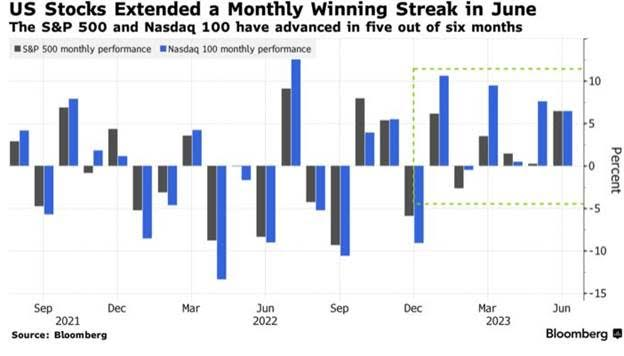

1. Investors Load Up on Bullish Bets at End of June

Dave Lutz Jones Trading THE FLOW SHOW– Investors piled into bullish bets on US stock futures toward the end of June, leaving positioning looking “very extended” and raising the risk of a pullback, Citigroup Inc. strategists said. New longs of about $7.1 billion were added to S&P 500 futures last week, and investors are sitting on “moderately large profits,” according to a note from the bank dated July 3.

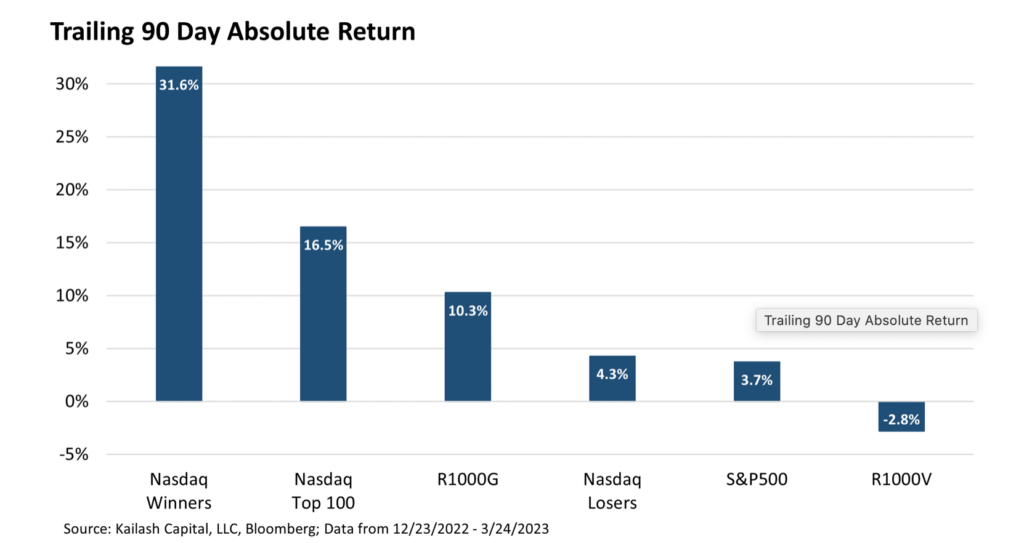

2. 90-DAY Absolute Return Spreads in Stocks

KAILASH CONCEPTS -The chart below shows the 90-day performance of the following six groups of stocks, from left to right:

- The largest 100 stocks in the Nasdaq that outperformed the index rose 31.6% in the last 90 days

- The 100 largest stocks in the Nasdaq were up 16.5% over the last 90 days

- The Russell 1000 growth index rose 10.3% over the last 90 days

- The Nasdaq 100’s largest stocks that underperformed the index rose only 4.3% in the last 90 days

- The S&P 500 rose 3.7% over the last 90 days

- The Russell 1000 value index fell -2.8% over the last 90 days

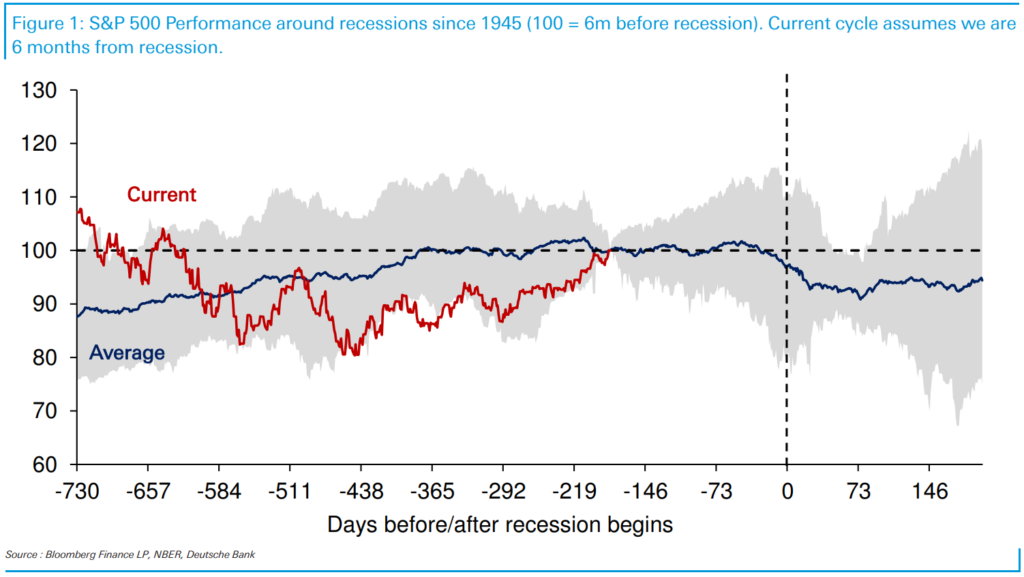

3. S&P Performance Around Recessions

Jim Reid-Deutsche Bank

This morning we have published our summer chart book entitled “If a recession was 6 months away, would markets & data tell you?” (link here). Henry and I will be doing a webinar on it at 2pm London time (9am ET) on Thursday July 13th. You can register Here to watch.

To help answer the question posed, the core of the chart book looks at how various assets and data perform leading up to previous US recessions through history, and compares that to what’s happened over the last couple of years. DB’s house view is for a US recession starting in Q4 2023, that could potentially get pushed back into Q1 2024. So these charts assume we’re 6 months away from a recession, and benchmarks where we are today against that point in previous cycles.

Today’s CoTD looks at equities in this framework. As you can see, the S&P 500 has on average performed very well from 2 years out up until the year before a US recession. However in the 12 months prior it flatlines (underperforming the long-term trend) before starting to fall 1-2 months before the recession. So you don’t get falls until the downturn is within touching distance but you do get sideways markets a year out.

This cycle is quite different at the moment. The S&P 500 was very weak “2 years out” for most of that year and then very strong over the last 6-9 months. So if you just look at this year there is absolutely no signal from equities that a recession is coming. However two caveats. Firstly if we did get a recession by year-end its likely at this stage that the 2-year lead-up to it would be the weakest equity performance in this post-WWII sample, so evidence of market concern in the lead-up as the rate environment completely changed. The second caveat is that as slide 9 in the pack shows, the equal weight S&P 500 has been trading more sideways over the last year, and much more typical of what you would see if a recession was now 6 months out. So it depends on your view of whether those handful of mega-cap tech stocks can influence the macro outlook.

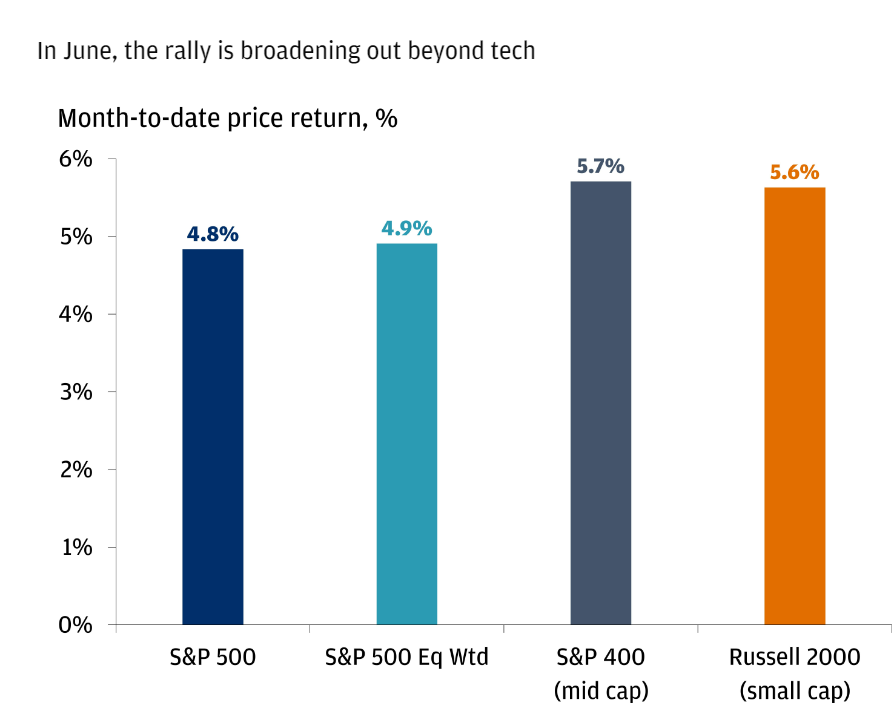

4. Mid and Small-Cap Participated in June

JP Morgan Private Wealth.

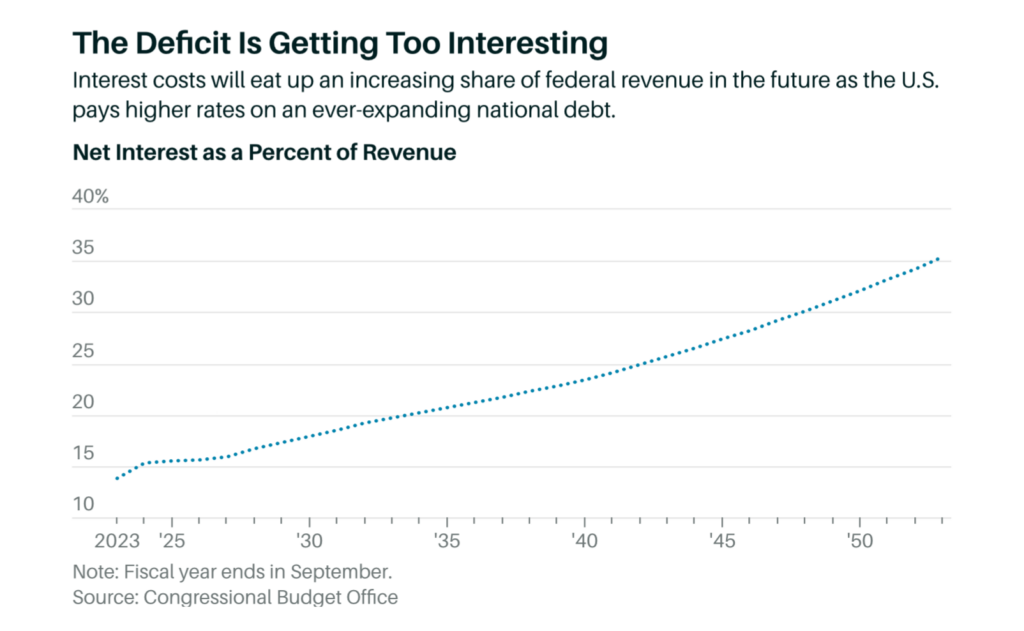

5. Interest Costs are Projected to Eat Up 35% of Federal Revenue in the Future

Barrons

By Barrons Randall W. Forsyth

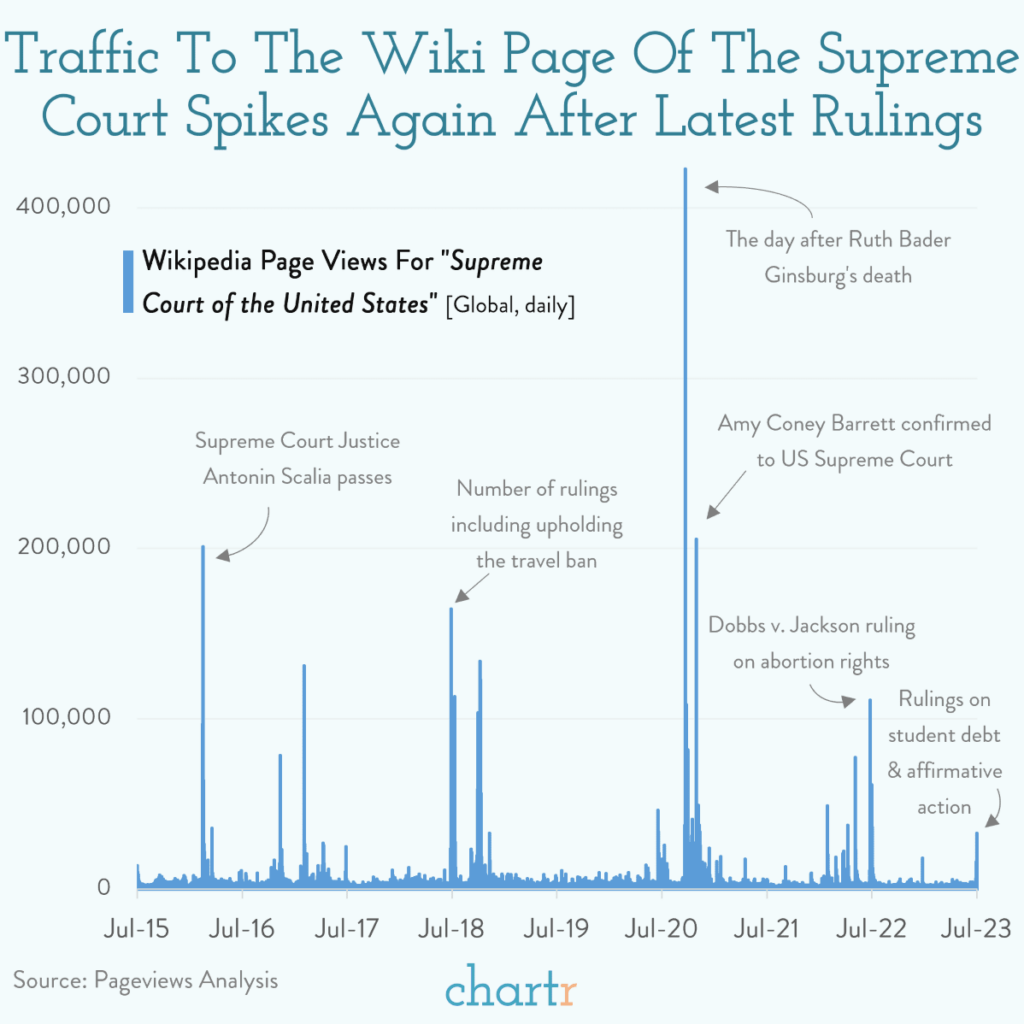

6. Traffic Based on Supreme Court Rulings

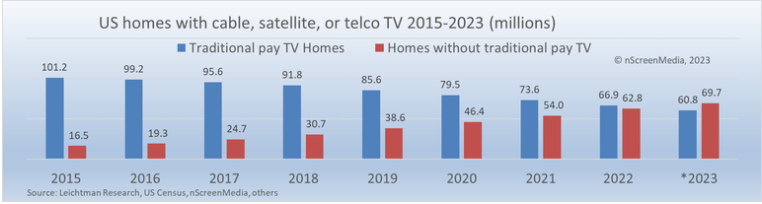

7. Traditional pay TV US home penetration to fall below 50% in 2023

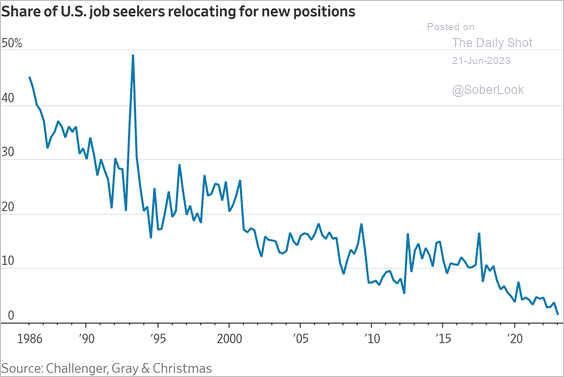

8. Change in Workers Relocating for a New Job….Another Reason Less Homes will be for Sale

Food for Thought: Lastly, the change in workers relocating for a new job: The Daily Shot Brief

Source: @jeffsparshott

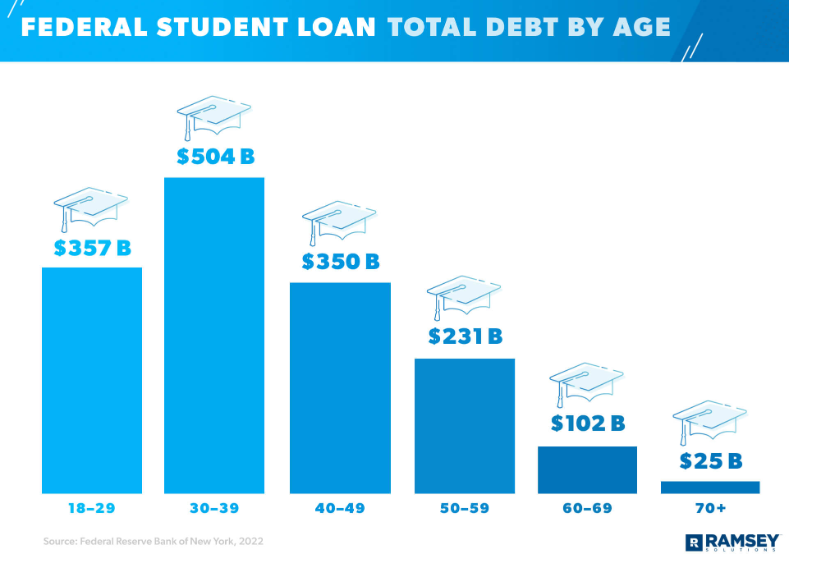

9. Federal Student Loan Debt by Age

Ramsey Solutions.

https://www.ramseysolutions.com/debt/average-student-loan-debt

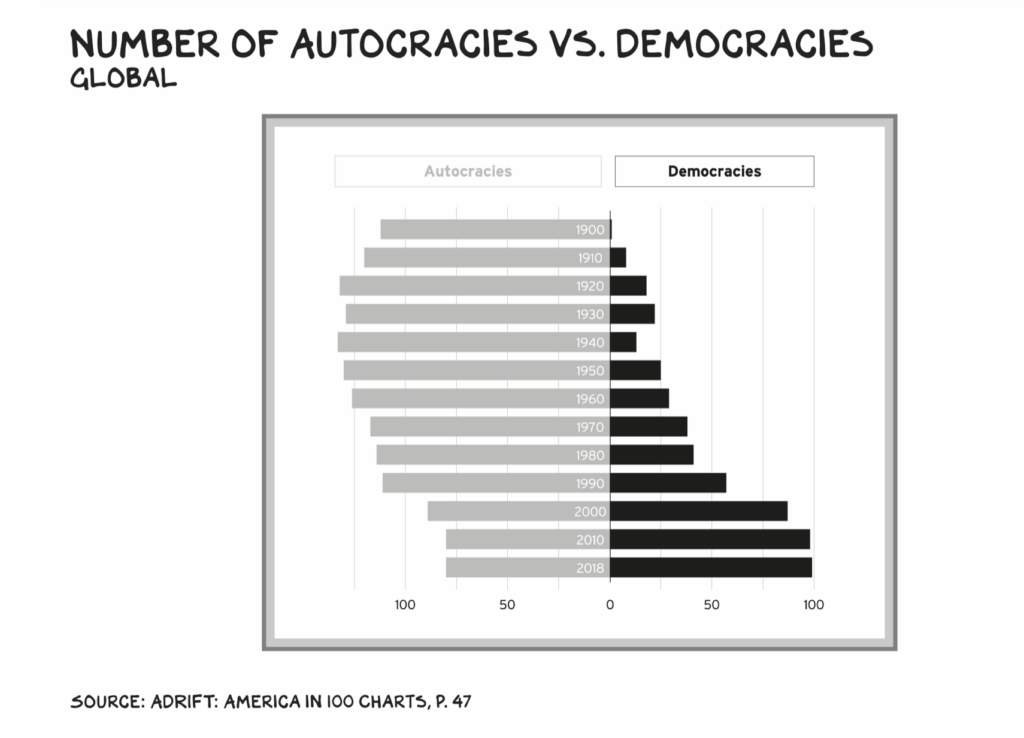

10. Democracy Still Winning-Scott Galloway No Mercy No Malice Blog

The Good News-Over the long term, democracy is steadily beating autocracy. A hundred years ago, for every five autocracies there was one democracy. Today, democracy is the most popular form of governance.