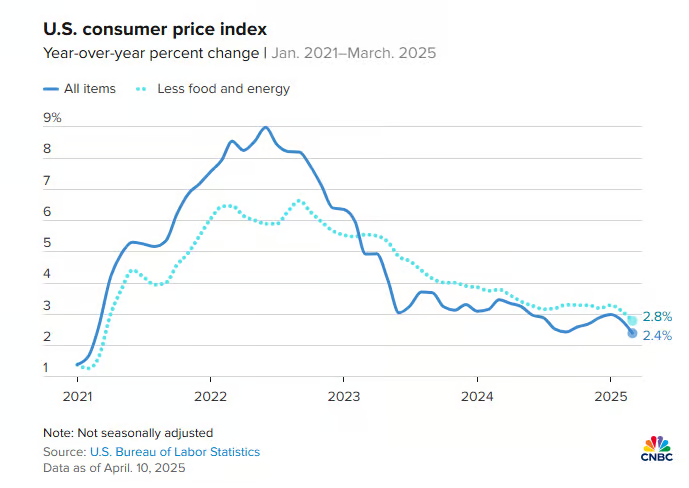

4. Every Pundit on Planet Arguing Whether Tariffs are Inflationary or Deflationary (demand destruction); CPI Today

CNBC

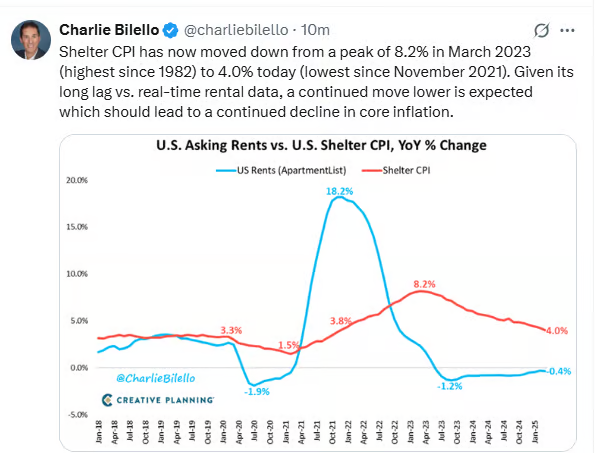

5. The Rent Lag in CPI Number

Charlie Bilello

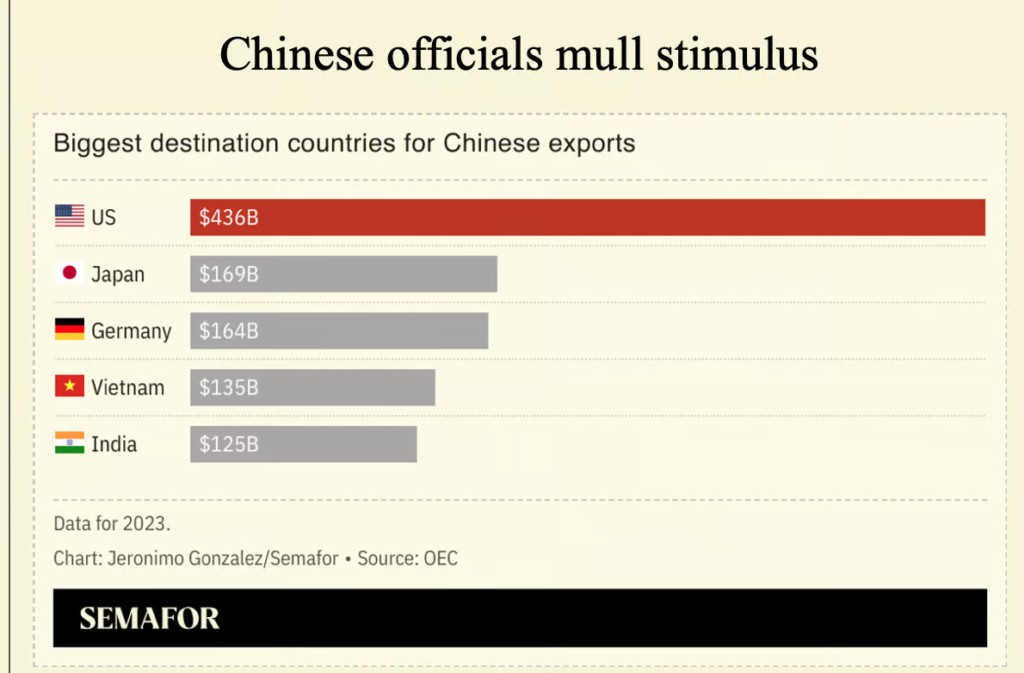

6. 300m Chinese Moved to Middle Class Selling to U.S.

Semafor

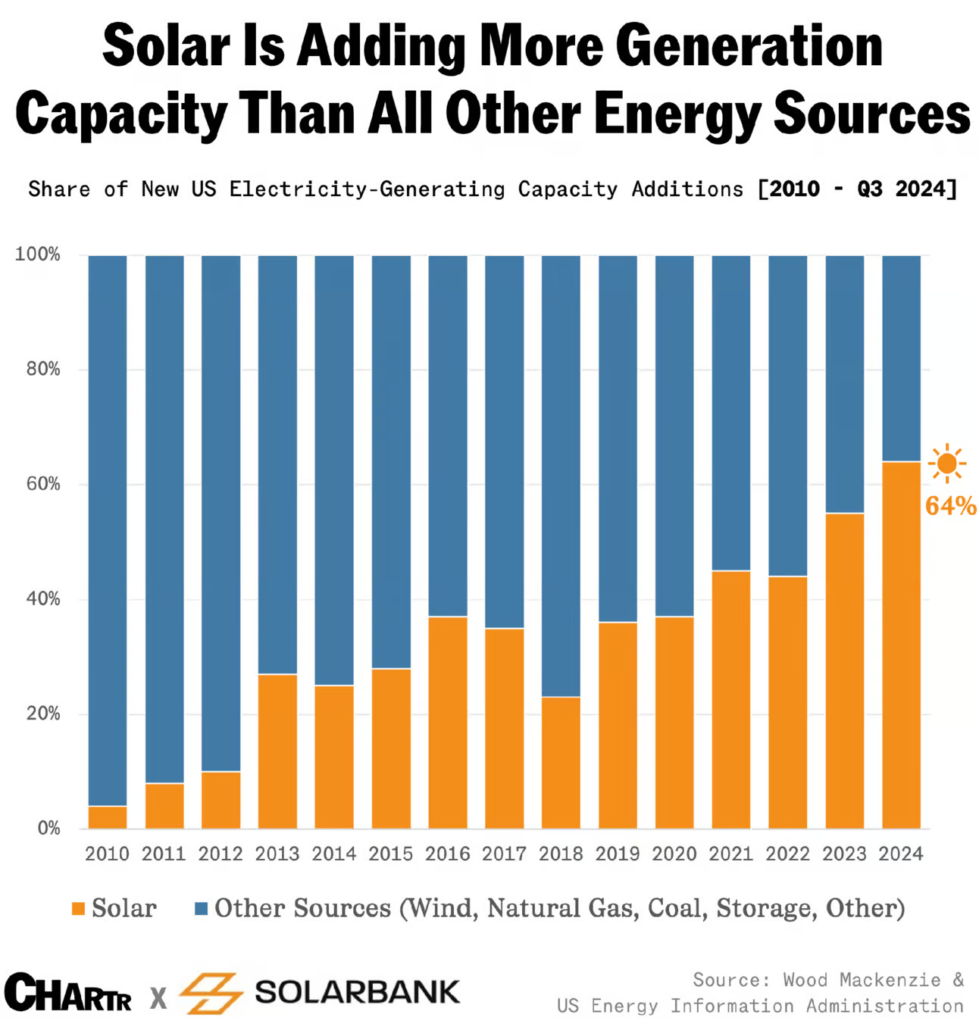

7. Solar is Adding More Generation than Any Energy Sources

Sherwood News

8. TAN Solar ETF Straight Down…All-Time High $104 2021…$28 Last

StockCharts

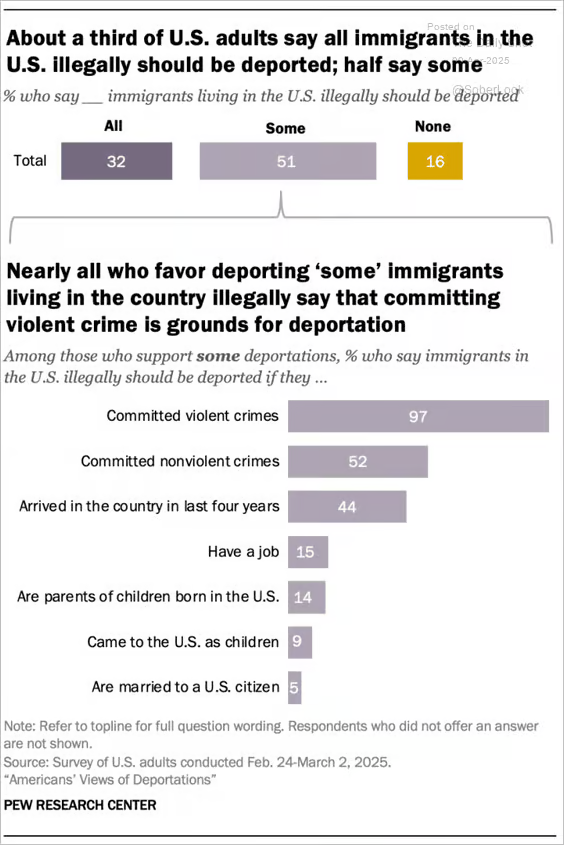

9. American Poll on Illegal Immigrants

Food for Thought: Americans’ views on the deportation of immigrants living in the country illegally

The Daily Shot Brief

10. For Your Weekend Read: NVDA Stock Fell -90% Twice

The New King of Tech-How Jensen Huang built Nvidia into a nearly $3 trillion business’

Via The Atlantic: Another day, another new AI large language model that’s supposedly better than all previous ones. When I began writing this story, Elon Musk’s xAI had just released Grok 3, which the company says performs better than its competitors against a wide range of benchmarks. As I was revising the article, Anthropic released Claude 3.7 Sonnet, which it says outperforms Grok 3. And by the time you read this, who knows? Maybe an entirely new LLM will have appeared. In January, after all, the AI world was temporarily rocked by the release of a low-cost, high-performance LLM from China called DeepSeek-R1. A month later, people were already wondering when DeepSeek-R2 would come out.

The competition among LLMs may be hard to keep track of, but for Nvidia, the company that designs the computer chips—or graphics-processing units (GPUs)—that many of these large language models have been trained on, it’s also enormously lucrative. Nvidia, which, as of this writing, is the third-most-valuable company in the world (after Apple and Microsoft), was started three decades ago by engineers who wanted to make graphics cards for gamers. How it evolved into the company that is providing almost all the picks and shovels for the AI gold rush is the story at the core of Stephen Witt’s The Thinking Machine. Framed as a biography of Jensen Huang, the only CEO Nvidia has ever had, the book is also something more interesting and revealing: a window onto the intellectual, cultural, and economic ecosystem that has led to the emergence of superpowerful AI.

That ecosystem’s center, of course, is Silicon Valley, where Huang has spent most of his adult life. He was born in Taiwan, the son of a chemical engineer and a teacher. The family moved to Thailand when he was 5, and a few years later, his parents sent him and his older brother to the United States to escape political unrest. Eventually, his parents relocated to the U.S. as well, and Huang grew up in the suburbs of Portland, Oregon. In the early 1980s, after majoring in electrical engineering at Oregon State (which at the time didn’t offer a computer-science major), he got a job at Advanced Micro Devices. The company—then the poor cousin of the chip giant Intel—was headquartered in Sunnyvale, California, near US 101, the highway that runs from San Jose to Stanford. Since then, Huang’s career has unfolded within a five-mile radius of that office.